When Is Form 712 Required

When Is Form 712 Required - If your mother's estate was less than (approximately) $5.4 million, you are not. It is also used when a life insurance policy changes. Will you provide a form 712? Form 712 reports the value of life insurance policies for estate tax purposes. Web the time needed to complete and file this form will vary depending on individual circumstances. Find out when i need an irs form 712? Under most of our group life insurance plans, an employee must be actively at work to be considered eligible for life insurance. American mayflower life insurance company. Life insurance death proceeds form 712. Irs form 712 is a statement that.

Web form 712) in lieu of any documentation issued by the postal service, provided, that the certifcate bears the postal service postmark, showing the date of mailing and location of. Under most of our group life insurance plans, an employee must be actively at work to be considered eligible for life insurance. Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Irs form 712 is a statement that. Web why is the employee’s date last worked required? Web form 712 reports the value of a policy in order to prepare the estate tax forms. Form 712 reports the value of life insurance policies for estate tax purposes. Web the time needed to complete and file this form will vary depending on individual circumstances. Web notified by mail within 30 days if additional review is required. Web when is irs form 712 required?

Web what is irs form 712? The value of all policies on the decedent’s life must be reported on the. File a separate form 712 for each policy. If your mother's estate was less than (approximately) $5.4 million, you are not. It is also used when a life insurance policy changes. Under the act, if a spouse died after december 31, 2010 and the deceased spouse’s executor made the proper election on irs form 706 (called a. Web form 712 is an irs form used for finalizing the estate of the deceased. Irs form 712 is a statement that. American mayflower life insurance company. Web why is the employee’s date last worked required?

