When To File Form 2290

When To File Form 2290 - Web 1 day agowhen should i file a form 2290? Web by filing form 2290, individuals and businesses fulfill their tax obligations and contribute to the funding of public highway maintenance and improvements. If the vehicle only traveled 3,000 miles during that time, you. The filing rules apply whether you are paying the tax. Web john uses a taxable vehicle on a public highway by driving it home from the dealership on july 2, 2023, after purchasing it. The current tax period for heavy highway vehicles. The filing rules apply whether you are paying the tax or reporting suspension of the tax. Figure and pay tax due on vehicles used during the reporting period with. Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month following the month of first use. Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast.

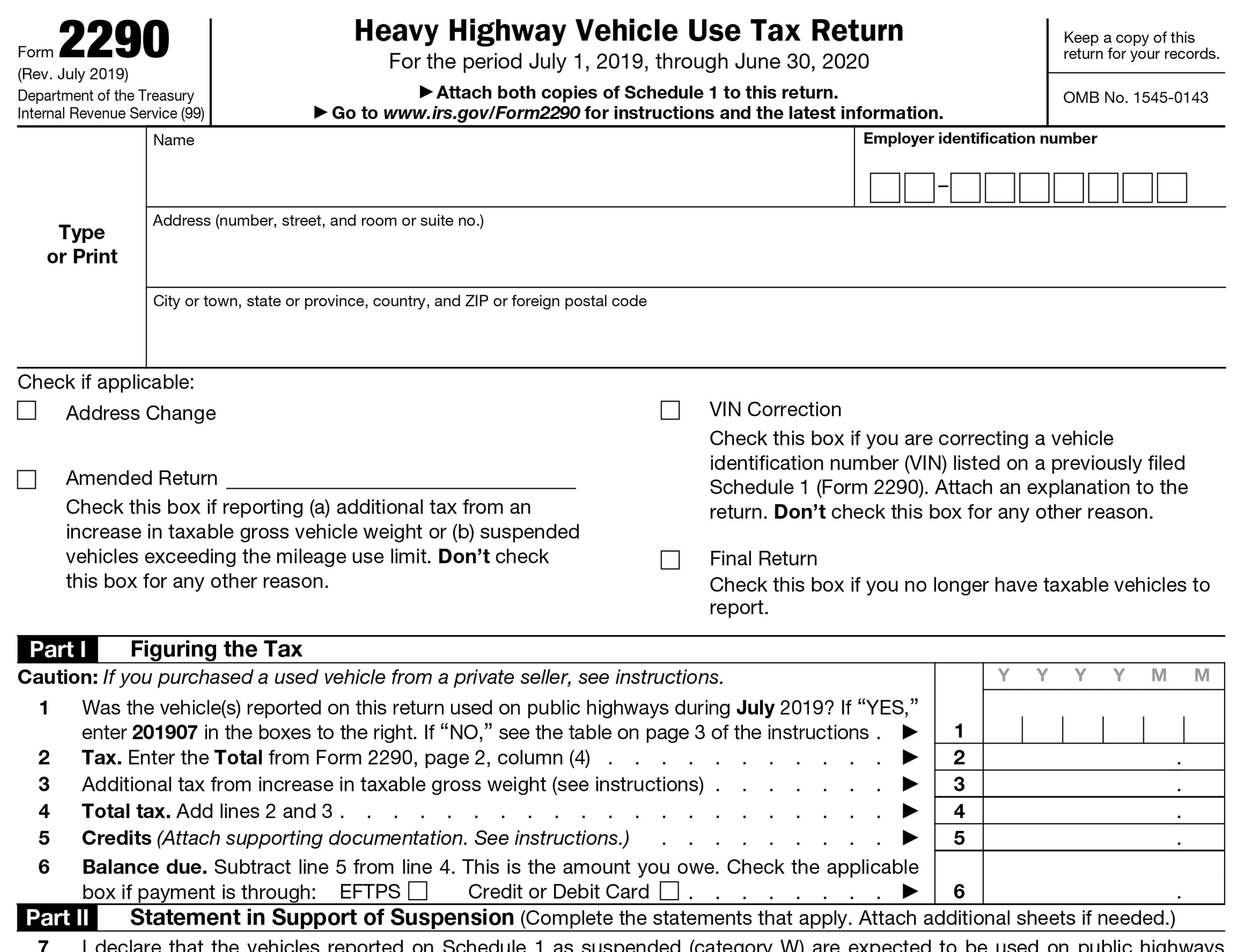

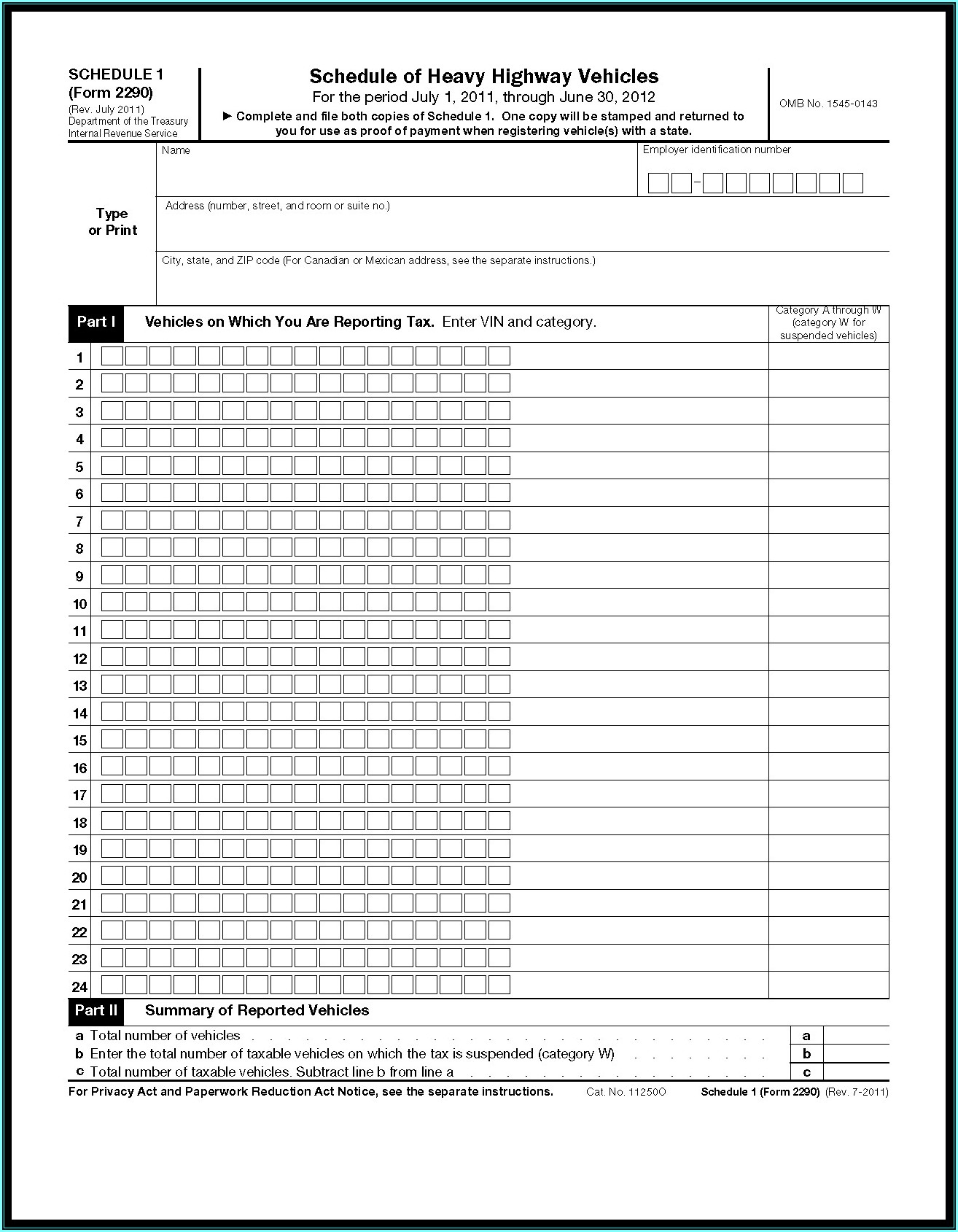

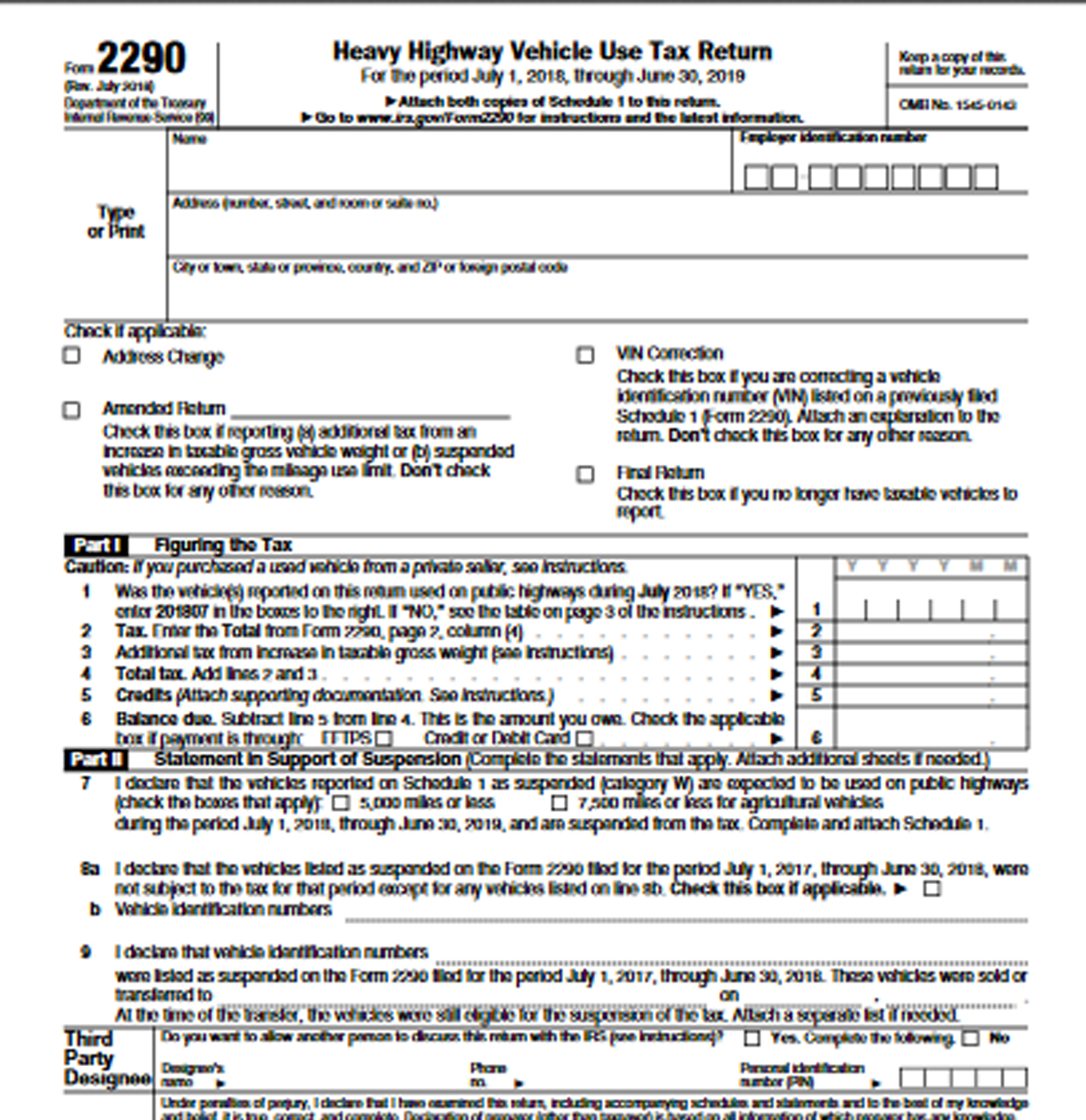

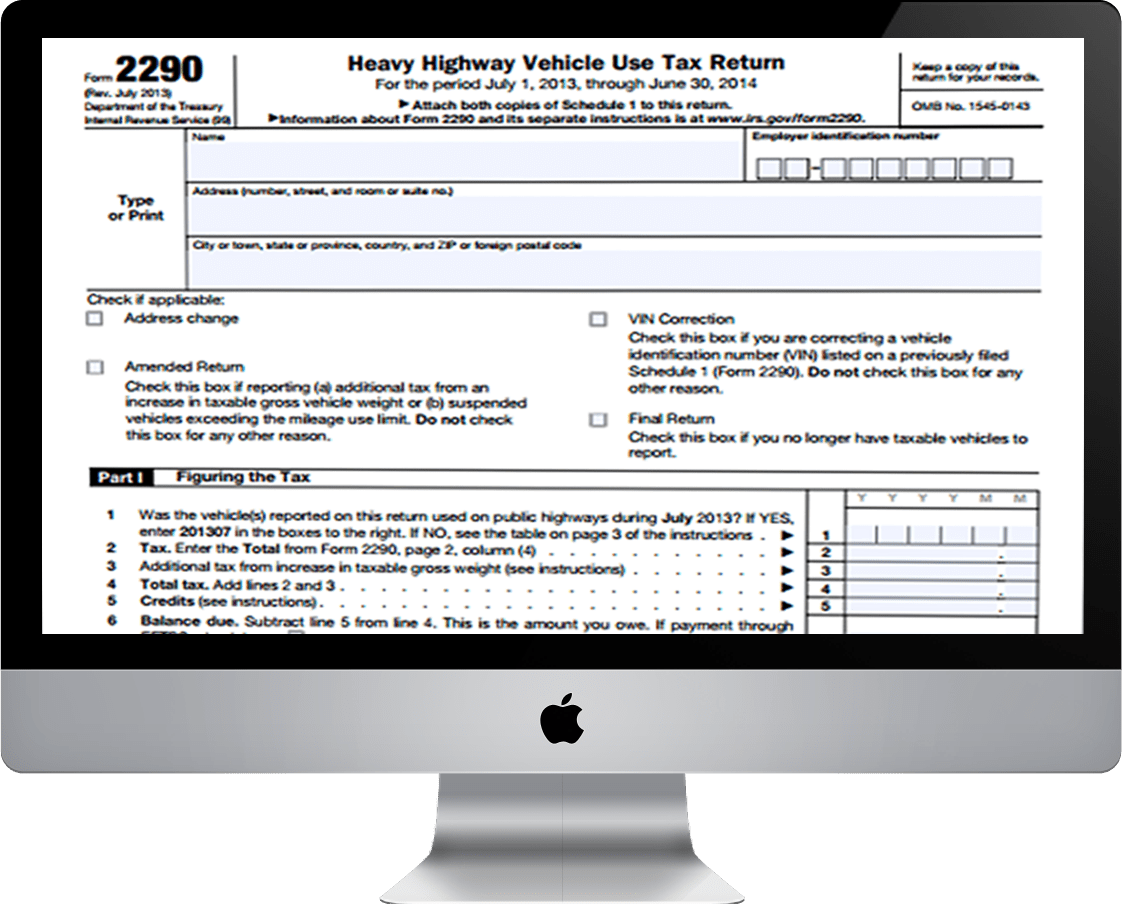

Use form 2290 to file in the following circumstances: Web by filing form 2290, individuals and businesses fulfill their tax obligations and contribute to the funding of public highway maintenance and improvements. File your 2290 online & get schedule 1 in minutes. With full payment and that payment is not drawn. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. If you are filing a form 2290 paper return: Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month following the month of first use. Web 1 day agowhen should i file a form 2290? Who needs to file form. Web the filing season for form 2290 filers is july 1 through june 30.

