What Is Form 8825

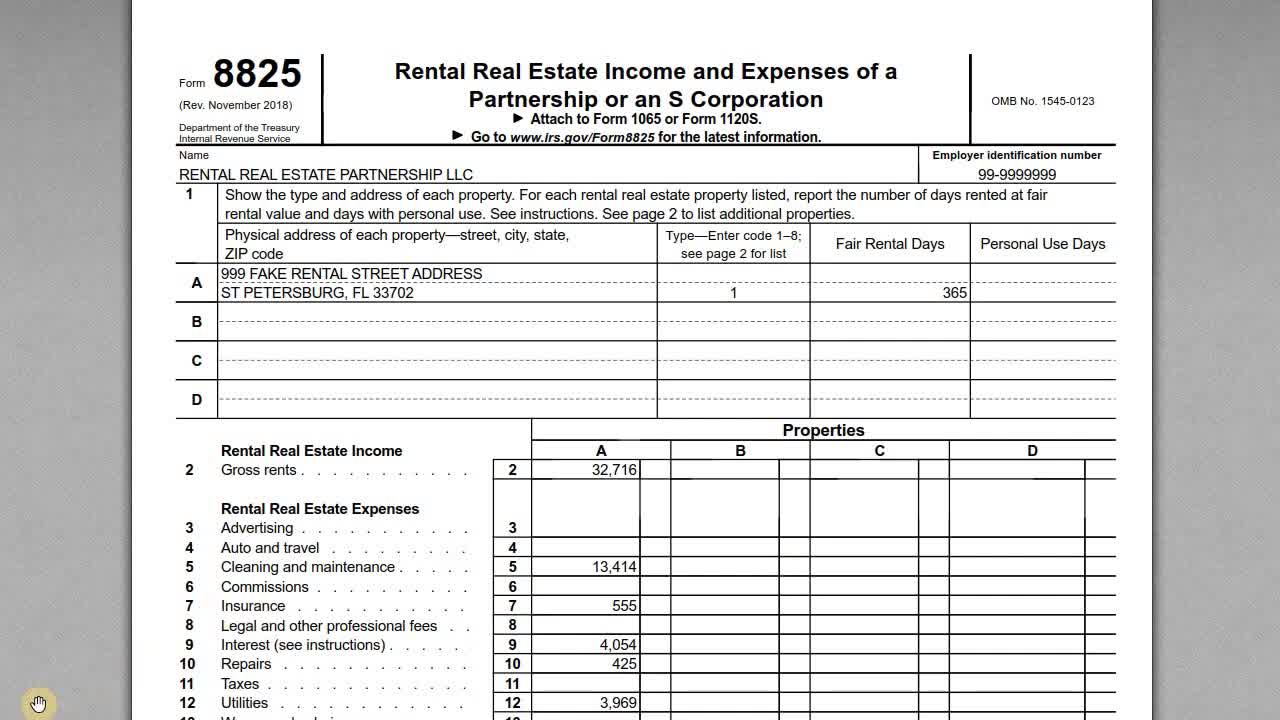

What Is Form 8825 - Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. Web what is form 8825? Web tax line mapping 8825. Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Web what is the 8825 tax form for and how do i file it? Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 8825 & more fillable forms, register and subscribe now!

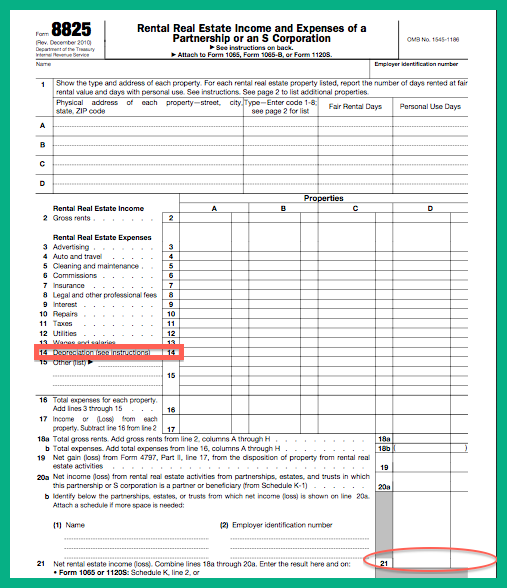

Web what is form 8825? Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). The abcd can be used for up to four properties in a single form. The 8825 tax form is the rental real estate income and expenses of a partnership or an s corporation. Ad access irs tax forms. The form allows you to record.

Get ready for tax season deadlines by completing any required tax forms today. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web what is form 8825? Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Web what is form 8825? Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from.

