Schedule 1 Form 2290 Instructions

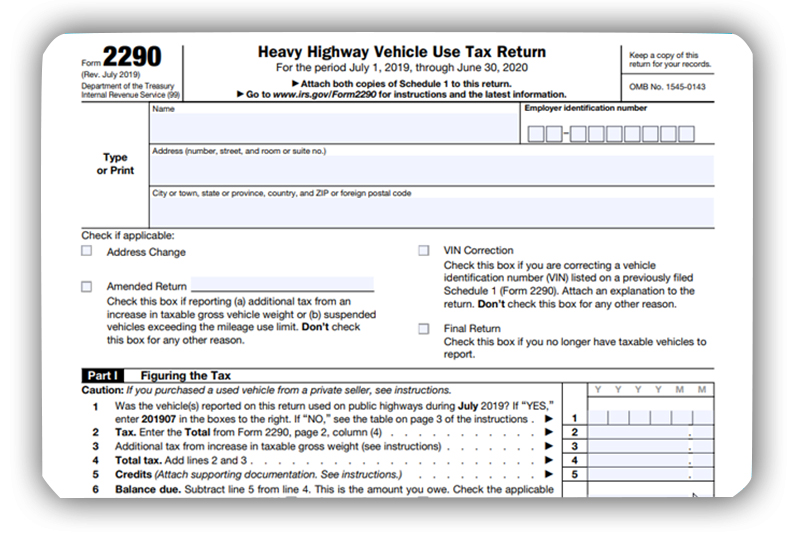

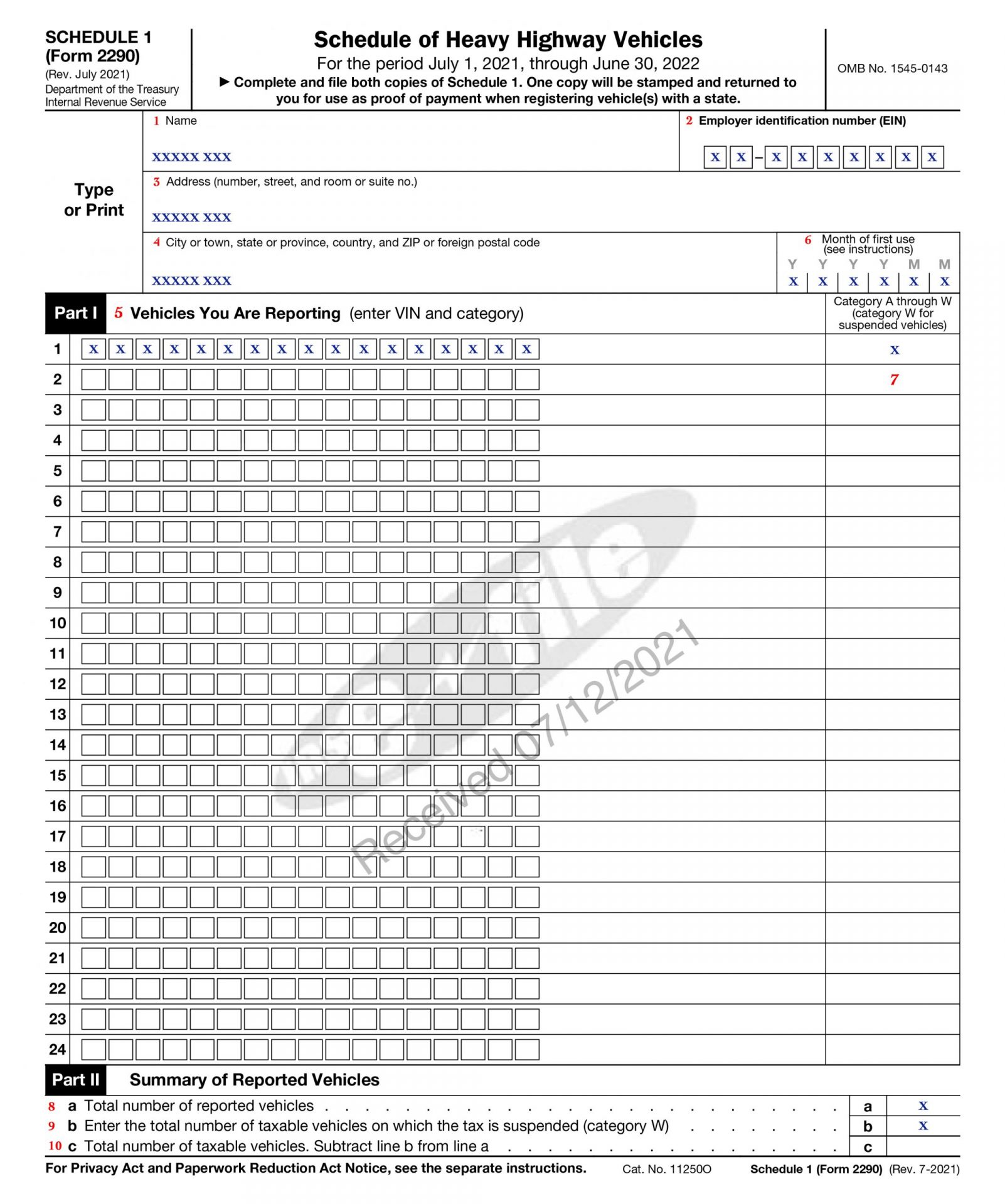

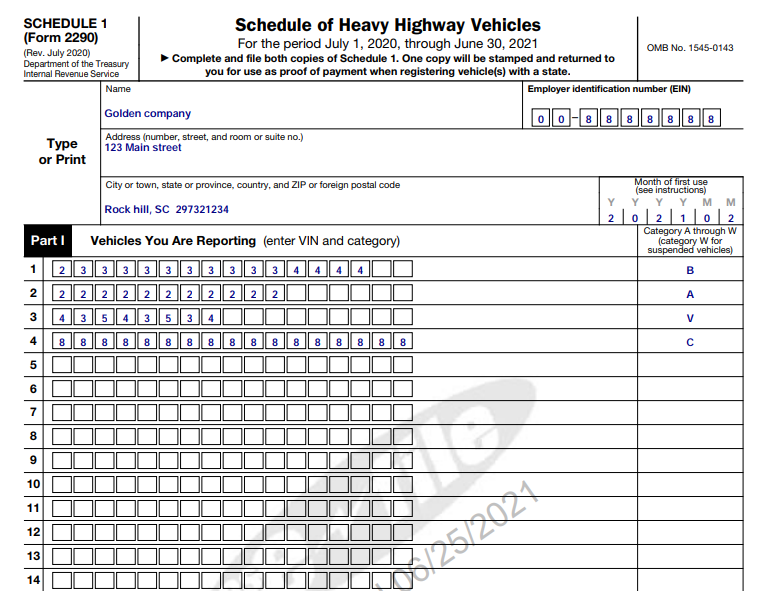

Schedule 1 Form 2290 Instructions - Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return. Web schedule 1 (form 2290)—month of first use. Easy, fast, secure & free to try. File your 2290 online & get schedule 1 in minutes. Provide consent to tax information disclosure as part of schedule 1. To renew your vehicle registration. Your employer identification number (ein). Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first. Form 2290 tax year begins from 1st july 2021 to 31st.

Web what is form 2290 schedule 1? This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. Provide consent to tax information disclosure as part of schedule 1. Form 2290 tax year begins from 1st july 2021 to 31st. Web schedule 1 (form 2290)—month of first use. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Report all vehicles for which the taxpayer is reporting tax (including an increase in taxable gross weight) report vehicles for which the taxpayer.

Web schedule 1 (form 2290)—month of first use. Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. Provide consent to tax information disclosure as part of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return. This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first. File your 2290 online & get schedule 1 in minutes. What are the requirements for schedule 1? Information about form 2290 and its.

File Form 2290 Online & Get IRS Stamped Schedule 1 in Minutes

This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. Web what is form 2290 schedule 1?.

Understanding Form 2290 StepbyStep Instructions for 20222023

Report all vehicles for which the taxpayer is reporting tax (including an increase in taxable gross weight) report vehicles for which the taxpayer. Easy, fast, secure & free to try. To renew your vehicle registration. Web setting options for 2290 clients. Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will.

Form 2290 Schedule 1 Schedule 1 eForm2290

Web irs form 2290, heavy highway vehicle use tax return, is used to figure and pay taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that. Web tax tips irs help irs 2290 schedule 1 irs needs two copies of schedule 1. Web schedule 1 (form 2290)—month of first use. To renew your.

Ssurvivor Irs Form 2290 Schedule 1 Instructions

Web to lease or contract your truck. Web schedule 1 form 2290 how to get tax help additional tips for filing form 2290 uses of form 2290 instructions according to the internal revenue service figure and pay the. File your 2290 online & get schedule 1 in minutes. This needs to be duly filled and submitted to the irs along.

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. You can choose to use v. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is. July 2020) departrnent of the treasury internal revenue.

Instructions For Form 2290 Schedule 1 Form Resume Examples QJ9eP5g2my

File your 2290 online & get schedule 1 in minutes. Web tax tips irs help irs 2290 schedule 1 irs needs two copies of schedule 1. Form 2290 tax year begins from 1st july 2021 to 31st. Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of.

Prominence of IRS Form 2290 Schedule 1 2290 Schedule 1 Proof 2021

File your 2290 online & get schedule 1 in minutes. Do your truck tax online & have it efiled to the irs! Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. Even if.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Web form 2290 schedule 1 instructions are designed to guide truck drivers and fleet owners who must complete and file form 2290 and obtain a schedule 1for hvut. Web what is form 2290 schedule 1? Even if your vehicle is. Information about form 2290 and its. File your 2290 online & get schedule 1 in minutes.

Web Schedule 1 Form 2290 How To Get Tax Help Additional Tips For Filing Form 2290 Uses Of Form 2290 Instructions According To The Internal Revenue Service Figure And Pay The.

Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. To renew your vehicle registration. Web receipted form 2290, schedule 1, you can provide the bill of sale, a photocopy of the bill of sale, or another document that is evidence of a title transfer and shows that you bought.

Web Setting Options For 2290 Clients.

Information about form 2290 and its. Web irs form 2290, heavy highway vehicle use tax return, is used to figure and pay taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that. This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles.

Easy, Fast, Secure & Free To Try.

Web tax tips irs help irs 2290 schedule 1 irs needs two copies of schedule 1. File your 2290 online & get schedule 1 in minutes. Web what is form 2290 schedule 1? What are the requirements for schedule 1?

Report All Vehicles For Which The Taxpayer Is Reporting Tax (Including An Increase In Taxable Gross Weight) Report Vehicles For Which The Taxpayer.

Provide consent to tax information disclosure as part of schedule 1. So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is. Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will be sent by the irs to you once you file your form 2290. Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return.