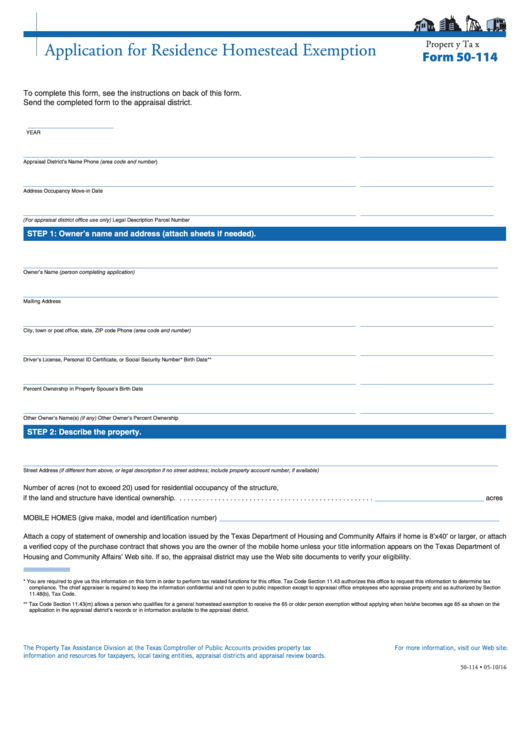

Residence Homestead Exemption Application Form 50-114

Residence Homestead Exemption Application Form 50-114 - Web file this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. Facilities assessment, feasibility study, and long. Try scribd free for 30 days. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. The address listed on your driver’s license or. Web residence homestead exemption. 1 and april 30 of the year. With scribd, you can take your ebooks and audibooks anywhere, even offline. The applicant is the owner of the manufactured home; Applying is free and only needs to be filed once.

