Usmv Fact Sheet

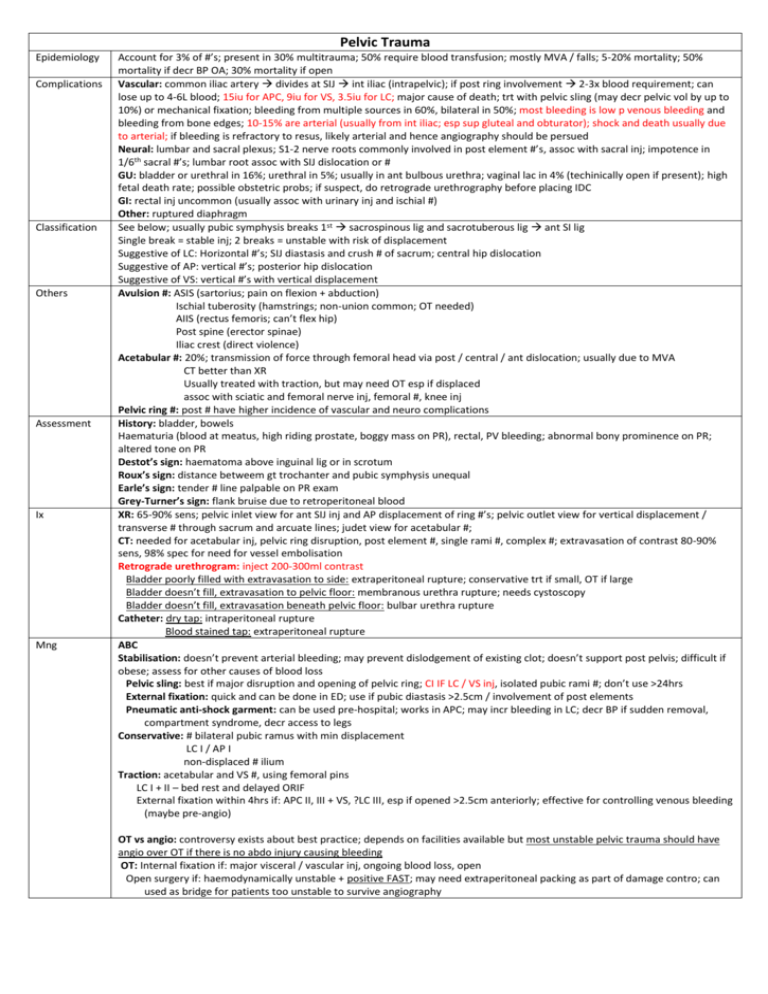

Usmv Fact Sheet - Consider usmv for a core position in a. Web usmv ishares msci usa min vol factor etf asset class median; The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Stocks with potentially less risk 2. Equities that, in the aggregate, have lower volatility characteristics relative to. Web usmv 0.15% 0.15% 11.66% 11.54% 6.80% 6.80% 11.32% 11.32% efav 0.20% 0.20% 17.79% 17.55% 0.56% 0.55% 5.17% 5.16% eemv 0.25% 0.25% 8.24%. 1 month market total return as of 06/17/2023 +1.45 +5.03%: Historically, usmv has declined less than the market during market downturns 1 3.

Equities that, in the aggregate, have lower volatility characteristics relative to. Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Consider usmv for a core position in a. Web usmv ishares msci usa min vol factor etf asset class median; Historically, usmv has declined less than the market during market downturns 1 3. 1 month market total return as of 06/17/2023 +1.45 +5.03%: Stocks with potentially less risk 2. The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. Web usmv 0.15% 0.15% 11.66% 11.54% 6.80% 6.80% 11.32% 11.32% efav 0.20% 0.20% 17.79% 17.55% 0.56% 0.55% 5.17% 5.16% eemv 0.25% 0.25% 8.24%.

The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. Equities that, in the aggregate, have lower volatility characteristics relative to. Web usmv ishares msci usa min vol factor etf asset class median; Web usmv 0.15% 0.15% 11.66% 11.54% 6.80% 6.80% 11.32% 11.32% efav 0.20% 0.20% 17.79% 17.55% 0.56% 0.55% 5.17% 5.16% eemv 0.25% 0.25% 8.24%. Stocks with potentially less risk 2. 1 month market total return as of 06/17/2023 +1.45 +5.03%: Historically, usmv has declined less than the market during market downturns 1 3. Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Consider usmv for a core position in a.

fact sheet

Web usmv 0.15% 0.15% 11.66% 11.54% 6.80% 6.80% 11.32% 11.32% efav 0.20% 0.20% 17.79% 17.55% 0.56% 0.55% 5.17% 5.16% eemv 0.25% 0.25% 8.24%. Historically, usmv has declined less than the market during market downturns 1 3. Web usmv ishares msci usa min vol factor etf asset class median; 1 month market total return as of 06/17/2023 +1.45 +5.03%: Stocks with.

Fact Sheet

Stocks with potentially less risk 2. Equities that, in the aggregate, have lower volatility characteristics relative to. The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. Web usmv ishares msci usa min vol factor etf asset class.

FACT SHEET SELECTIVITY

Equities that, in the aggregate, have lower volatility characteristics relative to. Stocks with potentially less risk 2. 1 month market total return as of 06/17/2023 +1.45 +5.03%: Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Consider usmv for a core position in.

The CFIR Card Game Fact Sheet Walk the Talk Toolkit

Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. Web usmv.

Fact sheet

Consider usmv for a core position in a. Web usmv 0.15% 0.15% 11.66% 11.54% 6.80% 6.80% 11.32% 11.32% efav 0.20% 0.20% 17.79% 17.55% 0.56% 0.55% 5.17% 5.16% eemv 0.25% 0.25% 8.24%. Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Historically, usmv has.

Geneaology Fact Sheet

Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Stocks with potentially less risk 2. The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been.

CCSSO COVID19 Relief Fact Sheet

Equities that, in the aggregate, have lower volatility characteristics relative to. The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. 1 month market total return as of 06/17/2023 +1.45 +5.03%: Web fact sheet as of 09/30/2023 the.

Fact Sheet

1 month market total return as of 06/17/2023 +1.45 +5.03%: Web usmv ishares msci usa min vol factor etf asset class median; Stocks with potentially less risk 2. Historically, usmv has declined less than the market during market downturns 1 3. Consider usmv for a core position in a.

Fact Sheet WNW

The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd) index (the underlying index), which has been developed by msci inc. Historically, usmv has declined less than the market during market downturns 1 3. Web usmv ishares msci usa min vol factor etf asset class median; Web fact sheet.

Fact Sheet tmmarks

Web usmv ishares msci usa min vol factor etf asset class median; Historically, usmv has declined less than the market during market downturns 1 3. Stocks with potentially less risk 2. Consider usmv for a core position in a. The ishares msci usa min vol factor etf seeks to track the investment results of the msci usa minimum volatility (usd).

The Ishares Msci Usa Min Vol Factor Etf Seeks To Track The Investment Results Of The Msci Usa Minimum Volatility (Usd) Index (The Underlying Index), Which Has Been Developed By Msci Inc.

Web usmv 0.15% 0.15% 11.66% 11.54% 6.80% 6.80% 11.32% 11.32% efav 0.20% 0.20% 17.79% 17.55% 0.56% 0.55% 5.17% 5.16% eemv 0.25% 0.25% 8.24%. Consider usmv for a core position in a. Stocks with potentially less risk 2. Historically, usmv has declined less than the market during market downturns 1 3.

1 Month Market Total Return As Of 06/17/2023 +1.45 +5.03%:

Equities that, in the aggregate, have lower volatility characteristics relative to. Web fact sheet as of 09/30/2023 the ishares msci usa min vol factor etf seeks to track the investment results of an index composed of u.s. Web usmv ishares msci usa min vol factor etf asset class median;