Virginia Military Spouse Tax Exemption Form

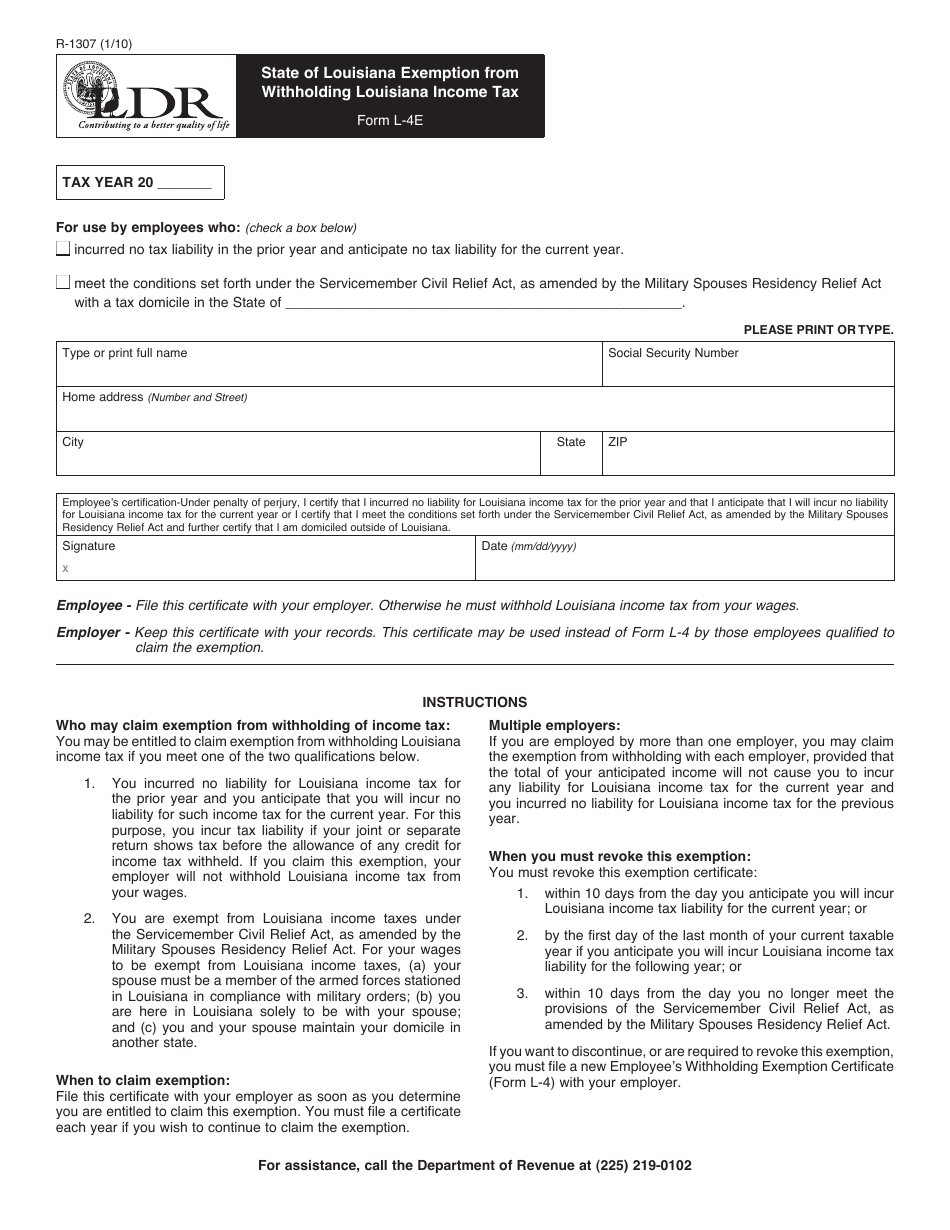

Virginia Military Spouse Tax Exemption Form - Personal exemption worksheet you may not claim more. Web to apply for exemption, the following documentation is required: Web dependent military id you must attach at least one of the following: Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web what form should i file | military spouse va. During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. A copy of your state income tax return b.

Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt from taxation. Web what form should i file | military spouse va. Web the virginia state income tax is administered by the virginia department of taxation (tax), po box 760, richmond, va 23206. Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Web pursuant to the service members civil relief act (scra) as amended by the veterans benefits and transitions act (vbta), effective january 1, 2019, i elect the same legal. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Personal exemption worksheet you may not claim more. Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. Web to apply for exemption, the following documentation is required: Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse.

Web online forms provide the option of submitting the form electronically to our office. Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. Web under the servicemember civil relief act, as amended by the military spouses residency relief act, a spouse of a military servicemember may be exempt from virginia income. A copy of your state income tax return b. Web what form should i file | military spouse va. Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. Web vehicles leased by a qualified military service member and/or spouse will receive a 100% state vehicle tax subsidy as a tax credit on the first $20,000 of assessed value. If you have questions relating to any of our personal property forms, please contact the. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran.

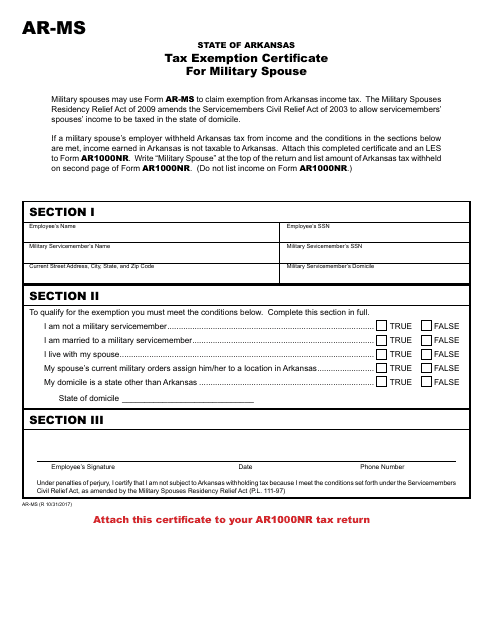

√ Military Spouse Residency Relief Act Tax Form Navy Docs

You will not qualify for exemption from the local vehicle tax if: Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption,.

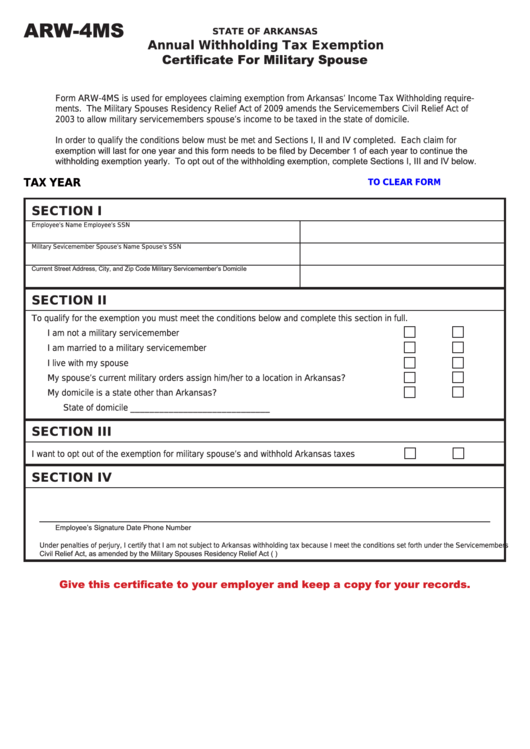

Fillable Form Arw4ms Annual Withholding Tax Exemption Certificate

Web under the servicemember civil relief act, as amended by the military spouses residency relief act, a spouse of a military servicemember may be exempt from virginia income. Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt.

