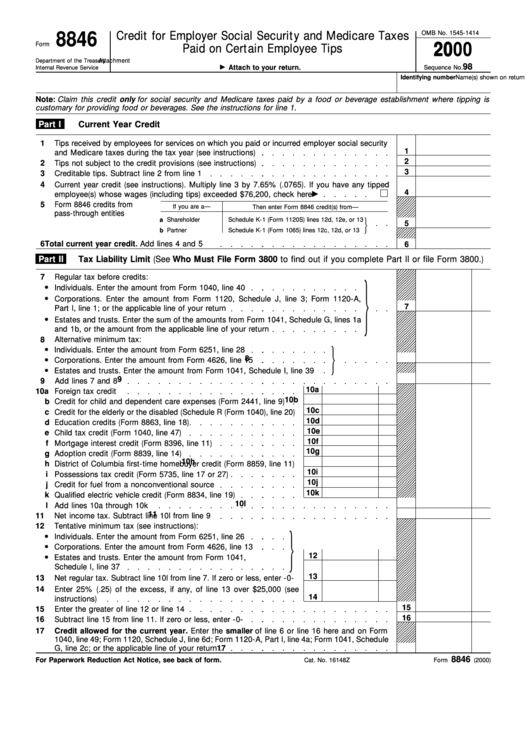

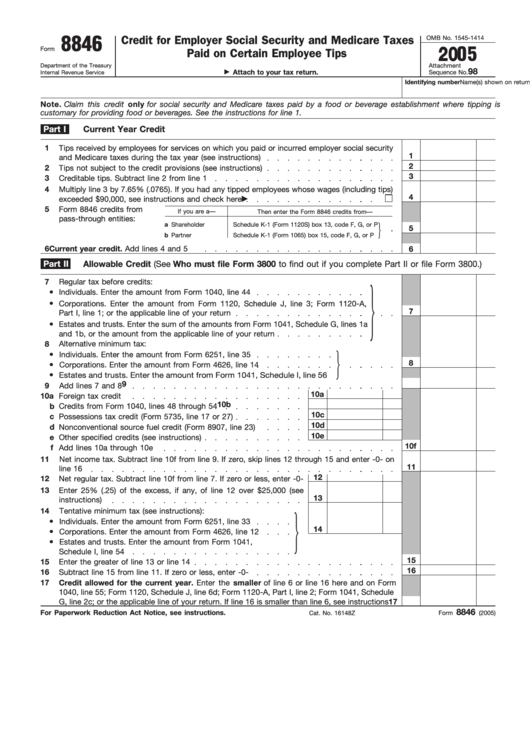

Tip Credit Form 8846

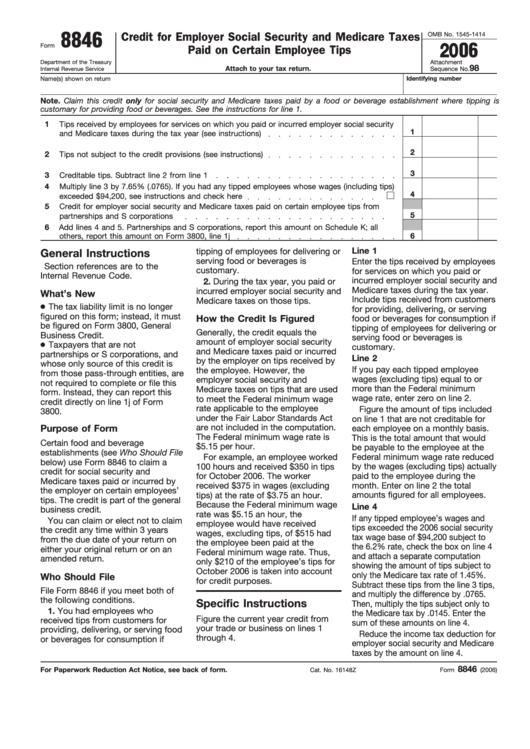

Tip Credit Form 8846 - Certain food and beverage establishments use this. Web tip credits can only be applied to a tipped employee — defined as an employee who regularly earns at least $30 per month in tips — and can only be applied. Web the 8846 worksheet is used to help prepare the top portion of form 8846 (credit for employer social security and medicare taxes paid on certain employee. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully. Filers receive a credit for the social security and. Web taxes paid on certain employee tips (form 8846), c contributions to selected community development corporations (form 8847), and the empowerment zone employment credit. It is reported on irs form 8846, which is sometimes called credit for employer social. This credit is part of the general. Scroll down to the employer social security credit (8846) section. Web (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips.

Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. This means you will be. It is reported on irs form 8846, which is sometimes called credit for employer social. Certain food and beverage establishments use this. Web the fica tip credit can be requested when business tax returns are filed. This credit is part of the general. Web select other credits from the left menu. The credit is part of the general. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on.

Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web the fica tip credit report is a part of toast's report library for customers to use when filing irs form 8846 to claim a tip credit. Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web to take advantage of the fica tip credits, an employer must request the appropriate forms for their tax returns with the irs (internal revenue service). Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. Web tip credits can only be applied to a tipped employee — defined as an employee who regularly earns at least $30 per month in tips — and can only be applied. The credit applies to social security and medicare taxes that the employer. This means you will be. Web select other credits from the left menu. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social.

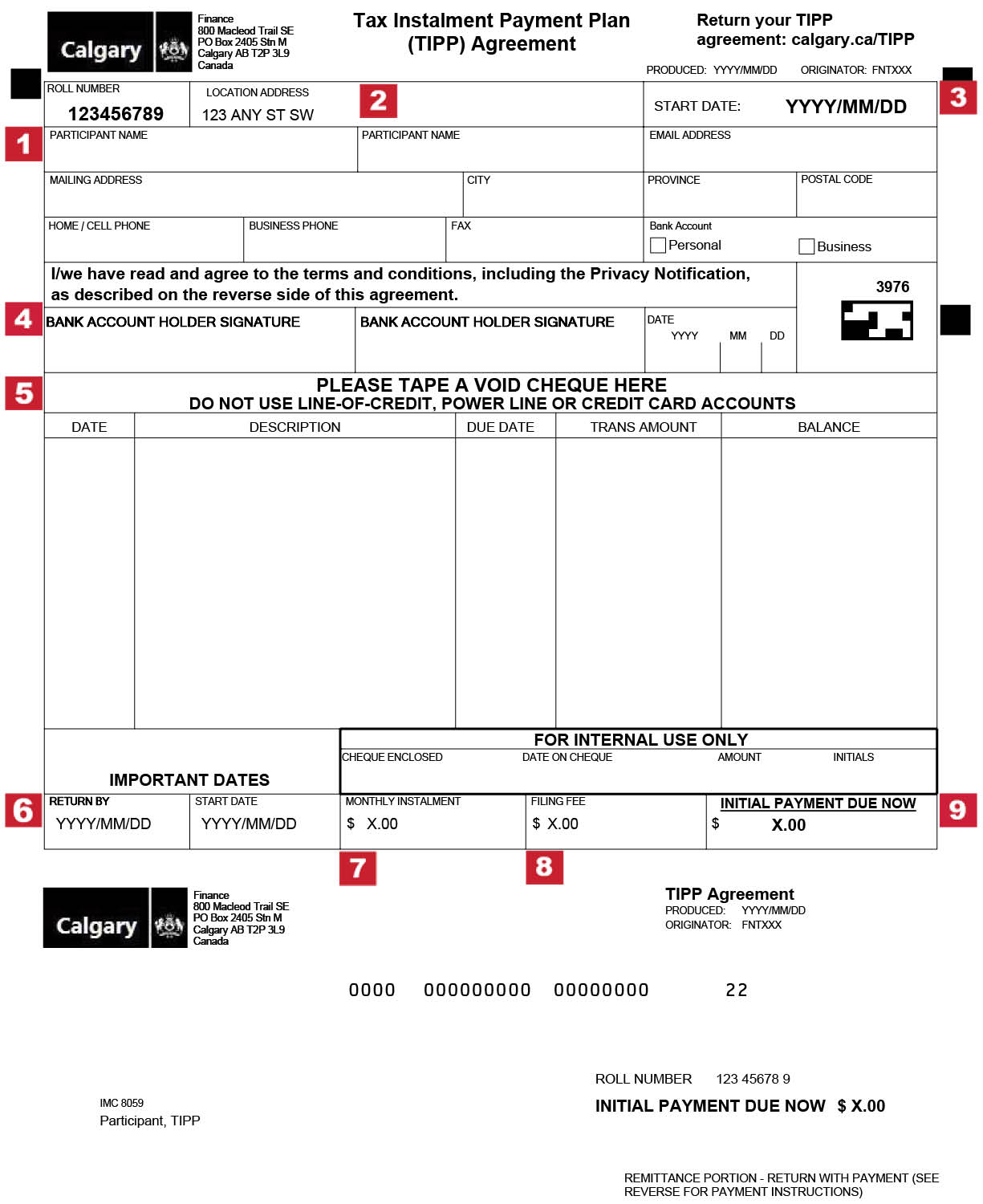

How to fill out your TIPP agreement

Web the fica tip credit report is a part of toast's report library for customers to use when filing irs form 8846 to claim a tip credit. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully. The credit.

Credit For Employer Social Security And Medicare Taxes Paid On Certain

Web select other credits from the left menu. Web the fica tip credit is a tax credit that allows businesses to take credit for a portion of employer social security paid on cash tips that are paid to an employee. Web (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid.

Your Guide To The FICA Tip Credit 2023 How Restaurants Can Save

Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social..

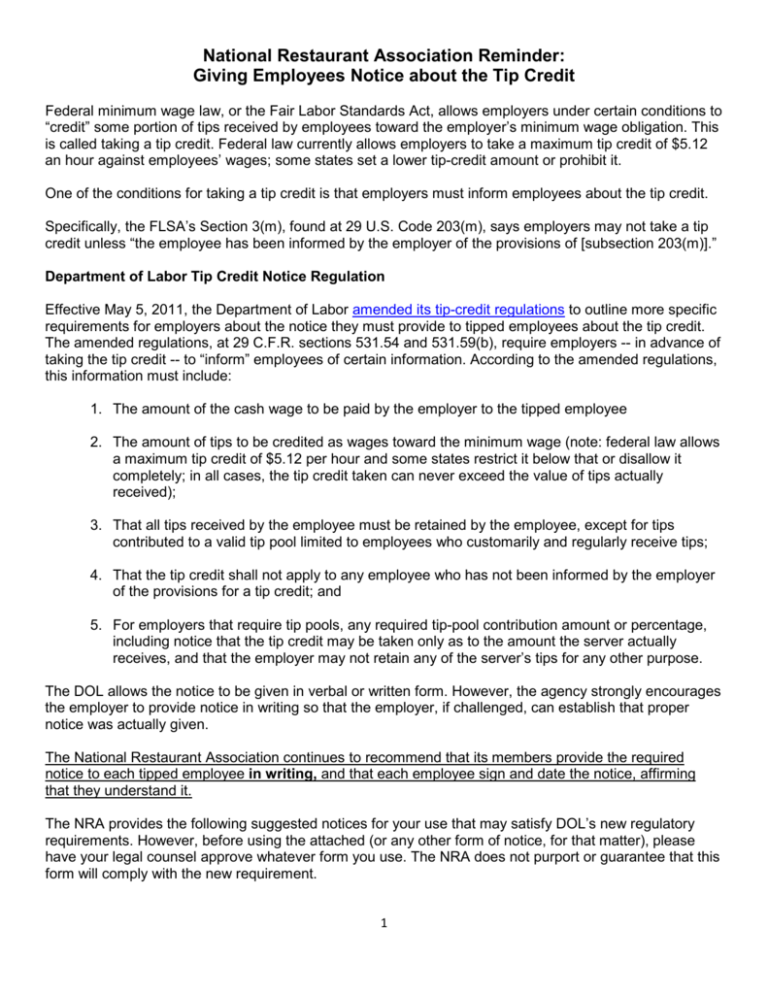

Giving Employees Notice about the Tip Credit

Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Scroll down to the employer social security credit (8846) section. Web form 8846 gives certain food and beverage establishments a general business tax credit. This means you will be. Web select.