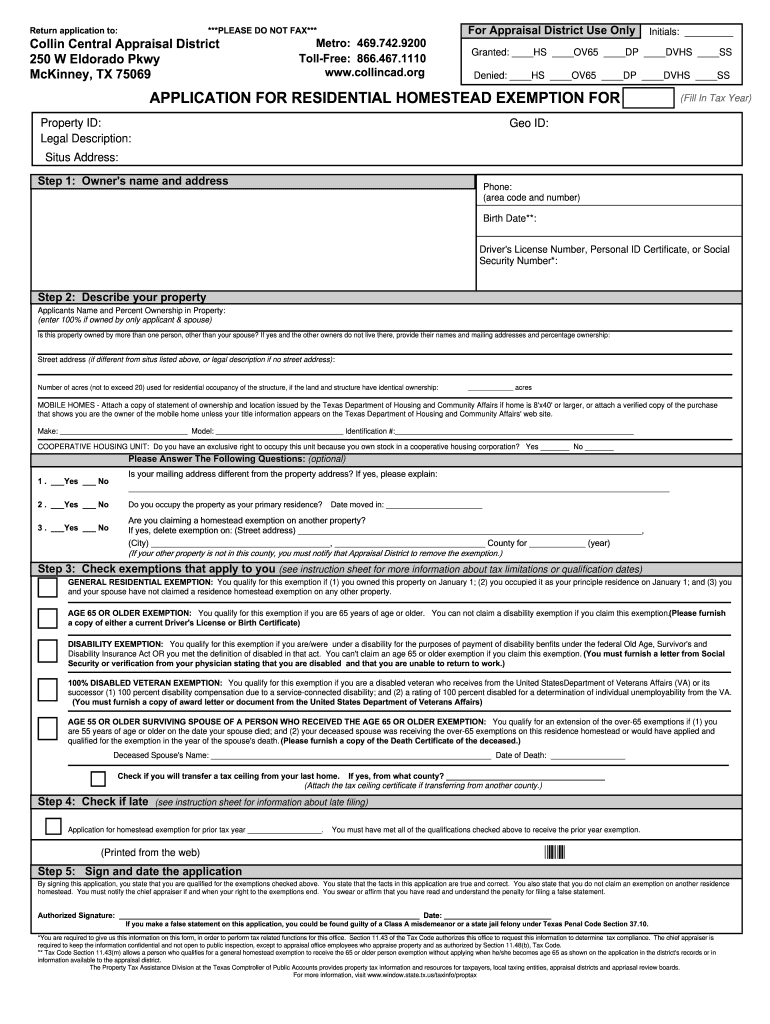

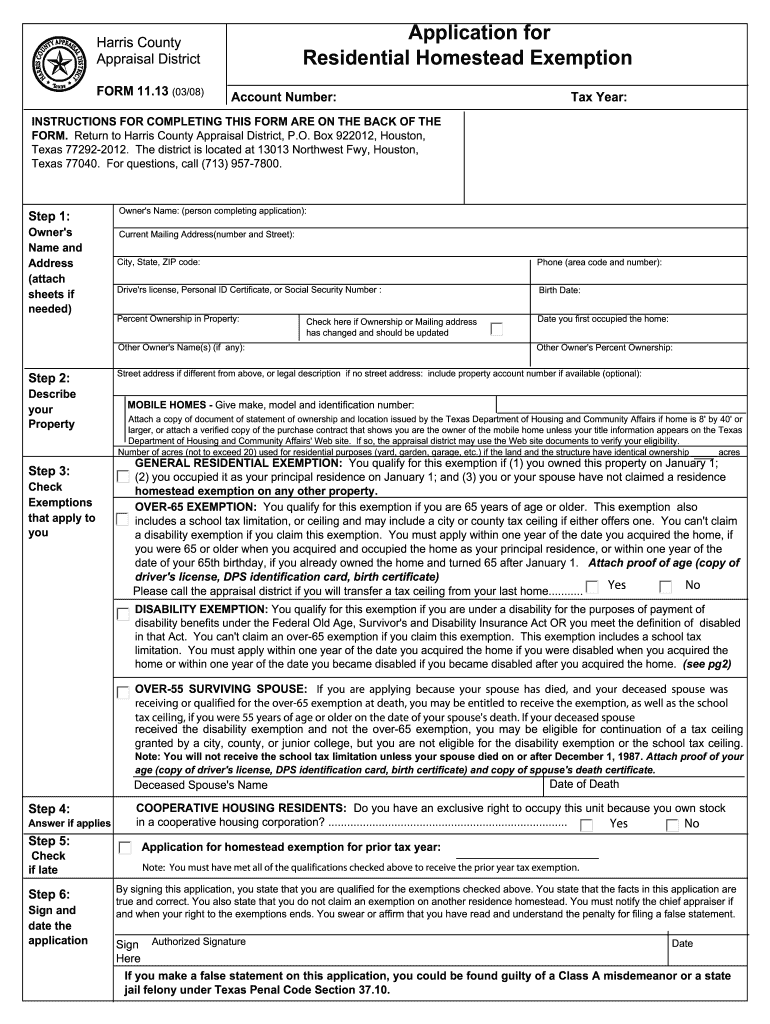

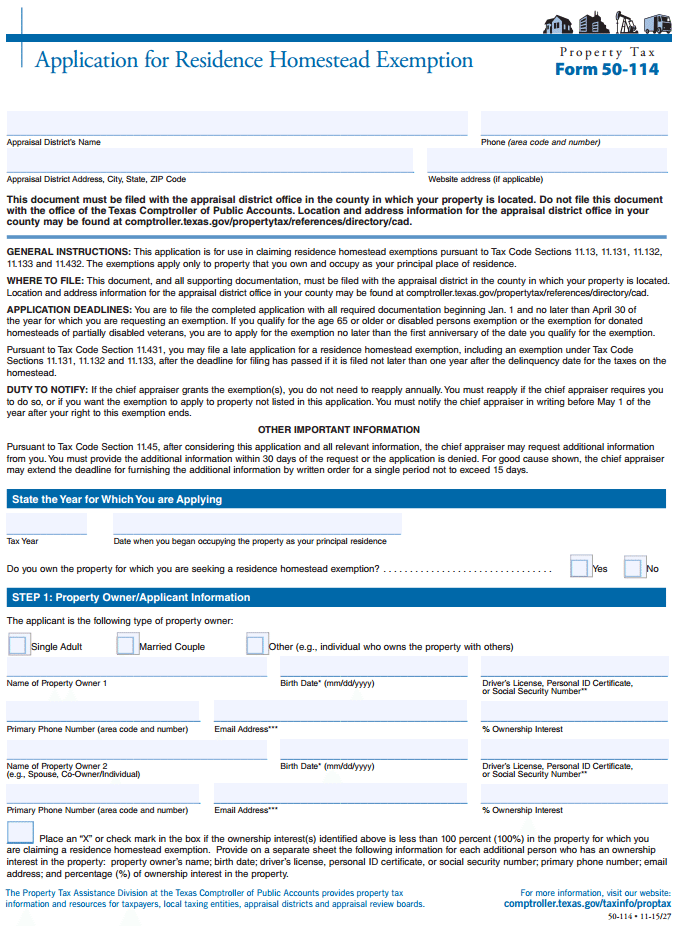

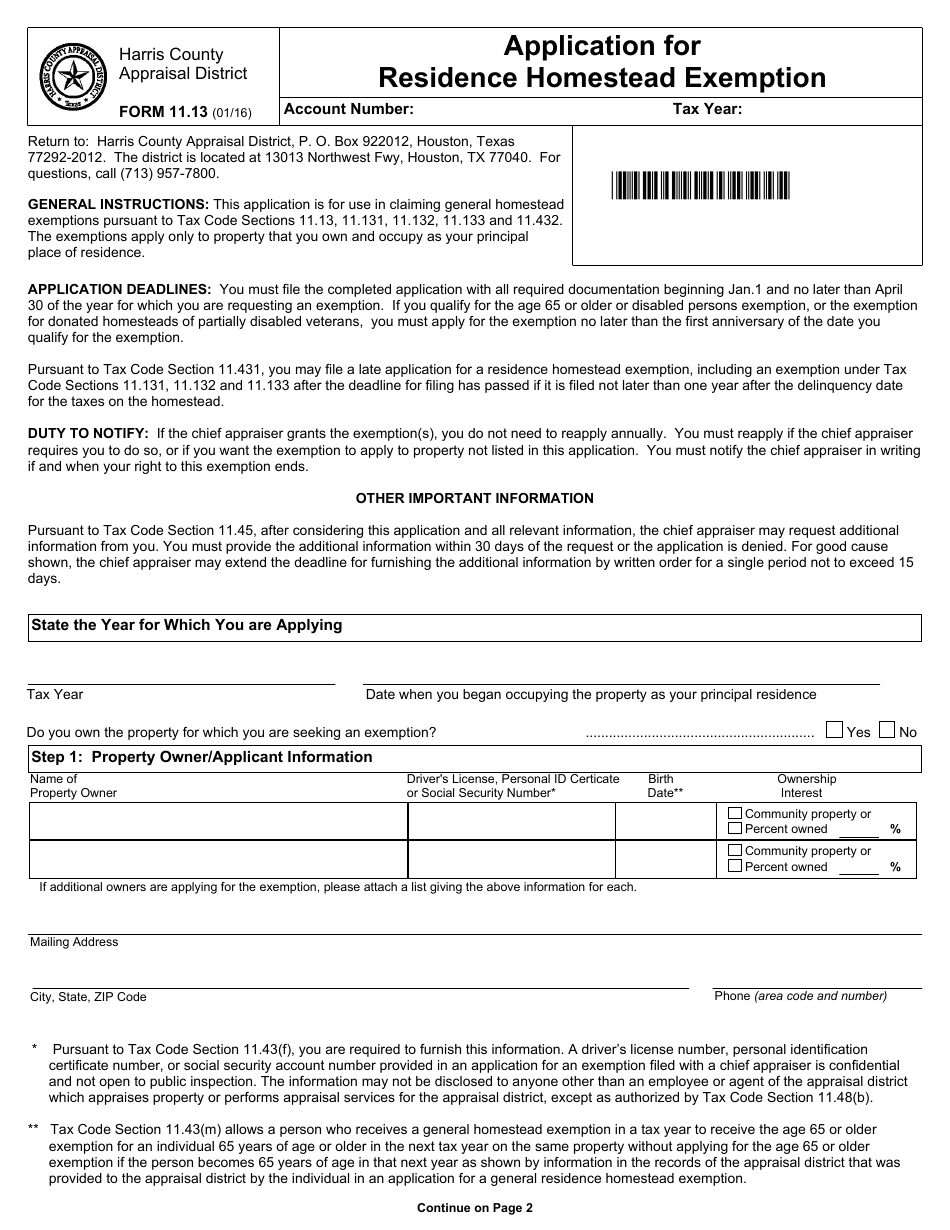

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. The address listed on your driver’s license or. Ad access millions of ebooks, audiobooks, podcasts, and more. ← request for proposal (rfp): Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and. Applying is free and only needs to be filed once. Web file this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. 1 and april 30 of the year. With scribd, you can take your ebooks and audibooks anywhere, even offline.

The address listed on your driver’s license or. The applicant is the owner of the manufactured home; Web file this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131,. The application can be found on your. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Ad access millions of ebooks, audiobooks, podcasts, and more. The seller of the manufactured home did not provide. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Facilities assessment, feasibility study, and long.

Fill Free fillable Form 50114 Residence Homestead Exemption

The address listed on your driver’s license or. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. ← request for proposal (rfp): 1 and april 30 of the year. The address listed on your driver’s license or.

Fill Free fillable Form 50114 Application for Residence Homestead

← request for proposal (rfp): With scribd, you can take your ebooks and audibooks anywhere, even offline. The address listed on your driver’s license or. The application can be found on your. Web of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead.

Fillable Form 50114 Application For Residence Homestead Exemption