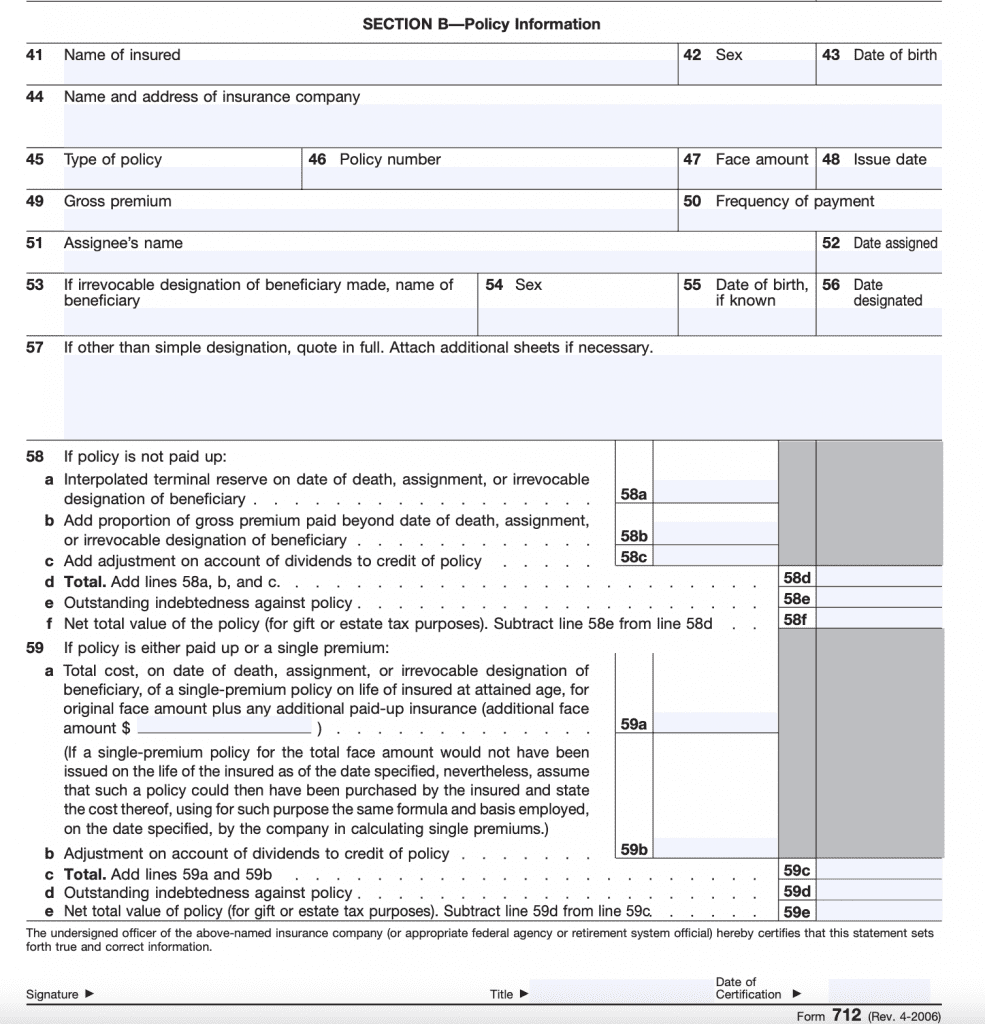

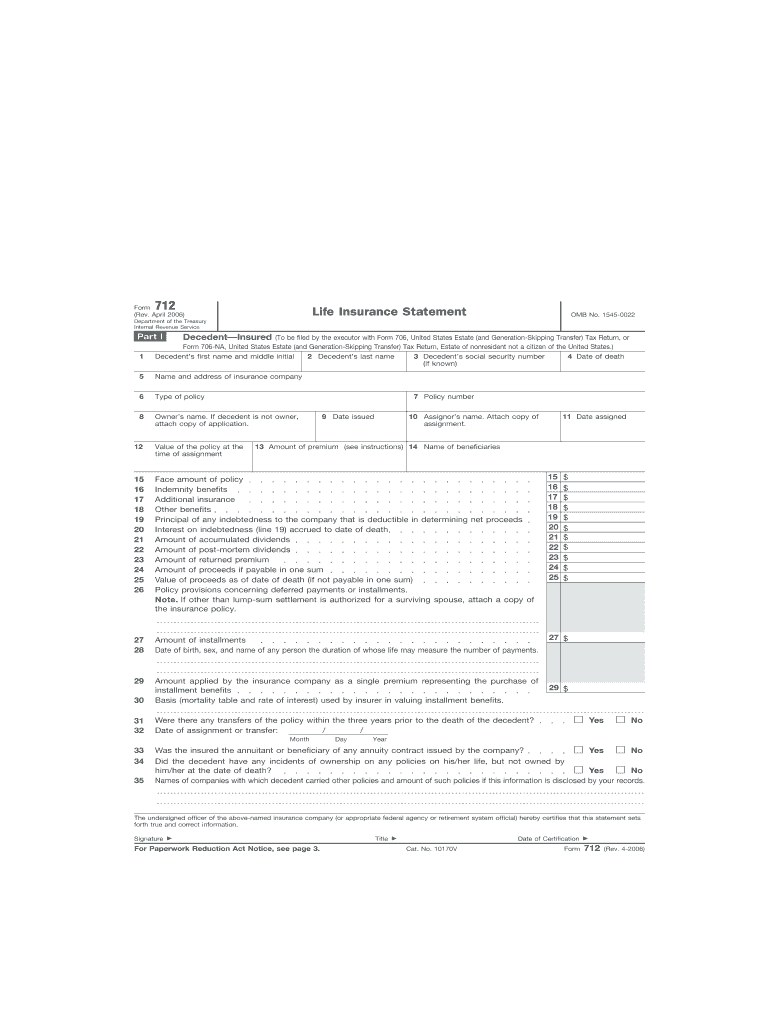

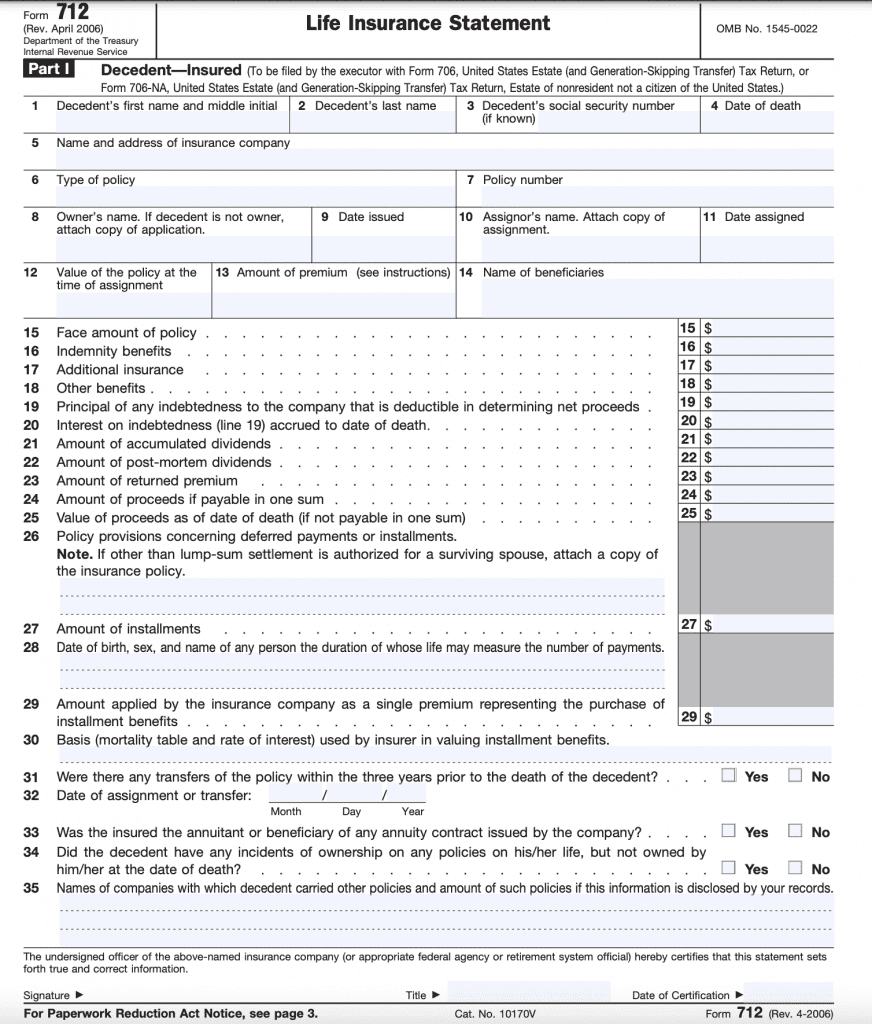

Form 712 Life Insurance Statement (2006) Free Download

Web notified by mail within 30 days if additional review is required. File a separate form 712 for each policy. Web why is the employee’s date last worked required? Web when is irs form 712 required? Web form 712 reports the value of a policy in order to prepare the estate tax forms.

