Tax Form Trust Distribution

Tax Form Trust Distribution - Web introduction what you need to know about estate/trust income to answer your 1040 clients questions. You can access the most recent revision of the form at pay.gov. Web trusts and estates report their income and deductions on form 1041 as well as the income distributed to beneficiaries of the trust or estate. Ordinary income that the trust earns, such as dividends and interest, is taxable to the trust or to its grantor if it's a revocable trust. Individual tax return form 1040 instructions; Web there are three main ways for a beneficiary to receive an inheritance from a trust: Request for taxpayer identification number (tin) and. Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts. When the settlor of a trust dies, the assets held by the trust will be distributed to trust beneficiaries in accordance with the. Outright distributions staggered distributions discretionary distributions a.

Web the trust itself gets a deduction for distributions to the extent that they don't exceed the amount of net income that the trust's assets generated. The tax rate varies from 33% to 40% of the distribution amount, but you. Form 5316 must be submitted electronically through pay.gov. Web a trust or, for its final tax year, a decedent’s estate may elect under section 643(g) to have any part of its estimated tax payments (but not income tax withheld) treated as made by. Web introduction what you need to know about estate/trust income to answer your 1040 clients questions. Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts. Web if you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year (and the trust paid taxes on that income), you must. Web form 1041, u.s. Web are trust distributions taxable? Ordinary income that the trust earns, such as dividends and interest, is taxable to the trust or to its grantor if it's a revocable trust.

Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s estate, trust, or bankruptcy estate to report:. You can access the most recent revision of the form at pay.gov. Web information about form 4970, tax on accumulation distribution of trusts, including recent updates, related forms and instructions on how to file. Web form 1041, u.s. Web the trust itself gets a deduction for distributions to the extent that they don't exceed the amount of net income that the trust's assets generated. Web trust income distributions. Web trusts and estates report their income and deductions on form 1041 as well as the income distributed to beneficiaries of the trust or estate. Outright distributions staggered distributions discretionary distributions a. Request for taxpayer identification number (tin) and. Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts.

How to Reduce Capital Gains Tax When Selling Investment Properties

You can access the most recent revision of the form at pay.gov. Web there are three main ways for a beneficiary to receive an inheritance from a trust: Web introduction what you need to know about estate/trust income to answer your 1040 clients questions. Web if you received a distribution for this tax year from a trust that accumulated its.

