What Happens To Secured Debt In Chapter 7

What Happens To Secured Debt In Chapter 7 - Dec 31st, 2020 in many chapter 7. Web when you can discharge secured debts in chapter 7 bankruptcy. Find out what you should know about chapter 7 and business debt, including: Web bear in mind that if you reaffirm and later fall behind on payments, the creditor has the option of going to court and seeking a deficiency judgment for the outstanding balance. Learn when a bankruptcy trustee will sell your home or car and use the proceeds to pay other creditors. By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. Web liens create secured debt in chapter 7 bankruptcy if you've started preparing your bankruptcy paperwork, you'll have noticed that you must categorize your debts as either secured or unsecured. Web those bills are unsecured. Web most debts, such as medical bills, credit cards, and payday loans, can be discharged in a chapter 7 bankruptcy. Web pros of switching to chapter 7.

Furthermore, secured creditors may have some rights to seize property that secures an underlying debt… How are secured credit cards treated in chapter 7 bankruptcy? You can't discharge some debts like child support, student loans, recent tax debt, and fines or penalties for violations of the law. 1) “dischargeability,” and 2) asset distribution. Here are more details about these important terms: Web those bills are unsecured. Web what happens to your “general unsecured debts” in a chapter 7 case depends on two very different considerations: If you’re paying on secured credit charges when you file, you’ll have to choose to do one of the following on the statement of intention for individuals filing under chapter 7. Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Is a secured credit card right for me?

Web most debts, such as medical bills, credit cards, and payday loans, can be discharged in a chapter 7 bankruptcy. By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. Web pros of switching to chapter 7. Web a secured debt is one that is secured by property, which the creditor can take if you default. Web keeping secured property: How are secured credit cards treated in chapter. Because the attached lien won't go away in bankruptcy. Web bear in mind that if you reaffirm and later fall behind on payments, the creditor has the option of going to court and seeking a deficiency judgment for the outstanding balance. To resolve your secured debts, the property held as collateral may be ordered returned to the creditor. Web those bills are unsecured.

