What Is The Minimum Debt To File Chapter 7

What Is The Minimum Debt To File Chapter 7 - Web how much debt do i need to file for chapter 7 bankruptcy? Web keep in mind that chapter 7 and chapter 13 provide different types of debt relief, and there are pros and cons to each. Here, you can’t have more than $1,257,850 in secured debt or. Some individuals file with as little as $3,000 of debt. Web no minimum debt amount needed to file for bankruptcy if you don't have much debt but want to file for bankruptcy, you're free to do so. It is available to individuals who cannot make regular, monthly, payments toward their debts. Will i have to pay the debt back in the future? There are currently no threshold amounts for chapter 7 bankruptcy eligibility. Web as of 2012, the federal bankruptcy code does not put a limit on the amount of unsecured debt you can claim in chapter 7. It will meet with creditors later this month on its.

However, it will stay on your credit report for ten years from the date of filing. There is, however, a limit that you need to be aware of, if you're considering filing for chapter. Businesses choosing to terminate their enterprises may also file chapter 7. The total amount of your debt is a crucial factor to consider before filing chapter 7. Web keep in mind that chapter 7 and chapter 13 provide different types of debt relief, and there are pros and cons to each. Minimum debt required for filing bankruptcy how much debt do you need to file for bankruptcy? Web filing for chapter 7 only takes four to six months to complete. (2) a schedule of current income and expenditures; Qualification factors while there is no minimum amount of debt required in order to file for chapter 7 protection, you will need to demonstrate an inability to pay your debts. Some debts (such as child support, civil lawsuit debts, or “new” tax debt) cannot be discharged in chapter 7.

Web “about 90% of the people who file bankruptcy can file chapter 7 based on their income alone because their income is below the median for a family of their size in their location,” pamela foohey, a professor of. (2) a schedule of current income and expenditures; Web i have good news on this front, the answer is, that there's no limit. However, it will stay on your credit report for ten years from the date of filing. Some chapters of bankruptcy do have debt limits, but there is no such thing as a debt minimum. What you will need to do is exhibit an incapacity to pay your debts. Web liquidation under chapter 7 is a common form of bankruptcy. Qualification factors while there is no minimum amount of debt required in order to file for chapter 7 protection, you will need to demonstrate an inability to pay your debts. Sometimes the main consideration on whether to file bankruptcy on a debt is the type of debt. Here, you can’t have more than $1,257,850 in secured debt or.

How To File Bankruptcy Chapter 7 Yourself In Ny opmakenopstardoll

You can have an infinite amount of debt and still be able to file for chapter 7 bankruptcy. Web evergrande's offshore debt restructuring involves a total of $31.7 billion, which include bonds, collateral and repurchase obligations. Businesses choosing to terminate their enterprises may also file chapter 7. A creditor has limited time to collect a debt. If your disposable monthly.

Can I File Chapter 7 Bankruptcy to Get Rid Of Business Debt? Karra L

Web the truth is, there is no minimum amount of debt one will need in order to file chapter 7. Web evergrande's offshore debt restructuring involves a total of $31.7 billion, which include bonds, collateral and repurchase obligations. To file chapter 7 bankruptcy, you must be deemed. Web as of 2012, the federal bankruptcy code does not put a limit.

Chapter 7 Bankruptcy

It will meet with creditors later this month on its. Web the short answer to this question is “no, there is no minimum amount of debt necessary to qualify for bankruptcy.” however, for chapter 7 bankruptcy cases, there is a requirement that the filer demonstrate that they do not have sufficient means to pay back their debts through a chapter..

Minimum Debt to File Bankruptcy? Is There A Minimum Debt Amount To File

Web what’s the minimum amount of debt to file chapter 7? There is, however, a limit that you need to be aware of, if you're considering filing for chapter. Qualification factors while there is no minimum amount of debt required in order to file for chapter 7 protection, you will need to demonstrate an inability to pay your debts. A.

200,000 In Debt Making Minimum Wage YouTube

Some individuals file with as little as $3,000 of debt. To file chapter 7 bankruptcy, you must be deemed. Web “about 90% of the people who file bankruptcy can file chapter 7 based on their income alone because their income is below the median for a family of their size in their location,” pamela foohey, a professor of. There is,.

How Much Do You Have to Be in Debt to File Chapter 7 Bankruptcy?

Some chapters of bankruptcy do have debt limits, but there is no such thing as a debt minimum. Instead of thinking about how much money you literally owe, focus on how much you can afford to pay. Web as of 2012, the federal bankruptcy code does not put a limit on the amount of unsecured debt you can claim in.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

However, it will stay on your credit report for ten years from the date of filing. Now, this question was specifically geared towards chapter 7 bankruptcy. Sometimes the main consideration on whether to file bankruptcy on a debt is the type of debt. However, a bankruptcy court might find your filing concerning. There is no minimum amount of debt to.

Arizona Chapter 7 Bankruptcy Bankruptcy Attorneys in AZ for Ch. 7 BK

Now, this question was specifically geared towards chapter 7 bankruptcy. Web keep in mind that chapter 7 and chapter 13 provide different types of debt relief, and there are pros and cons to each. Here, you can’t have more than $1,257,850 in secured debt or. Web liquidation under chapter 7 is a common form of bankruptcy. Some individuals file with.

