Strong Form Efficient Market Hypothesis

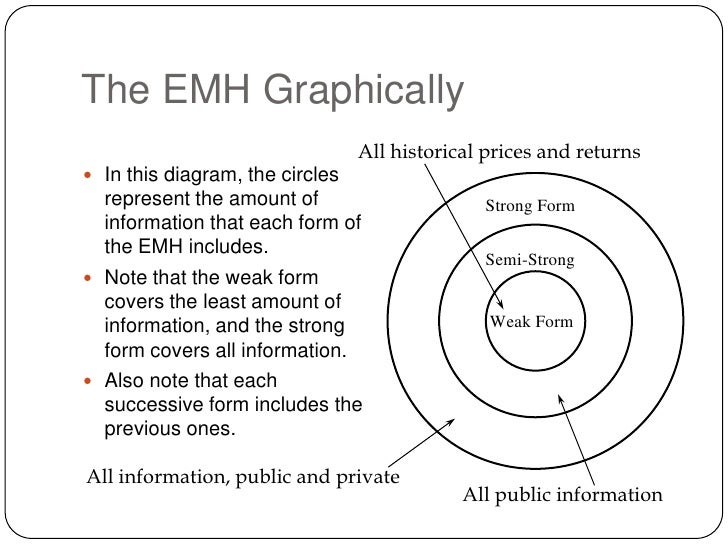

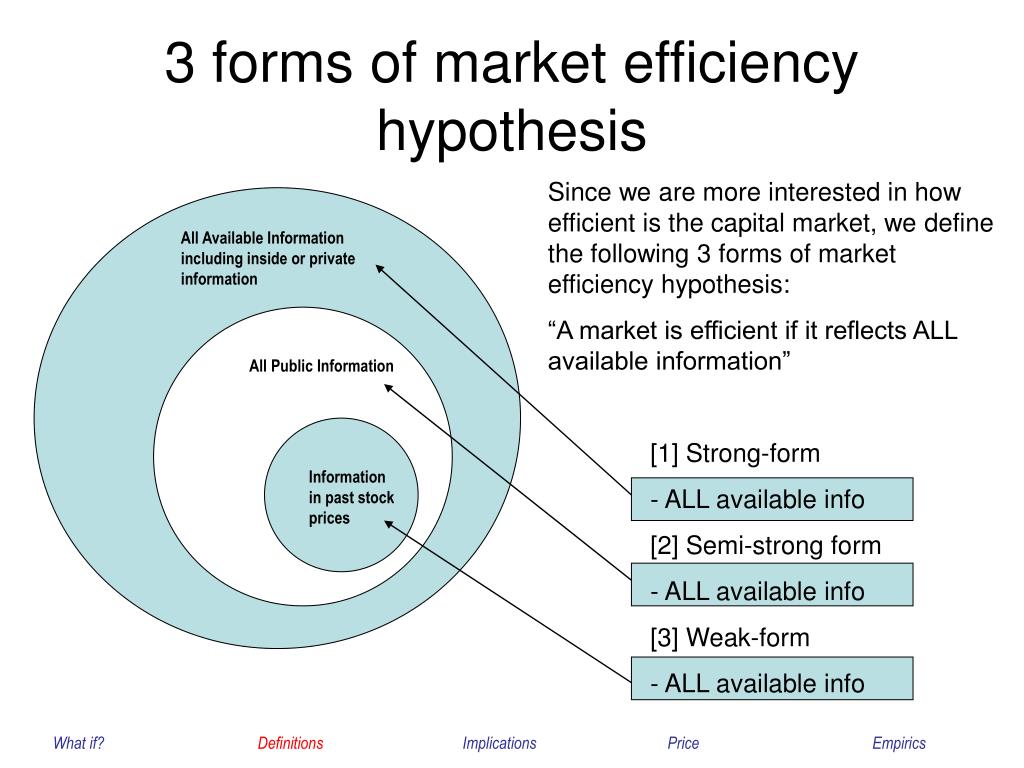

Strong Form Efficient Market Hypothesis - Strong form emh says that all information, both public and private, is priced into stocks; All publicly available information is reflected in the current market prices. Web there are three tenets to the efficient market hypothesis: Eugene fama classified market efficiency into three distinct forms: Recall that the efficient market hypothesis (emh) is the idea that information is quickly and efficiently Here's a little more about each: The weak make the assumption that current stock prices reflect all available. The emh hypothesizes that stocks trade at their fair market value on exchanges. Web strong form efficiency is the most stringent version of the efficient market hypothesis (emh) investment theory, stating that all information in a market, whether public or private, is. Web the efficient market hypothesis (emh) or theory states that share prices reflect all information.

