Tax Form 8915

Tax Form 8915 - If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. Complete, edit or print tax forms instantly. Web solved•by turbotax•3030•updated january 13, 2023. Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem fx® tax. Web up to 10% cash back log in to file irs federal and state taxes, check your return status, access prior year returns, amend a return, file an extension, and more. Web income menu other income desktop: From within your taxact return (online or desktop), click federal. Use this tool to look up when your individual tax forms will be available in turbotax. Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr. Web solved•by intuit•594•updated january 17, 2023.

Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem fx® tax. Web solved•by turbotax•3030•updated january 13, 2023. Use this tool to look up when your individual tax forms will be available in turbotax. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Complete, edit or print tax forms instantly. Web up to 10% cash back log in to file irs federal and state taxes, check your return status, access prior year returns, amend a return, file an extension, and more. Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr. The forms release status web page shows when the. From within your taxact return (online or desktop), click federal. Web income menu other income desktop:

Web solved•by intuit•594•updated january 17, 2023. Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr. The forms release status web page shows when the. Web solved•by turbotax•3030•updated january 13, 2023. Use this tool to look up when your individual tax forms will be available in turbotax. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem fx® tax. From within your taxact return (online or desktop), click federal. Web up to 10% cash back log in to file irs federal and state taxes, check your return status, access prior year returns, amend a return, file an extension, and more. Complete, edit or print tax forms instantly.

