What Is Form 593

What Is Form 593 - Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Escrow provides this form to the seller, typically when the escrow instructions. Web 593 escrow or exchange no. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be. You must file form 2553 no later. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Web when is form 2553 due? Web form 2553 is an irs form.

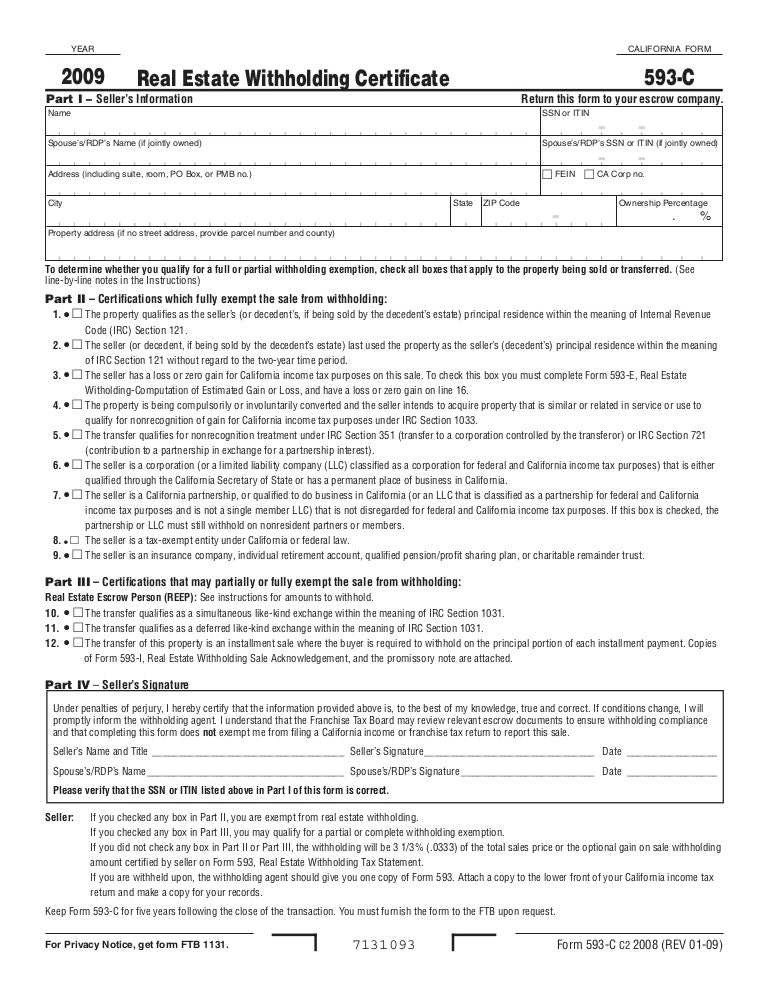

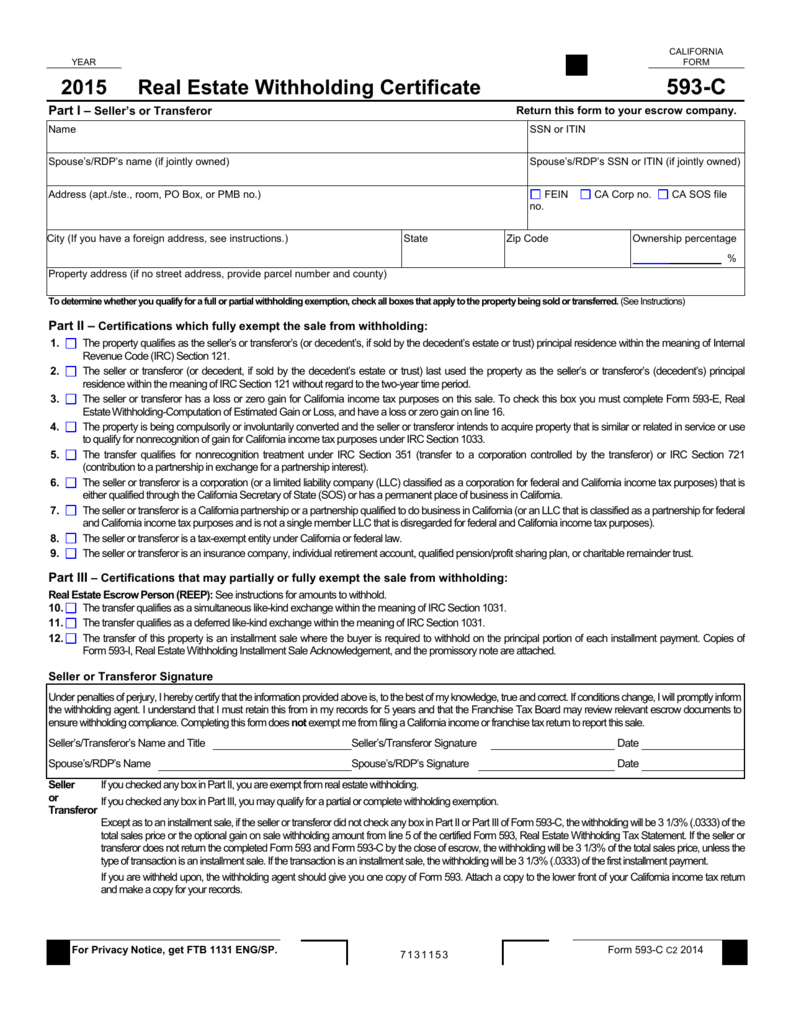

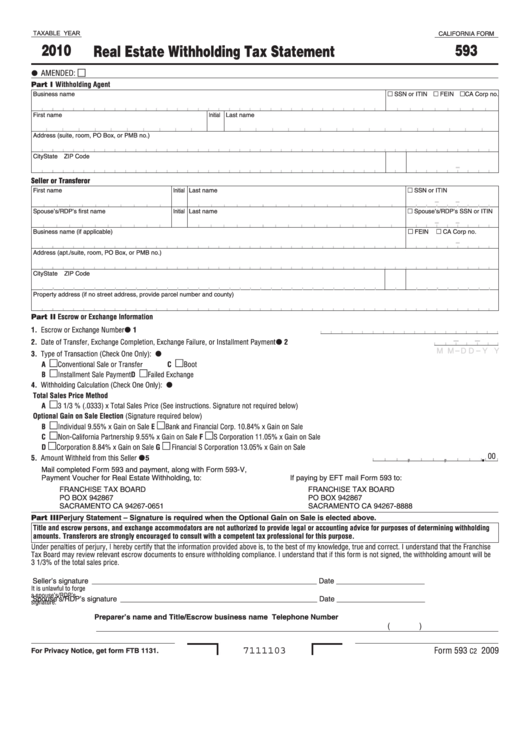

The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Web 593 escrow or exchange no. Web how do i enter ca form 593 real estate withholding? You must file form 2553 no later. Web purpose of form 2553. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web california form 593 remitter information • reep • qualified intermediary • buyer/transferee other________________________________ part iii certifications.

Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be. The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. You must file form 2553 no later. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,. Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Web how do i enter ca form 593 real estate withholding? Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. It serves as a mechanism for the collections of state. Web california form 593 remitter information • reep • qualified intermediary • buyer/transferee other________________________________ part iii certifications. Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions.

Ca Form 593 slidesharetrick

Web 593 escrow or exchange no. Web how do i enter ca form 593 real estate withholding? Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be. The main purpose of irs form 2553 is for a.

Form 593 C slidesharetrick

It serves as a mechanism for the collections of state. Web how do i enter ca form 593 real estate withholding? Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Web form 2553 is an irs form. Filing form.