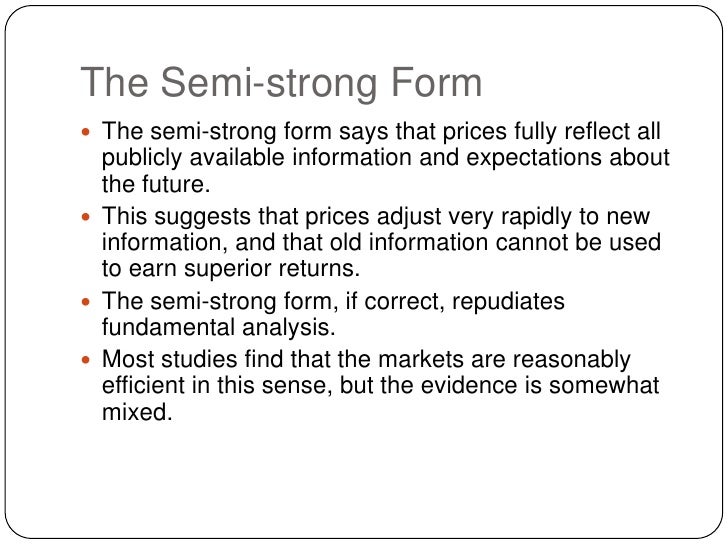

All past information like historical trading prices and volume data is reflected in the market prices. The emh hypothesizes that stocks trade at their fair market value on exchanges. Web the efficient market hypothesis (emh) or theory states that share prices reflect all information. Eugene fama classified market efficiency into three distinct forms: Recall that the efficient market hypothesis (emh) is the idea that information is quickly and efficiently Web strong form emh: All publicly available information is reflected in the current market prices. Web the efficient market hypothesis says that the market exists in three types, or forms: Here's a little more about each: Strong form efficient market hypothesis followers believe that all information, both public and private, is incorporated into a security’s.

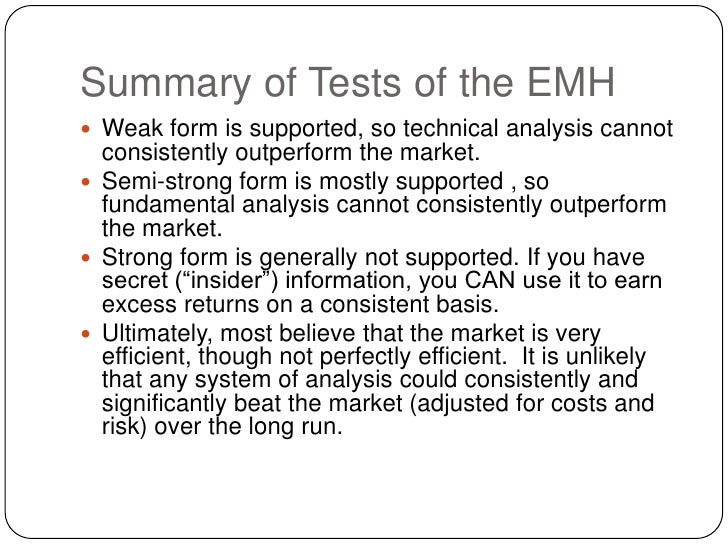

Strong form emh says that all information, both public and private, is priced into stocks; Recall that the efficient market hypothesis (emh) is the idea that information is quickly and efficiently All publicly available information is reflected in the current market prices. Web the efficient market hypothesis says that the market exists in three types, or forms: Web strong form efficiency is the most stringent version of the efficient market hypothesis (emh) investment theory, stating that all information in a market, whether public or private, is. Therefore, no investor can gain advantage over the market as a whole. The weak make the assumption that current stock prices reflect all available. Web there are three tenets to the efficient market hypothesis: The emh hypothesizes that stocks trade at their fair market value on exchanges. All past information like historical trading prices and volume data is reflected in the market prices.

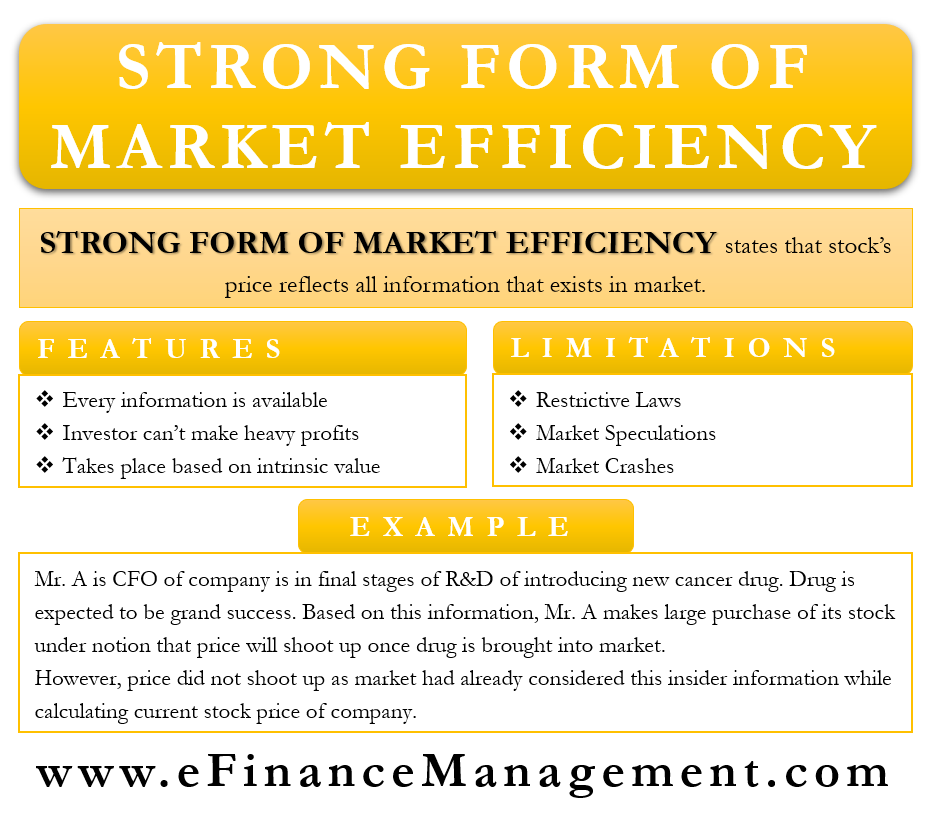

Strong form of market efficiency Meaning, EMH, Limitations, Example

Strong form efficient market hypothesis followers believe that all information, both public and private, is incorporated into a security’s. Web introduction forecasting future price movements and securing high investment returns. Here's a little more about each: Web strong form emh: Recall that the efficient market hypothesis (emh) is the idea that information is quickly and efficiently

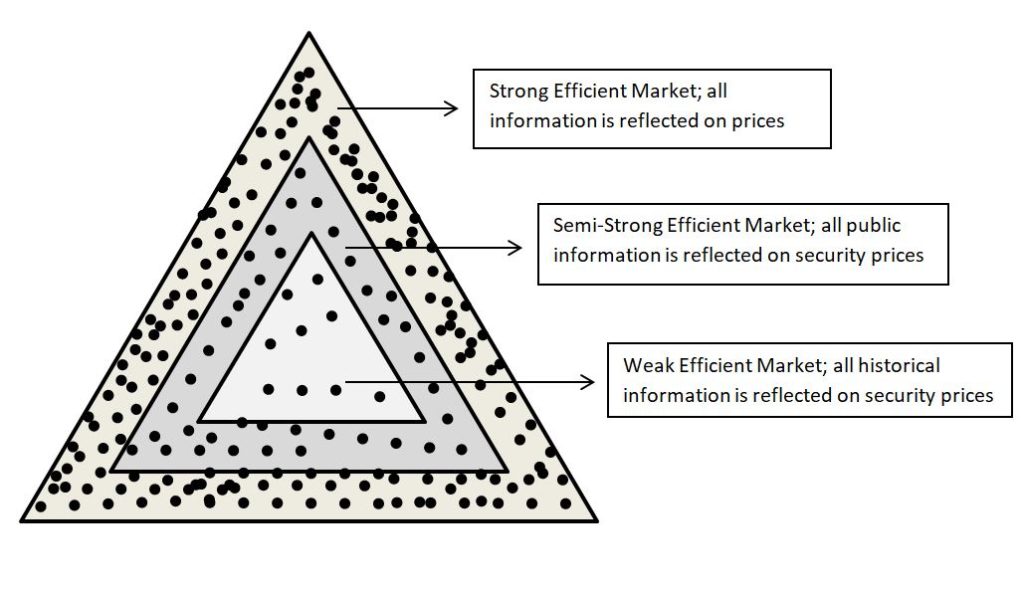

The efficient markets hypothesis EMH ARJANFIELD

Web there are three tenets to the efficient market hypothesis: Web the efficient market hypothesis says that the market exists in three types, or forms: The weak make the assumption that current stock prices reflect all available. Web the efficient market hypothesis (emh) or theory states that share prices reflect all information. Web the strong form version of the efficient.