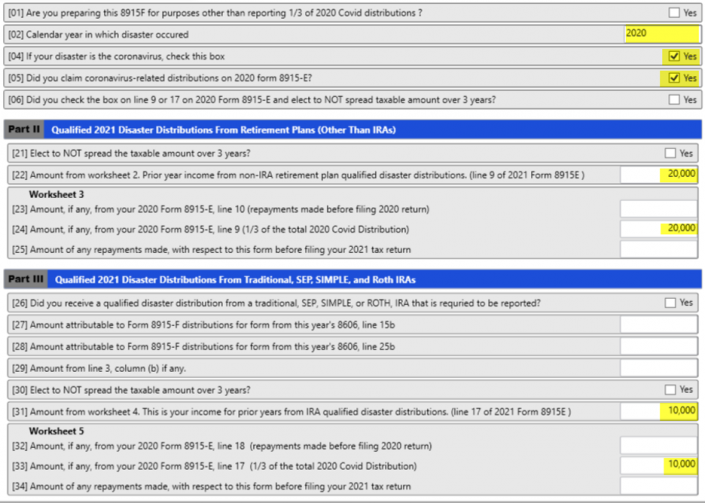

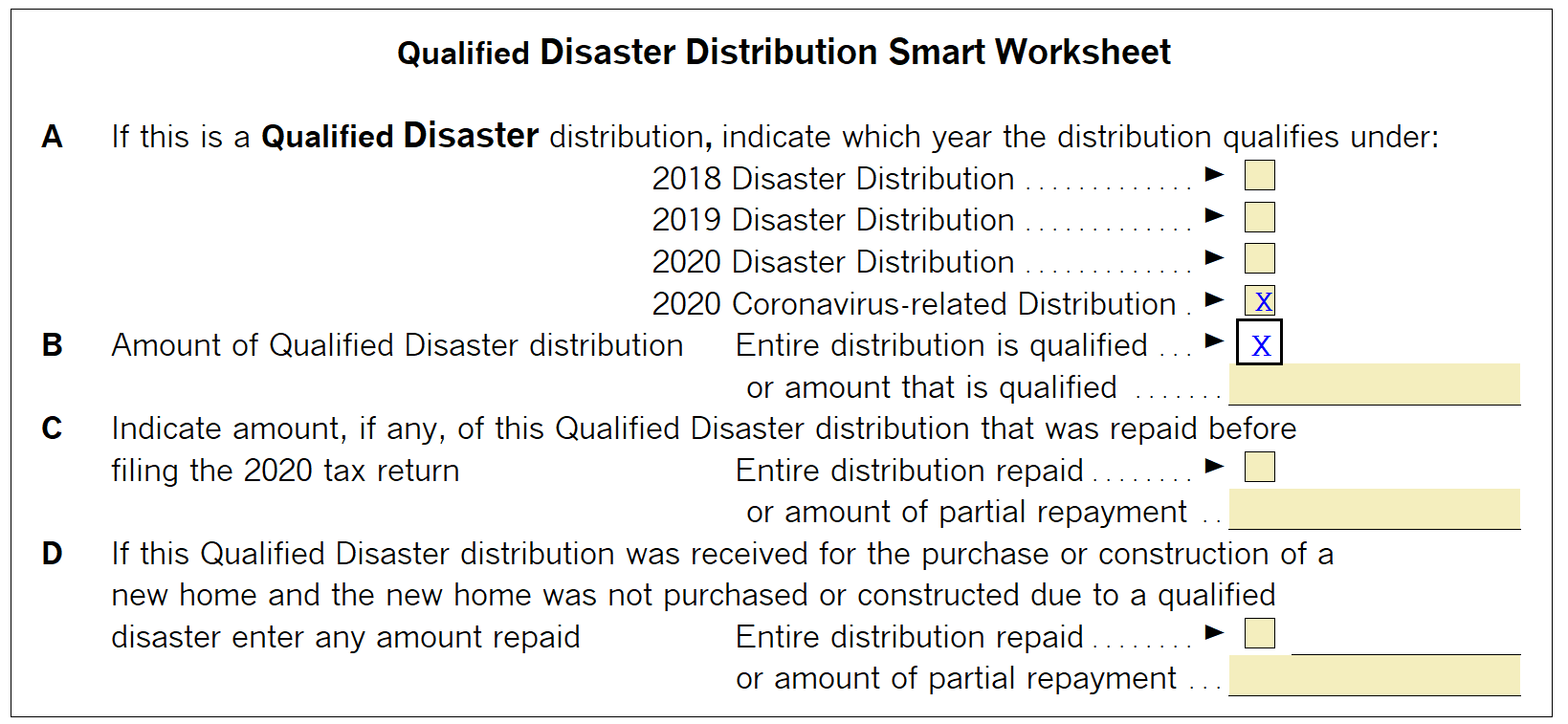

Basic 8915F Instructions for 2021 Taxware Systems

Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem fx® tax. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Web solved•by intuit•594•updated january 17, 2023. From within your taxact return (online or desktop), click federal. Web up to 10% cash.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Use this tool to look up when your individual tax forms will be available in turbotax. The forms release status web page shows when the. If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. Web income menu other income desktop: Web up to 10%.

form 8915 e instructions turbotax Renita Wimberly

The forms release status web page shows when the. Web up to 10% cash back log in to file irs federal and state taxes, check your return status, access prior year returns, amend a return, file an extension, and more. From within your taxact return (online or desktop), click federal. Web this video explains how to find when tax forms.

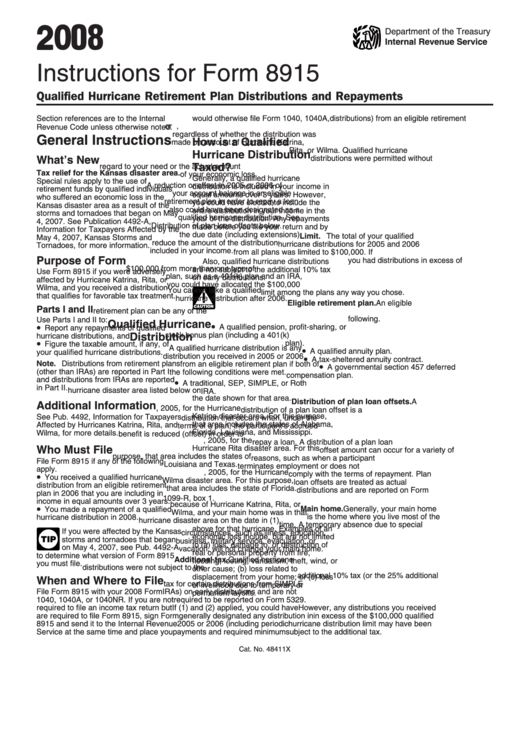

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Use this tool to look up when your individual tax forms will be available in turbotax. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Web solved•by intuit•594•updated january 17, 2023. The forms release status web page shows when the. Web this video explains how to find when tax forms will be available to.

Instructions For Form 8915 2008 printable pdf download

If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem fx® tax. Web income menu other income desktop: Web qualified disaster retirement plan.

