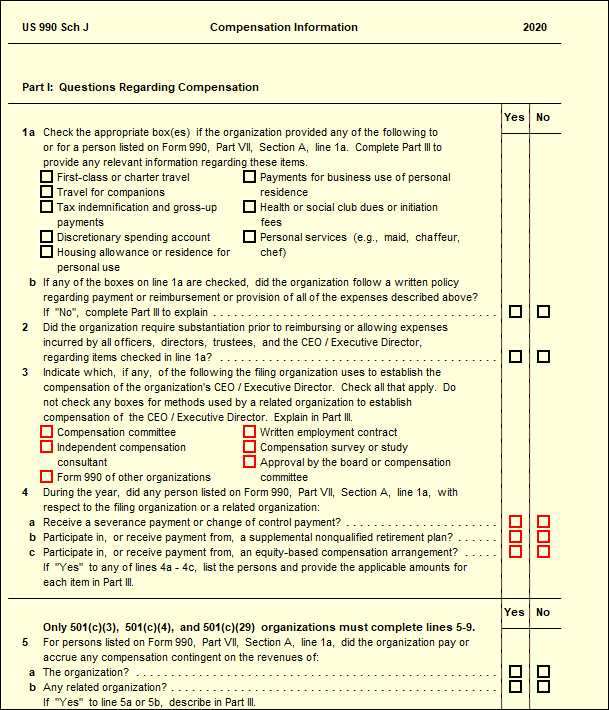

Schedule J Form 990 Instructions

Schedule J Form 990 Instructions - Web understanding the form 990, schedule j, for executive compensation analysis by cathy benfer, manager of workforce solutions on june 21, 2022 the. Schedule j (form 990) 2020 teea4101l 09/25/20 uc santa cruz alumni association 23. What is the purpose of schedule j? It appears you don't have a pdf plugin for this browser. Web follow the simple instructions below: Web schedule j (form 990) 2021 page 2 part ii officers, directors, trustees, key employees, and highest compensated employees. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. Web exempt organization annual reporting requirements: How to complete schedule j? Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to.

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Are all organizations that list individuals in form 990, part vii also required. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web follow the simple instructions below: (column (b) must equal form 990, part x, col. How to complete schedule j? For each individual whose compensation must be reported. If people aren?t connected to document managing and law procedures, completing irs forms can be extremely hard. Schedule j (form 990) 2020 teea4101l 09/25/20 uc santa cruz alumni association 23. Web a public disclosure copy of the acs 2019 form 990, return of organization exempt from income tax, is available on the acs public website, with compensation information.

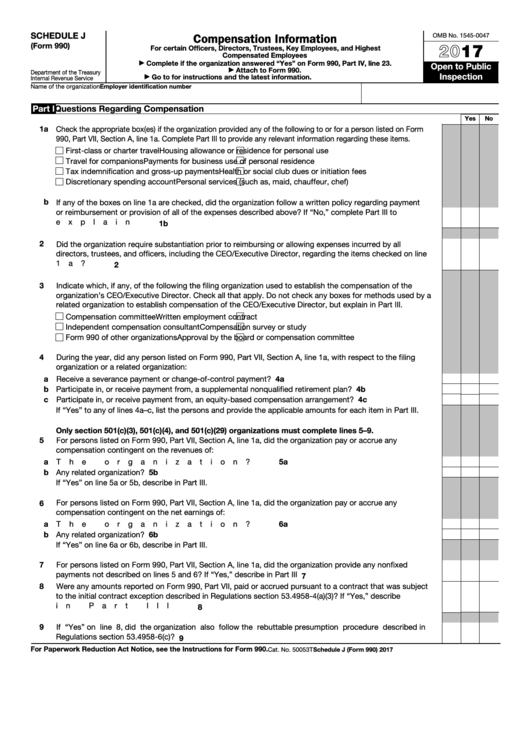

Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. For each individual whose compensation must. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. How to complete schedule j? Web schedule j, “compensation information for certain officers, directors, trustees, key employees, and highest compensated employees.” in each instance,. For each individual whose compensation must be reported. If people aren?t connected to document managing and law procedures, completing irs forms can be extremely hard. Web form 990 schedules with instructions. (column (b) must equal form 990, part x, col. What are internet society’s legal responsibilities for posting the form 990?