The application can be found on your. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Ad access millions of ebooks, audiobooks, podcasts, and more. ← request for proposal (rfp): The address listed on your driver’s license or.

2008 TX Form 11.13 Fill Online, Printable, Fillable, Blank pdfFiller

The seller of the manufactured home did not provide. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. The application can be found on your. With scribd, you can take your ebooks and audibooks anywhere, even offline. Web the missouri property tax credit claim gives credit to certain.

Texas Homestead Tax Exemption Form

The address listed on your driver’s license or. 1 and april 30 of the year. Ad access millions of ebooks, audiobooks, podcasts, and more. Web residence homestead exemption. Web of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead.

Form 50 114 Fill Out and Sign Printable PDF Template signNow

Facilities assessment, feasibility study, and long. The applicant is the owner of the manufactured home; Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web this application is for claiming residence homestead exemptions pursuant to tax code sections.

2011 Form TX Comptroller 50114 Fill Online, Printable, Fillable, Blank

The address listed on your driver’s license or. With scribd, you can take your ebooks and audibooks anywhere, even offline. Web of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return.

Re Download Aadhar Card Downlllll

Web of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. The application can be found on your. The address listed on your driver’s license or. Web this application.

Fill Free fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION PDF form

Web residence homestead exemption. 1 and april 30 of the year. Ad access millions of ebooks, audiobooks, podcasts, and more. With scribd, you can take your ebooks and audibooks anywhere, even offline. Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and.

Form 11.13 Download Printable PDF or Fill Online Application for

Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web residence homestead exemption. Ad access millions of ebooks,.

Web File This Form And All Supporting Documentation With The Appraisal District Office In Each County In Which The Property Is Located Generally Between Jan.

Try scribd free for 30 days. 1 and april 30 of the year. The seller of the manufactured home did not provide. The address listed on your driver’s license or.

With Scribd, You Can Take Your Ebooks And Audibooks Anywhere, Even Offline.

Applying is free and only needs to be filed once. Web residence homestead exemption. Web you must apply with your county appraisal district to apply for a homestead exemption. The application can be found on your.

Web This Application Is For Use In Claiming Residence Homestead Exemptions Pursuant To Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134 And 11.432.

Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131,. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Facilities assessment, feasibility study, and long.

Web File Your Kansas Income Tax Return And Homestead Refund Claim With Kansas Webfile, A Free State Tax Return Service Provided By The Kansas Department Of Revenue And.

The applicant is the owner of the manufactured home; Web of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. ← request for proposal (rfp): Ad access millions of ebooks, audiobooks, podcasts, and more.