What Is Form 8615

What Is Form 8615 - For 2020, a child must file form 8615 if all of the. 2) the child is required to file a. You had more than $2,300 of unearned. Web form 8615 must be filed for any child who meets all of the following conditions. 1) the child's unearned income was more than $2,100. Web what is form 8615 used for. Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. The child had more than $2,300 of unearned income. Texas health and human services subject: Web to fill out form 8615 in turbotax:

Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. Refer to each child's taxpayer's information for use when. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed for any child who meets all of the following conditions. Web what is form 8615 used for. When using form 8615 in proseries, you should enter the child as the taxpayer on the. Type child’s income in search in the upper right; Texas health and human services subject: See who must file, later.

The child had more than $2,000 of unearned income. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. The child is required to file a tax return. Click jump to child’s income; Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. See who must file, later. 1) the child's unearned income was more than $2,100. Web form 8615, tax for certain children who have unearned income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the. Web to fill out form 8615 in turbotax: You had more than $2,300 of unearned.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Continue with the interview process to enter all of the appropriate. Web form 8615, tax for certain children who have unearned income. Web form 8615 must be filed for a child if all of the following statements are true. The child had more than $2,300 of unearned income. Form 8615 is required to be used when a taxpayer’s child had.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Under age 18, age 18 and did. Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. Web form 8615 must be filed for any child who meets all of the following conditions. Texas health and human services subject: For 2020, a child must file form 8615.

Form 8615 Office Depot

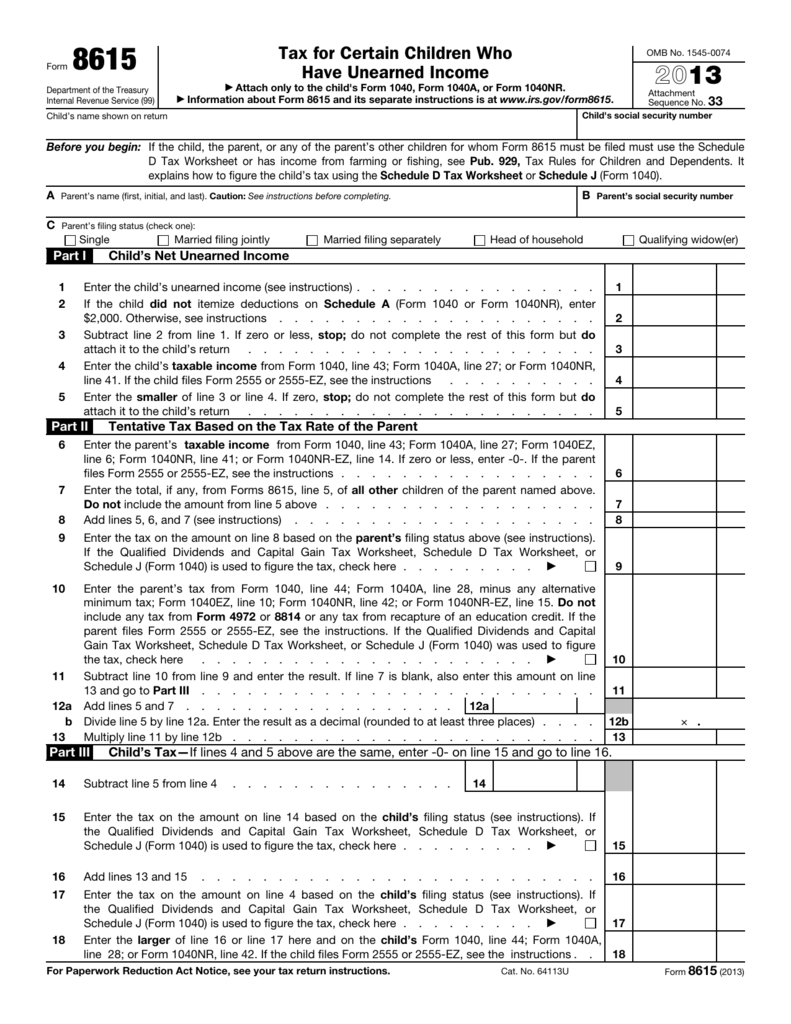

Web what is form 8615, tax for children under age 18? Web what is form 8615 used for. Web form 8615 must be filed for a child if all of the following statements are true. Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain.

Form 8615 Kiddie Tax Question tax

Web form 8615, tax for certain children who have unearned income. 2) the child is required to file a. The child is required to file a tax return. The child had more than $2,300 of unearned income. Continue with the interview process to enter all of the appropriate.

What Is Form 8615 Used For?

For 2020, a child must file form 8615 if all of the. Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. Type child’s income in search in the upper right; Continue with the interview process to enter all of the appropriate. Refer to each child's taxpayer's.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Web what is form 8615, tax for children under age 18? 1) the child's unearned income was more than $2,100. The child is required to file a tax return. Web form 8615, tax for certain children who have unearned income. Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under.

Form 8615 Edit, Fill, Sign Online Handypdf

Web to fill out form 8615 in turbotax: Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: 2) the child is required to file a. Web form 8615 must be filed for any child who meets all of the following conditions. For 2020, a child must file form 8615 if all.