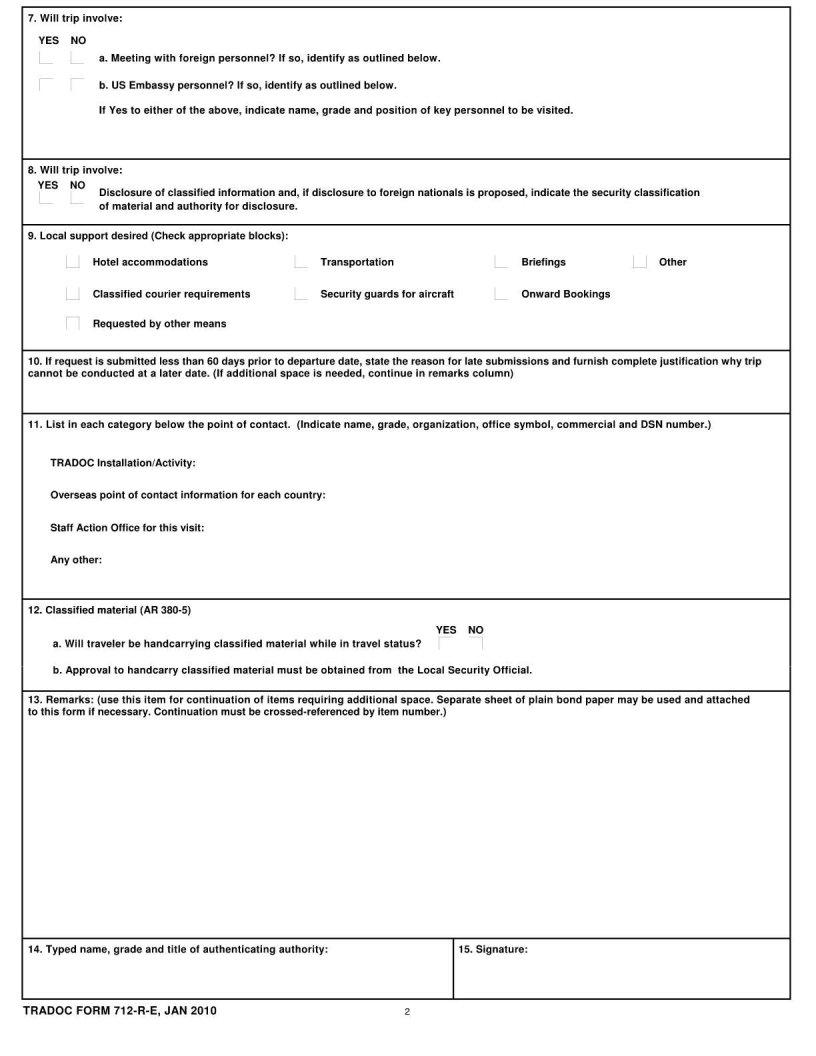

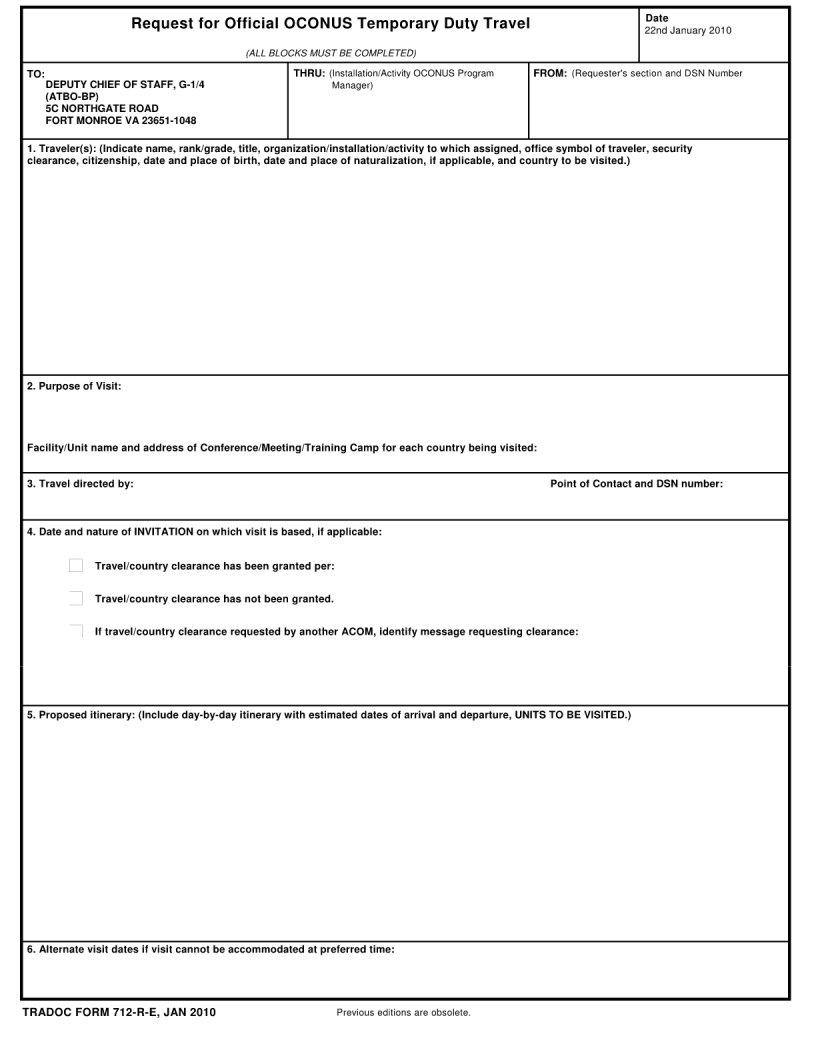

Tradoc Form 712 R E ≡ Fill Out Printable PDF Forms Online

Web notified by mail within 30 days if additional review is required. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web why is the employee’s date last worked required? Under most of our group life insurance plans, an employee must.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

It is also used when a life insurance policy changes. Web notified by mail within 30 days if additional review is required. Will you provide a form 712? Find out when i need an irs form 712? If your mother's estate was less than (approximately) $5.4 million, you are not.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

If your mother's estate was less than (approximately) $5.4 million, you are not. Web the time needed to complete and file this form will vary depending on individual circumstances. Will you provide a form 712? Under most of our group life insurance plans, an employee must be actively at work to be considered eligible for life insurance. Irs form 712.

Tradoc Form 712 R E ≡ Fill Out Printable PDF Forms Online

Web the time needed to complete and file this form will vary depending on individual circumstances. Will you provide a form 712? The value of all policies on the decedent’s life must be reported on the. Life insurance death proceeds form 712. Web form 712 reports the value of a policy in order to prepare the estate tax forms.