3.11.15 Return of Partnership Internal Revenue Service

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. The rent screen is used to enter rental income from sources other than real estate, such as. Web what is the form used for? Web the 8825 screen is used to enter income and expenses from rental.

IRS Form 8825 Reporting Rental and Expenses

Ad download or email irs 8825 & more fillable forms, register and subscribe now! Web the 8825 screen is used to enter income and expenses from rental real estate. Web what is form 8825? The form allows you to record. Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february.

Form 8825 Rental Real Estate and Expenses of a Partnership or

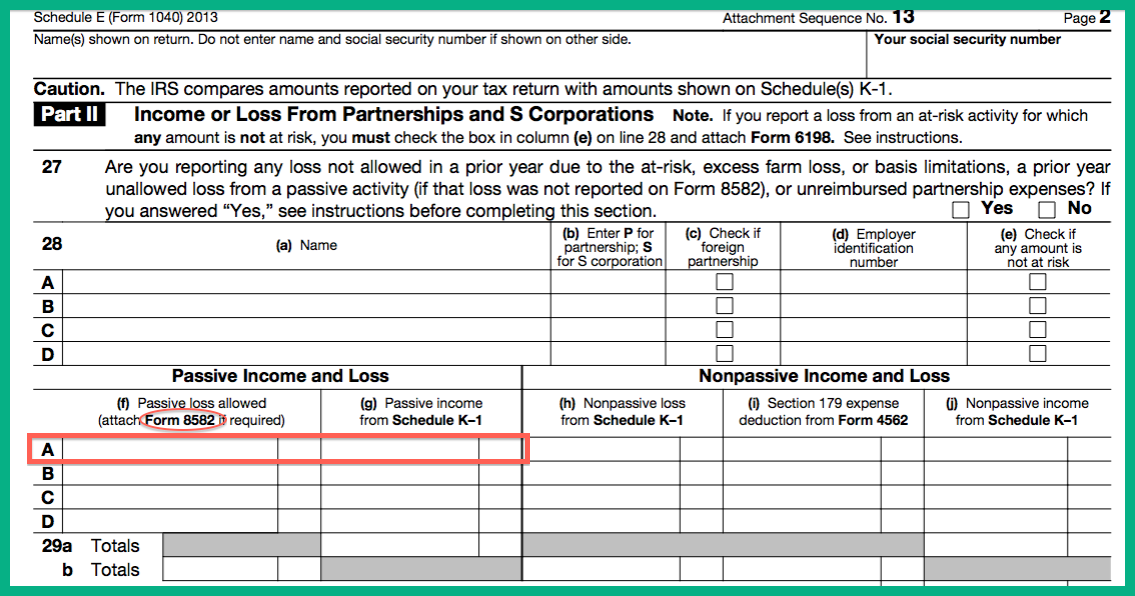

Web what is form 8825? Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income. Ad access irs tax forms. Web tax line mapping 8825. Rents form 8825 is matched to partnership return forms 1065 or 1120.

