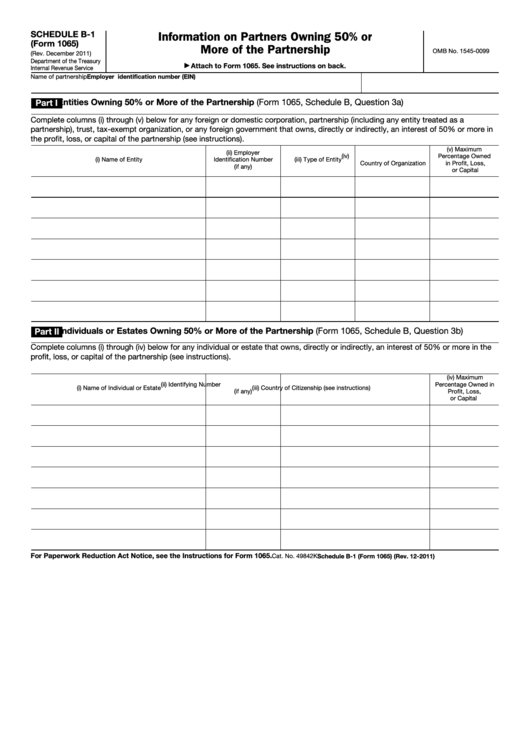

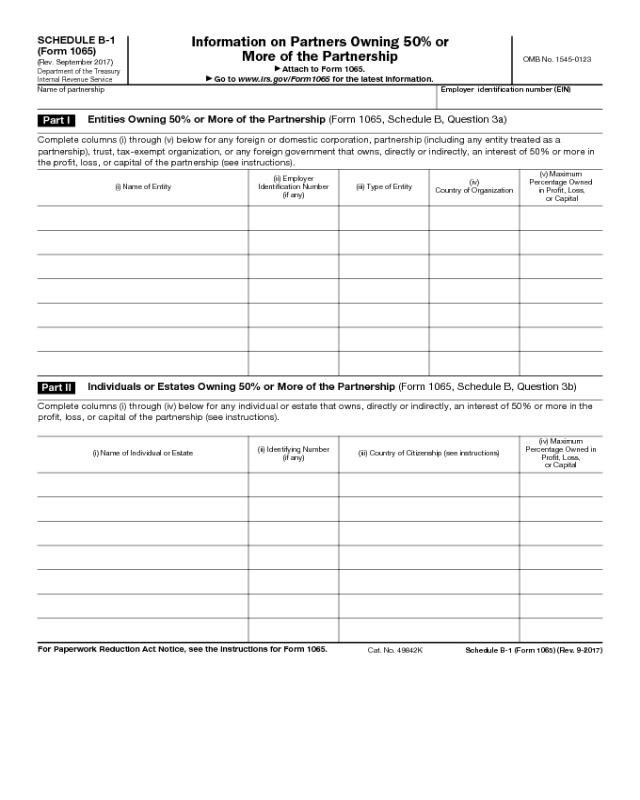

Schedule B-1 Form 1065

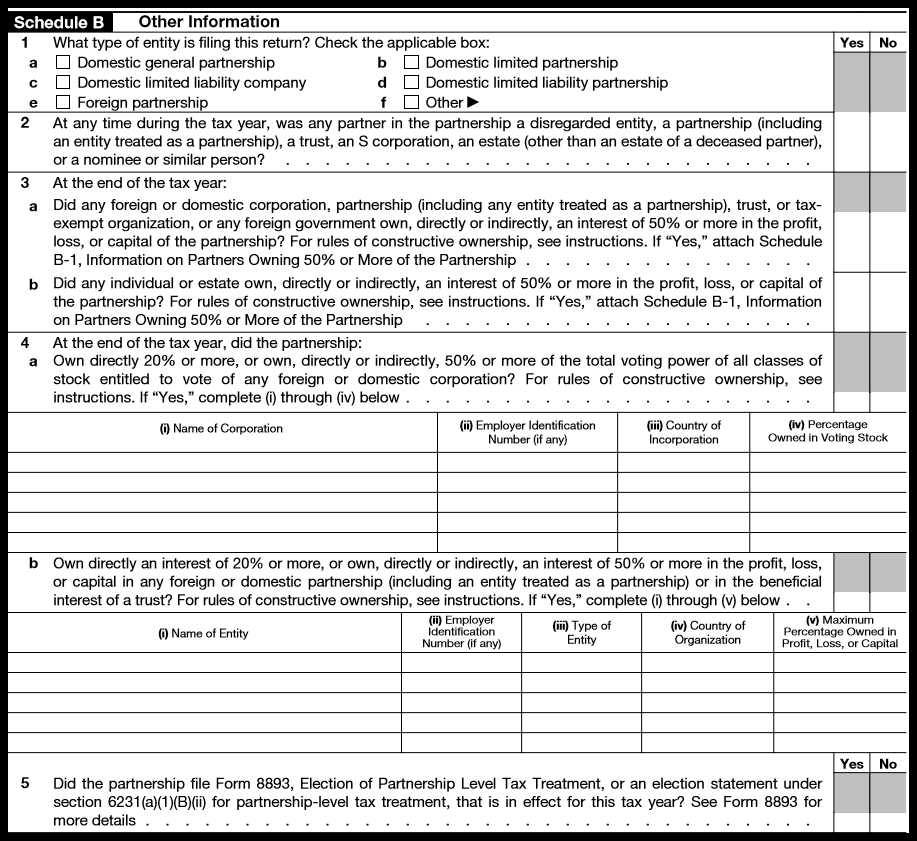

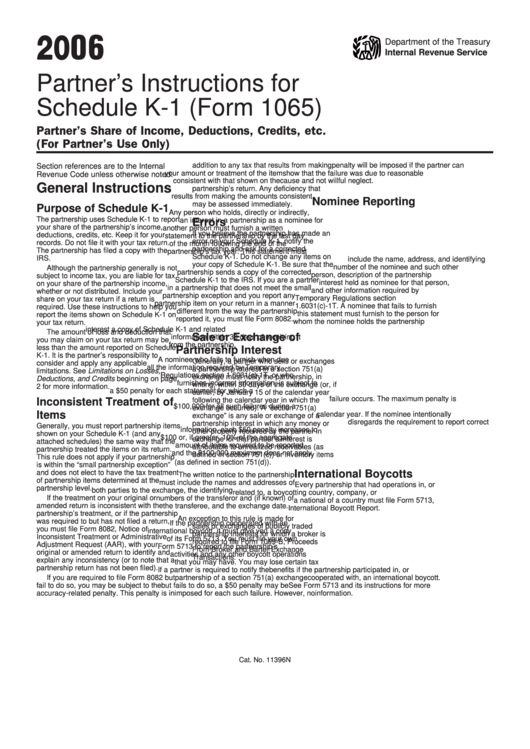

Schedule B-1 Form 1065 - Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions. Solved•by intuit•7•updated august 05, 2022. Web form 1065, u.s. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. However, you don’t need to attach a schedule b every year you earn interest. Web to select your partnership entity type within taxact ® 1065: Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Return of partnership income, schedule b instructions to form 1065, u.s. Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries. Web schedule b reports the interest and dividend income you receive during the tax year.

Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). From within your taxact return ( online or desktop), click federal. Web schedule b reports the interest and dividend income you receive during the tax year. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income, schedule b instructions to form 1065,. This code will let you know if you should. Total assets (see instructions) $ g. Solved•by intuit•7•updated august 05, 2022. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Return of partnership income, schedule b instructions to form 1065, u.s.

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. However, you don’t need to attach a schedule b every year you earn interest. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The greater of the profit, loss, or capital percentage at the end of. Solved•by intuit•7•updated august 05, 2022. Web to select your partnership entity type within taxact ® 1065: Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries. Web form 1065, u.s. Web schedule b reports the interest and dividend income you receive during the tax year.