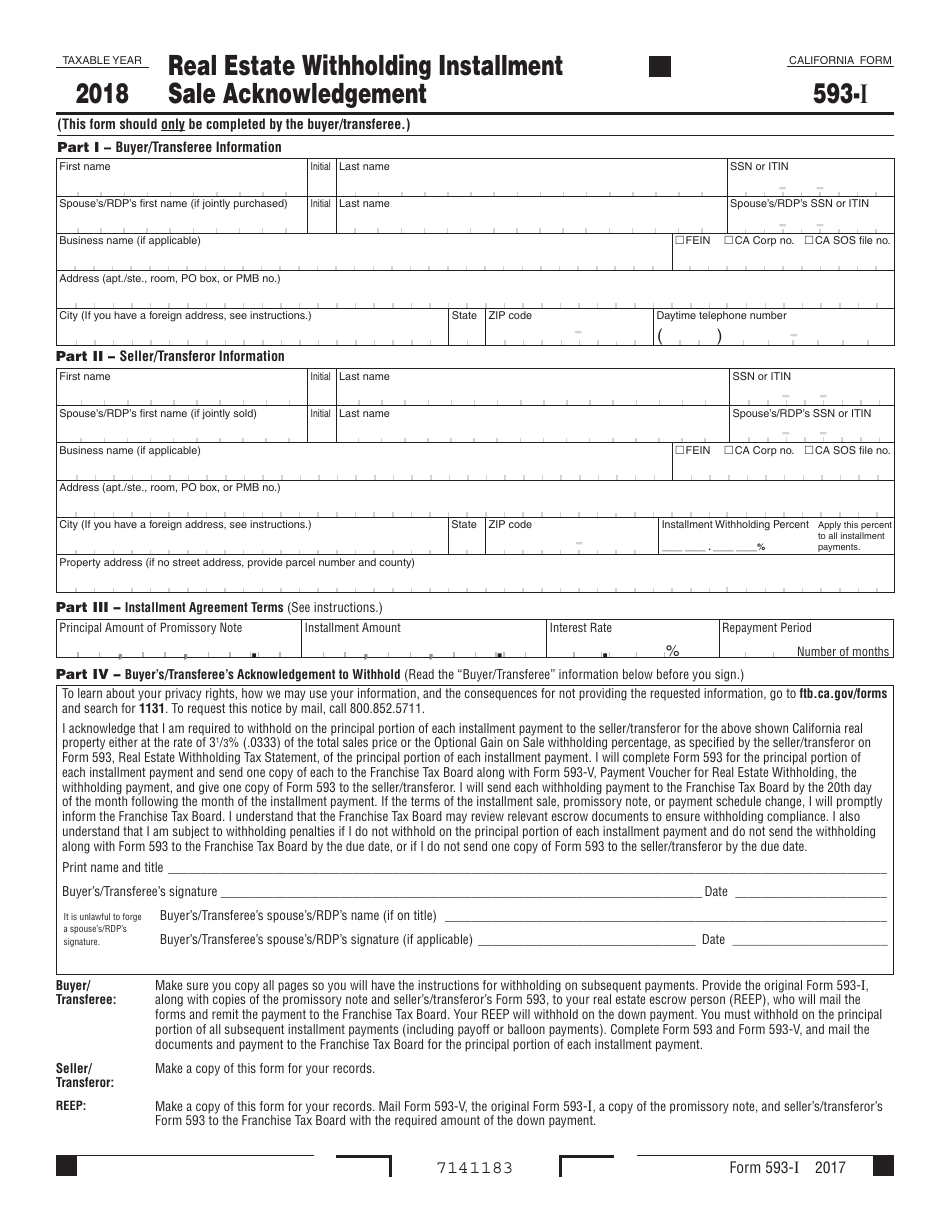

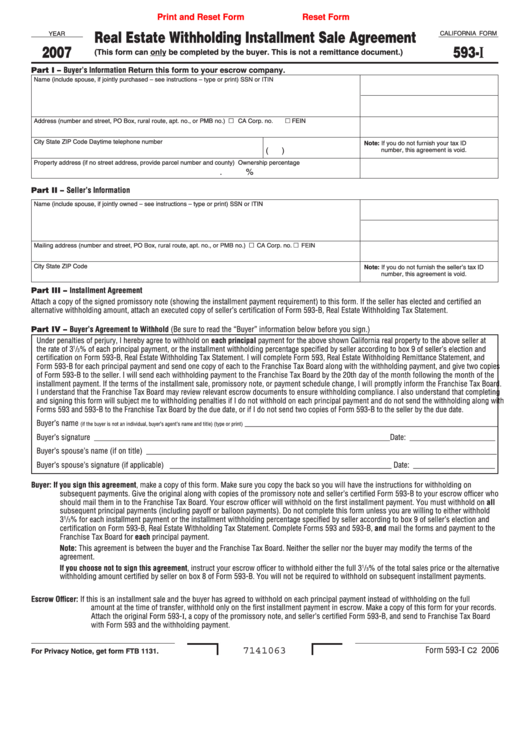

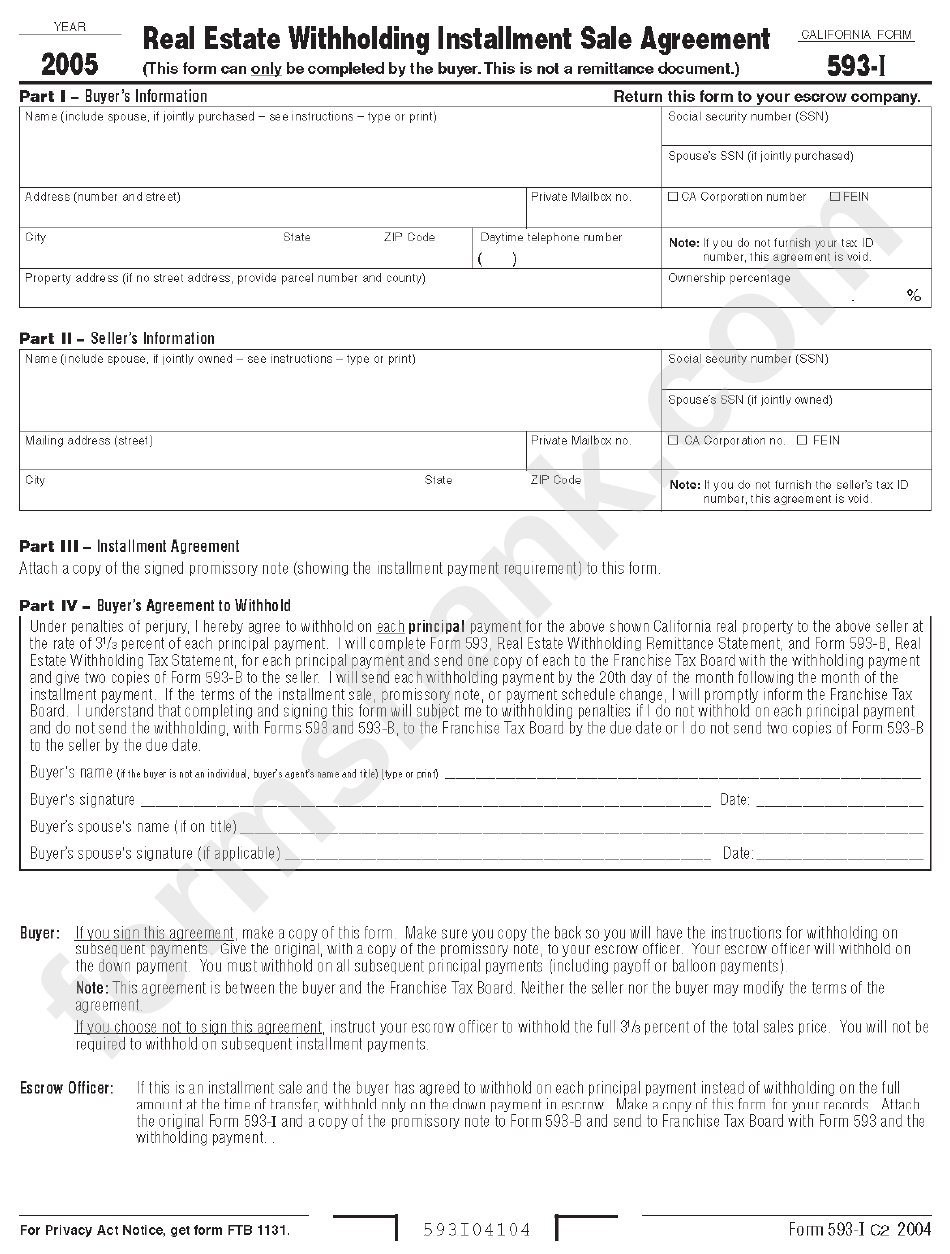

Form 593I Download Printable PDF or Fill Online Real Estate

Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the beginning of the tax year in which the s corporation will take. Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. An explanation for sellers when real estate.