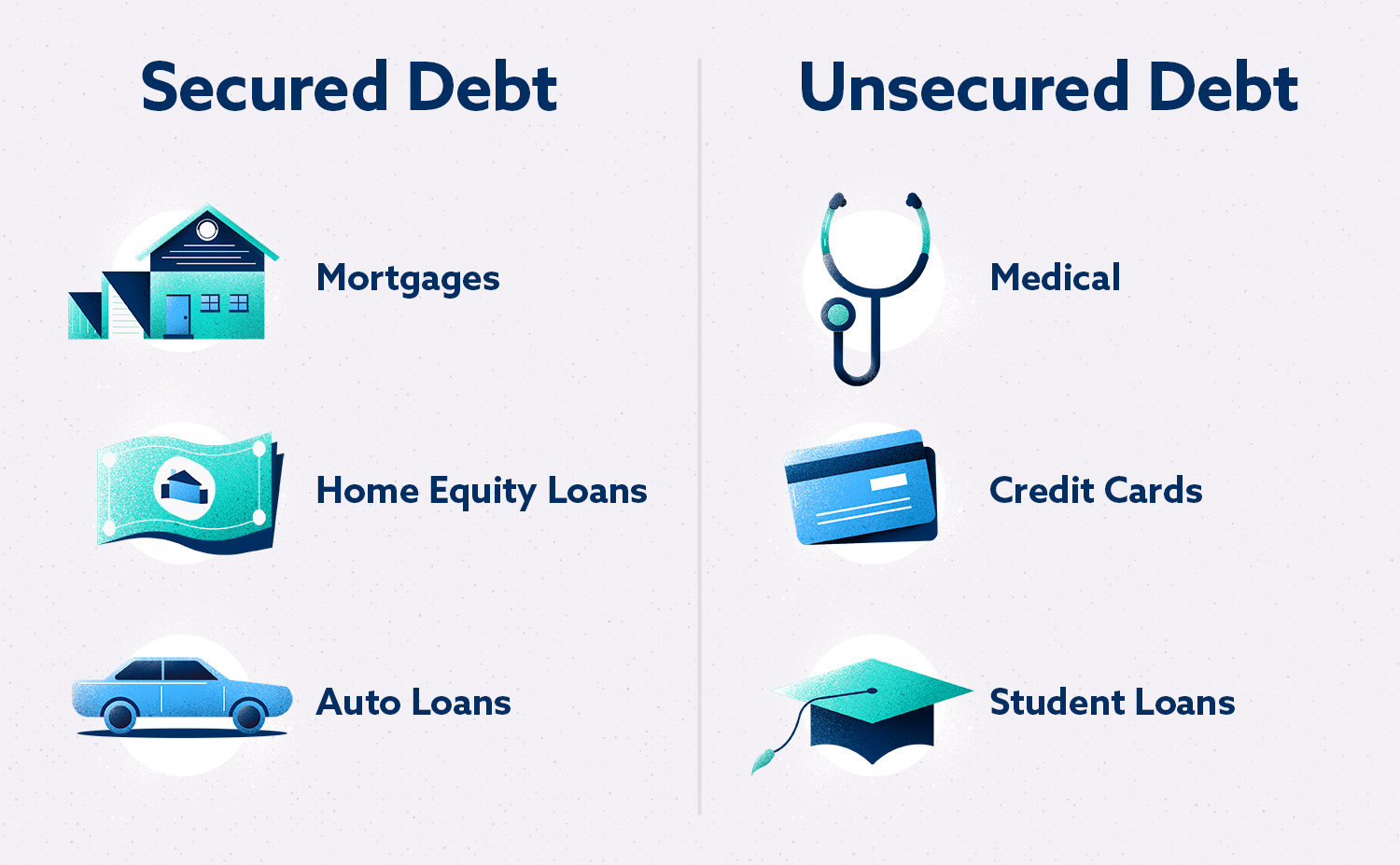

What Is The Difference Between Secured and Unsecured Debt

Web bear in mind that if you reaffirm and later fall behind on payments, the creditor has the option of going to court and seeking a deficiency judgment for the outstanding balance. Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web most debts, such as medical bills, credit cards, and payday loans, can.

The Pros and Cons of Secured Debt In Newsweekly

The creditor will still be able to take the property if the debt. Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. To resolve your secured debts, the property held as collateral may be ordered returned to the creditor. Web secured debts.

Secured Debt Free of Charge Creative Commons Typewriter image

Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. The chapter 7 discharge eliminates your obligation to pay back the secured loan. Any secured debt can always be discharged, but you won't be able to keep the property serving as collateral, such as your house or car. Who can.

What Happens if Someone Dies With Debt? SeekersGuidance

What happens to secured credit card debt in bankruptcy? But, if you want to keep the property that the bank has a. If you default on your loan, the lender can sell your home to. Web updated july 25, 2023 table of contents what is a secured credit card? Web those bills are unsecured.

What Happens to Debt When You Die?

But, if you want to keep the property that the bank has a. Furthermore, secured creditors may have some rights to seize property that secures an underlying debt… Web when you can discharge secured debts in chapter 7 bankruptcy. Web keeping secured property: However, this is not true for all obligations.

Secured Debt Investments

A loan with a charge against it? By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. How do i choose the best secured credit card? If you default on your loan, the lender can sell your home to. Debt reaffirmation it is harder to discharge secured debt than it is to discharge.

What's the Difference Between Unsecured and Secured Debts?

By cara o'neill, attorney updated: Web bear in mind that if you reaffirm and later fall behind on payments, the creditor has the option of going to court and seeking a deficiency judgment for the outstanding balance. How are secured credit cards treated in chapter. Web those bills are unsecured. Discharging most unsecured debts such as credit card balances and.

What Happens if You Default on a Secured Debt? dealstruck

Who can wipe out business debt in chapter 7. The creditor will still be able to take the property if the debt. Debt reaffirmation it is harder to discharge secured debt than it is to discharge unsecured debt. You can't discharge some debts like child support, student loans, recent tax debt, and fines or penalties for violations of the law..

Secured and Unsecured Debt Limitations Under Chapter 13

You can't discharge some debts like child support, student loans, recent tax debt, and fines or penalties for violations of the law. Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Web learn about secured debts, what happens to them in bankruptcy,.

What Happens After You File Bankruptcy

Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web a secured debt is one that is secured by property, which the creditor can take if you default. You can't discharge some debts like child support, student loans, recent tax debt, and fines or penalties for violations of the law. Web what happens to.

Dec 31St, 2020 In Many Chapter 7.

Is a secured credit card right for me? If you’re paying on secured credit charges when you file, you’ll have to choose to do one of the following on the statement of intention for individuals filing under chapter 7. By cara o'neill, attorney updated: Web bear in mind that if you reaffirm and later fall behind on payments, the creditor has the option of going to court and seeking a deficiency judgment for the outstanding balance.

Web In Chapter 7 Bankruptcy, You Can Keep Property Secured By Collateral (Such As Your Car) By Reaffirming The Debt.

A debt with a lien on it? Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web updated july 25, 2023 table of contents what is a secured credit card? Web when will the trustee pay secured debt in chapter 7 bankruptcy?

Because The Attached Lien Won't Go Away In Bankruptcy.

However, this is not true for all obligations. Furthermore, secured creditors may have some rights to seize property that secures an underlying debt… But, if you want to keep the property that the bank has a. Find out what you should know about chapter 7 and business debt, including:

You Can't Discharge Some Debts Like Child Support, Student Loans, Recent Tax Debt, And Fines Or Penalties For Violations Of The Law.

Web secured debts in chapter 7 bankruptcy: Who can wipe out business debt in chapter 7. Web when you can discharge secured debts in chapter 7 bankruptcy. For example, your mortgage is secured by your home.