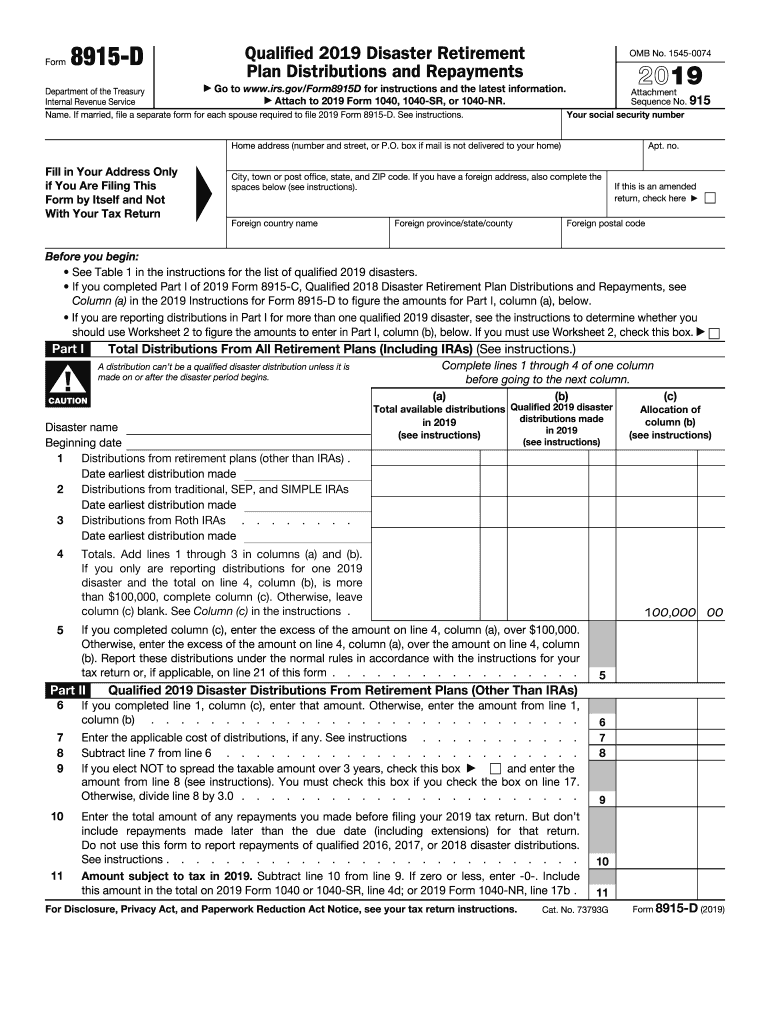

8915 D Form Fill Out and Sign Printable PDF Template signNow

Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr. If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. Use this tool to look up when your individual tax forms will be available in turbotax. Web solved•by turbotax•3030•updated january 13, 2023. From.

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Web income menu other income desktop: Complete, edit or print tax forms instantly. If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem.

Generating Form 8915E in ProSeries Intuit Accountants Community

From within your taxact return (online or desktop), click federal. Use this tool to look up when your individual tax forms will be available in turbotax. The forms release status web page shows when the. If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to..

Generating Form 8915E in ProSeries Intuit Accountants Community

If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. The forms release status web page shows when the. Web solved•by intuit•594•updated january 17, 2023. Web solved•by turbotax•3030•updated january 13, 2023. Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr.

Basic 8915F Instructions for 2021 Taxware Systems

Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr. Use this tool to look up when your individual tax forms will be available in turbotax. Complete, edit or print tax forms instantly. The forms release status web page shows when the. From within your taxact return (online or desktop), click federal.

Complete, Edit Or Print Tax Forms Instantly.

If you are not required to file an income tax return but are required to file form 8915, sign form 8915 and send it to. Web income menu other income desktop: Web file form 8915 with your 2009 form 1040, 1040a, or 1040nr. Web this video explains how to find when tax forms will be available to file using cch axcess™ tax and cch® prosystem fx® tax.

Web Solved•By Intuit•594•Updated January 17, 2023.

The forms release status web page shows when the. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Web up to 10% cash back log in to file irs federal and state taxes, check your return status, access prior year returns, amend a return, file an extension, and more. Web solved•by turbotax•3030•updated january 13, 2023.

Use This Tool To Look Up When Your Individual Tax Forms Will Be Available In Turbotax.

From within your taxact return (online or desktop), click federal.

.jpeg)