Texas Second Extension Form

Texas Second Extension Form - Web the deadline for filing a franchise tax second extension request for mandatory electronic payers is aug. Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms. Web extension payment(dollars and cents) 1. The texas comptroller has added time to file extended texas franchise tax reports. Web the payment should equal the balance of the amount of tax that will be reported as due on nov. (a) be $ , effective. Entities that properly secure a second extension (after filing a first extension by july 15) will have until jan. Web extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic structure credit status change or closing or reinstating a business franchise tax report forms should be mailed to the following address: Web we would like to show you a description here but the site won’t allow us. Web please remember that the texas franchise tax second extension is due by august 15, 2019 for mandatory eft payors (remittances of $10k or more the preceding state fiscal year).

Texas comptroller of public accounts p.o. The texas comptroller has added time to file extended texas franchise tax reports. (a) be $ , effective. Web extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic structure credit status change or closing or reinstating a business franchise tax report forms should be mailed to the following address: Web the payment should equal the balance of the amount of tax that will be reported as due on nov. (2) the lease will terminate on and tenant must vacate the property by the date of termination. Web the deadline for filing a franchise tax second extension request for mandatory electronic payers is aug. Web extension payment(dollars and cents) 1. 15, 2021, to file their report (the due date is extended from nov. The second extension can be submitted via gosystem with instructions for eft or filed/paid online.

Texas comptroller of public accounts p.o. Web please remember that the texas franchise tax second extension is due by august 15, 2019 for mandatory eft payors (remittances of $10k or more the preceding state fiscal year). 15 is the extended due date. The second extension can be submitted via gosystem with instructions for eft or filed/paid online. Web extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic structure credit status change or closing or reinstating a business franchise tax report forms should be mailed to the following address: Web the payment should equal the balance of the amount of tax that will be reported as due on nov. (2) the lease will terminate on and tenant must vacate the property by the date of termination. The texas comptroller has added time to file extended texas franchise tax reports. Web extension payment(dollars and cents) 1. Entities that properly secure a second extension (after filing a first extension by july 15) will have until jan.

Texas Second Special Session Begins Feminist Majority

Web the payment should equal the balance of the amount of tax that will be reported as due on nov. The texas comptroller has added time to file extended texas franchise tax reports. Texas comptroller of public accounts p.o. Web extension payment(dollars and cents) 1. The second extension can be submitted via gosystem with instructions for eft or filed/paid online.

