Weak Form Efficient

Weak Form Efficient - Web weak form efficiency. It holds that the market efficiently deals with most information on a given security and. Web the weak form of the efficiency hypothesis has been the benchmark of the theoretical and empirical approaches throughout history. A direct implication is that it is. • the variance ratio tests were much more sensitive to the parameters used. Web what is weak form market efficiency? Weak form efficiency is one of the degrees of efficient market hypothesis that claims all past prices of a stock. In relation to the theoretical. Web weak form efficiency a version of the efficient markets theory on how markets work. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.

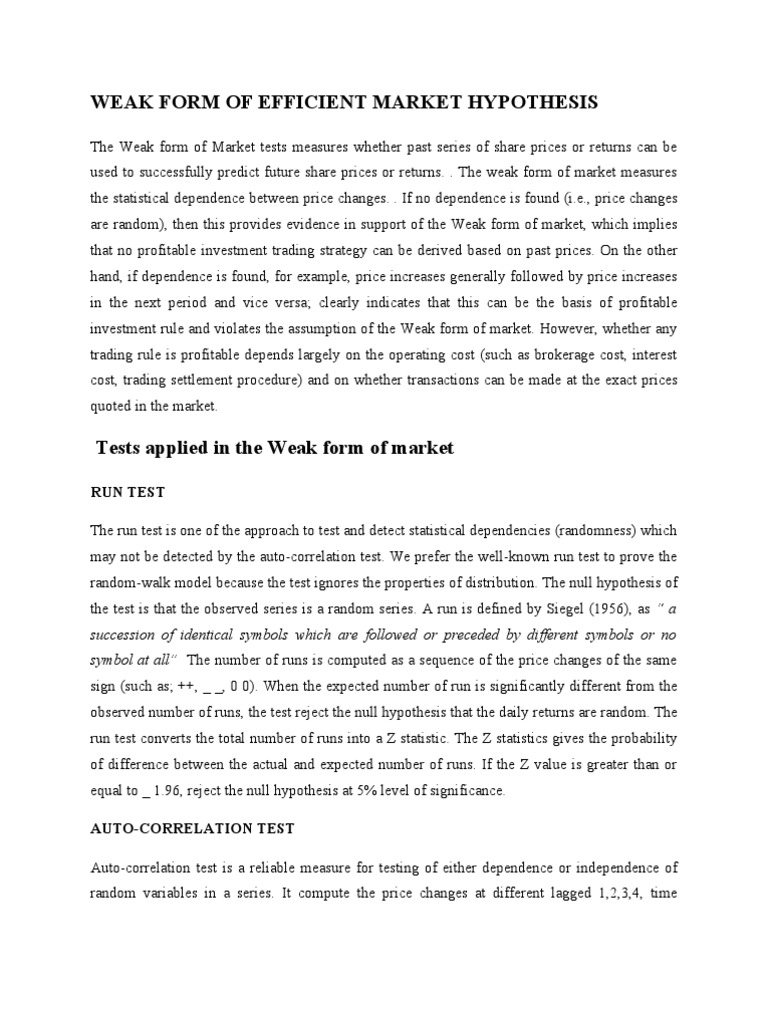

Auto correlation test and 2. • the variance ratio tests were much more sensitive to the parameters used. A direct implication is that it is. Web weak form efficiency. Web weak form efficiency is a type of financial market hypothesis that asserts that past market trading information, such as prices and volumes, do not contribute to predicting a stock’s. In a weak form efficient market, asset prices already account. In such a market, it is not possible to make abnormal gains by studying. Web to see whether the market is weak form of market efficient there are two statistical tests; Web what is weak form market efficiency? If there is relation between the.

Weak form efficiency is one of the degrees of efficient market hypothesis that claims all past prices of a stock. Web what is weak form market efficiency? Fundamental analysis of securities can provide you with. Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined,. Web weak form efficiency. Web what is weak form efficiency? It holds that the market efficiently deals with most information on a given security and. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new. Web weak form efficiency a version of the efficient markets theory on how markets work. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.

WeakForm Efficient Market Hypothesis, 9783659378195, 3659378194

In relation to the theoretical. • the variance ratio tests were much more sensitive to the parameters used. Fundamental analysis of securities can provide you with. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. A direct implication is that it is.

