Sc Withholding Tax Form

Sc Withholding Tax Form - If too little is withheld, you will generally owe tax when. Web your tax withholding will remain in effect until you change or revoke it. 12/13/19) south carolina employee's 3527 dor.sc.gov withholding allowance. Web the income tax withholding for the state of south carolina includes the following changes: Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at this link:. Web tax and legal forms. If you have too much tax withheld, you will. Web manage your south carolina tax accounts online. The maximum standard deduction in the case of any exemptions has. Web what’s new for withholding tax?

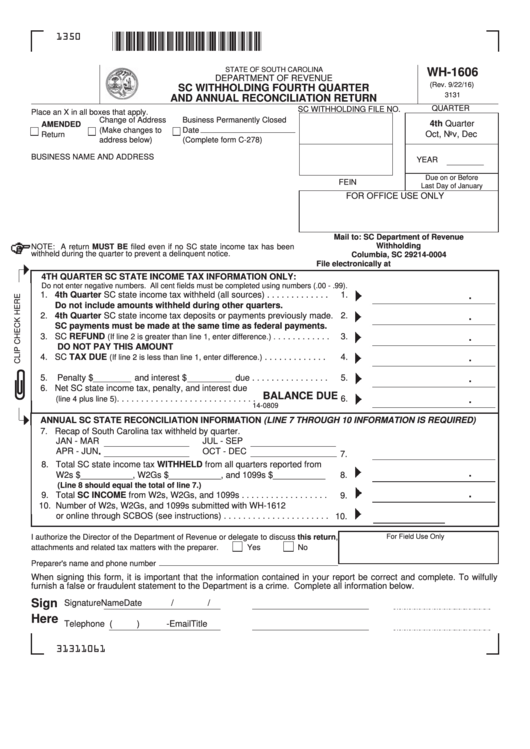

Securely file, pay, and register most south carolina taxes using the scdor’s free online tax portal, mydorway. Web what’s new for withholding tax? If too little is withheld, you will generally owe tax when. Web south carolina department of revenue Web sc withholding quarterly tax return business name and address place an x in all boxes that apply. Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. Ad discover 2290 form due dates for heavy use vehicles placed into service. If you have too much tax withheld, you will. Web file now with turbotax. You can download or print.

If you have too much tax withheld, you will. Change of address (make changes to address below) close. Web the income tax withholding for the state of south carolina includes the following changes: Web manage your south carolina tax accounts online. You can download or print. Web sc withholding quarterly tax return business name and address place an x in all boxes that apply. For the latest information about south carolina. Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at this link:. Web what’s new for withholding tax? The maximum standard deduction in the case of any exemptions has.

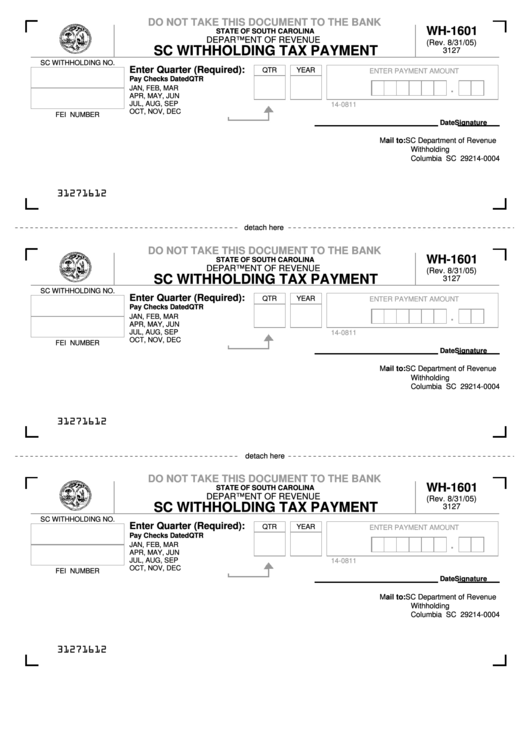

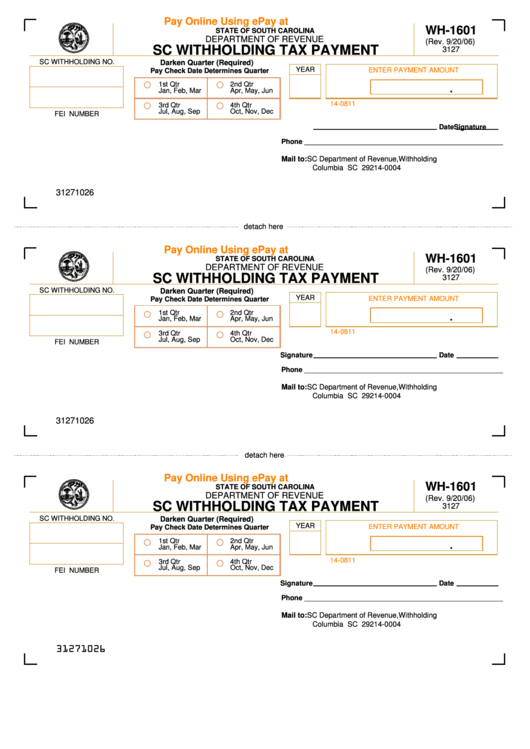

2010 Form SC WH1601 Fill Online, Printable, Fillable, Blank pdfFiller

Web sc withholding quarterly tax return business name and address place an x in all boxes that apply. Web the income tax withholding for the state of south carolina includes the following changes: Web file now with turbotax. Web manage your south carolina tax accounts online. Web withholding accurate and helps you avoid surprises when you file your south carolina.

Form Wh1601 Sc Withholding Tax Payment printable pdf download

Ad discover 2290 form due dates for heavy use vehicles placed into service. Web every employer/withholding agent that has an employee earning wages in south carolina (and who is required to file a return or deposit with the irs) must make a return or. Web file now with turbotax. Web tax and legal forms. Web sc withholding quarterly tax return.

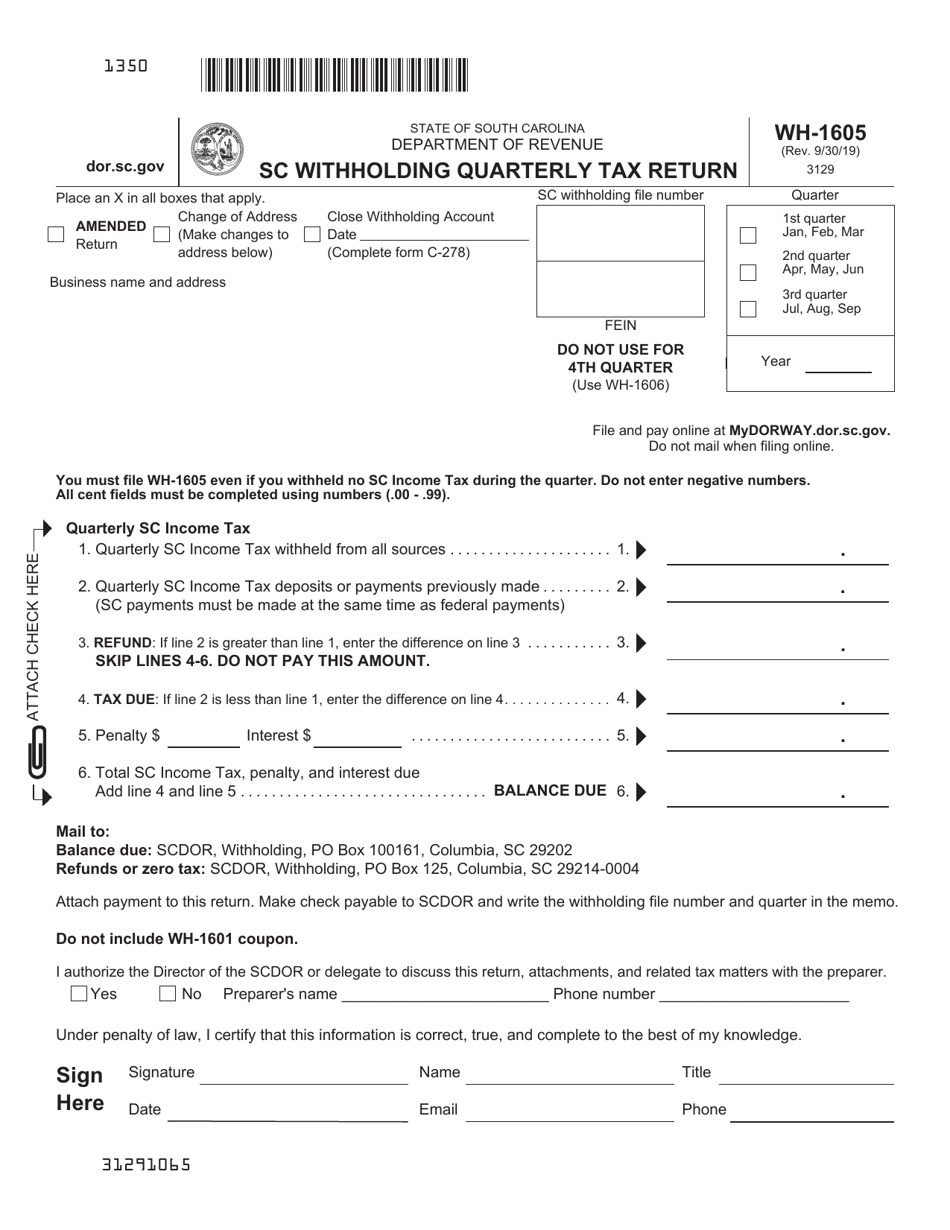

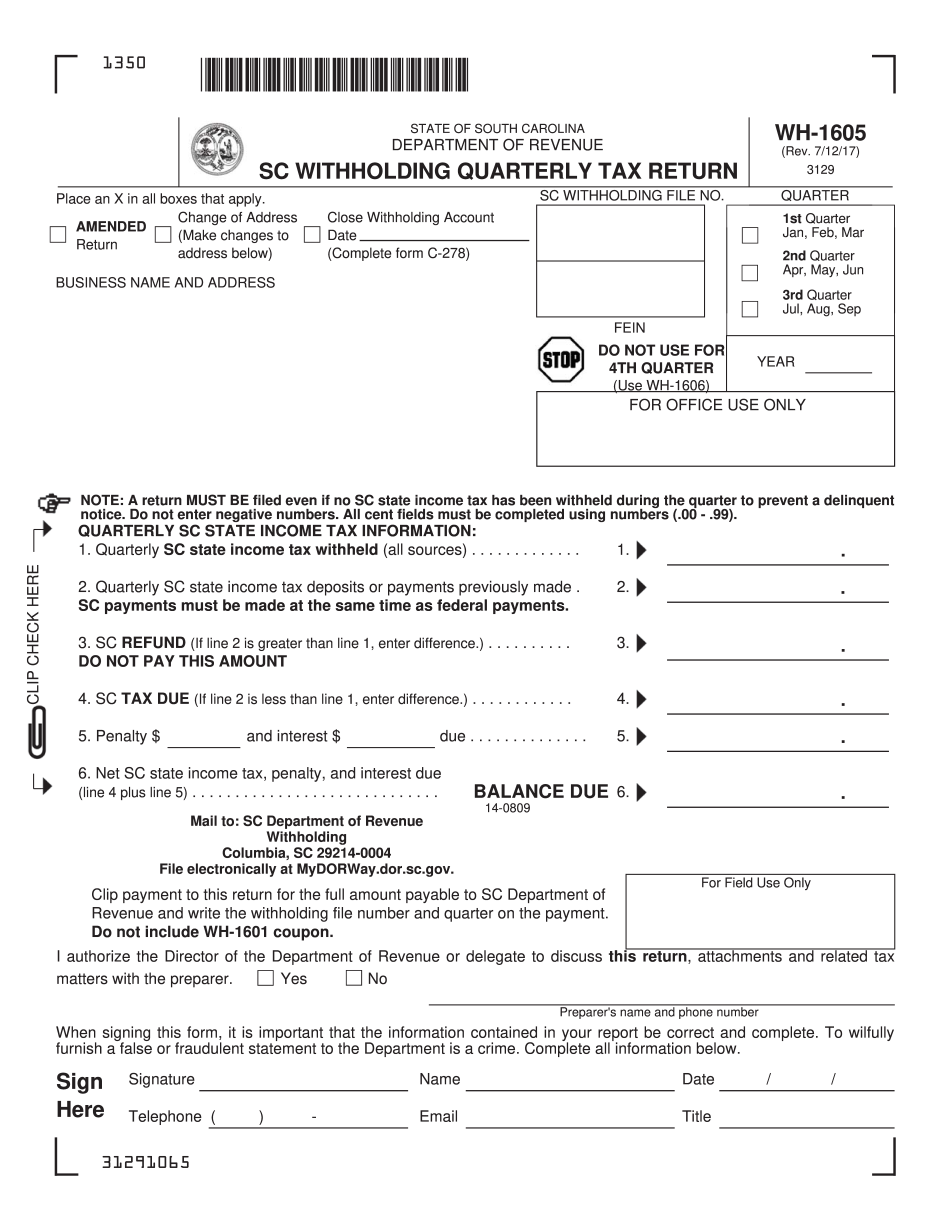

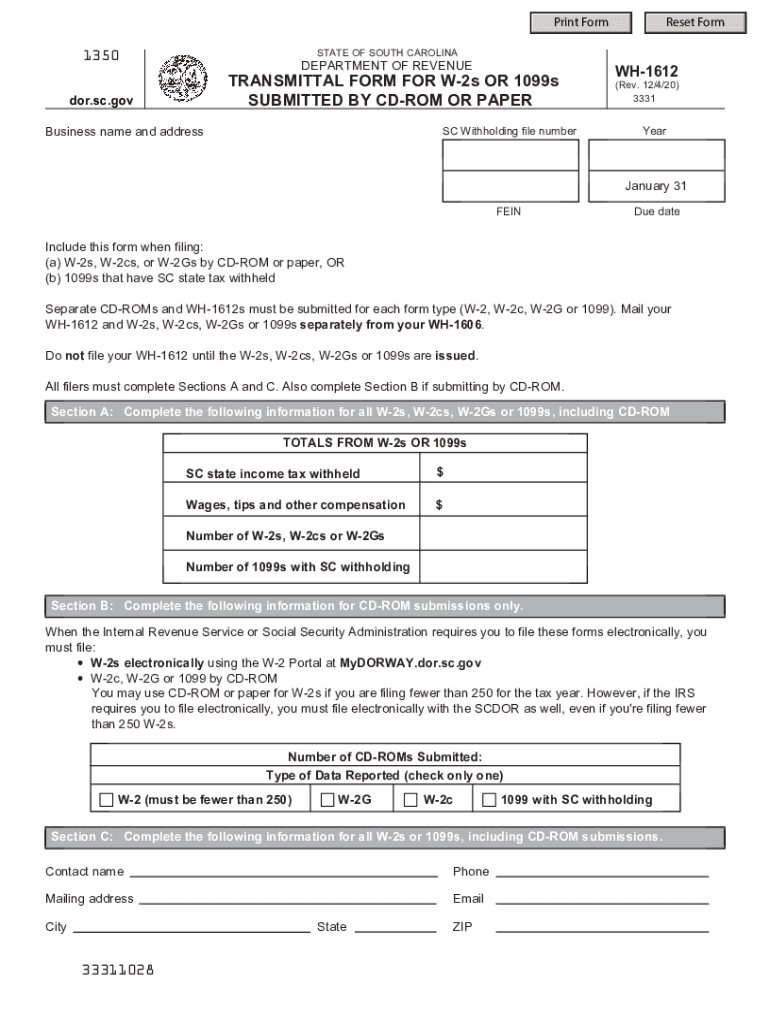

Form WH1605 Download Printable PDF or Fill Online Sc Withholding

For the latest information about south carolina. This form is for income earned in tax year. Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at this link:. Web south carolina department of revenue Web what’s new for withholding tax?

Federal W4 2022 W4 Form 2022 Printable

For the latest information about south carolina. 12/13/19) south carolina employee's 3527 dor.sc.gov withholding allowance. Change of address (make changes to address below) close. State tax withholding state code: Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at this link:.

Employee Tax Withholding Forms For South Carolina 2022

Change of address (make changes to address below) close. For the latest information about south carolina. Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at.

South Carolina Form WH1605 Printable SC Withholding Quarterly Tax Return

Driver's license renewal [pdf] disabled. Web tax and legal forms. For the latest information about south carolina. Web your tax withholding will remain in effect until you change or revoke it. If you have too much tax withheld, you will.

Form Wh1601 Sc Withholding Tax Payment printable pdf download

This form is for income earned in tax year. Web manage your south carolina tax accounts online. Web the income tax withholding for the state of south carolina includes the following changes: If too little is withheld, you will generally owe tax when. If you have too much tax withheld, you will.

Filers Sc Withholding Form Fill Out and Sign Printable PDF Template

Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. The maximum standard deduction in the case of any exemptions has. Driver's license renewal [pdf] disabled. Ad discover 2290 form due dates for heavy use vehicles placed into service. This form is for income earned in tax year.

2016 Form SC DoR SC1040 Fill Online, Printable, Fillable, Blank pdfFiller

Web what’s new for withholding tax? For the latest information about south carolina. Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at this link:. This form is for income earned in tax year. Driver's license renewal [pdf] disabled.

W9 tax form Withholding Tax Social Security Number

Securely file, pay, and register most south carolina taxes using the scdor’s free online tax portal, mydorway. Web south carolina department of revenue Driver's license renewal [pdf] disabled. 12/13/19) south carolina employee's 3527 dor.sc.gov withholding allowance. Web file now with turbotax.

Web South Carolina Department Of Revenue

12/13/19) south carolina employee's 3527 dor.sc.gov withholding allowance. Web your tax withholding will remain in effect until you change or revoke it. Web every employer/withholding agent that has an employee earning wages in south carolina (and who is required to file a return or deposit with the irs) must make a return or. Web for employees that might need assistance on completing the form there is a withholding tax estimator published by the irs that can be used at this link:.

For The Latest Information About South Carolina.

This form is for income earned in tax year. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. Web the income tax withholding for the state of south carolina includes the following changes:

Notary Public Application [Pdf] Motor Vehicle Forms.

Web manage your south carolina tax accounts online. If too little is withheld, you will generally owe tax when. If you have too much tax withheld, you will. Web file now with turbotax.

Driver's License Renewal [Pdf] Disabled.

You can download or print. Web sc withholding quarterly tax return business name and address place an x in all boxes that apply. Complete, edit or print tax forms instantly. The maximum standard deduction in the case of any exemptions has.