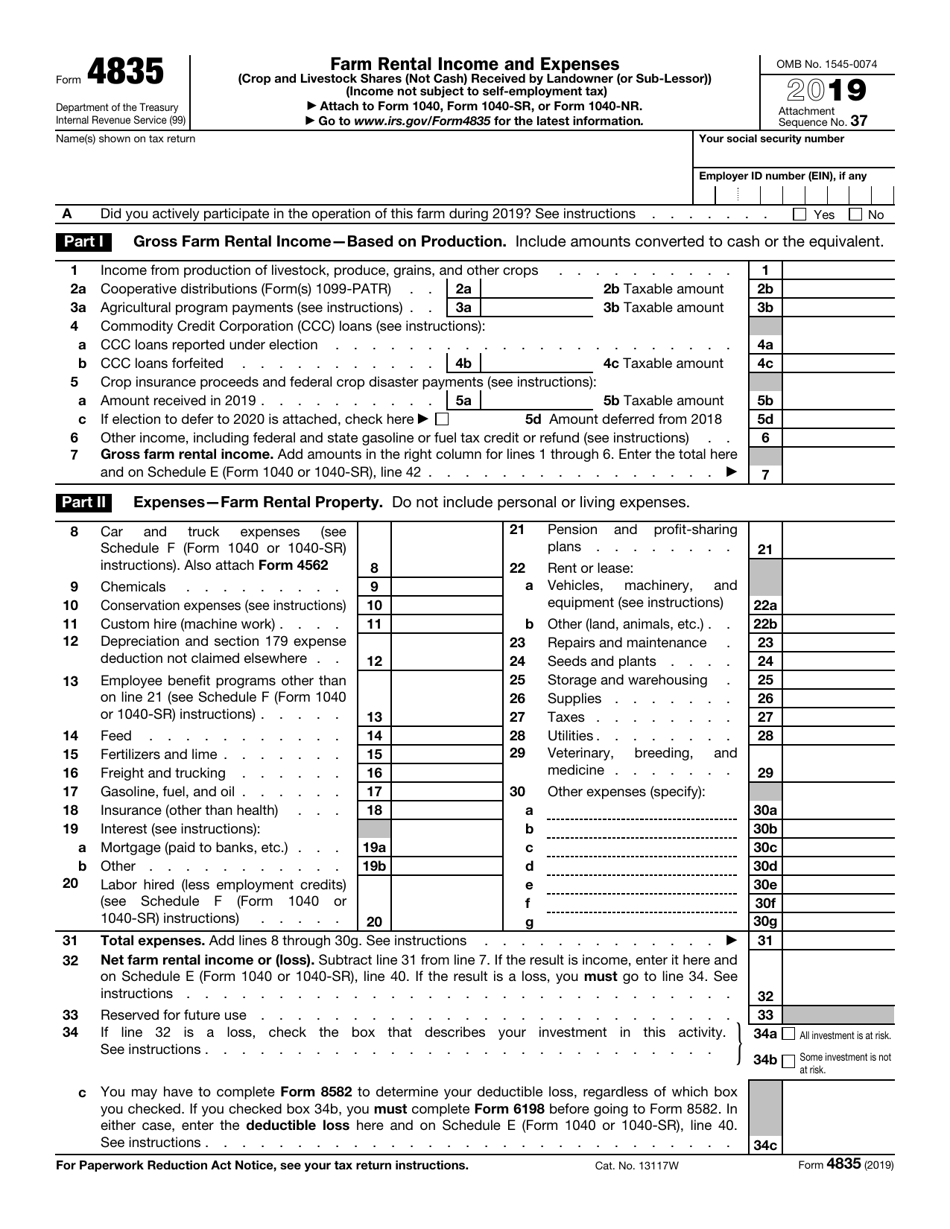

IRS Form 4835 Download Fillable PDF or Fill Online Farm Rental

The 8825 tax form is the rental real estate income and expenses of a partnership or an s corporation. Complete, edit or print tax forms instantly. The abcd can be used for up to four properties in a single form. Ad download or email irs 8825 & more fillable forms, register and subscribe now! Web partnerships and s corporations use.

Linda Keith CPA » All about the 8825

Web the 8825 screen is used to enter income and expenses from rental real estate. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). The 8825 tax form is the rental real estate income and expenses of a partnership or an s corporation. Get ready for tax.

IRS Form 8825 Other Misc. Expenses Irs forms, Irs, Form

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web what is form 8825? Partnerships and s corporations use.

Linda Keith CPA » All about the 8825

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Get ready for tax season deadlines by completing any required tax forms today. The abcd can be used for up to four properties in a single form. Irs form 8825 is a special tax form specifically for.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Rents form 8825 is matched to partnership return forms 1065 or 1120. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. Web what is the 8825 tax form for and how do i file it? Partnerships and.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully. Web what is form 8825? The abcd can be used for up to four properties in a single form. Ad download or email irs 8825 & more fillable forms,.

Form 8825 Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Rents form 8825 is matched to partnership return forms 1065 or 1120. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. The form allows you to record. Partnerships and s corporations use form 8825 to report income and deductible expenses.

Irs Form 8825 Is A Special Tax Form Specifically For Reporting The Rental Income And Expenses Of A Partnership Or S Corporation.

The rent screen is used to enter rental income from sources other than real estate, such as. Ad access irs tax forms. Web what is form 8825? Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss).

Irs Form 8825 Is A Special Tax Form Specifically For Reporting The Rental Income And Expenses Of A Partnership Or S Corporation.

Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web what is form 8825? The 8825 tax form is the rental real estate income and expenses of a partnership or an s corporation.

The Abcd Can Be Used For Up To Four Properties In A Single Form.

Ad download or email irs 8825 & more fillable forms, register and subscribe now! Rents form 8825 is matched to partnership return forms 1065 or 1120. Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully. Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new.

Web Form 8825 Will Generate As Blank If A Number Is Entered In The If Disposition Applies To Rental, Enter Rental Number (Enter As A Negative If Not Real Estate) Field Located.

Complete, edit or print tax forms instantly. Web what is the form used for? Get ready for tax season deadlines by completing any required tax forms today. Web tax line mapping 8825.