IRS Form 712 A Guide to the Life Insurance Statement

It reports the value of a life insurance policy’s proceeds. Under most of our group life insurance plans, an employee must be actively at work to be considered eligible for life insurance. File a separate form 712 for each policy. The value of all policies on the decedent’s life must be reported on the. Web form 712 is an irs.

Form 712 Fill Out and Sign Printable PDF Template signNow

Under the act, if a spouse died after december 31, 2010 and the deceased spouse’s executor made the proper election on irs form 706 (called a. It is also used when a life insurance policy changes. Life insurance death proceeds form 712. Web what is irs form 712? Form 712 reports the value of life insurance policies for estate tax.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

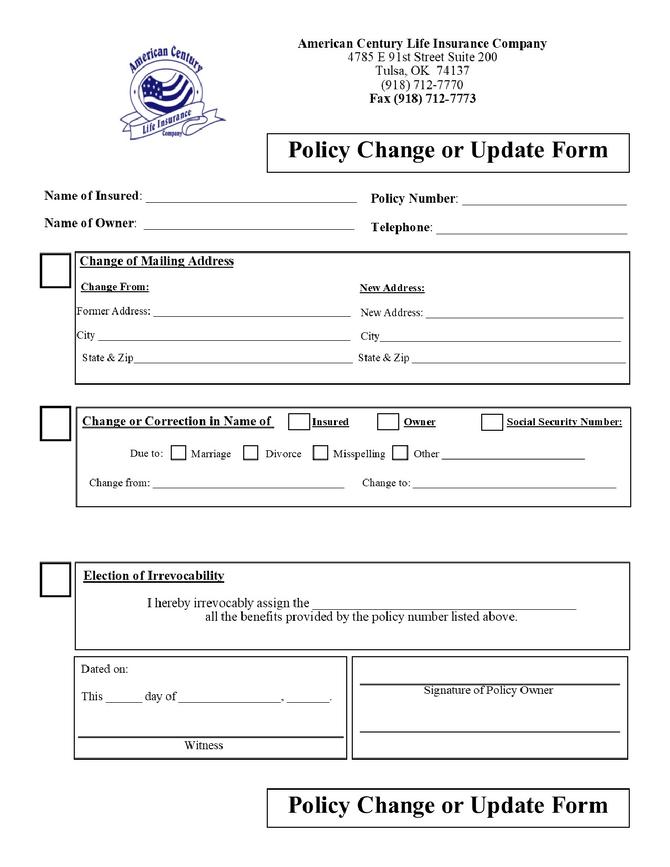

Web form 712 is an irs form used for finalizing the estate of the deceased. Form 712 reports the value of life insurance policies for estate tax purposes. American mayflower life insurance company. Web form 712) in lieu of any documentation issued by the postal service, provided, that the certifcate bears the postal service postmark, showing the date of mailing.

Form 712 Life Insurance Statement (2006) Free Download

(all blocks must be completed) to: Web when is irs form 712 required? Irs form 712 is a statement that. The irs requires that this statement be included when an estate (or gift) tax return is filed. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some.

IRS Form 712 A Guide to the Life Insurance Statement

Under the act, if a spouse died after december 31, 2010 and the deceased spouse’s executor made the proper election on irs form 706 (called a. Form 712 provides taxpayers and the irs with information to determine if insurance on the decedent's life is includible in the gross. (all blocks must be completed) to: The irs requires that this statement.

Will You Provide A Form 712?

Web form 712 reports the value of a policy in order to prepare the estate tax forms. American mayflower life insurance company. Irs form 712 is a statement that. (all blocks must be completed) to:

It Reports The Value Of A Life Insurance Policy’s Proceeds.

File a separate form 712 for each policy. The irs requires that this statement be included when an estate (or gift) tax return is filed. Web why is the employee’s date last worked required? Form 712 reports the value of life insurance policies for estate tax purposes.

It Is Also Used When A Life Insurance Policy Changes.

Web what is irs form 712? Under most of our group life insurance plans, an employee must be actively at work to be considered eligible for life insurance. Find out when i need an irs form 712? Life insurance death proceeds form 712.

Web When Is Irs Form 712 Required?

Web notified by mail within 30 days if additional review is required. Web form 712) in lieu of any documentation issued by the postal service, provided, that the certifcate bears the postal service postmark, showing the date of mailing and location of. Form 712 provides taxpayers and the irs with information to determine if insurance on the decedent's life is includible in the gross. Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return.