Use form 2290 to file in the following circumstances: Web form 2290 is an annual return that needs to be filed every year. With full payment and that payment is not drawn. If the vehicle only traveled 3,000 miles during that time, you. The irs 2290 deadline for filing the 2290 tax form and paying heavy vehicle use tax is “august 31st”. Web john uses a taxable vehicle on a public highway by driving it home from the dealership on july 2, 2023, after purchasing it. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Irs 2290 form should be filed for each month a. If you are filing a form 2290 paper return: Web the filing season for form 2290 filers is july 1 through june 30.

10 Easy steps to efile form 2290 online for the TY 202122 Precise

Who needs to file form. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. The current tax period for heavy highway vehicles. If you are filing a form 2290 paper return: Web find out where to.

Printable 2290 Form Customize and Print

If the vehicle only traveled 3,000 miles during that time, you. If you are filing a form 2290 paper return: Web when to file irs form 2290. Use form 2290 to file in the following circumstances: The current period begins july 1,.

How to e file form 2290 for new vehicle by Express Truck Tax Issuu

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Form 2290 must be filed for each month a taxable vehicle is first used on public highways during the current period. The tax period to file your.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Get schedule 1 in minutes, your form 2290 is efiled directly to the irs. The tax period to file your return begins july 1 and ends on june 30 every year. Web the 2290 form must be filed by the last day of the month following the first month of use. File your 2290 online & get schedule 1 in.

E File Form 2290 Irs Form Resume Examples Wk9yzrvY3D

Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum). Web for example, say you paid your hvut return for the period spanning july 1, 2021 through june 30, 2022. Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped.

PreFile 2290 Form Online for 20222023 Tax Year & Pay HVUT Later

All the information needed to. The filing rules apply whether you are paying the tax. Web month form 2290 must be filed; Who needs to file form. Web for example, say you paid your hvut return for the period spanning july 1, 2021 through june 30, 2022.

How to e file form 2290 for new vehicle

Web irs 2290 form should be used for filing your truck tax in a timely manner to avoid possible penalties. The filing deadline for form 2290 is based on the month you first use the taxable vehicle on public. Get schedule 1 or your money back. The current tax period for heavy highway vehicles. The current period begins july 1,.

Notifications for every situation when you efile Form 2290 Online

The vehicle is required to be registered in his name. Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month following the month of first use. The filing rules apply whether you are paying the tax. Irs 2290 form should be filed for each month a. Web for example, say you.

How to Efile Form 2290 for 202223 Tax Period

Any individual, llc, cooperation, or any other type of organization that registers heavy vehicles with a taxable gross weight of 55,000 pounds or more must file form. The tax period to file your return begins july 1 and ends on june 30 every year. Web find out where to mail your completed form. If you are filing a form 2290.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web month form 2290 must be filed; The current tax period for heavy highway vehicles. Web for example, say you paid your hvut return for the period spanning july 1, 2021 through june 30, 2022. Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum)..

Web When To File Irs Form 2290.

The filing rules apply whether you are paying the tax. Irs 2290 form should be filed for each month a. The filing rules apply whether you are paying the tax or reporting suspension of the tax. Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month following the month of first use.

Ad Efile Form 2290 (Hvut) Tax Return Directly To The Irs And Get Your Stamped Schedule 1 Fast.

The filing deadline for form 2290 is based on the month you first use the taxable vehicle on public. Get schedule 1 or your money back. The vehicle is required to be registered in his name. Web by filing form 2290, individuals and businesses fulfill their tax obligations and contribute to the funding of public highway maintenance and improvements.

File Your 2290 Online & Get Schedule 1 In Minutes.

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Any individual, llc, cooperation, or any other type of organization that registers heavy vehicles with a taxable gross weight of 55,000 pounds or more must file form. The irs 2290 deadline for filing the 2290 tax form and paying heavy vehicle use tax is “august 31st”. Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum).

If You Are Filing A Form 2290 Paper Return:

Figure and pay tax due on vehicles used during the reporting period with. Get schedule 1 in minutes, your form 2290 is efiled directly to the irs. File your 2290 online & get schedule 1 in minutes. Web find out where to mail your completed form.