Efficient Market Theory/Hypothesis EMH Forms, Concepts BBAmantra

The weak make the assumption that current stock prices reflect all available. All publicly available information is reflected in the current market prices. Web the efficient market hypothesis (emh) or theory states that share prices reflect all information. Web strong form emh: Eugene fama classified market efficiency into three distinct forms:

Download Investment Efficiency Theory Gif invenstmen

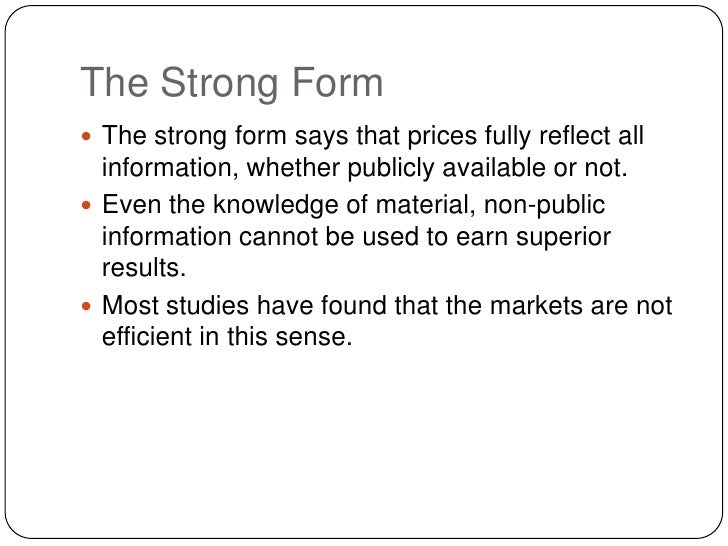

Web the strong form version of the efficient market hypothesis states that all information—both the information available to the public and any information not publicly known—is completely. Strong form emh says that all information, both public and private, is priced into stocks; The weak make the assumption that current stock prices reflect all available. Therefore, no investor can gain advantage.

Efficient market hypothesis

All past information like historical trading prices and volume data is reflected in the market prices. Strong form emh does not say it's impossible to get an abnormally high return. The weak make the assumption that current stock prices reflect all available. Here's a little more about each: Web there are three tenets to the efficient market hypothesis:

Efficient market hypothesis

Eugene fama classified market efficiency into three distinct forms: Web introduction forecasting future price movements and securing high investment returns. All publicly available information is reflected in the current market prices. All past information like historical trading prices and volume data is reflected in the market prices. Therefore, no investor can gain advantage over the market as a whole.

Efficient market hypothesis

Web the strong form of the efficient market hypothesis. Here's a little more about each: The emh hypothesizes that stocks trade at their fair market value on exchanges. Web the efficient market hypothesis (emh) or theory states that share prices reflect all information. All publicly available information is reflected in the current market prices.

Efficient market hypothesis

Strong form emh says that all information, both public and private, is priced into stocks; Eugene fama classified market efficiency into three distinct forms: Web the strong form version of the efficient market hypothesis states that all information—both the information available to the public and any information not publicly known—is completely. Web strong form emh: Web strong form efficiency is.

PPT Efficient Market Hypothesis The concepts PowerPoint Presentation

Web strong form emh: Web there are three tenets to the efficient market hypothesis: Web the efficient market hypothesis says that the market exists in three types, or forms: Web the strong form of the efficient market hypothesis. Recall that the efficient market hypothesis (emh) is the idea that information is quickly and efficiently

Efficient market hypothesis

Eugene fama classified market efficiency into three distinct forms: Strong form emh does not say it's impossible to get an abnormally high return. All publicly available information is reflected in the current market prices. Web the strong form version of the efficient market hypothesis states that all information—both the information available to the public and any information not publicly known—is.

Web Strong Form Emh:

The emh hypothesizes that stocks trade at their fair market value on exchanges. Web the strong form of the efficient market hypothesis. Recall that the efficient market hypothesis (emh) is the idea that information is quickly and efficiently Web the strong form version of the efficient market hypothesis states that all information—both the information available to the public and any information not publicly known—is completely.

Web The Efficient Market Hypothesis (Emh) Or Theory States That Share Prices Reflect All Information.

Web introduction forecasting future price movements and securing high investment returns. Web there are three tenets to the efficient market hypothesis: Eugene fama classified market efficiency into three distinct forms: All past information like historical trading prices and volume data is reflected in the market prices.

Here's A Little More About Each:

Strong form emh says that all information, both public and private, is priced into stocks; Therefore, no investor can gain advantage over the market as a whole. Strong form emh does not say it's impossible to get an abnormally high return. Strong form efficient market hypothesis followers believe that all information, both public and private, is incorporated into a security’s.

The Weak Make The Assumption That Current Stock Prices Reflect All Available.

Web strong form efficiency is the most stringent version of the efficient market hypothesis (emh) investment theory, stating that all information in a market, whether public or private, is. All publicly available information is reflected in the current market prices. Web the efficient market hypothesis says that the market exists in three types, or forms: