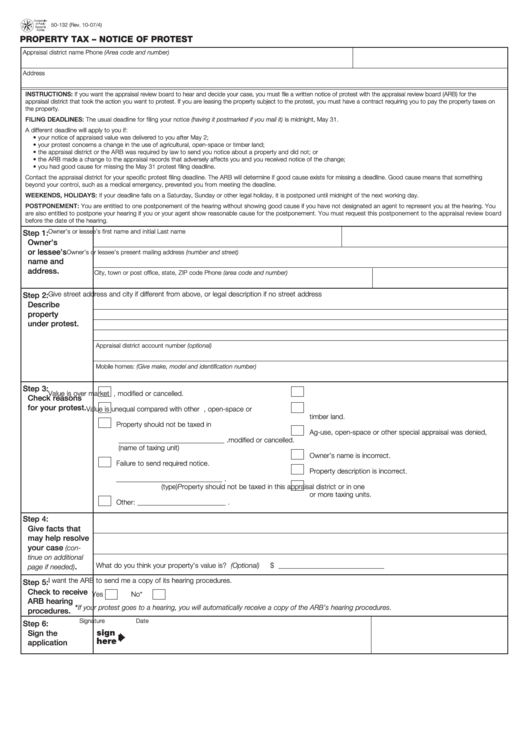

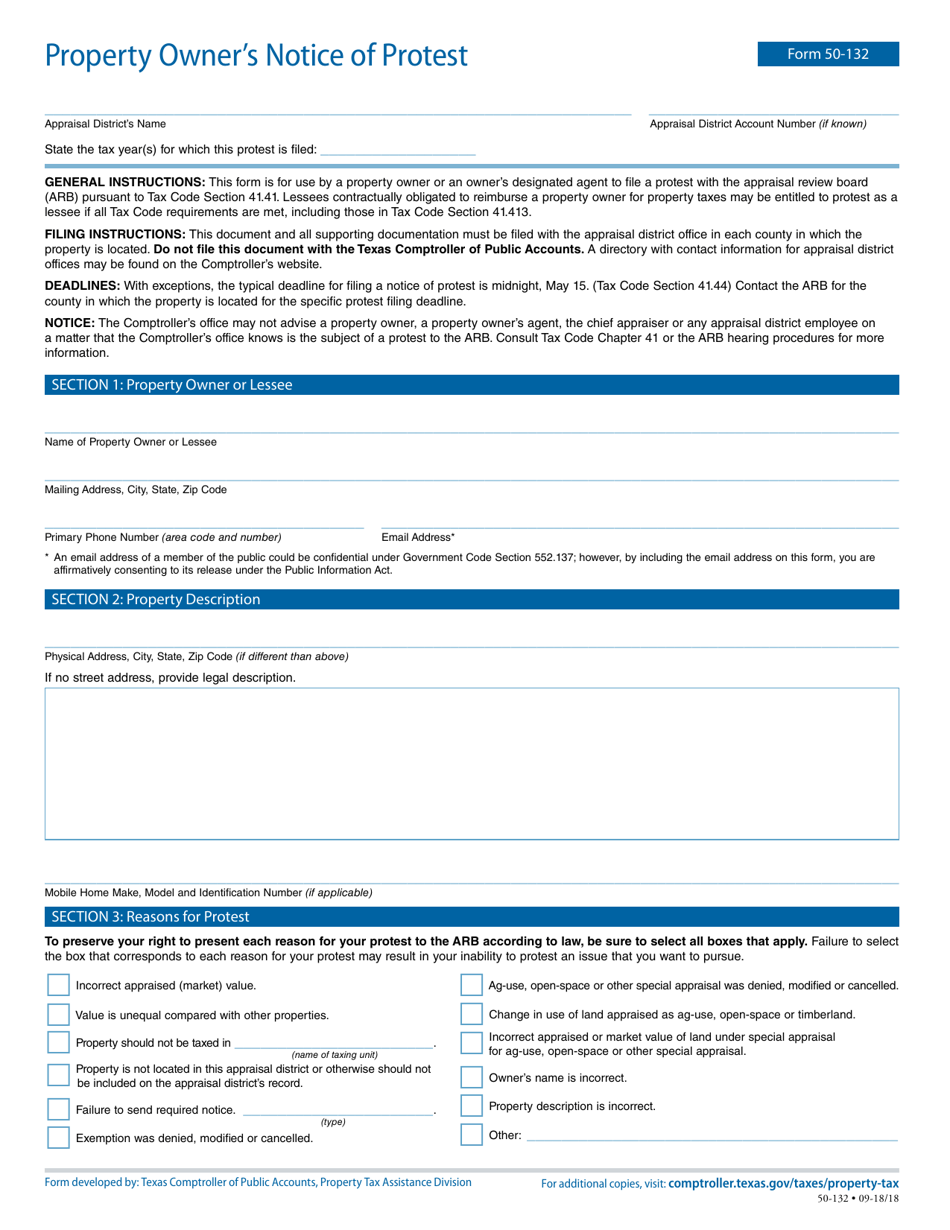

Texas Property Tax Protest Form

Texas Property Tax Protest Form - At hcad offices located at 13013 northwest freeway. Section 41.44 (a) texas property tax. You may have thrown away big money if you discarded a certain envelope from the appraisal district; Web attention texas homeowners: Web property tax notice of protest forms are available: Web forms can be mailed or dropped off at 625 fm 1460, georgetown, texas 78726. Complete, edit or print tax forms instantly. Web it is your right as a texas taxpayer to protest and appeal your property taxes. Below, we have outlined the six main steps to. Protest forms can be submitted in the online.