Fillable Schedule J (Form 990) Compensation Information 2017

For each individual whose compensation must. Web follow the simple instructions below: Web instructions for form 990, return of organization exempt from income tax. Web form 990 schedules with instructions. Web a public disclosure copy of the acs 2019 form 990, return of organization exempt from income tax, is available on the acs public website, with compensation information.

Fill Free fillable Compensation Information Schdul J Form 990 PDF form

If people aren?t connected to document managing and law procedures, completing irs forms can be extremely hard. Web understanding the form 990, schedule j, for executive compensation analysis by cathy benfer, manager of workforce solutions on june 21, 2022 the. It appears you don't have a pdf plugin for this browser. Purpose of schedule schedule j (form 990) is used.

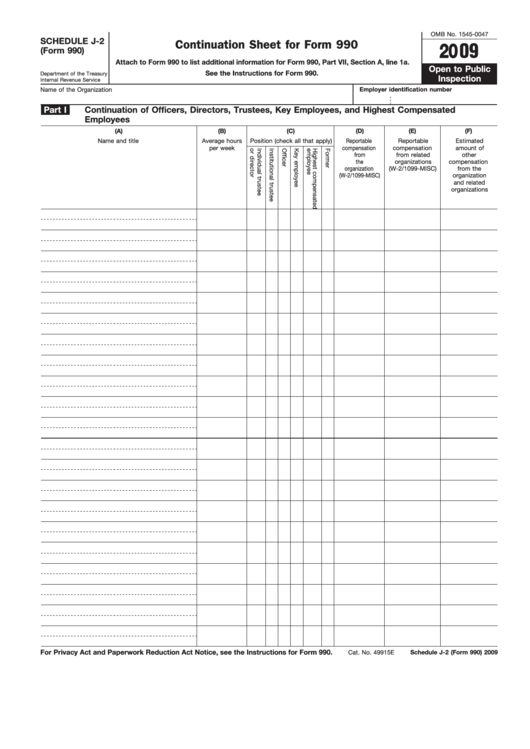

Fillable Schedule J2 (Form 990) Continuation Sheet For Form 990

Web schedule j (form 990) 2021 page 2 part ii officers, directors, trustees, key employees, and highest compensated employees. Extracted financial data is not available for this tax period, but form 990. Choose tax990 to file your form 990 with schedule j what is the. How to complete schedule j? Who must file schedule j?

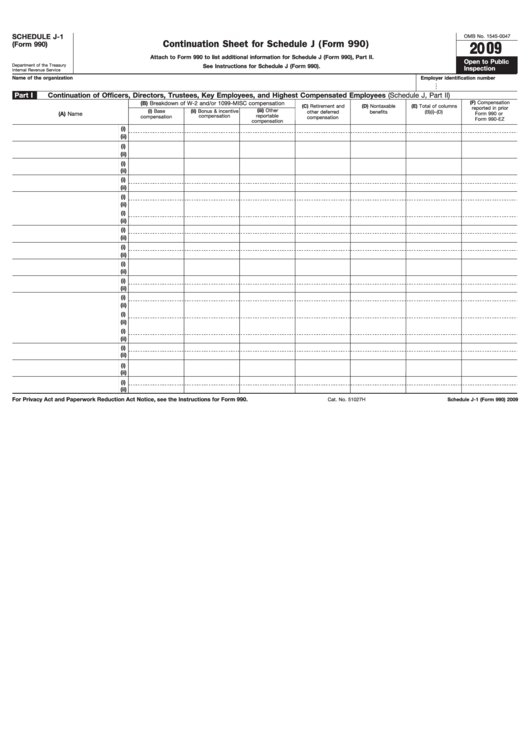

Fillable Schedule J1 (Form 990) Continuation Sheet For Schedule J

What is the difference between the public inspection copy and the copy of. Web exempt organization annual reporting requirements: Web baa for paperwork reduction act notice, see the instructions for form 990. What is a form 990? Are all organizations that list individuals in form 990, part vii also required.