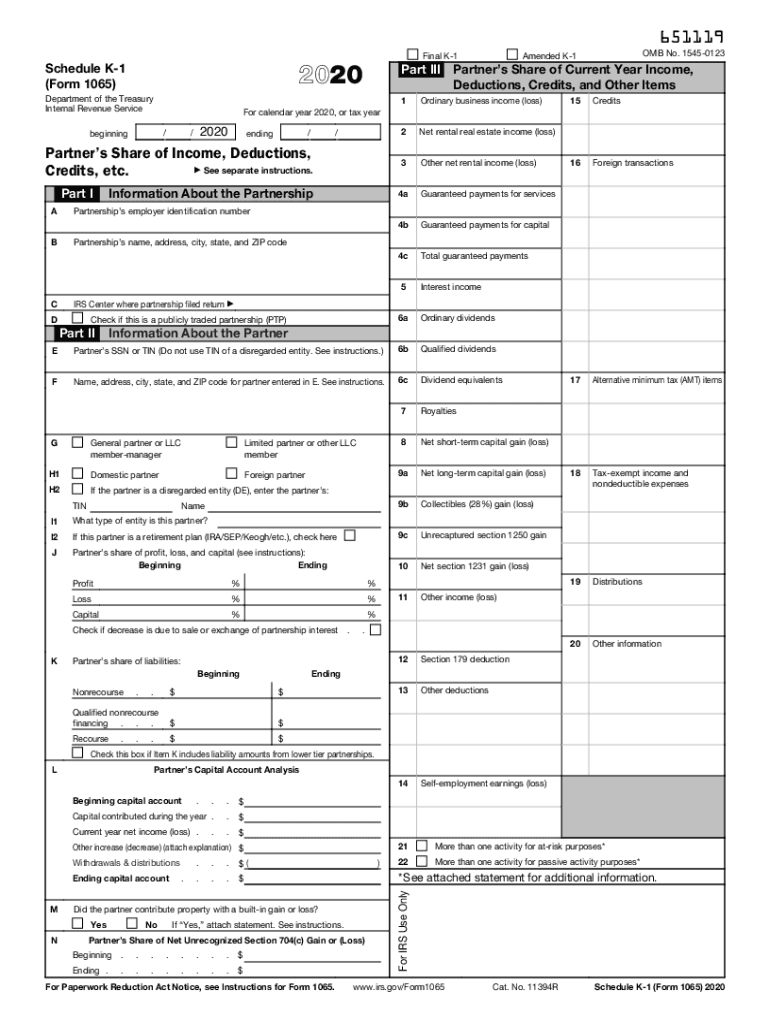

IRS 1065 Schedule K1 2020 Fill out Tax Template Online US Legal

The greater of the profit, loss, or capital percentage at the end of. From within your taxact return ( online or desktop), click federal. Total assets (see instructions) $ g. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Solved•by intuit•7•updated august 05, 2022.

How to fill out an LLC 1065 IRS Tax form

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web a 1065 form is the annual us tax return filed by partnerships. However, you don’t need to attach a schedule b every year you.

Form 1065 Schedule B1 Edit, Fill, Sign Online Handypdf

The new audit regime applies to all partnerships. The greater of the profit, loss, or capital percentage at the end of. From within your taxact return ( online or desktop), click federal. This code will let you know if you should. Web a 1065 form is the annual us tax return filed by partnerships.

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Total assets (see instructions) $ g. Web schedule b reports the interest and dividend income you receive during the tax year. Web to select your partnership entity type within taxact ® 1065: Return of partnership income, schedule b instructions to form 1065,. The new audit regime applies to all partnerships.

How to fill out an LLC 1065 IRS Tax form

This code will let you know if you should. The new audit regime applies to all partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. However, you don’t need to attach a schedule b every year you earn.

Fillable Schedule B1 (Form 1065) Information On Partners Owning 50

Return of partnership income, schedule b instructions to form 1065, u.s. From within your taxact return ( online or desktop), click federal. Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries. It is used to report the partnership’s.

How To Complete Form 1065 US Return of Partnership

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. This code will let you know if you should. However, you don’t need to attach a schedule b every year you earn interest. The greater of the profit, loss, or capital percentage at the end of. Web intuit help intuit input for schedule b, form 1065.

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Return of partnership income, schedule b instructions to form 1065,. The new audit regime applies to all partnerships. The greater of the profit, loss, or capital percentage at the end of. Web schedule b reports the interest and dividend income you receive during the tax year. From within your taxact return ( online or desktop), click federal.

How to fill out a 1065 tax form hohpaken

Web schedule b reports the interest and dividend income you receive during the tax year. This code will let you know if you should. However, you don’t need to attach a schedule b every year you earn interest. The new audit regime applies to all partnerships. Solved•by intuit•7•updated august 05, 2022.

Publication 541 Partnerships; Form 1065 Example

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web form 1065, u.s. Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries. Web schedule b reports the interest and dividend income you receive.

Web Intuit Help Intuit Input For Schedule B, Form 1065 In Lacerte Solved • By Intuit • 13 • Updated 1 Year Ago Lacerte Will Automatically Complete Many Of The Entries.

Solved•by intuit•7•updated august 05, 2022. Web schedule b reports the interest and dividend income you receive during the tax year. Return of partnership income, schedule b instructions to form 1065,. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions.

Return Of Partnership Income, Schedule B Instructions To Form 1065, U.s.

Total assets (see instructions) $ g. From within your taxact return ( online or desktop), click federal. However, you don’t need to attach a schedule b every year you earn interest. The new audit regime applies to all partnerships.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

Web a 1065 form is the annual us tax return filed by partnerships. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web to select your partnership entity type within taxact ® 1065: Web form 1065, u.s.

The Greater Of The Profit, Loss, Or Capital Percentage At The End Of.

Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. This code will let you know if you should.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/word-image-743.png)