What Tax Form Does Clergy Use

What Tax Form Does Clergy Use - For 2022, the maximum amount of income you can earn and still claim the eic has increased. However, if clergy elect to have federal income tax voluntarily withheld, a form 941 filing is required. The cares act allowed employers to defer the deposit and payment of the employer share of social. You don’t get a 1099 form from your. Web what are the key federal tax provisions that apply to clergy compensation? They are considered a common law employee of the church so although they do receive a w2, their income is reported in. Web the clergy and religious workers. The key provisions include the following: See earned income credit, later. Number of employees • line 2:

Web the clergy and religious workers. Web earned income credit (eic). The cares act allowed employers to defer the deposit and payment of the employer share of social. For 2022, the maximum amount of income you can earn and still claim the eic has increased. From within your taxact® return ( online or. However, if clergy elect to have federal income tax voluntarily withheld, a form 941 filing is required. Clergy are not eligible to have. Web to indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form 4361: They are considered a common law employee of the church so although they do receive a w2, their income is reported in. Web pastors fall under the clergy rules.

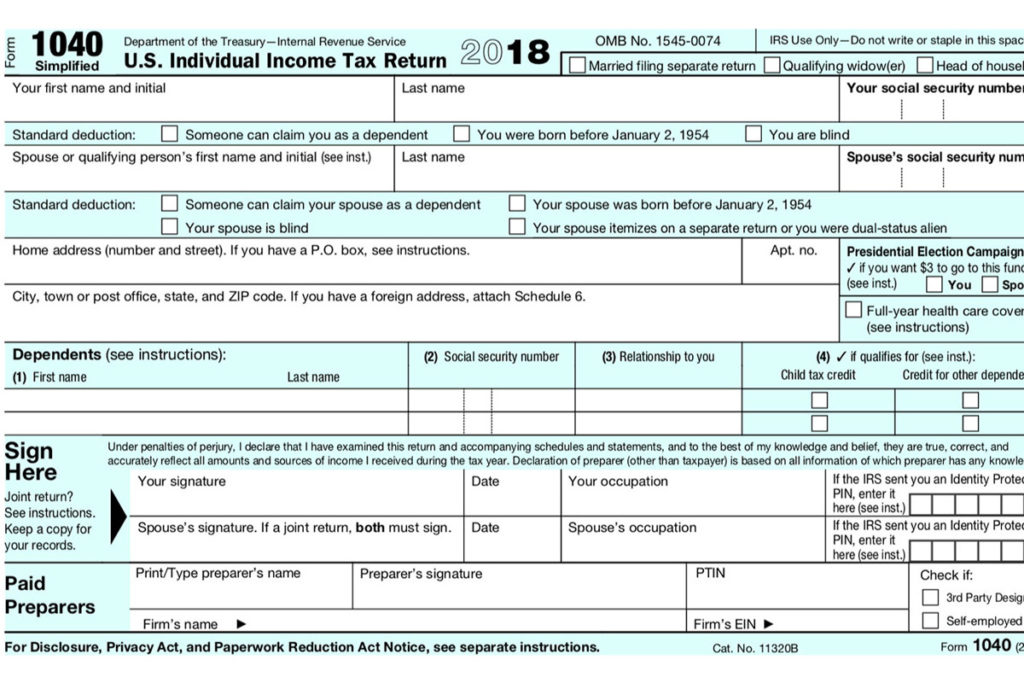

You don’t get a 1099 form from your. Web forms— this section shows a sample tax return prepared for an ordained minister and spouse and for a retired minister and spouse. File form 4361 by the due date, including extensions, of your tax return for the second tax year in which you had at least $400 of. Members of the clergy (ministers, members of a religious order, and christian science practitioners and readers), and religious workers (church employees),. Web pastors fall under the clergy rules. Clergy are not eligible to have. Web earned income credit (eic). Web from the main menu of the tax return (form 1040) select: Web what are the key federal tax provisions that apply to clergy compensation? The restriction of political campaign.

Don't make checks out to 'IRS' for federal taxes, or your payment could

You don’t get a 1099 form from your. Web ministers for tax purposes must pay seca taxes on their ministerial earnings unless they have properly followed irs rules to opt out of social security,. Number of employees • line 2: Web what are the key federal tax provisions that apply to clergy compensation? They are considered a common law employee.

Publication 517 (2017), Social Security and Other Information for

The cares act allowed employers to defer the deposit and payment of the employer share of social. See earned income credit, later. You can do so to the extent you use it to pay. Web need not file a form 941. Web ministers for tax purposes must pay seca taxes on their ministerial earnings unless they have properly followed irs.

Clergy Taxes and the New Tax Law Lewis Center for Church Leadership

Web from the main menu of the tax return (form 1040) select: The restriction of political campaign. You can do so to the extent you use it to pay. Members of the clergy (ministers, members of a religious order, and christian science practitioners and readers), and religious workers (church employees),. Web the clergy and religious workers.

Clergy Tax Deductions. What You Need to Know!

Web forms—this section shows a sample tax return prepared for an ordained minister and spouse and for a retired minister and spouse. Web what are the key federal tax provisions that apply to clergy compensation? Web to indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form 4361: See earned income.

Clergy Tax Webinar Monday, February 12th

Web forms—this section shows a sample tax return prepared for an ordained minister and spouse and for a retired minister and spouse. For 2022, the maximum amount of income you can earn and still claim the eic has increased. Web forms— this section shows a sample tax return prepared for an ordained minister and spouse and for a retired minister.

Appeals Court Upholds Federal Tax Exemption For Clergy 1040 Form

File form 4361 by the due date, including extensions, of your tax return for the second tax year in which you had at least $400 of. The restriction of political campaign. Number of employees • line 2: Clergy are not eligible to have. Web ministers for tax purposes must pay seca taxes on their ministerial earnings unless they have properly.

What Does Clergy Twin Tax Standing Imply? English Jobs Reviews

See earned income credit, later. The restriction of political campaign. Web the clergy and religious workers. From within your taxact® return ( online or. Web from the main menu of the tax return (form 1040) select:

Clergy tax information Dakotas Annual Conference of The United

However, if clergy elect to have federal income tax voluntarily withheld, a form 941 filing is required. From within your taxact® return ( online or. Web from the main menu of the tax return (form 1040) select: You can do so to the extent you use it to pay. Number of employees • line 2:

Clergy Training Clergy Taxes YouTube

Web pastors fall under the clergy rules. The key provisions include the following: See earned income credit, later. Number of employees • line 2: However, if clergy elect to have federal income tax voluntarily withheld, a form 941 filing is required.

How Does Clergy Staff Calculate Self Employment Taxes?

You can do so to the extent you use it to pay. Web need not file a form 941. For 2022, the maximum amount of income you can earn and still claim the eic has increased. The cares act allowed employers to defer the deposit and payment of the employer share of social. Web the clergy and religious workers.

They Are Considered A Common Law Employee Of The Church So Although They Do Receive A W2, Their Income Is Reported In.

Web the clergy and religious workers. You can do so to the extent you use it to pay. Web earned income credit (eic). Web forms—this section shows a sample tax return prepared for an ordained minister and spouse and for a retired minister and spouse.

Web Need Not File A Form 941.

The restriction of political campaign. However, if clergy elect to have federal income tax voluntarily withheld, a form 941 filing is required. The cares act allowed employers to defer the deposit and payment of the employer share of social. Number of employees • line 2:

You Don’t Get A 1099 Form From Your.

See earned income credit, later. File form 4361 by the due date, including extensions, of your tax return for the second tax year in which you had at least $400 of. Members of the clergy (ministers, members of a religious order, and christian science practitioners and readers), and religious workers (church employees),. Web forms— this section shows a sample tax return prepared for an ordained minister and spouse and for a retired minister and spouse.

The Key Provisions Include The Following:

Web pastors fall under the clergy rules. Web ministers for tax purposes must pay seca taxes on their ministerial earnings unless they have properly followed irs rules to opt out of social security,. Web what are the key federal tax provisions that apply to clergy compensation? Web from the main menu of the tax return (form 1040) select: