Two Certified Letters From Irs

Two Certified Letters From Irs - There are numerous reasons for receiving. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: Web not all letters and notices you receive from the irs are sent via certified mail, but the ones that the irs does send via certified mail are usually important and may even have legal significance. Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. If you see those three letters in the return address spot, there’s no need to panic. Web if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: To minimize additional interest and penalty charges. They have a balance due. They are due a larger or smaller refund. To preserve your appeal rights if.

To preserve your appeal rights if. To minimize additional interest and penalty charges. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: There are numerous reasons for receiving. They are due a larger or smaller refund. If you see those three letters in the return address spot, there’s no need to panic. As a result, scammers are telling taxpayers they must take action. The agency has a question about their tax. They have a balance due. Web a certified letter from the irs means they have started the time clock on a deadline.

There are numerous reasons for receiving. To preserve your appeal rights if. Web not all letters and notices you receive from the irs are sent via certified mail, but the ones that the irs does send via certified mail are usually important and may even have legal significance. The agency has a question about their tax. They are due a larger or smaller refund. To minimize additional interest and penalty charges. Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. As a result, scammers are telling taxpayers they must take action. If you see those three letters in the return address spot, there’s no need to panic. Web if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply:

Fillable Online IRS Audit Letter 2604C Sample PDF Fax

They are due a larger or smaller refund. To minimize additional interest and penalty charges. Web a certified letter from the irs means they have started the time clock on a deadline. If you see those three letters in the return address spot, there’s no need to panic. There are numerous reasons for receiving.

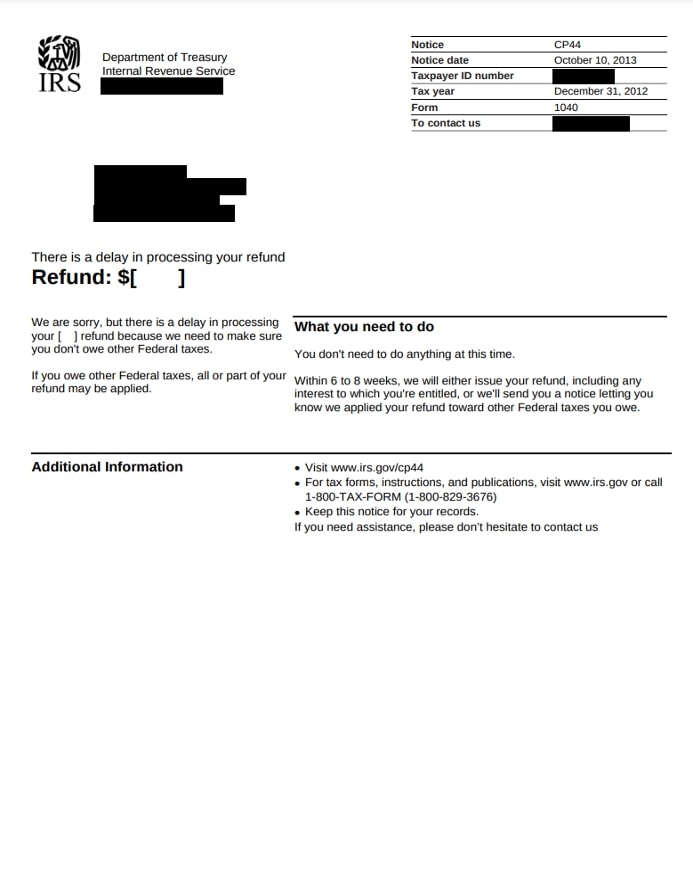

The new 3,600 child tax credit Watch for two letters from the IRS WBFF

Web a certified letter from the irs means they have started the time clock on a deadline. Web not all letters and notices you receive from the irs are sent via certified mail, but the ones that the irs does send via certified mail are usually important and may even have legal significance. They have a balance due. They are.

What to Do When an IRS Letter Lands in Your Mailbox

Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. They are due a larger or smaller refund. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: Web if your notice or letter requires a response by a specific date, there are two main.

How to Respond to an IRS CP2501 Notice CryptoTaxAudit Blog

To preserve your appeal rights if. Web not all letters and notices you receive from the irs are sent via certified mail, but the ones that the irs does send via certified mail are usually important and may even have legal significance. The agency has a question about their tax. They are due a larger or smaller refund. To minimize.

What to Do After Receiving an IRS Certified Letter The Zen Buffet

The agency has a question about their tax. To preserve your appeal rights if. Web if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. As a result, scammers are.

純粋な ラオス人 連隊 irs lock in letter iccclinic.jp

As a result, scammers are telling taxpayers they must take action. They have a balance due. Web not all letters and notices you receive from the irs are sent via certified mail, but the ones that the irs does send via certified mail are usually important and may even have legal significance. The agency has a question about their tax..

Why Would the IRS Send a Certified Letter? To Begin...

There are numerous reasons for receiving. Web if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Web a certified letter from the irs means they have started the time clock on a deadline. To preserve your appeal rights if. Web not all letters and notices you receive from.

The IRS Certified Letter Guide Why Did I Receive This? Silver Tax Group

To preserve your appeal rights if. Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. The agency has a question about their tax. Web a certified letter from the irs means they have started the time clock on a deadline. As a result, scammers are telling taxpayers they must take.

What Does a Certified Letter From the IRS Mean? (2024)

The agency has a question about their tax. They have a balance due. They are due a larger or smaller refund. Web if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned.

IRS Warns of New Phone Scam Involving Bogus Certified Letters; Reminds

To preserve your appeal rights if. To minimize additional interest and penalty charges. Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. As a result, scammers are telling taxpayers they must take action. Web the irs mails letters or notices to taxpayers for a variety of reasons including if:

As A Result, Scammers Are Telling Taxpayers They Must Take Action.

There are numerous reasons for receiving. To preserve your appeal rights if. They have a balance due. Web if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply:

To Minimize Additional Interest And Penalty Charges.

Web the scammer will try to convince the taxpayer that two certified letters were mailed, but returned as undeliverable. Web a certified letter from the irs means they have started the time clock on a deadline. The agency has a question about their tax. If you see those three letters in the return address spot, there’s no need to panic.

Web Not All Letters And Notices You Receive From The Irs Are Sent Via Certified Mail, But The Ones That The Irs Does Send Via Certified Mail Are Usually Important And May Even Have Legal Significance.

They are due a larger or smaller refund. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: