What Is A 2290 Form In Trucking

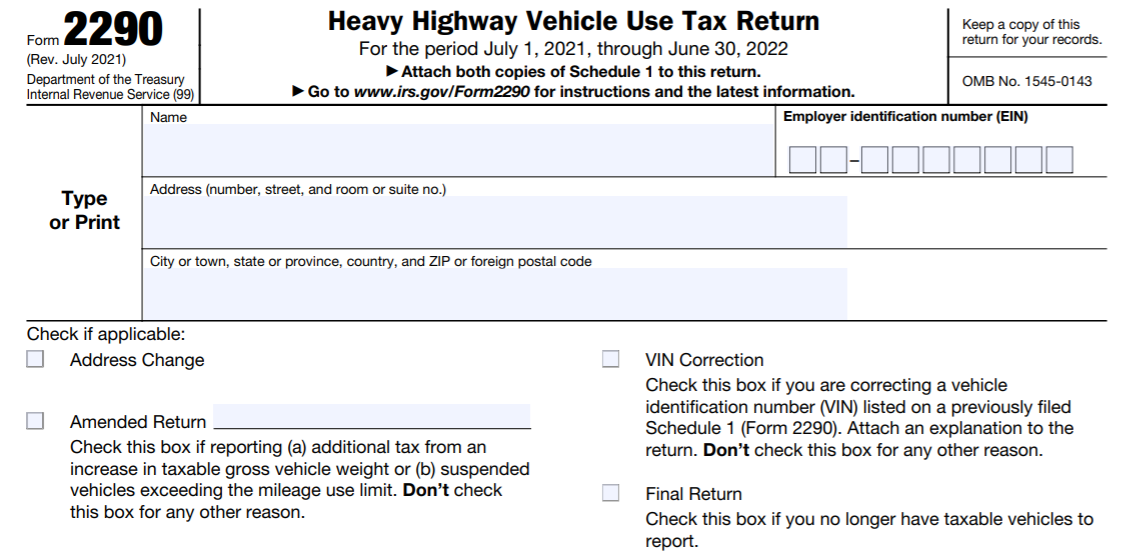

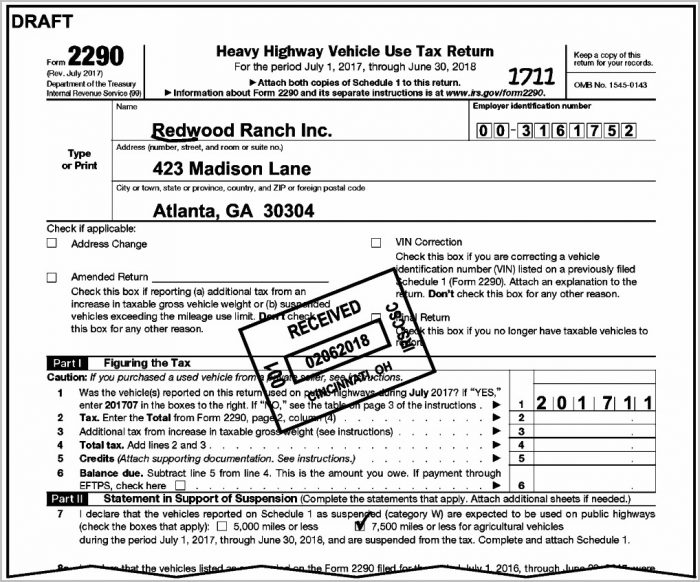

What Is A 2290 Form In Trucking - Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. This tax is imposed on heavy vehicles that operate on public highways with a gross weight of 55,000 pounds or more. Every truck driver must file this form in order to pay their highway vehicle use tax (hvut). Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Use the table below to determine your filing deadline. Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1. What is a stamped schedule 1? (this runs from july 1st to june 30th each year) what is the purpose of a form 2290?

Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Every truck driver must file this form in order to pay their highway vehicle use tax (hvut). These due date rules apply whether you are paying the tax or reporting the suspension of tax. Web general instructions purpose of form use form 2290 for the following actions. Web what is a form 2290? (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? What is a stamped schedule 1? Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Use the table below to determine your filing deadline.

This total is figured using the taxable gross weight for vehicles that weigh 55,000 pounds or more. This tax is imposed on heavy vehicles that operate on public highways with a gross weight of 55,000 pounds or more. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year. Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). Web what is a form 2290? Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Without this proof of payment, you will be unable to renew your tags at the dmv or renew your registration for ifta, irp, or ucr. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways.

Learn How to Fill the Form 2290 Internal Revenue Service Tax YouTube

Use the table below to determine your filing deadline. This tax is imposed on heavy vehicles that operate on public highways with a gross weight of 55,000 pounds or more. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related.

The Usefulness of Form 2290 to the Trucking Business Diesel trucks

Web what is a form 2290? See when to file form 2290 for more details. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1. In short, a form 2290 is a.

Form 2290 The Trucker's Bookkeeper

Use the table below to determine your filing deadline. Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). Everyone must complete the first and second pages of form 2290 along with both pages of.

Trucking Spotlight Blog ExpressTruckTax EFile IRS Form 2290 Online

Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. See when to file form 2290 for more details. These due date rules apply whether you are paying the tax or reporting the suspension of tax. This total is figured using the taxable gross weight for.

Trucking Spotlight Blog ExpressTruckTax EFile IRS Form 2290 Online

See when to file form 2290 for more details. Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1. Use the table below to determine your filing deadline. Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay..

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Use the table below to determine your filing deadline. The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. These due date rules apply whether you are paying.

Irs Gives Truckers Three Month Extension; Highway Use Tax Return Due

(this runs from july 1st to june 30th each year) what is the purpose of a form 2290? Web what is a form 2290? See when to file form 2290 for more details. Your stamped schedule 1 is proof of payment for your heavy vehicle use tax. Everyone must complete the first and second pages of form 2290 along with.

New To Trucking? Here Is What You Should Know About Form 2290 Blog

Use the table below to determine your filing deadline. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. What is a stamped schedule 1? Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web what is a form 2290?

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax

Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was.

What Is A Stamped Schedule 1?

Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Your stamped schedule 1 is proof of payment for your heavy vehicle use tax. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year.

Form 2290 Is Used To Figure And Pay The Tax Due On Certain Heavy Highway Motor Vehicles.

Every truck driver must file this form in order to pay their highway vehicle use tax (hvut). Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay. It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more.

Web You Will Need To File Hvut Form 2290 And Pay Any Taxes Owed To Receive Your Stamped Schedule 1.

Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year.

This Total Is Figured Using The Taxable Gross Weight For Vehicles That Weigh 55,000 Pounds Or More.

Web what is a form 2290? Without this proof of payment, you will be unable to renew your tags at the dmv or renew your registration for ifta, irp, or ucr. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. Use the table below to determine your filing deadline.