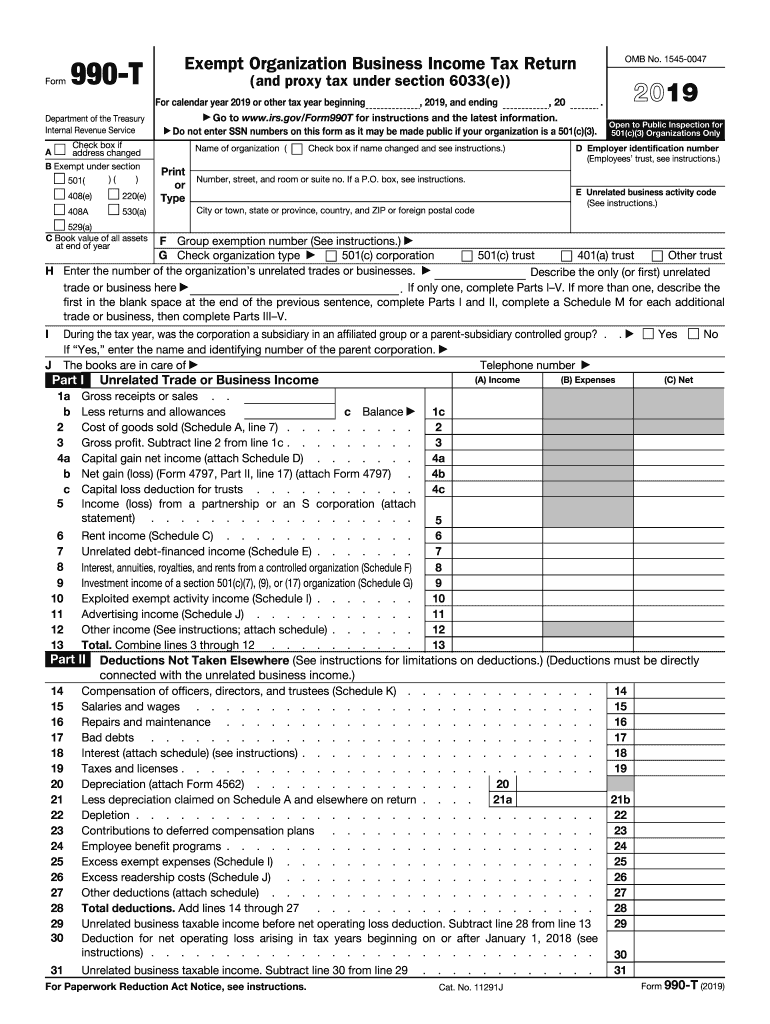

990 T Fill Out and Sign Printable PDF Template signNow

Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. Web instructions for form 990, return of organization exempt from income tax. (column (b) must equal form 990, part x, col. Web a public disclosure copy of the acs 2019 form.

Form 990 Schedule J Instructions

If people aren?t connected to document managing and law procedures, completing irs forms can be extremely hard. Web baa for paperwork reduction act notice, see the instructions for form 990. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. Are all organizations that list individuals in form.

Schedule J (990) Compensation Information UltimateTax Solution Center

Web a public disclosure copy of the acs 2019 form 990, return of organization exempt from income tax, is available on the acs public website, with compensation information. Complete, edit or print tax forms instantly. Web baa for paperwork reduction act notice, see the instructions for form 990. The following schedules to form 990, return of organization exempt from income.