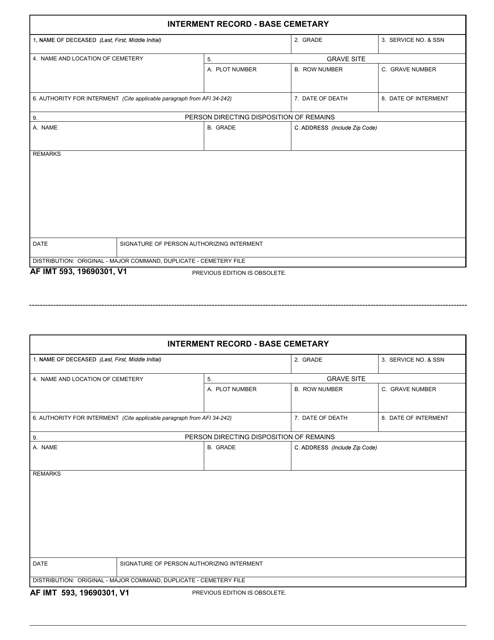

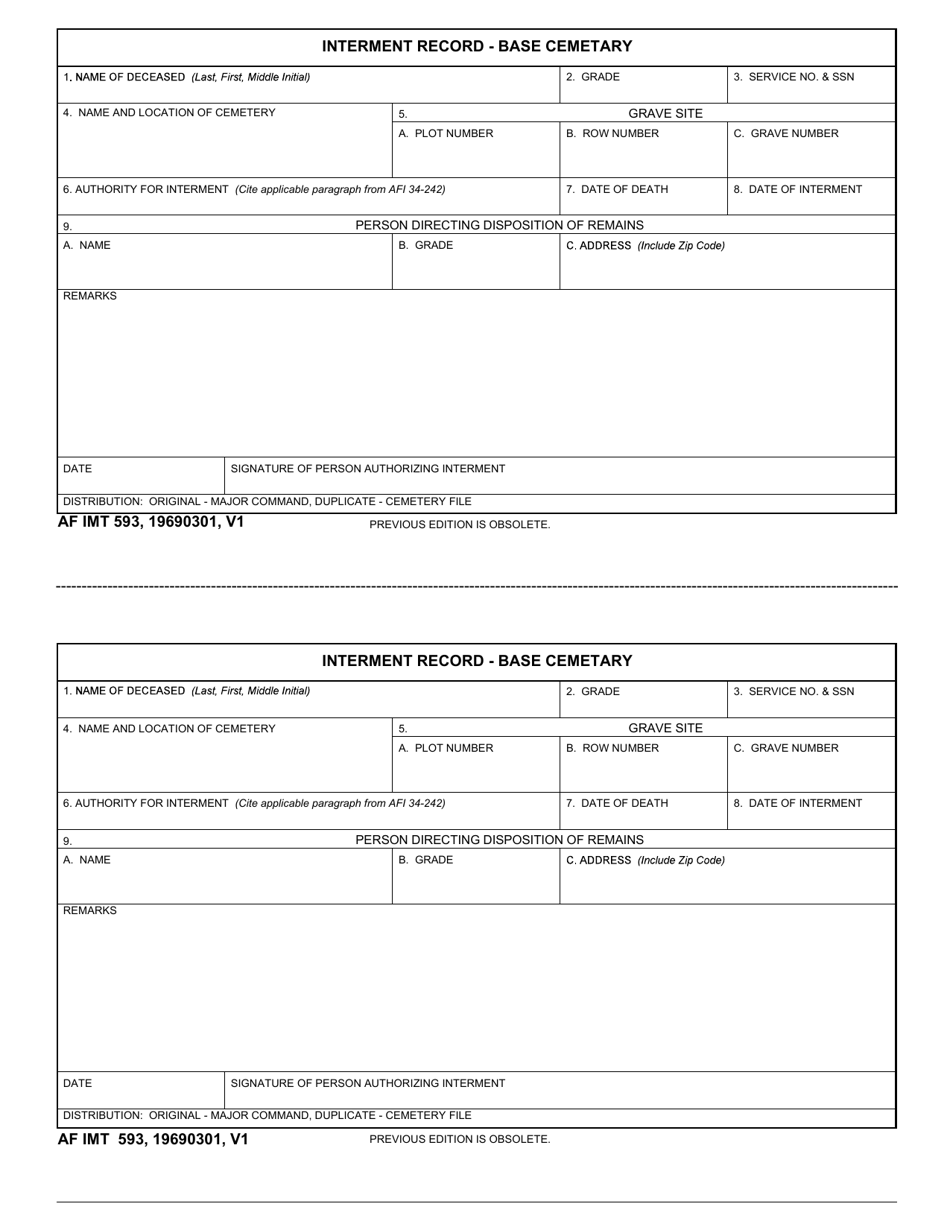

AF IMT Form 593 Download Fillable PDF or Fill Online Interment Record

Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web when is form 2553 due? Web form 2553 is an irs form. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. _________________________ part i remitter information • reep •.