Hawaii Employers Council DOL Announces Proposed Rule Regarding Tip

Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web the fica tip.

Fillable Form 8846 Credit For Employer Social Security And Medicare

Web the 8846 worksheet is used to help prepare the top portion of form 8846 (credit for employer social security and medicare taxes paid on certain employee. Filers receive a credit for the social security and. Web select other credits from the left menu. Web the fica tip credit can be requested when business tax returns are filed. Web taxes.

Credit Tip 2 Main Street

Web (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. This means you will be. Filers receive a credit for the social security and. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare.

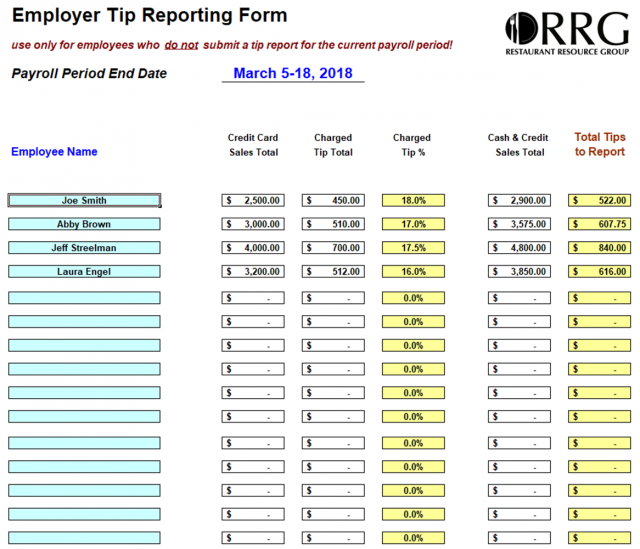

Restaurant Tip Out Sheet Template Card Template

Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully. The credit is part of the general. Certain food and beverage establishments use this. Web taxes paid on certain employee tips (form 8846), c contributions to selected community development.

What is the Tip Credit?

Filers receive a credit for the social security and. Web the 8846 worksheet is used to help prepare the top portion of form 8846 (credit for employer social security and medicare taxes paid on certain employee. This means you will be. Web the fica tip credit report is a part of toast's report library for customers to use when filing.

Fillable Form 8846 Credit For Employer Social Security And Medicare

Web tip credits can only be applied to a tipped employee — defined as an employee who regularly earns at least $30 per month in tips — and can only be applied. Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. The credit is part.

Web Tip Credits Can Only Be Applied To A Tipped Employee — Defined As An Employee Who Regularly Earns At Least $30 Per Month In Tips — And Can Only Be Applied.

Web (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Certain food and beverage establishments use this. Web taxes paid on certain employee tips (form 8846), c contributions to selected community development corporations (form 8847), and the empowerment zone employment credit. It is reported on irs form 8846, which is sometimes called credit for employer social.

Web The Fica Tip Credit Report Is A Part Of Toast's Report Library For Customers To Use When Filing Irs Form 8846 To Claim A Tip Credit.

Web the 8846 worksheet is used to help prepare the top portion of form 8846 (credit for employer social security and medicare taxes paid on certain employee. Web to take advantage of the fica tip credits, an employer must request the appropriate forms for their tax returns with the irs (internal revenue service). The credit is part of the general. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips.

This Credit Is Part Of The General.

Web select other credits from the left menu. This means you will be. The credit applies to social security and medicare taxes that the employer. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully.

Web Form 8846 Gives Certain Food And Beverage Establishments A General Business Tax Credit.

Scroll down to the employer social security credit (8846) section. Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web the fica tip credit is a tax credit that allows businesses to take credit for a portion of employer social security paid on cash tips that are paid to an employee. Web the fica tip credit can be requested when business tax returns are filed.