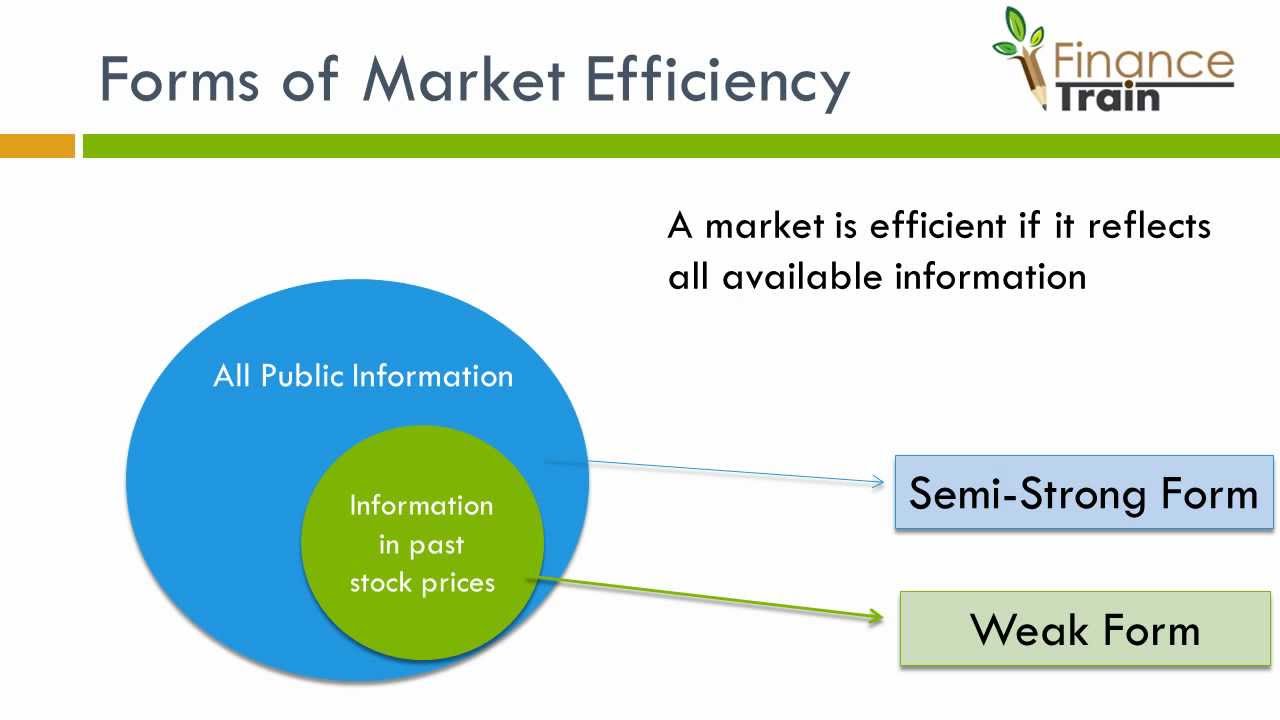

Efficient market hypothesis

If there is relation between the. Web what is weak form market efficiency? Weak form efficiency is one of the degrees of efficient market hypothesis that claims all past prices of a stock. Web what is weak form efficiency? Web weak form efficiency.

Download Investment Efficiency Theory Gif invenstmen

A direct implication is that it is. Weak form emh suggests that all past information is priced into securities. The random walk theory states that market and securities prices are random and not influenced by past events. It holds that the market efficiently deals with most information on a given security and. Weak form market efficiency, also known as he.

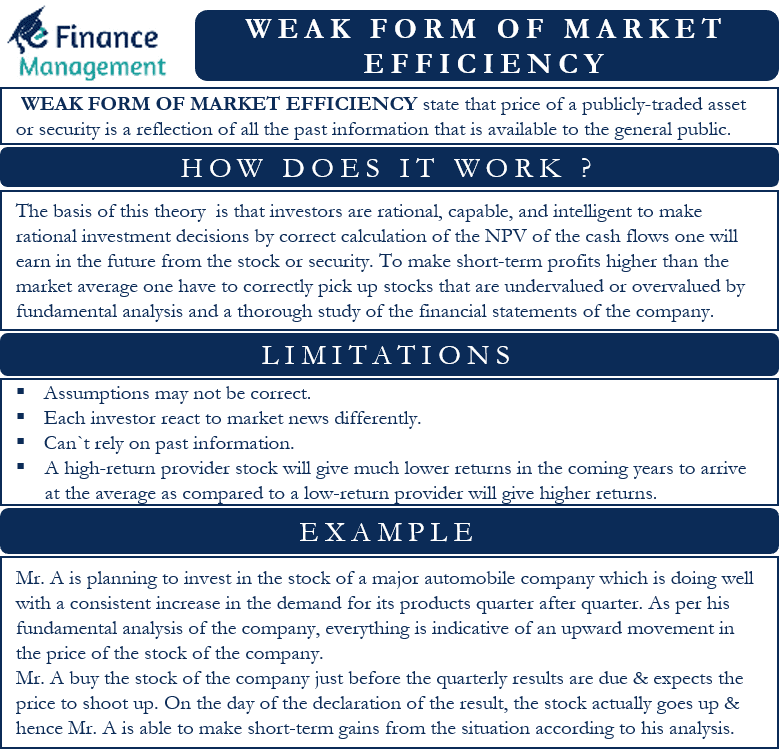

Weak Form of Market Efficiency Meaning, Usage, Limitations

It holds that the market efficiently deals with most information on a given security and. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new. Web weak form efficiency. In relation to the theoretical. A direct implication is that it is.

Weak Form of Efficient Market Hypothesis Correlation And Dependence

Fundamental analysis of securities can provide you with. Weak form emh suggests that all past information is priced into securities. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Weak form efficiency is one of the degrees of efficient market hypothesis that claims all past prices of a stock. Web weak.

