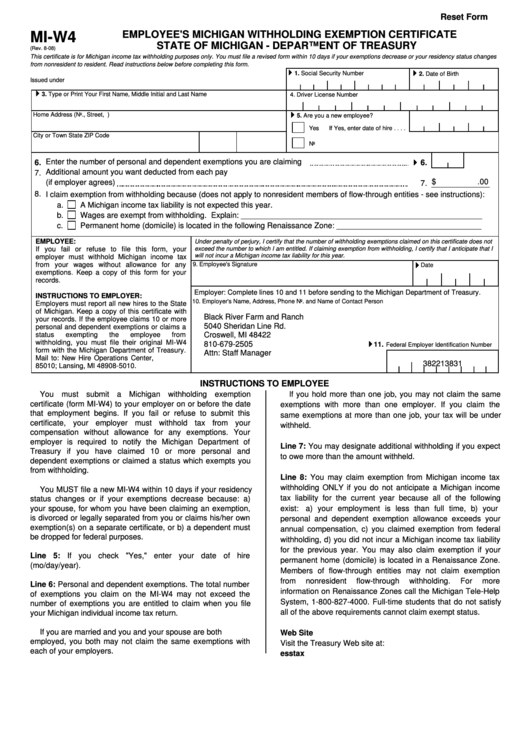

W4 Form Michigan

W4 Form Michigan - If too little is withheld, you will generally owe tax when you file your tax return. 2020 sales, use and withholding 4% and 6% monthly/quarterly and. Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. Web 2020 sales, use and withholding monthly/quarterly and amended monthly/quarterly worksheet: If you fail or refuse to submit. Web effort certification process streamlined for terminating employees. Web withholding tables for pension and retirement payments from a government entity, exempt from social security, paid to recipient born after 1952 upon reaching age 62:. New hire operations center, p.o. Access the wolverine access web site click on employee self service login using the employee uniqname and kerberos. Employee's michigan withholding exemption certificate:.

If too little is withheld, you will generally owe tax when you file your tax return. Web 2021 sales, use and withholding monthly/quarterly and amended monthly/quarterly worksheet: Web 2018 fiduciary tax forms. New hire operations center, p.o. Web instructions included on form: If you fail or refuse to submit. Access the wolverine access web site click on employee self service login using the employee uniqname and kerberos. 2020 sales, use and withholding 4% and 6% monthly/quarterly and. This form is for income earned in tax. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury.

New hire operations center, p.o. If too little is withheld, you will generally owe tax when you file your tax return. 2020 sales, use and withholding 4% and 6% monthly/quarterly and. 2021 sales, use and withholding 4% and 6% monthly/quarterly and. If you fail or refuse to submit. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. Access the wolverine access web site click on employee self service login using the employee uniqname and kerberos. Employee's michigan withholding exemption certificate:. Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. Web instructions included on form:

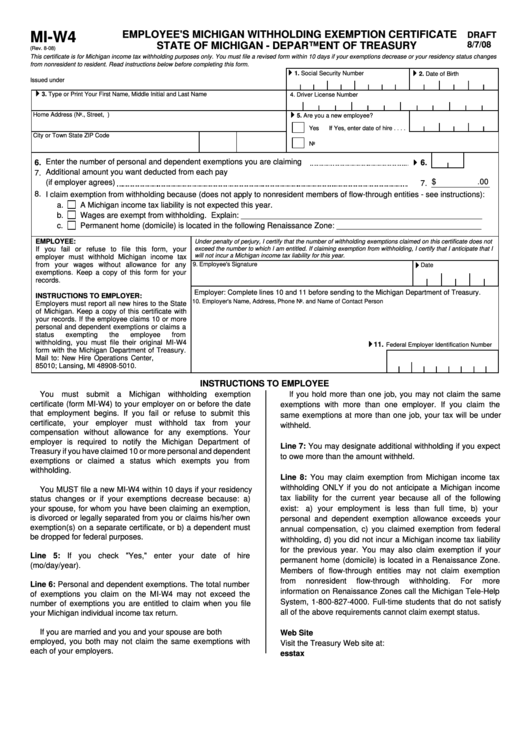

Form MiW4 Employee'S Michigan Withholding Exemption Certificate

Web effort certification process streamlined for terminating employees. Looking for forms from 2015 and earlier? Employee's michigan withholding exemption certificate:. Web withholding tables for pension and retirement payments from a government entity, exempt from social security, paid to recipient born after 1952 upon reaching age 62:. If too little is withheld, you will generally owe tax when you file your.

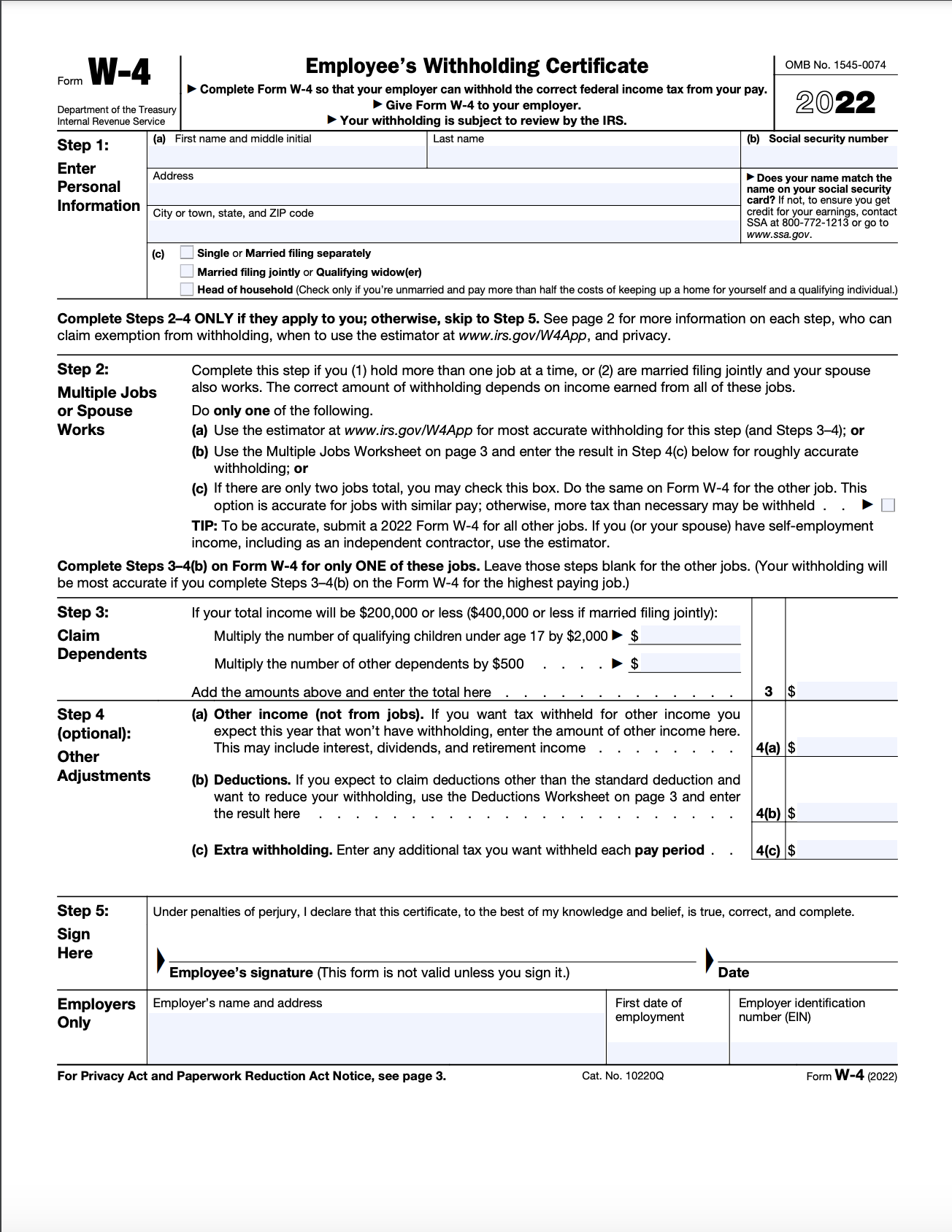

Form W4 2017 (IRS Tax) Fill Out Online & Download [+ Free Template]

Web effort certification process streamlined for terminating employees. Web 2021 sales, use and withholding monthly/quarterly and amended monthly/quarterly worksheet: Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. 2020 sales, use and withholding 4% and 6% monthly/quarterly and. If you fail.

New W4 tax form explained 47abc

Payroll department is closed to the public until further. If too little is withheld, you will generally owe tax when you file your tax return. Web 2020 sales, use and withholding monthly/quarterly and amended monthly/quarterly worksheet: If you fail or refuse to submit. Access the wolverine access web site click on employee self service login using the employee uniqname and.