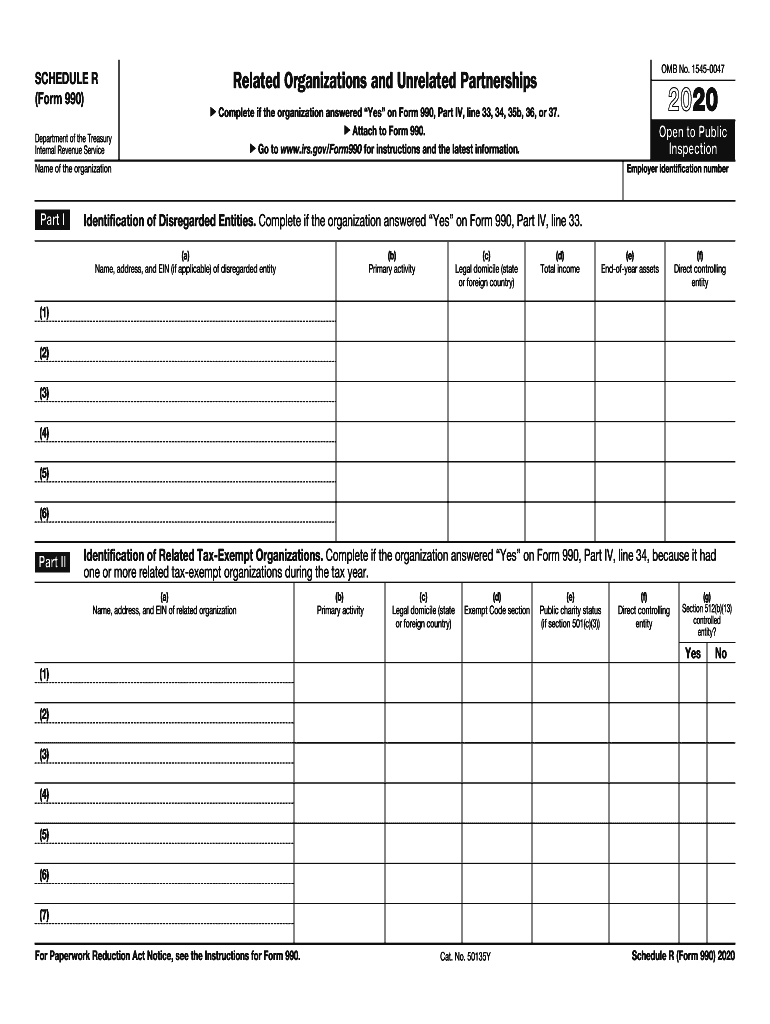

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. It appears you don't have a pdf plugin for this browser. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web schedule j (form 990) 2021 schedule j (form 990) 2021.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Web a public disclosure copy of the acs 2019 form 990, return of organization exempt from income tax, is available on the acs public website, with compensation information. What is the purpose of schedule j? (column (b) must equal form 990, part x, col. What are internet society’s legal responsibilities for posting the form 990? Web schedule d (form 990).

2022 form 990 Schedule J Instructions Fill online, Printable

Web exempt organization annual reporting requirements: Filing requirements for schedule j, form 990. For each individual whose compensation must be reported. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations.

What Is The Purpose Of Schedule J?

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web baa for paperwork reduction act notice, see the instructions for form 990. For each individual whose compensation must be reported. How to complete schedule j?

Web Exempt Organization Annual Reporting Requirements:

Schedule j (form 990) 2020 teea4101l 09/25/20 uc santa cruz alumni association 23. Web form 990 schedules with instructions. What is the difference between the public inspection copy and the copy of. Filing requirements for schedule j, form 990.

Web A Public Disclosure Copy Of The Acs 2019 Form 990, Return Of Organization Exempt From Income Tax, Is Available On The Acs Public Website, With Compensation Information.

Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. Who must file schedule j? The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Choose Tax990 To File Your Form 990 With Schedule J What Is The.

Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. It appears you don't have a pdf plugin for this browser. Web understanding the form 990, schedule j, for executive compensation analysis by cathy benfer, manager of workforce solutions on june 21, 2022 the. What is a form 990?