Fillable California Form 593I Real Estate Withholding Installment

It serves as a mechanism for the collections of state. Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the beginning of the tax year in which the s corporation will take. An explanation for sellers when real estate is sold in california, the state requires that income tax.

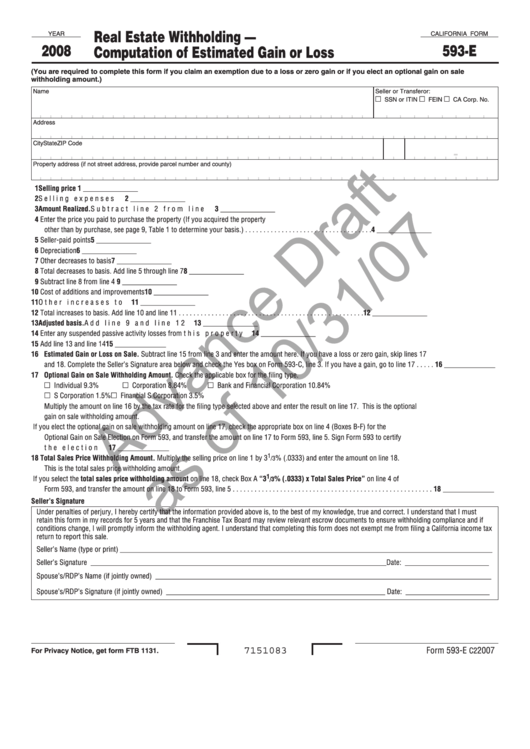

Form 593E Draft Real Estate Withholding Computation Of Estimated

Web 593 escrow or exchange no. Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the beginning of the tax year in which the s corporation will take. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Escrow provides this form.

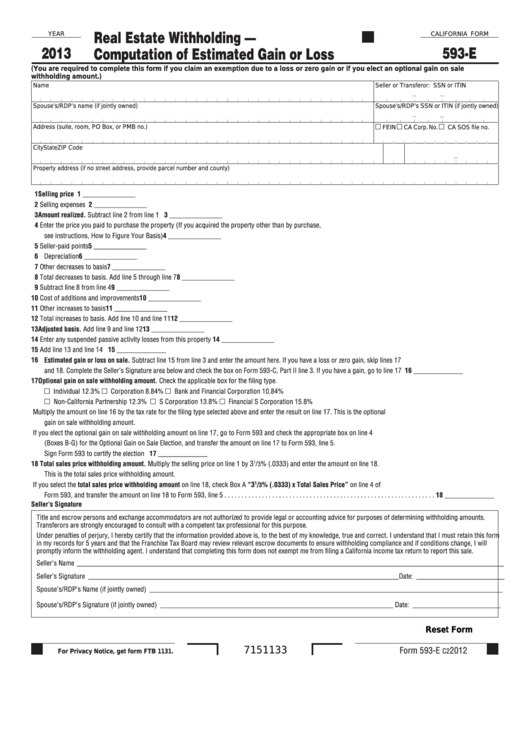

Fillable California Form 593E Real Estate Withholding Computation

An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the.

Form 593 C slidesharetrick

Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web when is form 2553 due? You must file form 2553 no.

Form 593I Real Estate Withholding Installment Sale Agreement 2005

Web 593 escrow or exchange no. Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the.

Fillable California Form 593 Real Estate Withholding Tax Statement

Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. It serves as a mechanism for the collections of state. You must file form 2553 no later. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web form 2553 is required to be filed no later than two.

Web When Selling A Property In California, The State Requires A Seller To Fill Out A 593 Real Estate Withholding Statement To Help The State Calculate What Tax If Any You Will Be.

It serves as a mechanism for the collections of state. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web the 593 form is a california specific form used to determine whether or not there should be state tax withheld on a property sale by the seller (individual, business entity, trust,.

Web How Do I Enter Ca Form 593 Real Estate Withholding?

Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Web when is form 2553 due? Web california form 593 remitter information • reep • qualified intermediary • buyer/transferee other________________________________ part iii certifications.

Web Purpose Of Form 2553.

Web 593 escrow or exchange no. Filing form 2553 on time is important if you want to take advantage of s corp treatment for the tax year. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation.

Web Use Form 593 To Report Real Estate Withholding On Sales Closing In 2013, On Installment Payments Made In 2013, Or On Exchanges That Were Completed Or Failed In 2013.

Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Escrow provides this form to the seller, typically when the escrow instructions. Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the beginning of the tax year in which the s corporation will take.