Fill Free fillable Form 8615 Tax for Children Who Have Unearned

Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. 1) the child's unearned income was more than $2,100. Web form 8615 must be filed for any child who meets all of the following conditions. Signnow allows users to edit,.

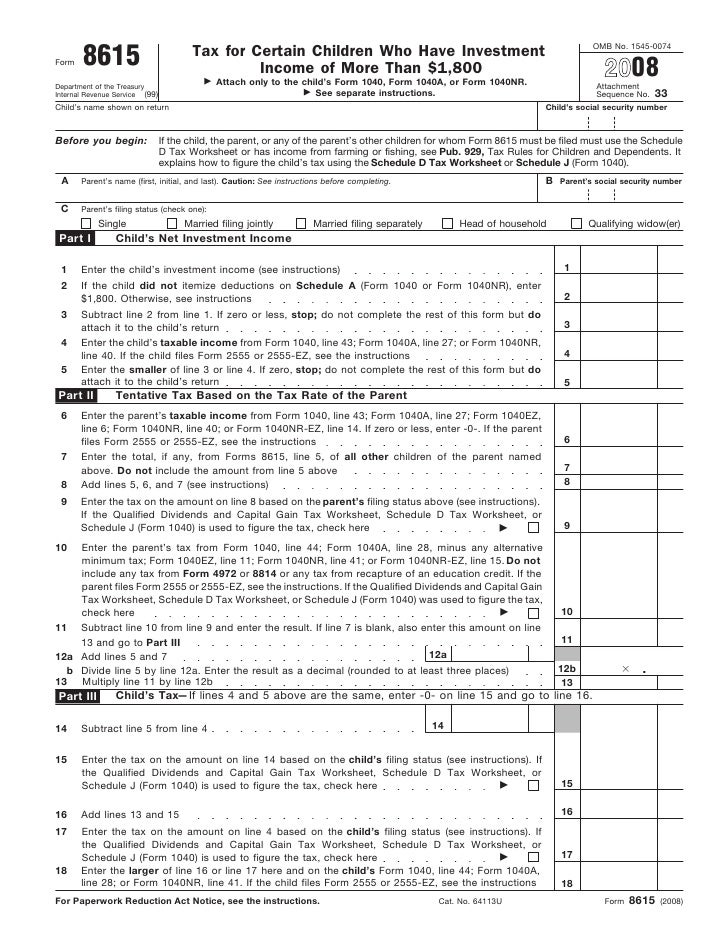

Form 8615Tax for Children Under Age 14 With Investment of Mor…

Web to fill out form 8615 in turbotax: The child had more than $2,300 of unearned income. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Continue with the interview process to enter all of the appropriate. Click jump to child’s.

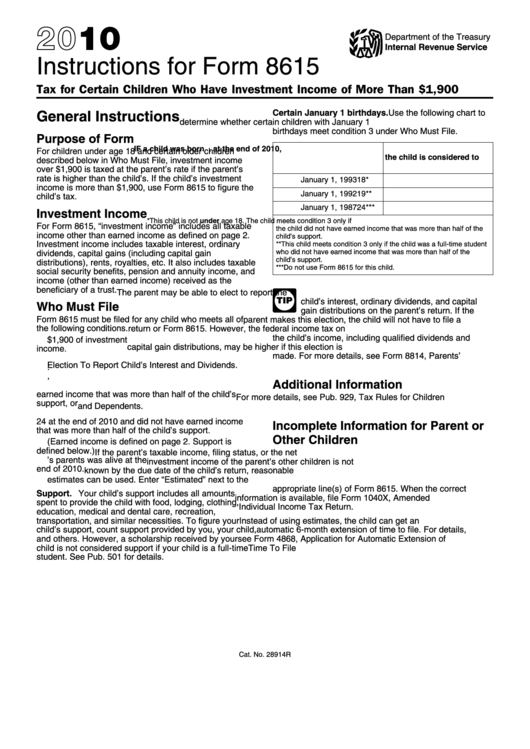

Instructions For Form 8615 Tax For Certain Children Who Have

Web what is form 8615, tax for children under age 18? Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. 1) the child's unearned income was more than $2,100. Ad register and subscribe now to work on your irs.

When Using Form 8615 In Proseries, You Should Enter The Child As The Taxpayer On The.

Web to fill out form 8615 in turbotax: Click jump to child’s income; Web form 8615, tax for certain children who have unearned income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the. Signnow allows users to edit, sign, fill and share all type of documents online.

Web Form 8615 Must Be Filed For A Child If All Of The Following Statements Are True.

Type child’s income in search in the upper right; Refer to each child's taxpayer's information for use when. The child had more than $2,300 of unearned income. Web what is form 8615 used for.

See Who Must File, Later.

Form 8615 must be filed with the child’s tax return if all of the following apply: The child is required to file a tax return. Texas health and human services subject: Web form 8615, tax for certain children who have unearned income.

Web The Line 5 Ratio Is The Last Line Of The Appropriate Line 5 Worksheet Divided By The First Line Of The Line 5 Worksheet.

For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,000 of unearned income. Continue with the interview process to enter all of the appropriate.