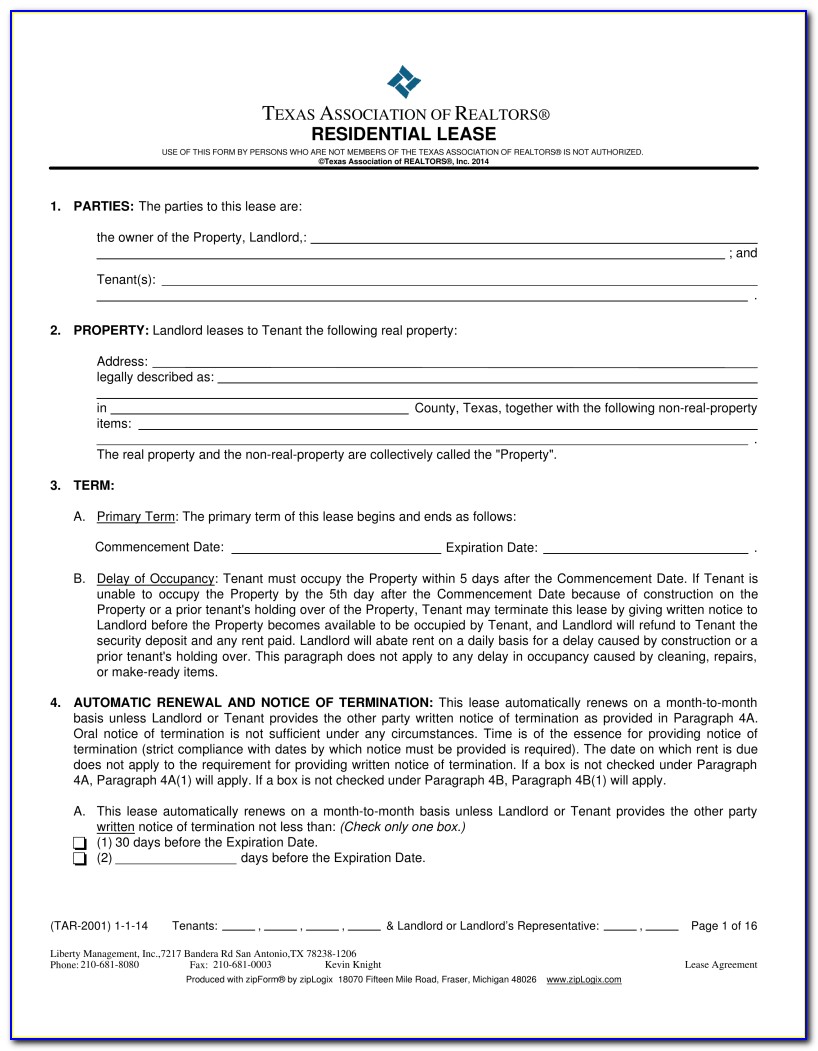

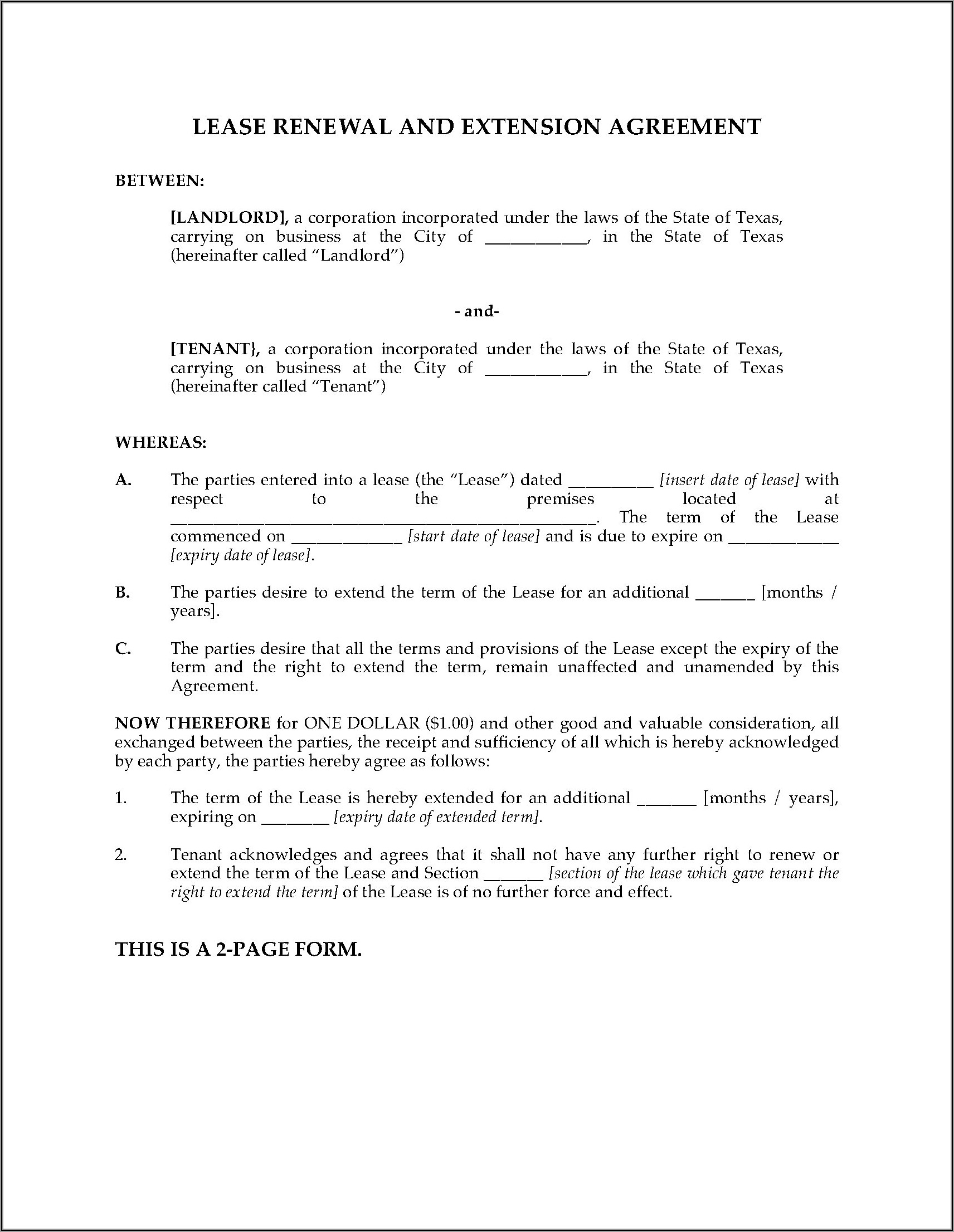

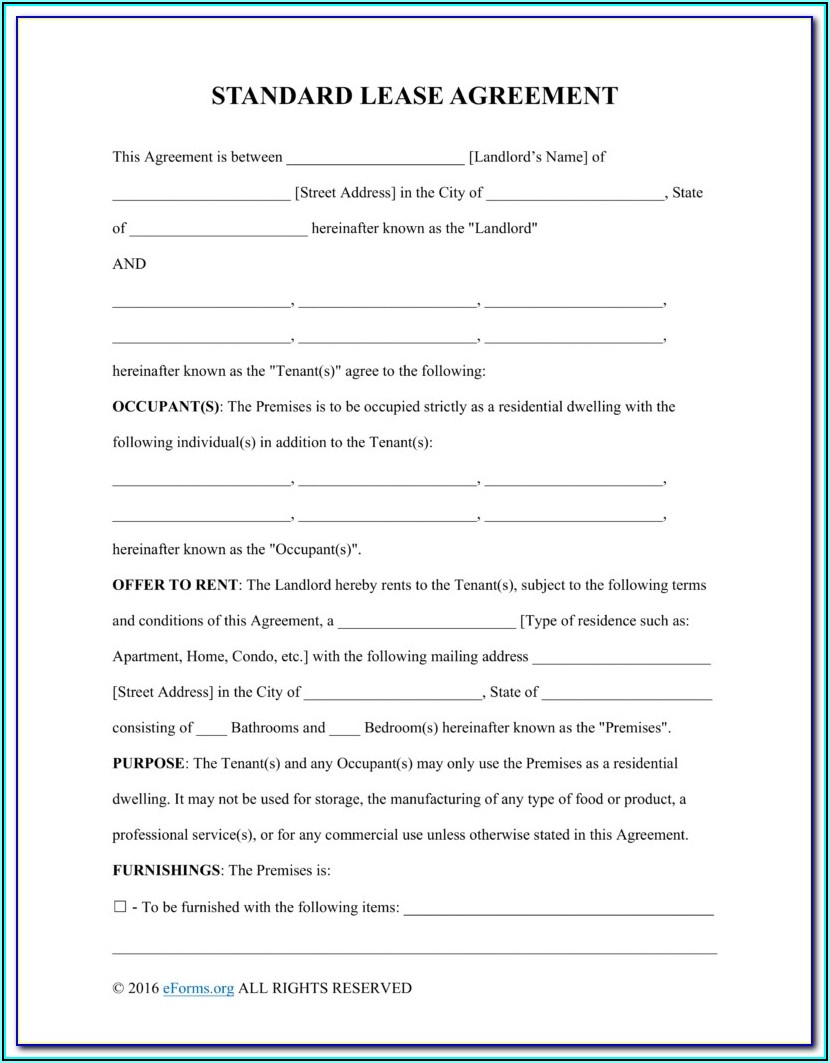

Texas Residential Lease Agreement Extension Form Form Resume

Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms. (2) the lease will terminate on and tenant must vacate the property by the date of termination. Entities that properly secure a second extension (after filing a first extension by july 15) will have until jan. The second extension can be submitted via gosystem with instructions for eft or filed/paid online..

Texas Extension Service YouTube

The texas comptroller has added time to file extended texas franchise tax reports. Web extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic structure credit status change or closing or reinstating a business franchise tax report forms should be mailed to the following address: 15, 2021, to file their report (the.

Texas Realtors Extension Of Residential Lease Fill Online, Printable

The texas comptroller has added time to file extended texas franchise tax reports. Web the payment should equal the balance of the amount of tax that will be reported as due on nov. Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms. Web the deadline for filing a franchise tax second extension request for mandatory electronic payers is aug. Web.

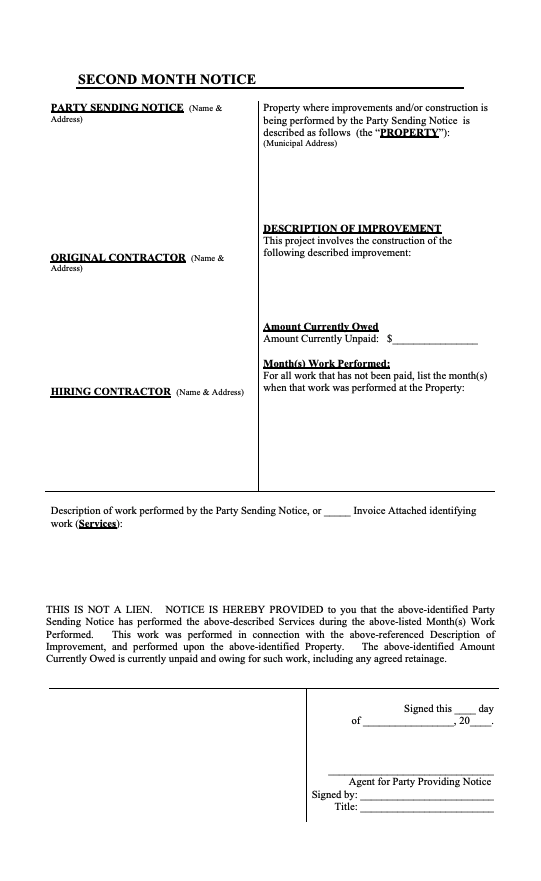

Texas Second Month Notice Form Free Downloadable Template

The second extension can be submitted via gosystem with instructions for eft or filed/paid online. Texas comptroller of public accounts p.o. The texas comptroller has added time to file extended texas franchise tax reports. (2) the lease will terminate on and tenant must vacate the property by the date of termination. 15 is the extended due date.

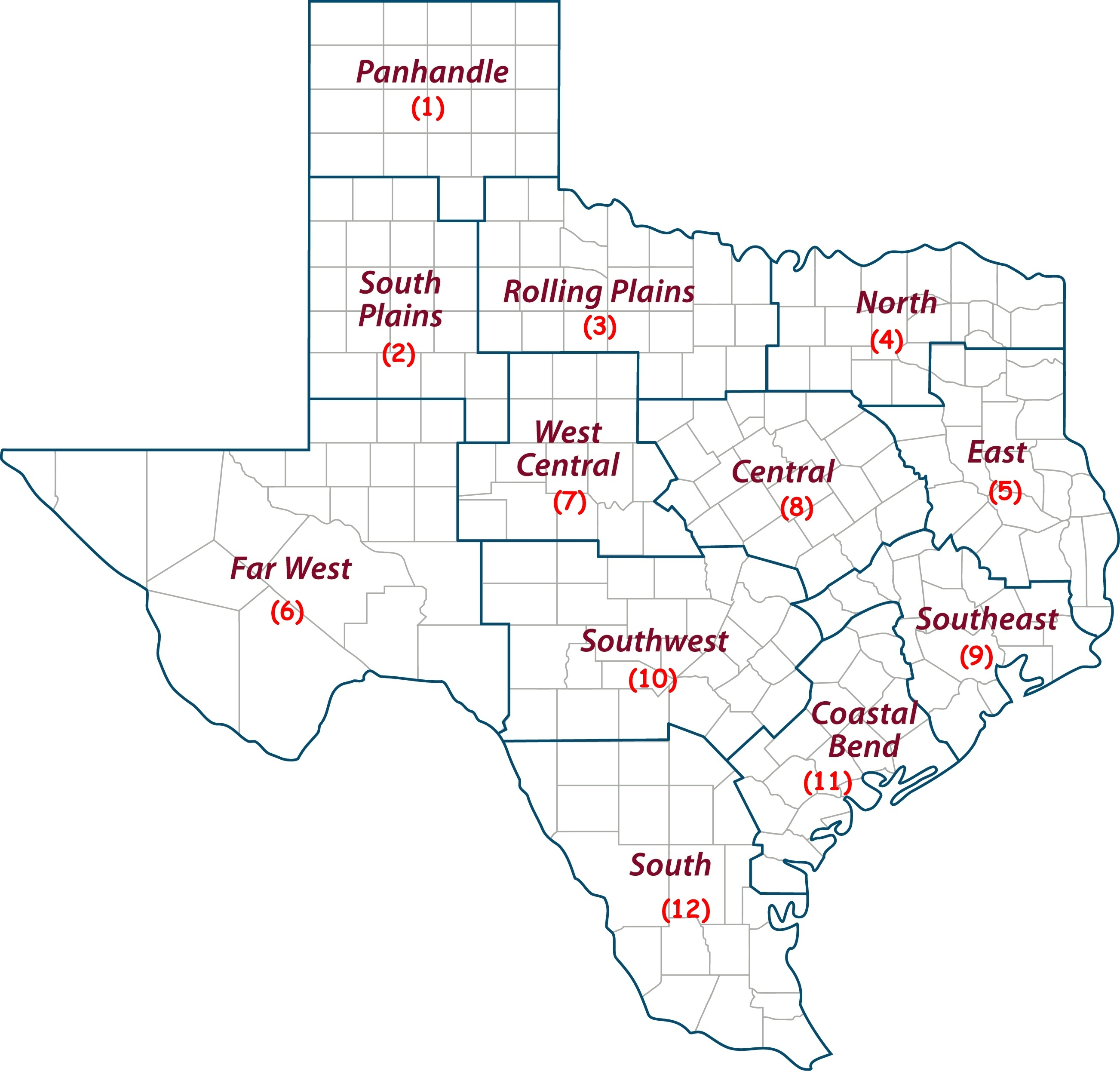

Texas crop, weather for Oct. 22, 2013 AgriLife Today

Web please remember that the texas franchise tax second extension is due by august 15, 2019 for mandatory eft payors (remittances of $10k or more the preceding state fiscal year). Texas comptroller of public accounts p.o. Entities that properly secure a second extension (after filing a first extension by july 15) will have until jan. The texas comptroller has added.

What you need to know about the Second Texas Franchise Tax Extension

Texas comptroller of public accounts p.o. Web the payment should equal the balance of the amount of tax that will be reported as due on nov. 15, 2021, to file their report (the due date is extended from nov. The texas comptroller has added time to file extended texas franchise tax reports. (2) the lease will terminate on and tenant.

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

15 is the extended due date. Web we would like to show you a description here but the site won’t allow us. The texas comptroller has added time to file extended texas franchise tax reports. Web please remember that the texas franchise tax second extension is due by august 15, 2019 for mandatory eft payors (remittances of $10k or more.

Texas Extension Form W3X (Fill Form) Letter Of Credit Fee

(a) be $ , effective. 15, 2021, to file their report (the due date is extended from nov. Web the payment should equal the balance of the amount of tax that will be reported as due on nov. Web the deadline for filing a franchise tax second extension request for mandatory electronic payers is aug. Web extension payment(dollars and cents).

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

(a) be $ , effective. Web extension payment(dollars and cents) 1. Entities that properly secure a second extension (after filing a first extension by july 15) will have until jan. 15, 2021, to file their report (the due date is extended from nov. 15 is the extended due date.

Instructions For Each Report Year Are Online At Www.comptroller.texas.gov/Taxes/Franchise/Forms.

15, 2021, to file their report (the due date is extended from nov. (a) be $ , effective. Web please remember that the texas franchise tax second extension is due by august 15, 2019 for mandatory eft payors (remittances of $10k or more the preceding state fiscal year). 15 is the extended due date.

Web The Payment Should Equal The Balance Of The Amount Of Tax That Will Be Reported As Due On Nov.

Web extension payment(dollars and cents) 1. Web the deadline for filing a franchise tax second extension request for mandatory electronic payers is aug. Entities that properly secure a second extension (after filing a first extension by july 15) will have until jan. The texas comptroller has added time to file extended texas franchise tax reports.

Texas Comptroller Of Public Accounts P.o.

(2) the lease will terminate on and tenant must vacate the property by the date of termination. Web we would like to show you a description here but the site won’t allow us. Web extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic structure credit status change or closing or reinstating a business franchise tax report forms should be mailed to the following address: The second extension can be submitted via gosystem with instructions for eft or filed/paid online.