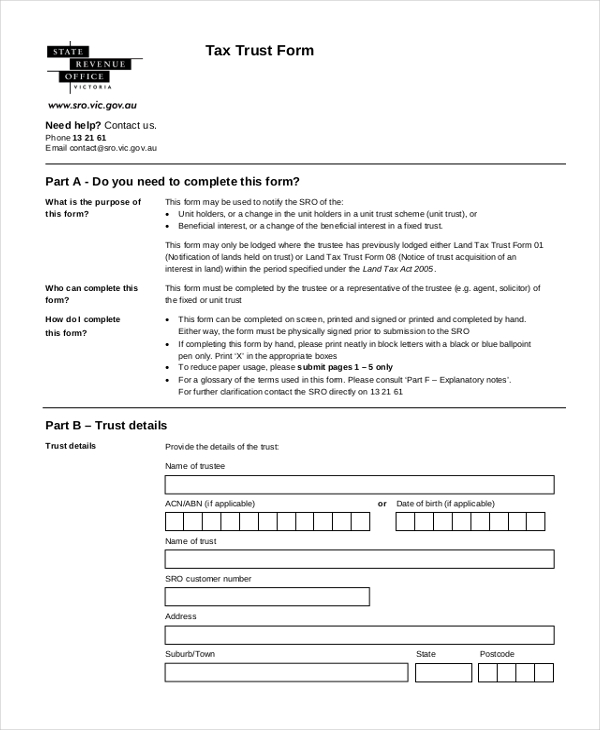

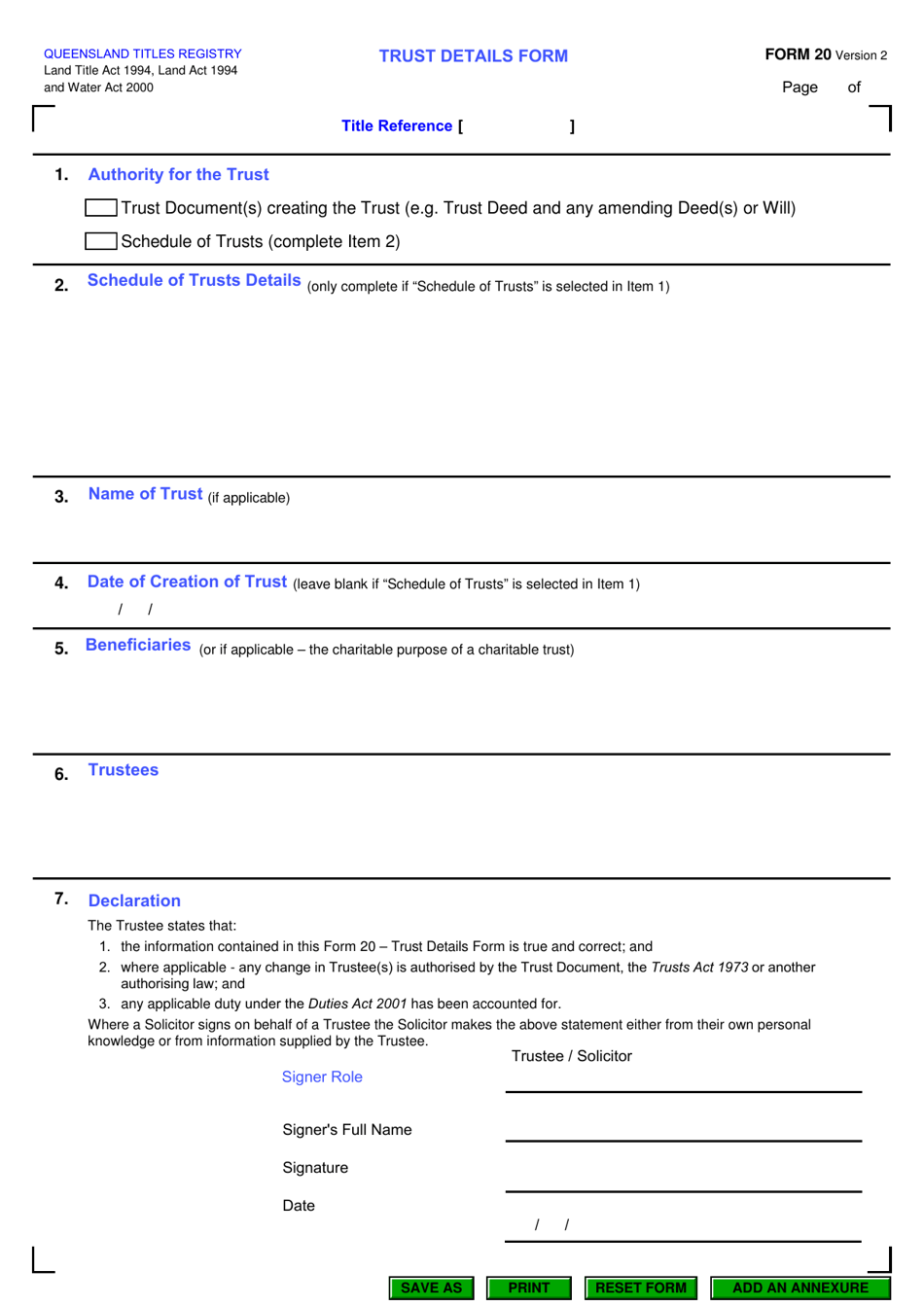

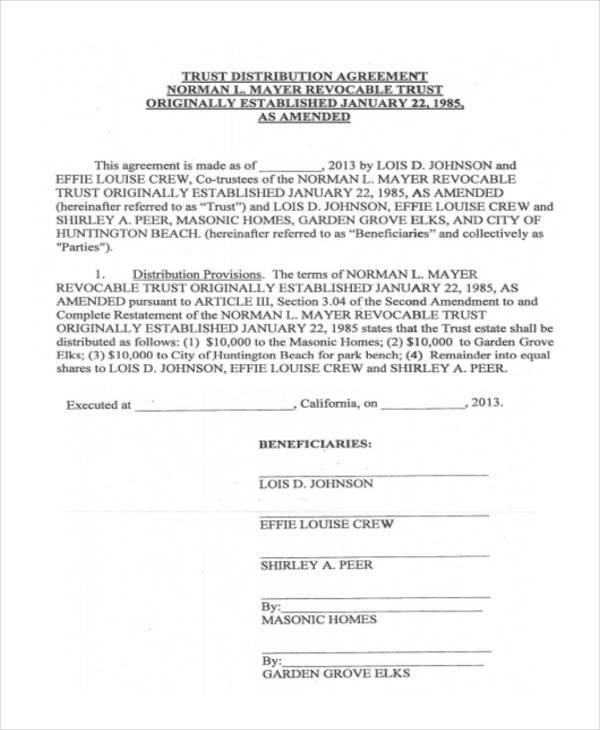

FREE 16+ Sample Will and Trust Forms in PDF MS Word

Web trusts and estates report their income and deductions on form 1041 as well as the income distributed to beneficiaries of the trust or estate. You can access the most recent revision of the form at pay.gov. Web there are three main ways for a beneficiary to receive an inheritance from a trust: Request for taxpayer identification number (tin) and..