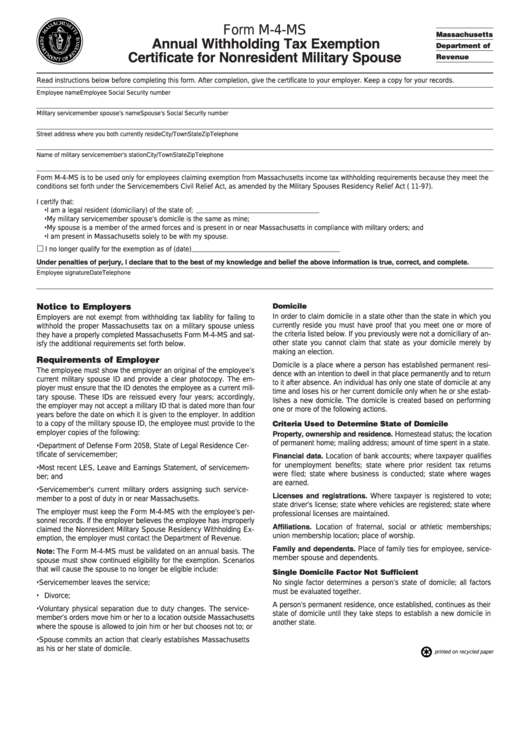

Form M4Ms Annual Withholding Tax Exemption Certificate For

Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt.

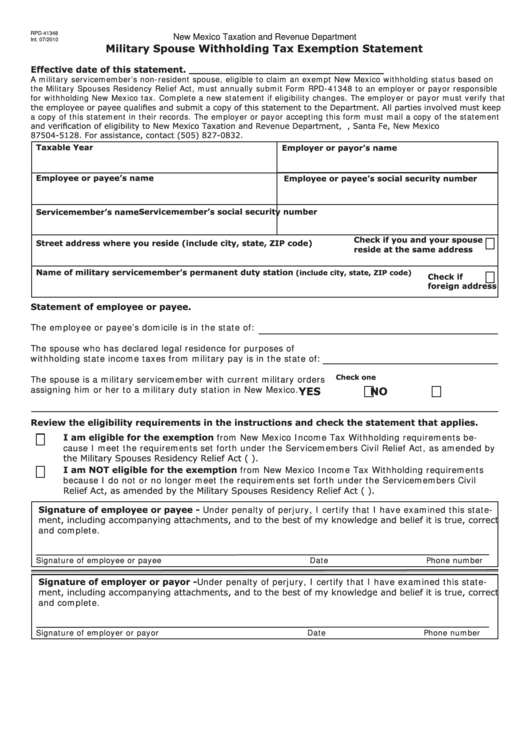

Military Spouse Withholding Tax Exemption Statement printable pdf download

Web dependent military id you must attach at least one of the following: A copy of your state income tax return b. Web to apply for exemption, the following documentation is required: Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web if.

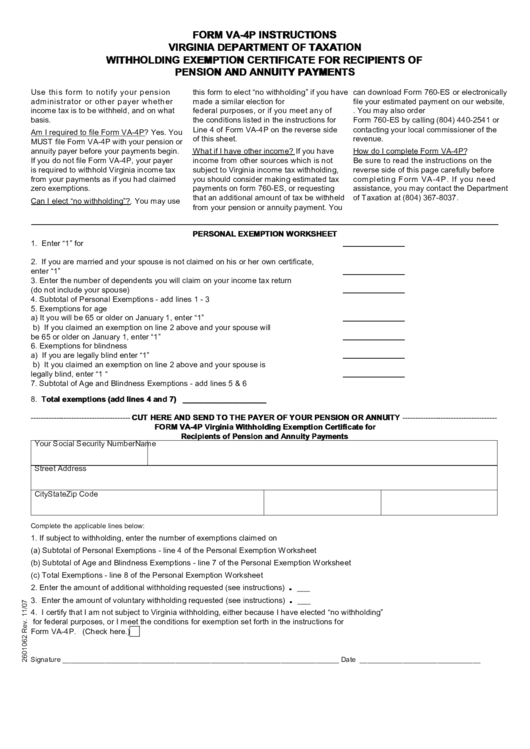

Fillable Form Va4p Virginia Withholding Exemption Certificate For

Web pursuant to the service members civil relief act (scra) as amended by the veterans benefits and transitions act (vbta), effective january 1, 2019, i elect the same legal. Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Web do not file this form, your employer.

Tax Checklist For The SelfEmployed Military Spouse NextGen MilSpouse

During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web vehicles leased by a qualified military service member and/or spouse will receive a 100% state vehicle tax subsidy as a tax credit on the first $20,000 of assessed value. Personal exemption worksheet you may not claim more..

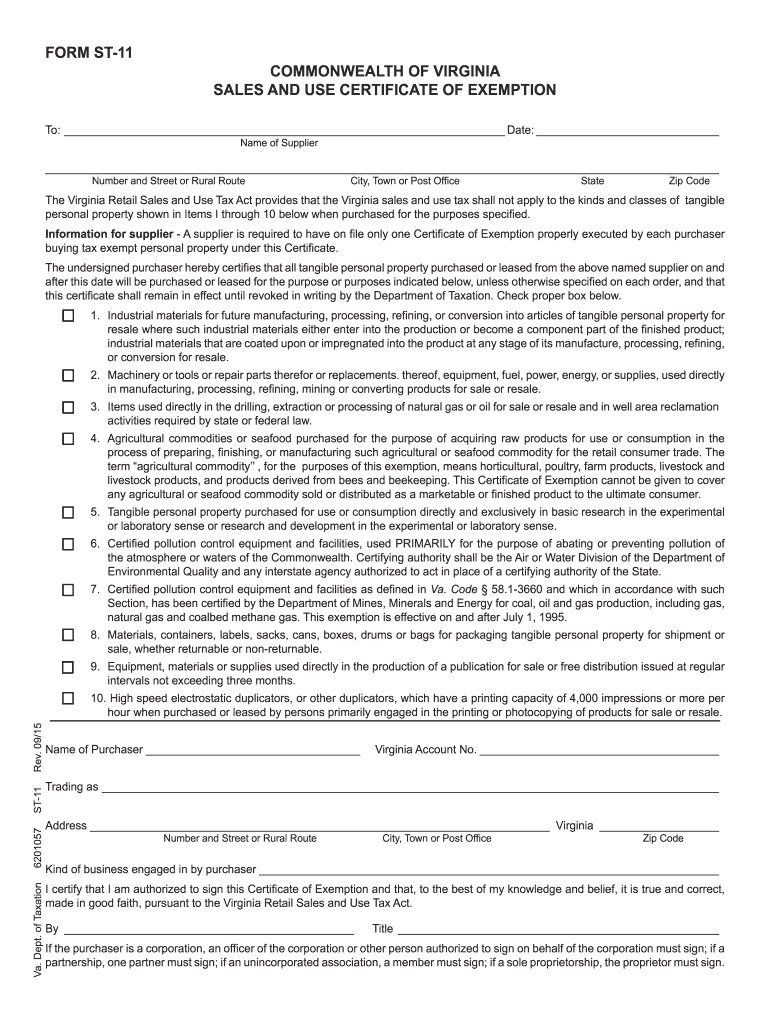

Virginia Sales Tax Exemption Form St 11 Fill Out and Sign Printable

Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt from taxation. Web what form should i file | military spouse va. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you.

VA Application for Real Property Tax Relief for Veterans with Rated 100

Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web under the servicemember civil relief act, as amended by the military spouses.

Real Estate Tax Exemption In Virginia For 100 P&T Veterans Page 2 VBN

Web under the servicemember civil relief act, as amended by the military spouses residency relief act, a spouse of a military servicemember may be exempt from virginia income. Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web what form should i file | military spouse va. You will not.

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web the military spouse residency relief act (msrra) allows a nonmilitary.

Web Do Not File This Form, Your Employer Must Withhold Virginia Income Tax As If You Had No Exemptions.

During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web dependent military id you must attach at least one of the following: Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:.

Web Online Forms Provide The Option Of Submitting The Form Electronically To Our Office.

Web what form should i file | military spouse va. Personal exemption worksheet you may not claim more. If you have questions relating to any of our personal property forms, please contact the. Web pursuant to the service members civil relief act (scra) as amended by the veterans benefits and transitions act (vbta), effective january 1, 2019, i elect the same legal.

Web Military Spouse Residency Affidavit For Tax Exemption Attest That I Am The Spouse Of An Active Duty Military Member With Legal Residence Other Than Virginia, Who Is In Virginia.

You will not qualify for exemption from the local vehicle tax if: Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web the virginia state income tax is administered by the virginia department of taxation (tax), po box 760, richmond, va 23206. Web vehicles leased by a qualified military service member and/or spouse will receive a 100% state vehicle tax subsidy as a tax credit on the first $20,000 of assessed value.

A Copy Of Your State Income Tax Return B.

Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt from taxation. Web to apply for exemption, the following documentation is required: