Tax Form 100S

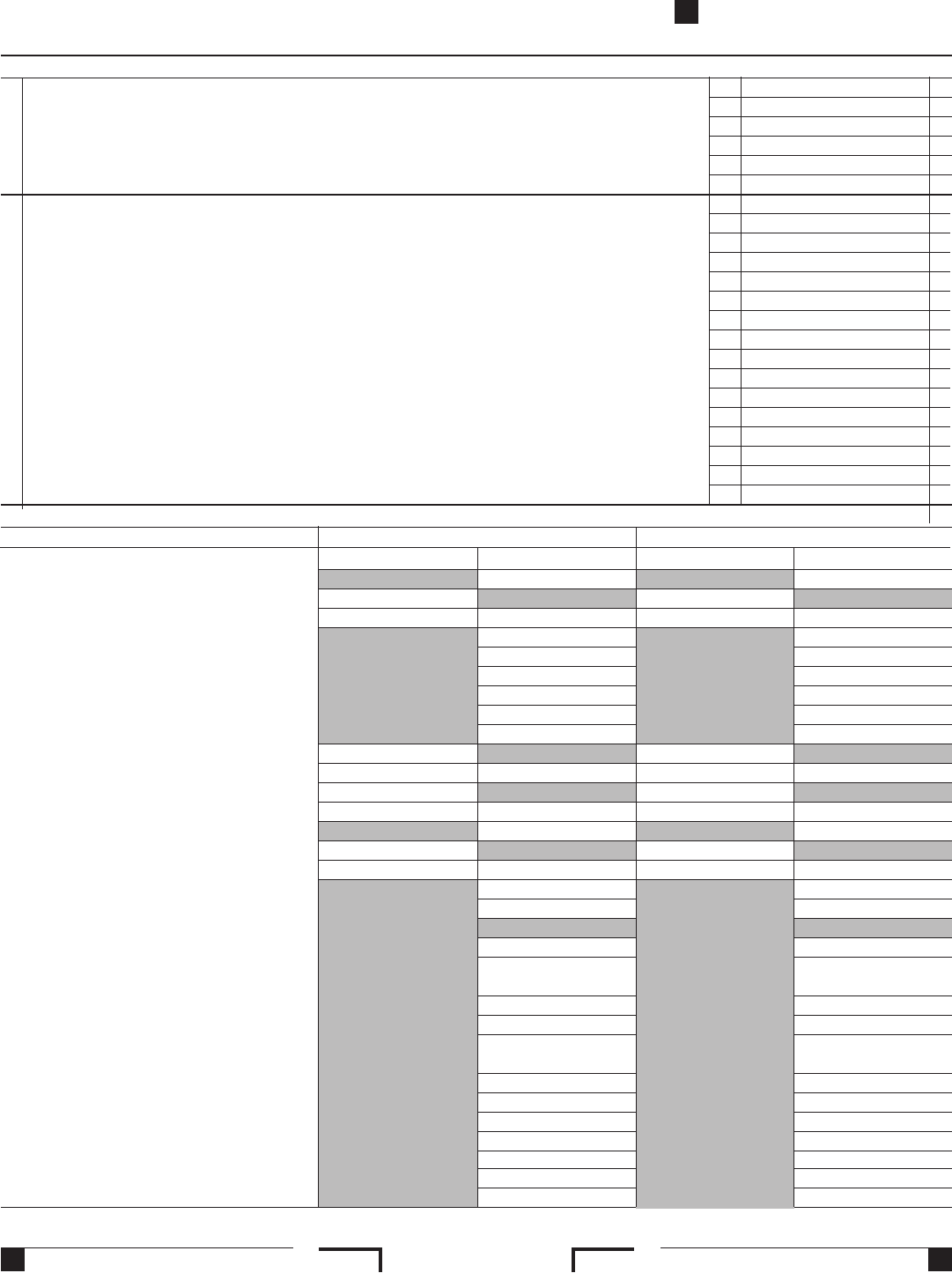

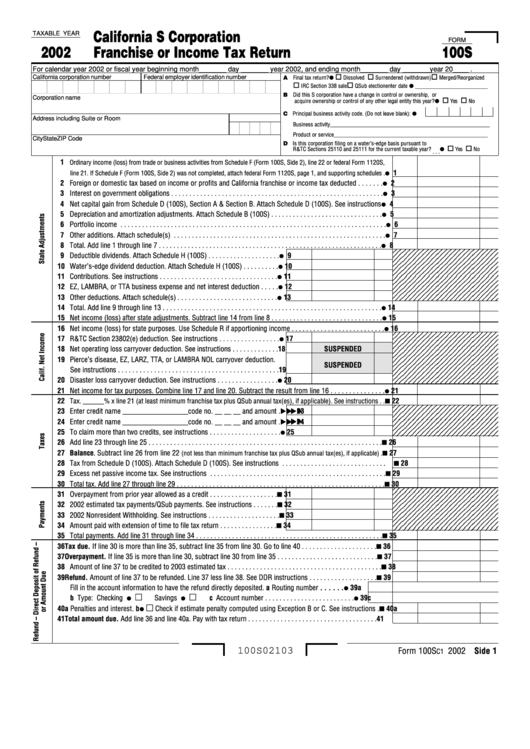

Tax Form 100S - Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. See the instructions for form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. This form is for income earned in tax year 2022, with tax. Web use schedule c (100s) to determine the allowable amount of tax credits to claim on the 2022 form 100s, california s corporation franchise or income tax return, and the. Web for more information on california s corporations, please see form 100s booklet (california s corporation franchise or income tax return booklet). Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Web addresses for forms beginning with the number 7.

Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. It is used to report the. Web ca form 100s, california s corporation franchise or income tax return. Incorporated in california doing business in california registered to. If the real estate was not your main home, report the transaction on form 4797,. Web form 100, 100s, 100w, or 100x estimated tax payment select this payment type when paying estimated tax. Web exchange of your main home on your tax return, see the instructions for schedule d (form 1040). Web get form ftb 4197 for more information. Web use schedule c (100s) to determine the allowable amount of tax credits to claim on the 2022 form 100s, california s corporation franchise or income tax return, and the. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

See the links below for the california ftb form instructions. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board. Web ca form 100s, california s corporation franchise or income tax return. It is used to report the. Estimated tax is generally due and payable in four installments:. Web exchange of your main home on your tax return, see the instructions for schedule d (form 1040). Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

See the links below for the california ftb form instructions. Lifo recapture due to s corporation election, irc sec. It is used to report the. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Scroll down in the left column to the california forms.

Fillable Form 100s California S Corporation Franchise Or Tax

Web for more information on california s corporations, please see form 100s booklet (california s corporation franchise or income tax return booklet). Web ca form 100s, california s corporation franchise or income tax return. Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Scroll down in the left column to the california.

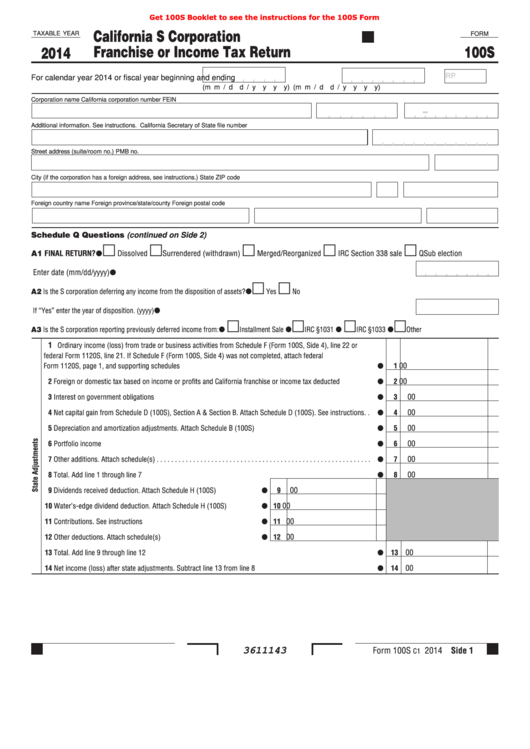

Fillable Form Cbt100sV Corporation Business TaxPayment Voucher

Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board..

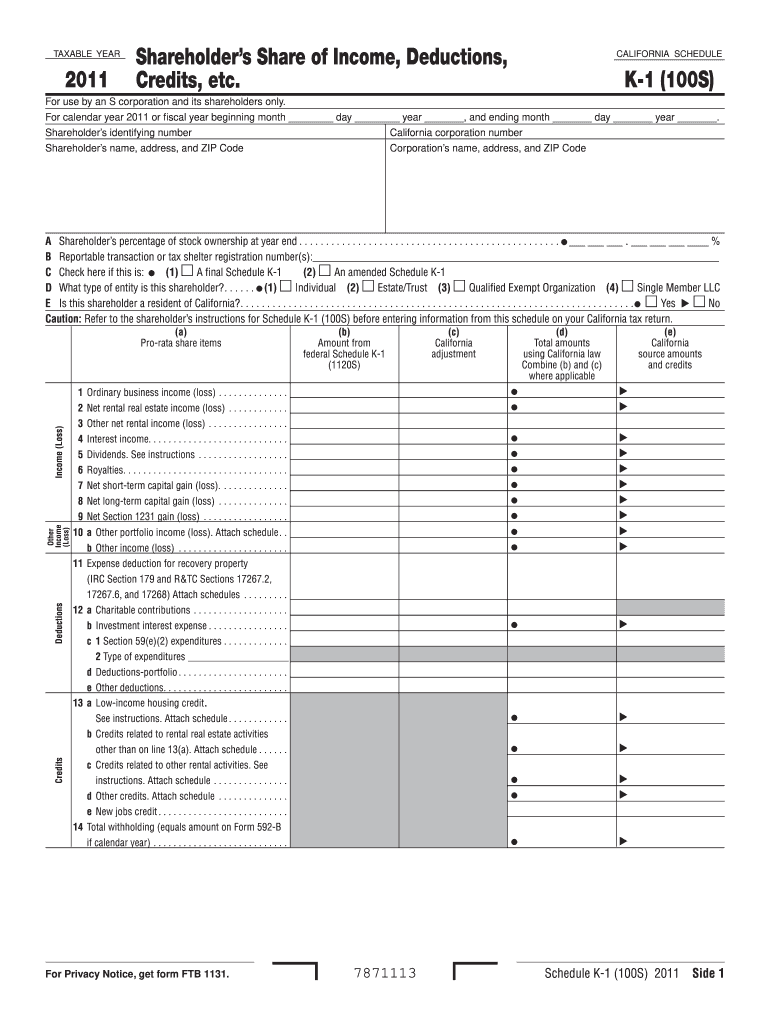

CA FTB 100S Schedule K1 2011 Fill out Tax Template Online US Legal

Web ca form 100s, california s corporation franchise or income tax return. It is used to report the. Web form 100, 100s, 100w, or 100x estimated tax payment select this payment type when paying estimated tax. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Lifo recapture due to s corporation.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

You may also have a filing requirement. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Incorporated in california doing business in california registered to. Web use schedule c (100s) to determine the allowable amount of tax credits to claim on the 2022 form 100s, california s corporation franchise or.

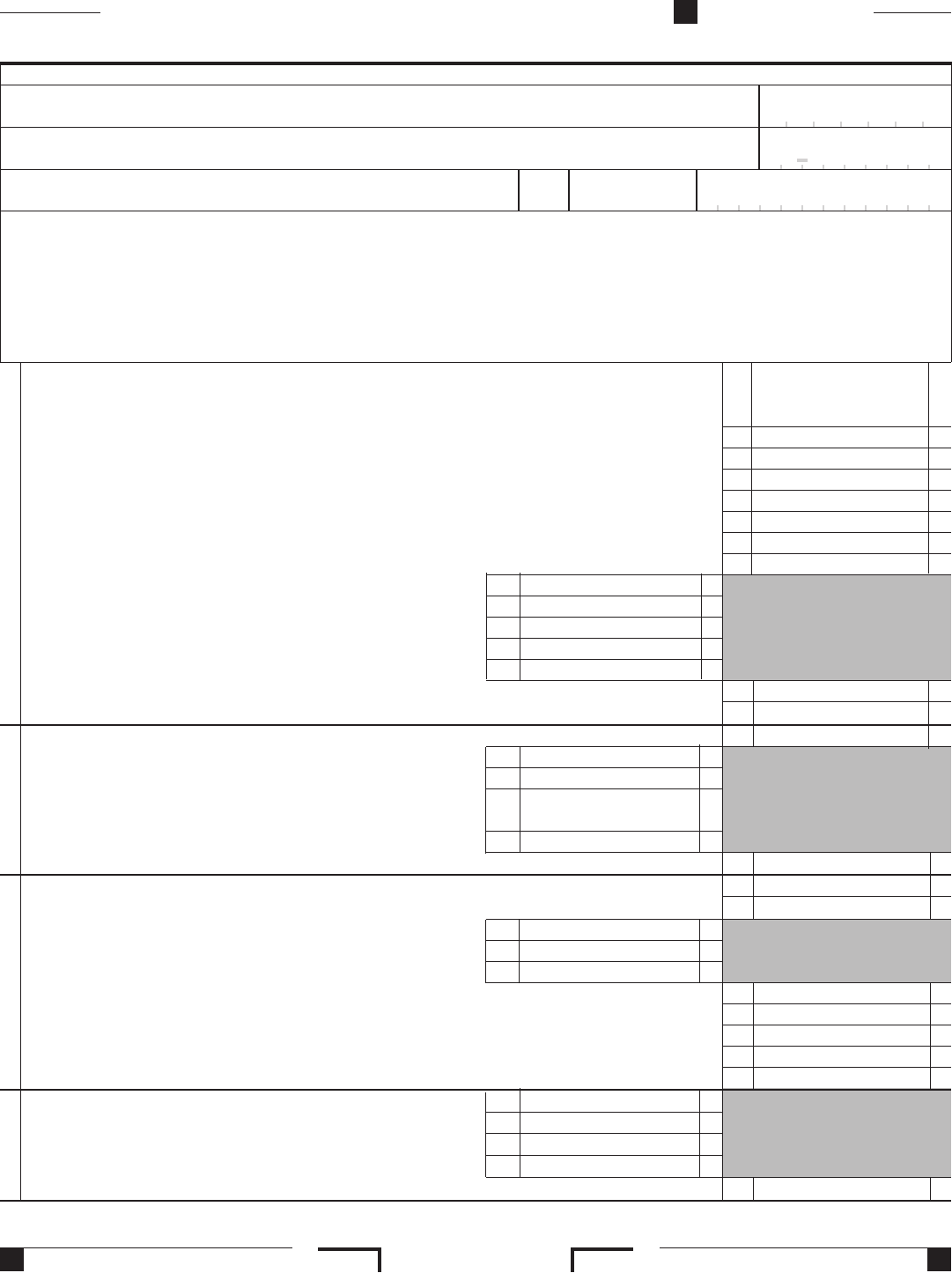

Fillable Form 100 California Corporation Franchise Or Tax

Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web get form ftb 4197 for more information. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Scroll down in the.

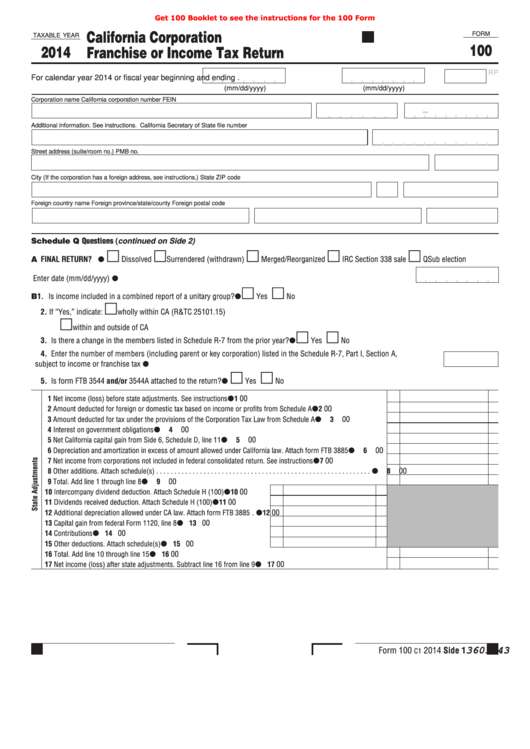

Fillable California Form 100Es Corporation Estimated Tax 2011

It is used to report the. Web use schedule c (100s) to determine the allowable amount of tax credits to claim on the 2022 form 100s, california s corporation franchise or income tax return, and the. Incorporated in california doing business in california registered to. This form is for income earned in tax year 2022, with tax. Web exchange of.

Form 100s California S Corporation Franchise Or Tax Return

See the instructions for form. Web exchange of your main home on your tax return, see the instructions for schedule d (form 1040). Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: This.

The UK as 100 Taxpayers [Infographic] Business 2 Community

It is used to report the. See the instructions for form. Web form 100, 100s, 100w, or 100x estimated tax payment select this payment type when paying estimated tax. Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Web ca form 100s, california s corporation franchise or income tax return.

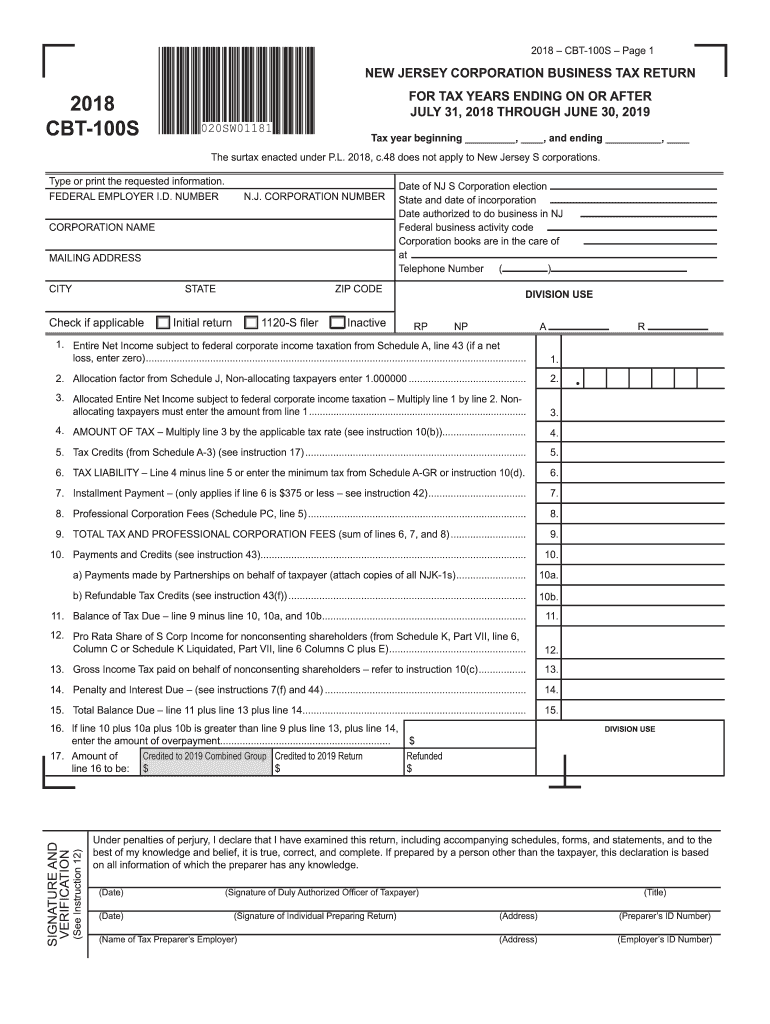

NJ CBT100S 2018 Fill out Tax Template Online US Legal Forms

Web ca form 100s, california s corporation franchise or income tax return. This form is for income earned in tax year 2022, with tax. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. You may also have a filing requirement. Lifo recapture due to s corporation election, irc sec.

Web To Access Available Forms In Turbotax Business, Click On The Forms Icon In The Turbotax Header.

You may also have a filing requirement. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. If the real estate was not your main home, report the transaction on form 4797,. Web get form ftb 4197 for more information.

Web For More Information On California S Corporations, Please See Form 100S Booklet (California S Corporation Franchise Or Income Tax Return Booklet).

Web exchange of your main home on your tax return, see the instructions for schedule d (form 1040). See the instructions for form. Web form 100, 100s, 100w, or 100x estimated tax payment select this payment type when paying estimated tax. See the links below for the california ftb form instructions.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Web use schedule c (100s) to determine the allowable amount of tax credits to claim on the 2022 form 100s, california s corporation franchise or income tax return, and the. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Estimated tax is generally due and payable in four installments:. Scroll down in the left column to the california forms.

Web Ca Form 100S, California S Corporation Franchise Or Income Tax Return.

Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web addresses for forms beginning with the number 7. Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board. Incorporated in california doing business in california registered to.

![The UK as 100 Taxpayers [Infographic] Business 2 Community](https://cdn.business2community.com/wp-content/uploads/2014/01/the-uk-as-a-100-taxpayers.jpg)