Tax Planning 2017 Trust Distribution Resolutions before 30 June YouTube

Web a trust or, for its final tax year, a decedent’s estate may elect under section 643(g) to have any part of its estimated tax payments (but not income tax withheld) treated as made by. Web trust income distributions. Web the trust itself gets a deduction for distributions to the extent that they don't exceed the amount of net income.

Land Tax Rates Qld Trust PRFRTY

Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts. When the settlor of a trust dies, the assets held by the trust will be distributed to trust beneficiaries in accordance with the. Web form 1041, u.s. Distributions of corpus are considered gifts by. Web trust income distributions.

Form 4970 Tax on Accumulation Distribution of Trusts (2014) Free Download

Distributions of corpus are considered gifts by. What books don’t tell you! Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts. Form 5316 must be submitted electronically through pay.gov. Web the trust itself gets a deduction for distributions to the extent that they don't exceed the amount of net income.

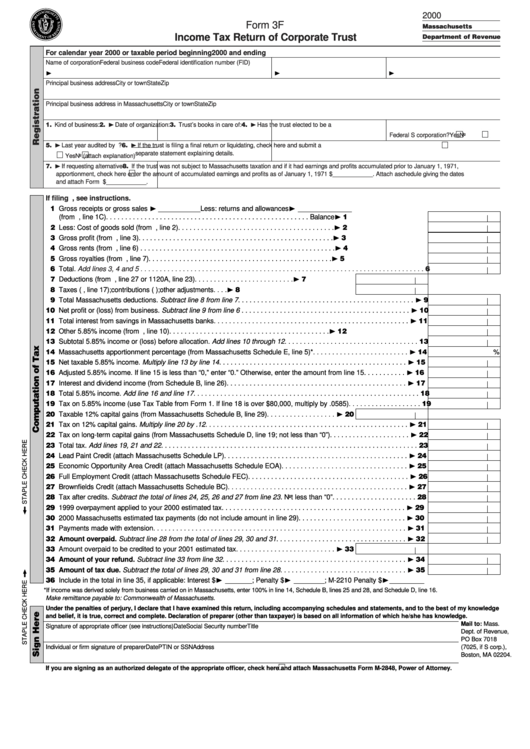

Form 3f Tax Return Of Corporate Trust 2000 printable pdf

Web trusts and estates report their income and deductions on form 1041 as well as the income distributed to beneficiaries of the trust or estate. Web if you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year (and the trust paid taxes on that income), you must. Request for.