Protest forms can be submitted in the online. This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district. Web this type of late protest must be filed before the appraisal review board approves the appraisal records on july 20 of the current year. Web the good news is you can protest your appraisal, and in fact real estate agents and financial experts say you should protest it every year to help keep your. Sign up today by simply. If you believe that this value is incorrect, you can file a protest with the. File an appeal with your local county and appraisal district. Web attention texas homeowners: Web this is where how and why to file a property tax protest in texas becomes important. You may protest if you disagree with the appraisal.

Complete, edit or print tax forms instantly. File a property tax appeal. At hcad offices located at 13013 northwest freeway. Save time editing, signing, filling pdf documents online. You may protest if you disagree with the appraisal. If you believe that this value is incorrect, you can file a protest with the. File an appeal with your local county and appraisal district. Web this is where how and why to file a property tax protest in texas becomes important. Web it is your right as a texas taxpayer to protest and appeal your property taxes. Web the good news is you can protest your appraisal, and in fact real estate agents and financial experts say you should protest it every year to help keep your.

Texas Property Tax Protest Made Easy Save Money on Taxes

Web this type of late protest must be filed before the appraisal review board approves the appraisal records on july 20 of the current year. Web attention texas homeowners: Protest forms can be submitted in the online. One of your most important rights as a taxpayer is your right to protest to the appraisal review board (arb). If you believe.

Universal Form To File A Tax Protest & O'Connor & Associates

Sign up today by simply. The keys to actually lowering. Web it is your right as a texas taxpayer to protest and appeal your property taxes. This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district. 850 east anderson lane austin, tx 78752 all property.

Texas Property Tax Protest Information YouTube

Web this type of late protest must be filed before the appraisal review board approves the appraisal records on july 20 of the current year. Residents choosing to contest property. If you believe that this value is incorrect, you can file a protest with the. File an appeal with your local county and appraisal district. File a property tax appeal.

Universal Form To File A Tax Protest & O'Connor & Associates

Residents choosing to contest property. If you believe that this value is incorrect, you can file a protest with the. Ad professional document creator and editor. Section 41.44 (a) texas property tax. File an appeal with your local county and appraisal district.

Universal Form To File A Tax Protest & O'Connor & Associates

At hcad offices located at 13013 northwest freeway. The keys to actually lowering. Web checklist of things you will need: Section 41.44 (a) texas property tax. This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district.

Texas Property Tax Protests Attorneys Wharton El Campo Richmond

Web forms can be mailed or dropped off at 625 fm 1460, georgetown, texas 78726. File a property tax appeal. This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district. Web this is where how and why to file a property tax protest in texas.

How to Protest Your Dallas County Property Taxes

Web if you have decided to protest your texas property taxes, it is essential to have a plan of action in place to protect your legal rights. Save time editing, signing, filling pdf documents online. Section 41.44 (a) texas property tax. The keys to actually lowering. Web it is your right as a texas taxpayer to protest and appeal your.

Fillable Form 50132 Property Tax Notice Of Protest printable pdf

850 east anderson lane austin, tx 78752 all property owners who file a protest will have access. The keys to actually lowering. If you disagree with the appraisal district's value, you have the right to file a protest. Section 41.44 (a) texas property tax. Join now for instant benefits!

Form 50132 Download Fillable PDF or Fill Online Property Owner's

Section 41.44 (a) texas property tax. Residents choosing to contest property. Sign up today by simply. Web forms can be mailed or dropped off at 625 fm 1460, georgetown, texas 78726. Web it is your right as a texas taxpayer to protest and appeal your property taxes.

Hcad From 41 44 Fill Online, Printable, Fillable, Blank pdfFiller

At hcad offices located at 13013 northwest freeway. Below, we have outlined the six main steps to. Join now for instant benefits! Protest forms can be submitted in the online. File an appeal with your local county and appraisal district.

This Form Is For Use By A Property Owner Or The Owner’s Designated Agent To File A Protest Regarding Certain Actions Of The Appraisal District.

850 east anderson lane austin, tx 78752 all property owners who file a protest will have access. Web attention texas homeowners: Ad professional document creator and editor. Web this is where how and why to file a property tax protest in texas becomes important.

Web If You Have Decided To Protest Your Texas Property Taxes, It Is Essential To Have A Plan Of Action In Place To Protect Your Legal Rights.

At hcad offices located at 13013 northwest freeway. Web forms can be mailed or dropped off at 625 fm 1460, georgetown, texas 78726. Web the good news is you can protest your appraisal, and in fact real estate agents and financial experts say you should protest it every year to help keep your. Web checklist of things you will need:

Sign Up Today By Simply.

Section 41.44 (a) texas property tax. Web property tax notice of protest forms are available: You may have thrown away big money if you discarded a certain envelope from the appraisal district; File a property tax appeal.

File An Appeal With Your Local County And Appraisal District.

Residents choosing to contest property. If you believe that this value is incorrect, you can file a protest with the. Protest forms can be submitted in the online. Web this type of late protest must be filed before the appraisal review board approves the appraisal records on july 20 of the current year.