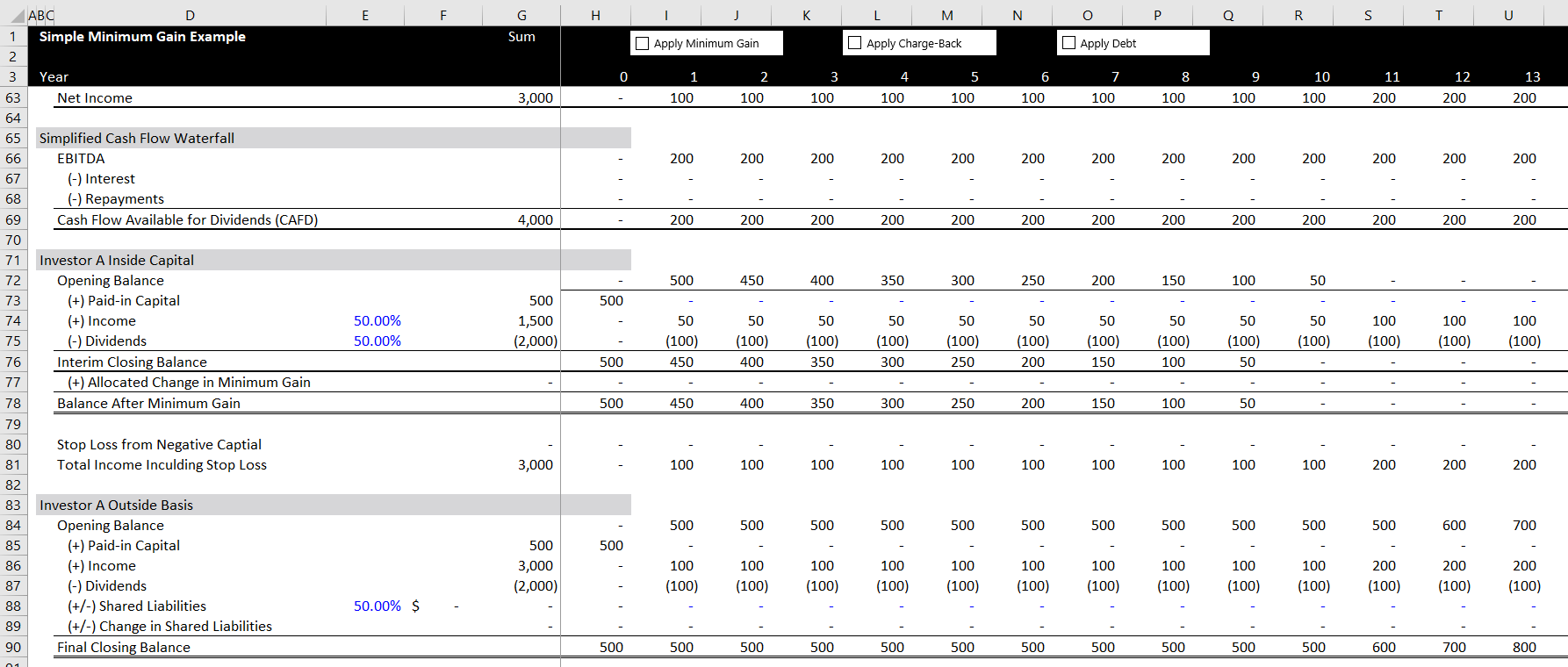

NonRecourse Debt and Minimum Gain Edward Bodmer Project and

The total amount of your debt is a crucial factor to consider before filing chapter 7. Sometimes the main consideration on whether to file bankruptcy on a debt is the type of debt. Minimum debt required for filing bankruptcy how much debt do you need to file for bankruptcy? When to file chapter 7 and determining if this is the..

Chapter 7 of the United States Bankruptcy Law Code

If your disposable monthly income is less than a certain amount (adjusted every. There are currently no threshold amounts for chapter 7 bankruptcy eligibility. The total amount of your debt is a crucial factor to consider before filing chapter 7. A creditor has limited time to collect a debt. Businesses choosing to terminate their enterprises may also file chapter 7.

Web Filing For Chapter 7 Only Takes Four To Six Months To Complete.

It is available to individuals who cannot make regular, monthly, payments toward their debts. Web keep in mind that chapter 7 and chapter 13 provide different types of debt relief, and there are pros and cons to each. There are currently no threshold amounts for chapter 7 bankruptcy eligibility. To file chapter 7 bankruptcy, you must be deemed.

Web Here Are The Debt And Eligibility Requirements For Filing Chapter 7 Bankruptcy.

Web is there a debt limit to file chapter 7? Qualification factors while there is no minimum amount of debt required in order to file for chapter 7 protection, you will need to demonstrate an inability to pay your debts. It will meet with creditors later this month on its. Sometimes the main consideration on whether to file bankruptcy on a debt is the type of debt.

A Creditor Has Limited Time To Collect A Debt.

There is no minimum amount of debt to file chapter 7 bankruptcy. Web the truth is, there is no minimum amount of debt one will need in order to file chapter 7. Now, this question was specifically geared towards chapter 7 bankruptcy. Web evergrande's offshore debt restructuring involves a total of $31.7 billion, which include bonds, collateral and repurchase obligations.

The Total Amount Of Your Debt Is A Crucial Factor To Consider Before Filing Chapter 7.

(1) schedules of assets and liabilities; Web i have good news on this front, the answer is, that there's no limit. However, it will stay on your credit report for ten years from the date of filing. You can have an infinite amount of debt and still be able to file for chapter 7 bankruptcy.