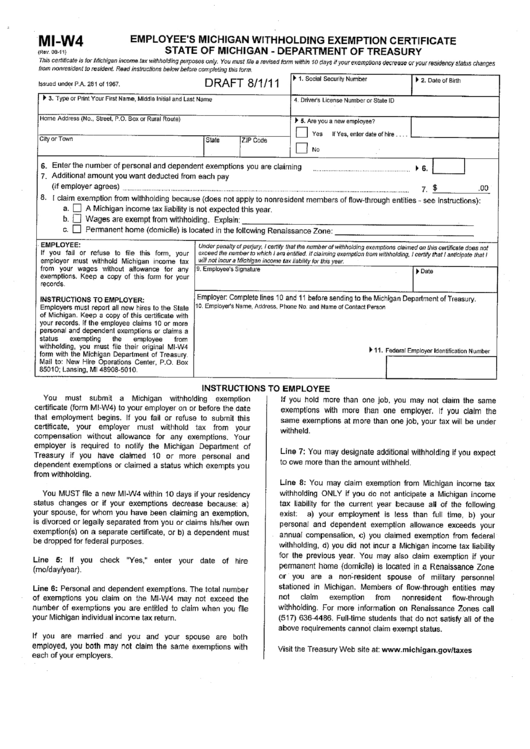

Fillable Form MiW4 Employee'S Michigan Withholding Exemption

Access the wolverine access web site click on employee self service login using the employee uniqname and kerberos. Web withholding tables for pension and retirement payments from a government entity, exempt from social security, paid to recipient born after 1952 upon reaching age 62:. Web city tax withholding (w4) forms links city tax withholding (w4) forms if you live or.

Download Michigan Form MIW4 for Free FormTemplate

2020 sales, use and withholding 4% and 6% monthly/quarterly and. If you fail or refuse to submit. Payroll department is closed to the public until further. Web instructions included on form: Web 2018 fiduciary tax forms.

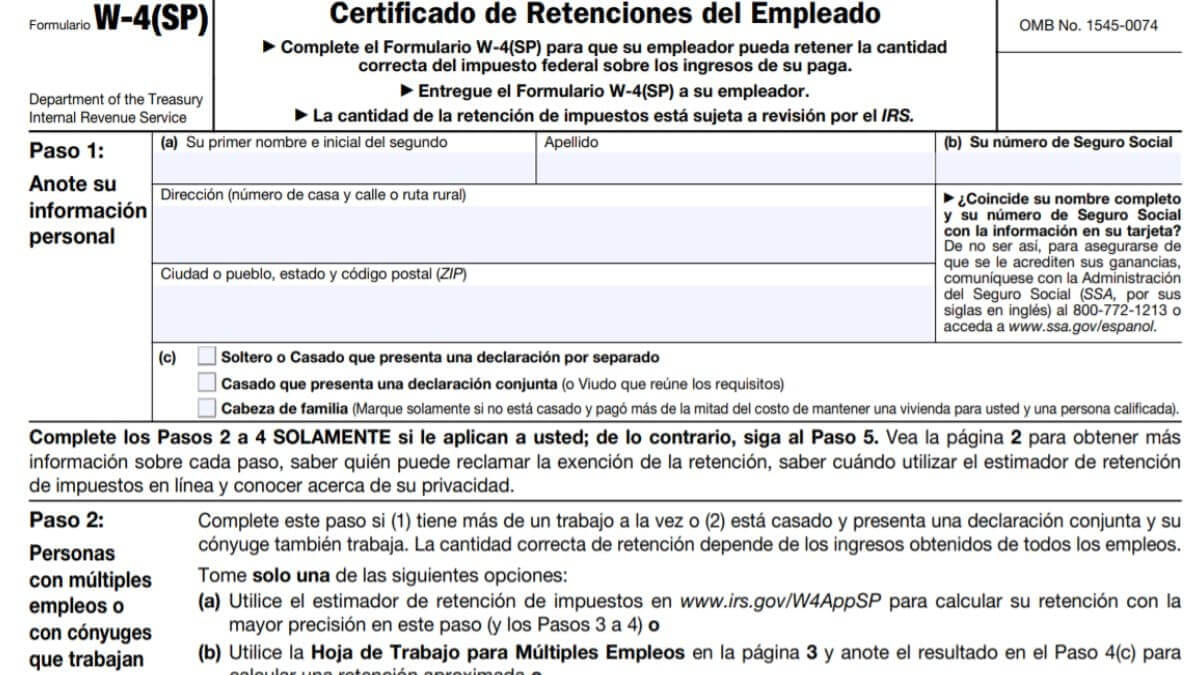

Form W4 Spanish 2023 IRS Forms Zrivo

Web effort certification process streamlined for terminating employees. Web 2018 fiduciary tax forms. This form is for income earned in tax. If too little is withheld, you will generally owe tax when you file your tax return. If you fail or refuse to submit.

Il W 4 2020 2022 W4 Form

Web city tax withholding (w4) forms links city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the. 2020 sales, use and withholding 4% and 6% monthly/quarterly and. If you fail or refuse to submit. This form is for income earned in tax. Web effort certification process.

Tax Information · Career Training USA · InterExchange

Looking for forms from 2015 and earlier? Payroll department is closed to the public until further. Web 2018 fiduciary tax forms. Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. Web city tax withholding (w4) forms links city tax withholding (w4).

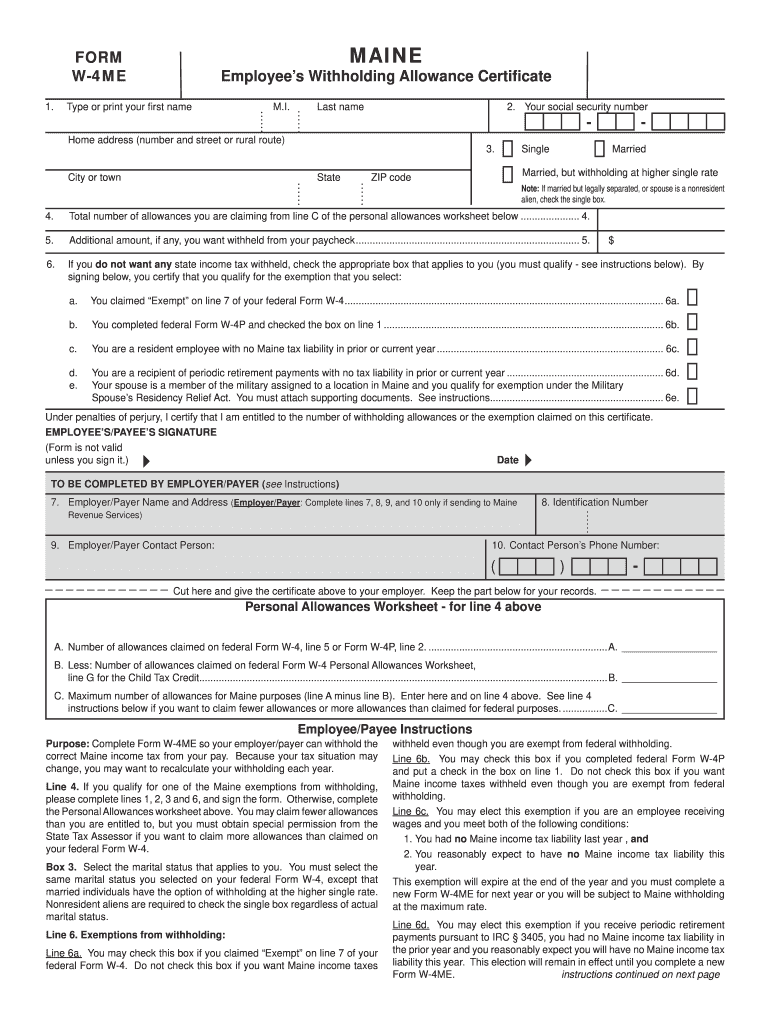

Maine W4 Forms 2021 Printable W4 Form 2021

2020 sales, use and withholding 4% and 6% monthly/quarterly and. Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. Payroll department is closed to the public until further. Web effort certification process streamlined for terminating employees. Web 2020 sales, use and.

Form MiW4 Draft Employee'S Michigan Withholding Exemption

If you fail or refuse to submit. Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. Access the wolverine access web site click on employee self service login using the employee uniqname and kerberos. If you fail or refuse to submit..

New Hire Operations Center, P.o.

Looking for forms from 2015 and earlier? Payroll department is closed to the public until further. If you fail or refuse to submit. 2020 sales, use and withholding 4% and 6% monthly/quarterly and.

Sales And Other Dispositions Of Capital Assets:

Web withholding tables for pension and retirement payments from a government entity, exempt from social security, paid to recipient born after 1952 upon reaching age 62:. Web extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for. Access the wolverine access web site click on employee self service login using the employee uniqname and kerberos. Web instructions included on form:

Employee's Michigan Withholding Exemption Certificate:.

Web 2018 fiduciary tax forms. If you fail or refuse to submit. 2021 sales, use and withholding 4% and 6% monthly/quarterly and. Web 2020 sales, use and withholding monthly/quarterly and amended monthly/quarterly worksheet:

Web Effort Certification Process Streamlined For Terminating Employees.

Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. This form is for income earned in tax. If too little is withheld, you will generally owe tax when you file your tax return. Web 2021 sales, use and withholding monthly/quarterly and amended monthly/quarterly worksheet:

![Form W4 2017 (IRS Tax) Fill Out Online & Download [+ Free Template]](https://www.pandadoc.com/app/uploads/form-w-4.png)