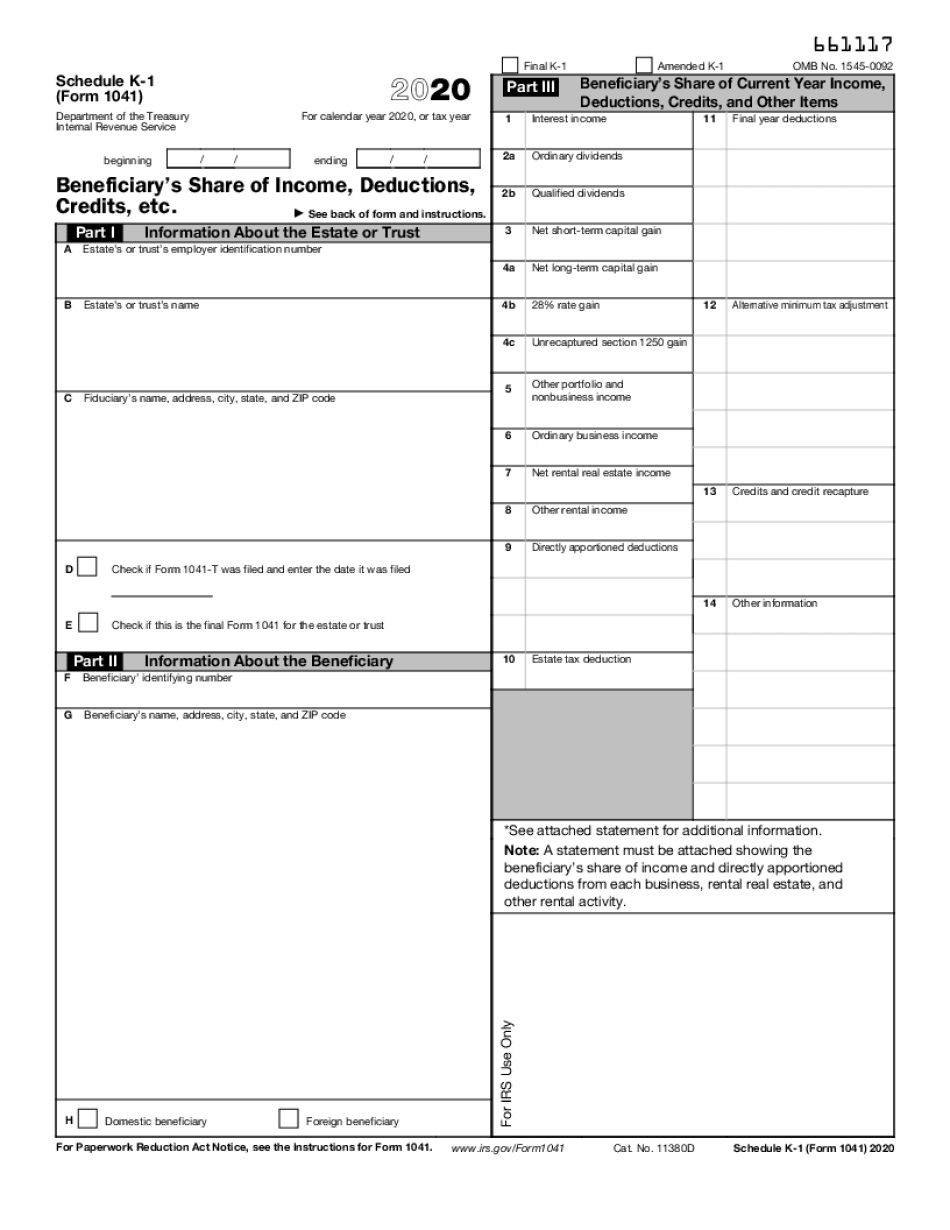

schedule k 1 trust codes Fill Online, Printable, Fillable Blank

Web form 1041, u.s. Web are trust distributions taxable? Form 5316 must be submitted electronically through pay.gov. Web information about form 4970, tax on accumulation distribution of trusts, including recent updates, related forms and instructions on how to file. Individual tax return form 1040 instructions;

FREE 10+ Distribution Agreement Forms in PDF MS Word

Web when the trustee of a trust makes a trust fund distribution to beneficiaries containing trust income, the trustee will usually deduct the distribution amount from the. You can access the most recent revision of the form at pay.gov. Web introduction what you need to know about estate/trust income to answer your 1040 clients questions. Individual tax return form 1040.

Trust Distribution Resolutions Wilson Pateras

Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts. Distributions of corpus are considered gifts by. Request for taxpayer identification number (tin) and. Web there are three main ways for a beneficiary to receive an inheritance from a trust: Ordinary income that the trust earns, such as dividends and interest,.

Understanding Taxes and Trust Distribution Tseng Law Firm

Web a trust or, for its final tax year, a decedent’s estate may elect under section 643(g) to have any part of its estimated tax payments (but not income tax withheld) treated as made by. Distributions of corpus are considered gifts by. Web form 1041, u.s. Web when the trustee of a trust makes a trust fund distribution to beneficiaries.

Web Trusts And Estates Report Their Income And Deductions On Form 1041 As Well As The Income Distributed To Beneficiaries Of The Trust Or Estate.

When the settlor of a trust dies, the assets held by the trust will be distributed to trust beneficiaries in accordance with the. Web the trust itself gets a deduction for distributions to the extent that they don't exceed the amount of net income that the trust's assets generated. Web when the trustee of a trust makes a trust fund distribution to beneficiaries containing trust income, the trustee will usually deduct the distribution amount from the. Web there are three main ways for a beneficiary to receive an inheritance from a trust:

Distributions Of Corpus Are Considered Gifts By.

What books don’t tell you! Web are trust distributions taxable? Web as noted earlier, a trust distribution tax is a federal tax that applies to distributions from qualified trusts. Web information about form 4970, tax on accumulation distribution of trusts, including recent updates, related forms and instructions on how to file.

Income Tax Return For Estates And Trusts Pdf, Is Used By The Fiduciary Of A Domestic Decedent’s Estate, Trust, Or Bankruptcy Estate To Report:.

The tax rate varies from 33% to 40% of the distribution amount, but you. Web form 1041, u.s. Web if you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year (and the trust paid taxes on that income), you must. Web introduction what you need to know about estate/trust income to answer your 1040 clients questions.

Ordinary Income That The Trust Earns, Such As Dividends And Interest, Is Taxable To The Trust Or To Its Grantor If It's A Revocable Trust.

Request for taxpayer identification number (tin) and. Web a trust or, for its final tax year, a decedent’s estate may elect under section 643(g) to have any part of its estimated tax payments (but not income tax withheld) treated as made by. Form 5316 must be submitted electronically through pay.gov. You can access the most recent revision of the form at pay.gov.