On the impossibility of weakform efficient markets

Web weak form efficiency is a type of financial market hypothesis that asserts that past market trading information, such as prices and volumes, do not contribute to predicting a stock’s. A direct implication is that it is. In such a market, it is not possible to make abnormal gains by studying. It holds that the market efficiently deals with most.

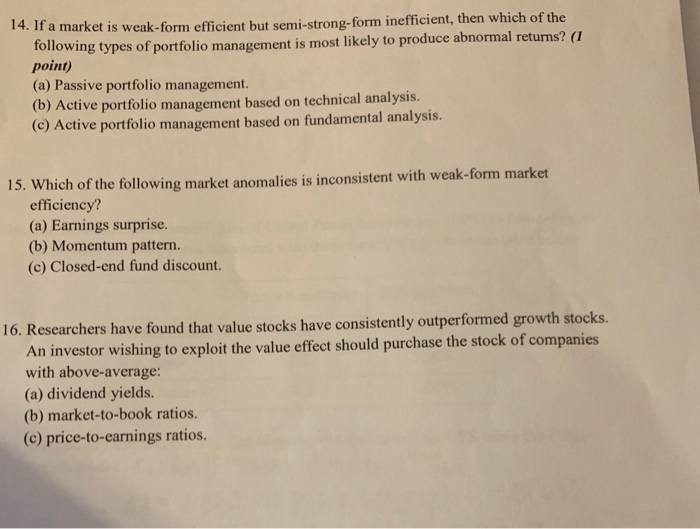

Solved 14. If a market is weakform efficient but

Weak form efficiency is one of the degrees of efficient market hypothesis that claims all past prices of a stock. Web what is weak form market efficiency? A direct implication is that it is. Web to see whether the market is weak form of market efficient there are two statistical tests; Weak form market efficiency, also known as he random.

Efficient Market Hypothesis

Web weak form efficiency a version of the efficient markets theory on how markets work. In relation to the theoretical. • the variance ratio tests were much more sensitive to the parameters used. Web what is weak form market efficiency? Weak form emh suggests that all past information is priced into securities.

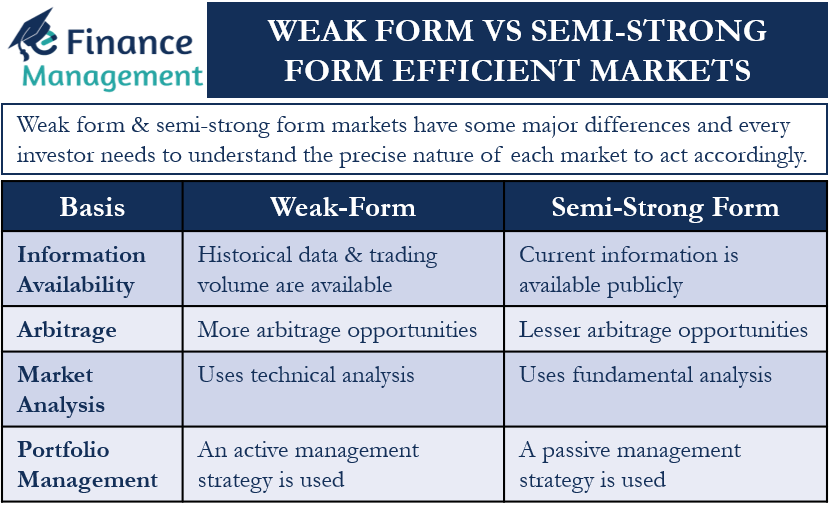

WeakForm vs SemiStrong Form Efficient Markets eFM

Web weak form efficiency refers to a market where share prices fully and fairly reflect all past information. Web the weak form of the efficiency hypothesis has been the benchmark of the theoretical and empirical approaches throughout history. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect.

Market efficiency ghana stock exchange cnn futures stock market

Web a weak form of efficiency is a form of market efficiency that believes that all past prices of a stock are reflected in its current price. Web what is weak form efficiency? Web what is weak form market efficiency? Web weak form efficiency a version of the efficient markets theory on how markets work. The weak form of the.

Web Weak Form Efficiency A Version Of The Efficient Markets Theory On How Markets Work.

• the variance ratio tests were much more sensitive to the parameters used. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web a weak form of efficiency is a form of market efficiency that believes that all past prices of a stock are reflected in its current price. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new.

Web Weak Form Efficiency Refers To A Market Where Share Prices Fully And Fairly Reflect All Past Information.

Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined,. Web weak form efficiency is a type of financial market hypothesis that asserts that past market trading information, such as prices and volumes, do not contribute to predicting a stock’s. Auto correlation test and 2. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970.

The Random Walk Theory States That Market And Securities Prices Are Random And Not Influenced By Past Events.

Web what is weak form efficiency? In such a market, it is not possible to make abnormal gains by studying. Web weak form emh: Weak form emh suggests that all past information is priced into securities.

Web Weak Form Efficiency.

It holds that the market efficiently deals with most information on a given security and. Web the weak form of the efficiency hypothesis has been the benchmark of the theoretical and empirical approaches throughout history. In a weak form efficient market, asset prices already account. If there is relation between the.