Ssa Form 1724

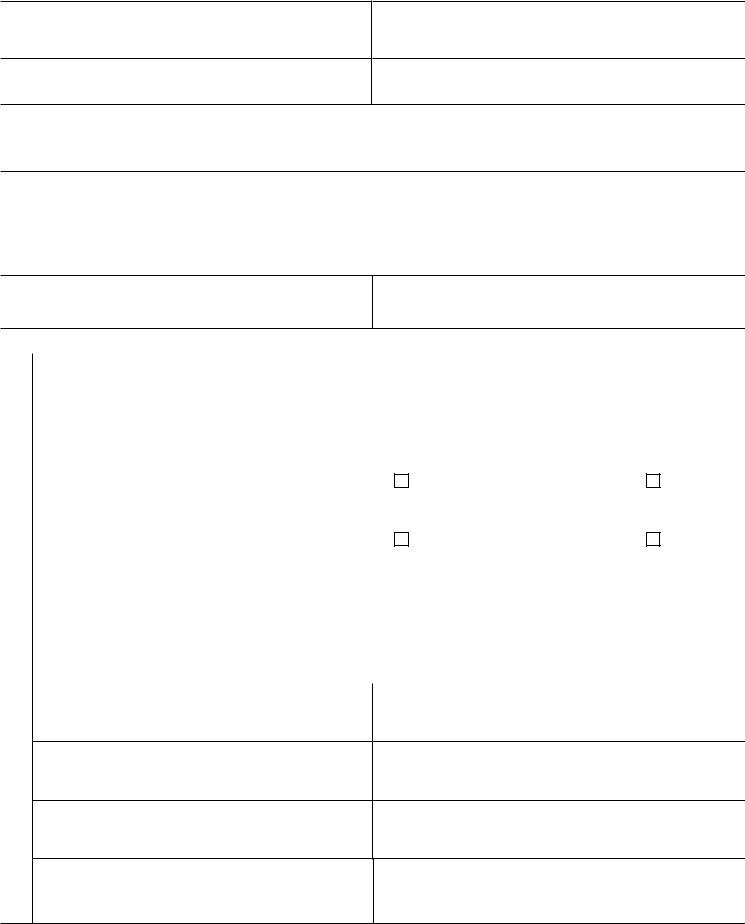

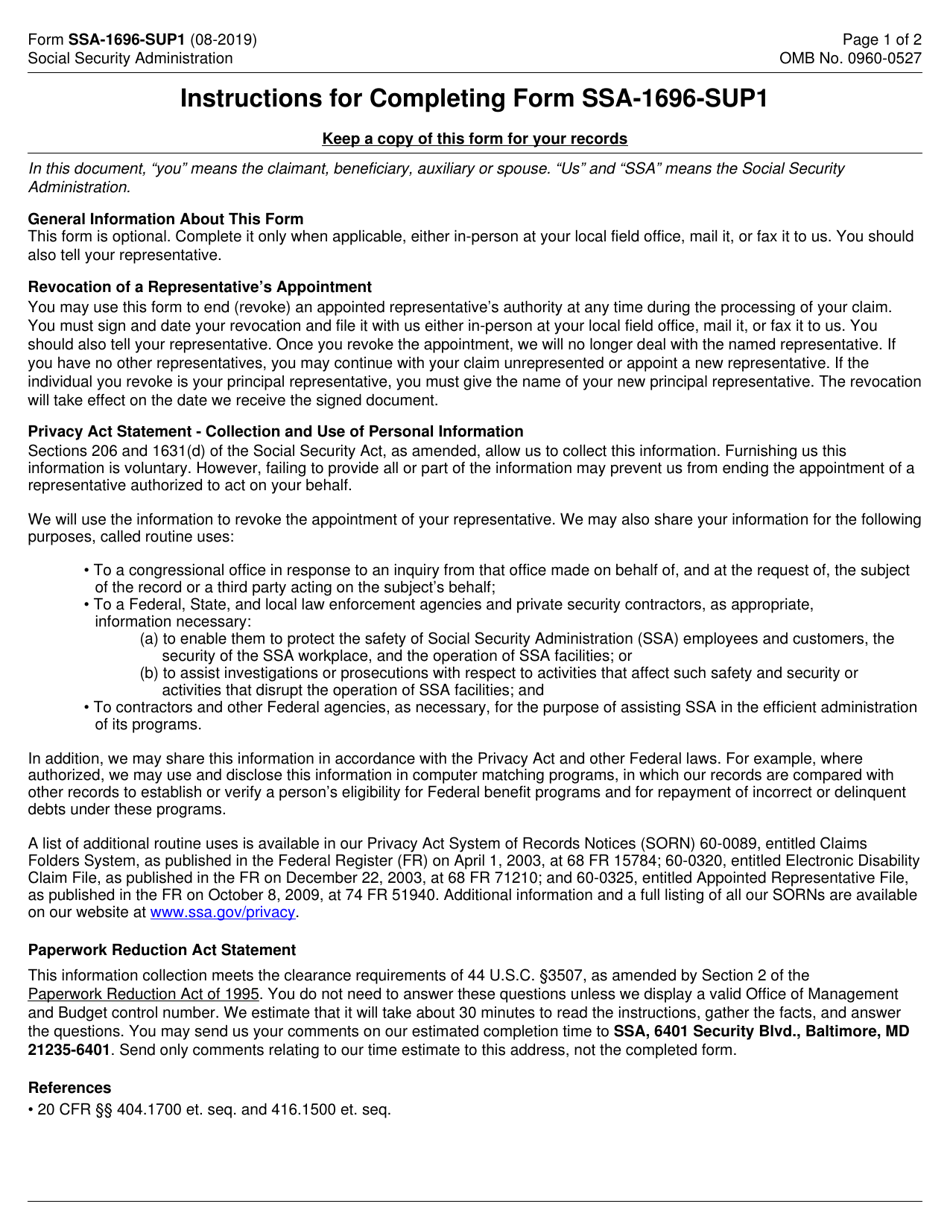

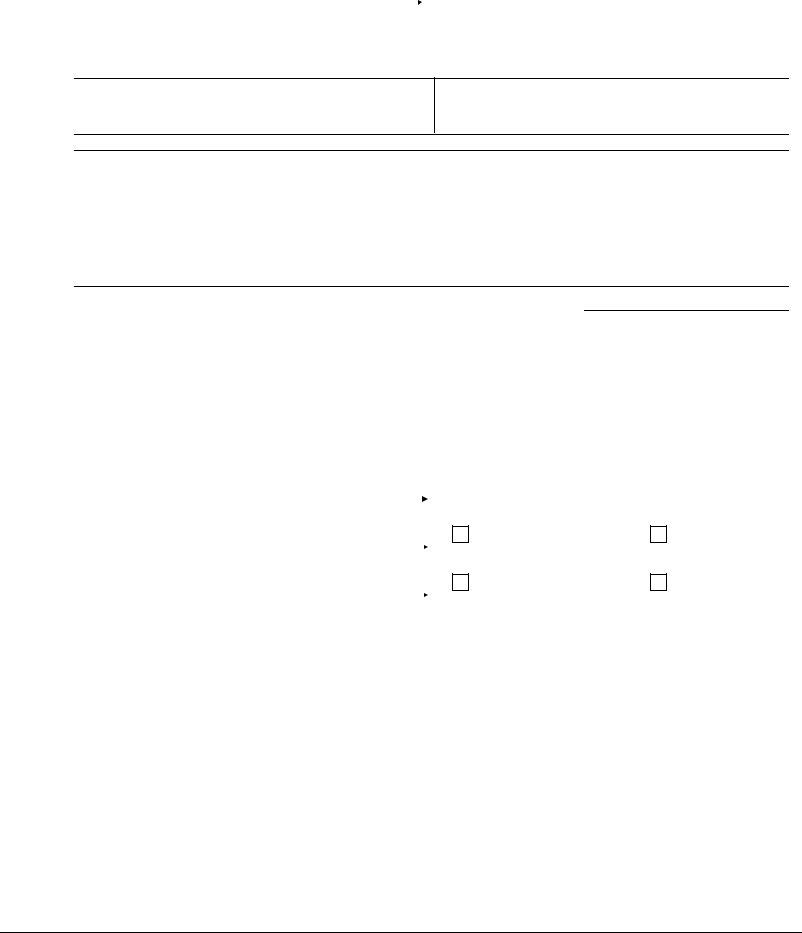

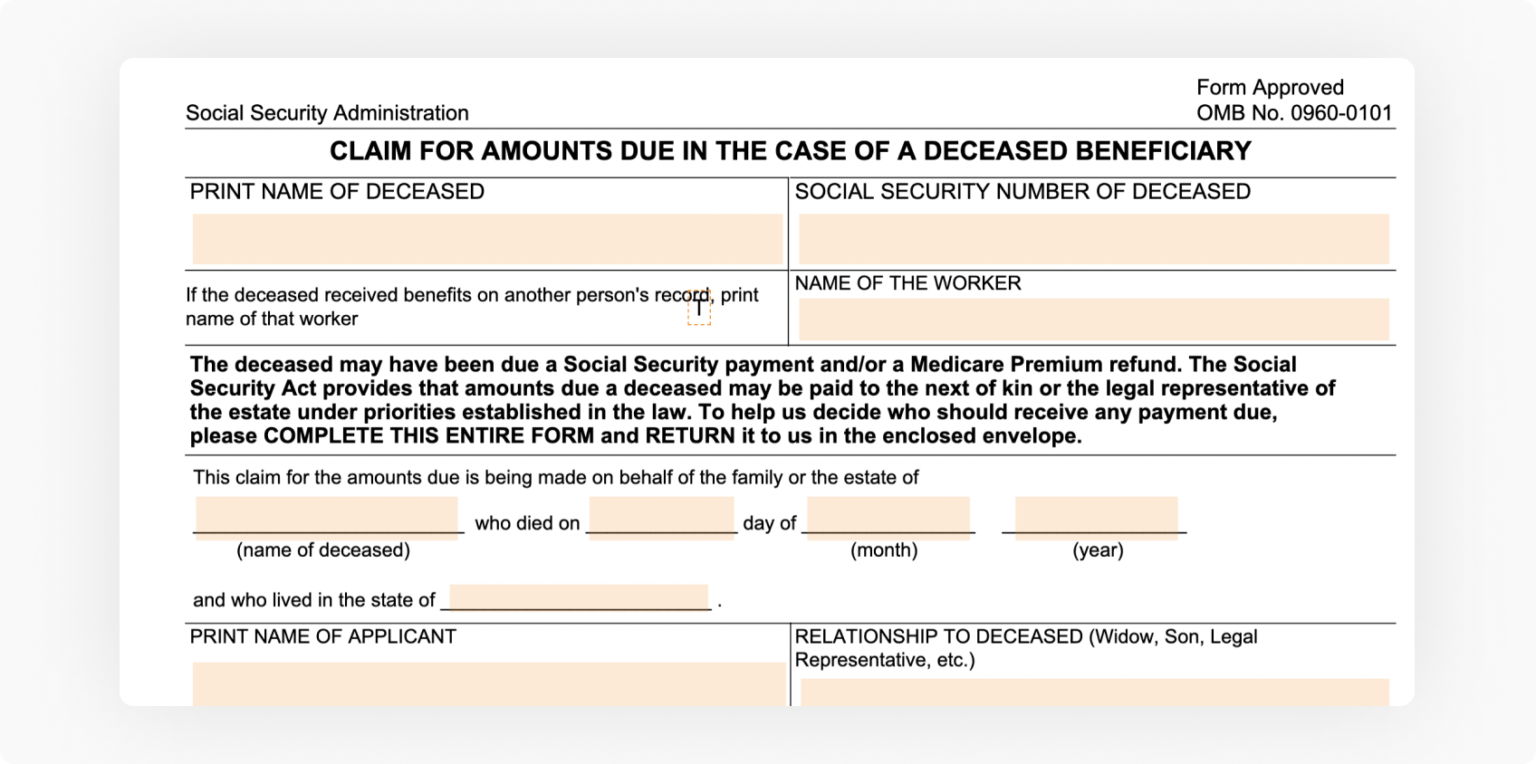

Ssa Form 1724 - Print name of deceased social security number of deceased. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. Generally, it is the individual's legal next of kin who completes this form. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. If the deceased received benefits on another person's record, print. If you download, print and complete a paper form, please mail or take it to your local social security. Not all forms are listed. Claim for amounts due in the case of a deceased beneficiary. Web a deceased beneficiary may have been due a social security payment at the time of death. Claim for amounts due in the case of deceased beneficiary.

Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Claim for amounts due in the case of a deceased beneficiary. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. If you download, print and complete a paper form, please mail or take it to your local social security. If the deceased received benefits on another person's record, print. Print name of deceased social security number of deceased. Web a deceased beneficiary may have been due a social security payment at the time of death. Where to send this form send the completed form to your local social security office. Web all forms are free. Generally, it is the individual's legal next of kin who completes this form.

Generally, it is the individual's legal next of kin who completes this form. Web a deceased beneficiary may have been due a social security payment at the time of death. If you download, print and complete a paper form, please mail or take it to your local social security. If the deceased received benefits on another person's record, print. Where to send this form send the completed form to your local social security office. Claim for amounts due in the case of deceased beneficiary. Web all forms are free. Not all forms are listed. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Print name of deceased social security number of deceased.

Ssa 1724 Form ≡ Fill Out Printable PDF Forms Online

Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. Not all forms are listed. Web a deceased beneficiary may have been due a social security payment at the time of death. Web all forms are.

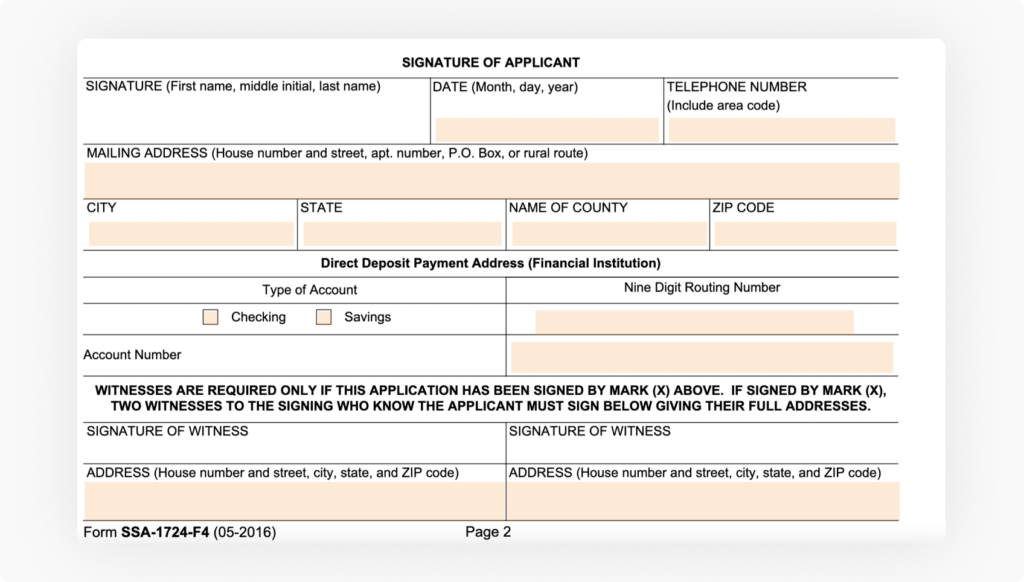

Fillable Form Ssa1724F4 Claim For Amounts Due In The Case Of A

We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Not all forms are listed. Claim for amounts due in the case of a deceased beneficiary. Web all forms are free. Print name of deceased social security number of deceased.

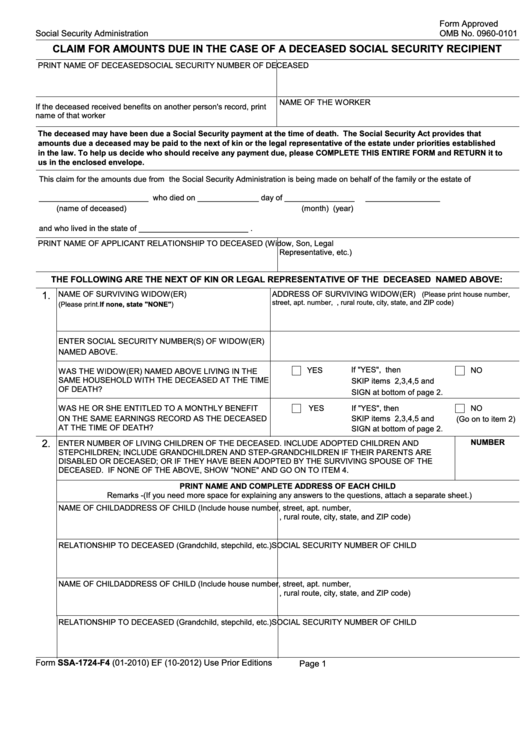

Form SSA1696 Supplement 1 Download Fillable PDF or Fill Online

Generally, it is the individual's legal next of kin who completes this form. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. If you download, print and complete a paper form, please mail or take it to your local social security. Print name of.

Form Ssa 1724 ≡ Fill Out Printable PDF Forms Online

Web a deceased beneficiary may have been due a social security payment at the time of death. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Not all forms are listed. Web form ssa 1724, claim for amounts due in the case of a.

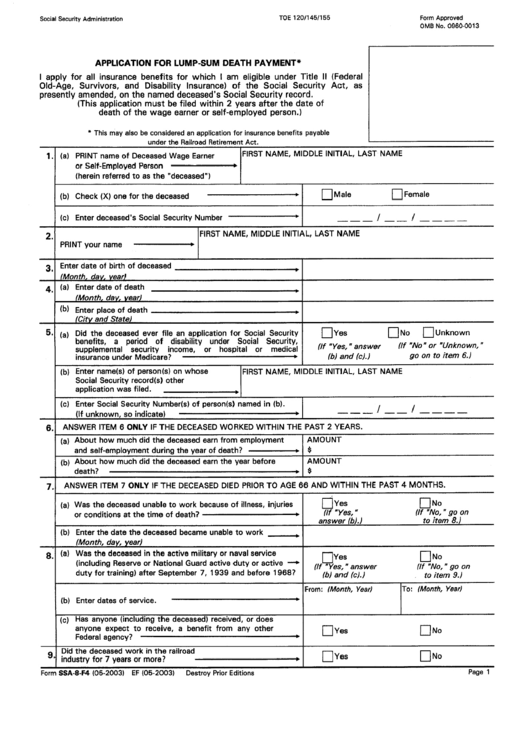

Form Ssa8F4 Application For LumpSum Death Payment printable pdf

Not all forms are listed. Claim for amounts due in the case of a deceased beneficiary. Web a deceased beneficiary may have been due a social security payment at the time of death. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Claim for amounts due in the case of deceased.

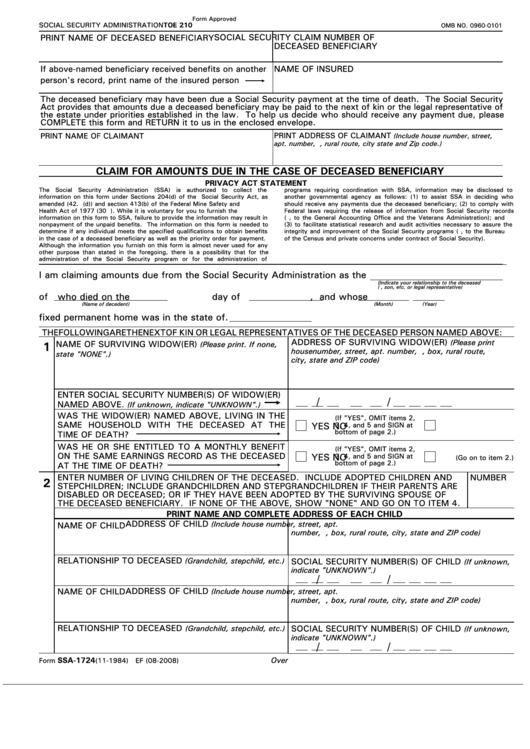

SSA1724F4 Claim for Amounts due in case of a Deceased Beneficiary

Where to send this form send the completed form to your local social security office. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. If you download, print and complete a paper form, please mail.

how do i complete form ssa 1724 2010 Fill out & sign online DocHub

Claim for amounts due in the case of deceased beneficiary. Not all forms are listed. Where to send this form send the completed form to your local social security office. Claim for amounts due in the case of a deceased beneficiary. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used.

Form SSA1724F4 Instructions to Follow pdfFiller Blog

If the deceased received benefits on another person's record, print. Print name of deceased social security number of deceased. Claim for amounts due in the case of deceased beneficiary. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Web a deceased beneficiary may have.

Form SSA1724F4 Instructions to Follow pdfFiller Blog

Where to send this form send the completed form to your local social security office. Generally, it is the individual's legal next of kin who completes this form. If the deceased received benefits on another person's record, print. Claim for amounts due in the case of deceased beneficiary. Web a deceased beneficiary may have been due a social security payment.

Form Ssa1724 Claim For Amounts Due In The Case Of Deceased

Not all forms are listed. Generally, it is the individual's legal next of kin who completes this form. Web all forms are free. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. If you download, print and complete a paper form, please mail or take it to your local social security.

If The Deceased Received Benefits On Another Person's Record, Print.

Generally, it is the individual's legal next of kin who completes this form. Print name of deceased social security number of deceased. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Where to send this form send the completed form to your local social security office.

Keep In Mind Social Security Payments Are For The Previous Month's Benefit And Are Paid Only If The Recipient Is Alive For The Full Month.

Claim for amounts due in the case of a deceased beneficiary. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. Not all forms are listed. Web all forms are free.

Web A Deceased Beneficiary May Have Been Due A Social Security Payment At The Time Of Death.

Claim for amounts due in the case of deceased beneficiary. If you download, print and complete a paper form, please mail or take it to your local social security.