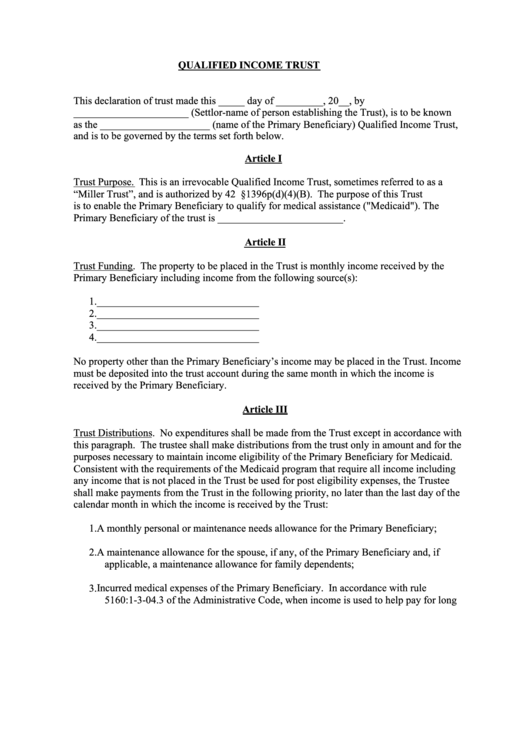

Qualified Income Trust Form Florida

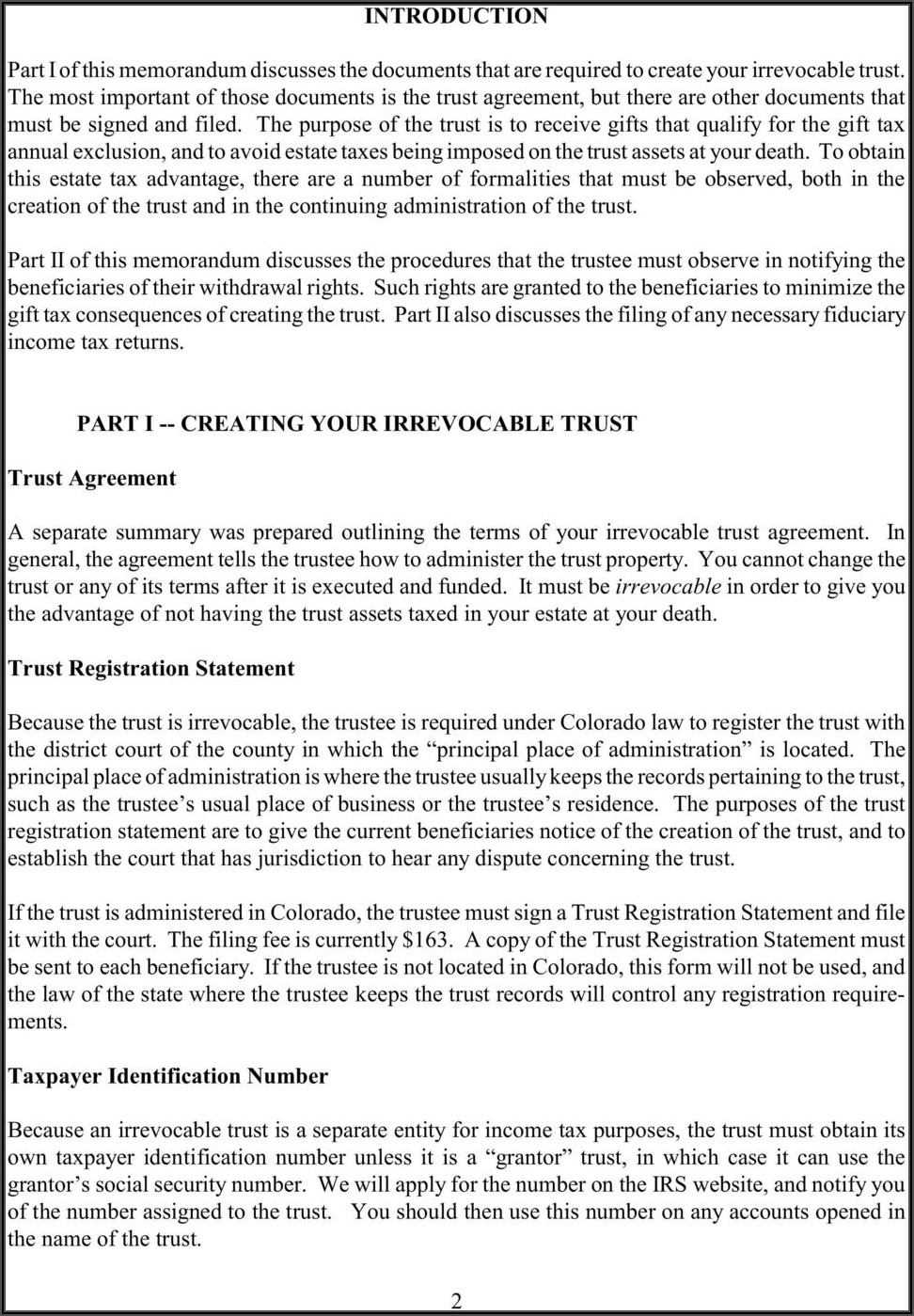

Qualified Income Trust Form Florida - How is income calculated for. Web if a medicaid applicant’s income exceeds the lawful amount for medicaid eligibility ($2,742.00 effective jan. A qualified income trust (or qit) is a mechanism to qualify for benefits when one's income exceeds the income limit (currently per month in fl). Can be customized to your needs Web income limit for qualified income trusts in florida as of the date of this updated posting in 2019 is $2,313 per applicant. Save or instantly send your ready documents. Rich text instant download buy now free preview description a trustor is the. Web qualified income trusts (qits) are a way for someone who earns above the medicaid income limit to get under that limit and become eligible for medicaid benefits. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web a qualified income trust is one of the best tools available that allow florida residents to qualify for medicaid.

Web qits, sometimes called miller trusts, are designed to make applicants eligible for medicaid even if their income is greater than medicaid’s restrictions allow. Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. As of january 2021, the federal ssi benefit rate is. (1) by a florida court of competent jurisdiction for the purpose of. Select popular legal forms & packages of any category. Save or instantly send your ready documents. Or irrevocable qualified income trust (qit). Rich text instant download buy now free preview description a trustor is the. Web the qualified medicaid income trust is a legal instrument which meets criteria in 42 united states code 1396 (p) and which allows individuals with income over the institutional. Web income limit for qualified income trusts in florida as of the date of this updated posting in 2019 is $2,313 per applicant.

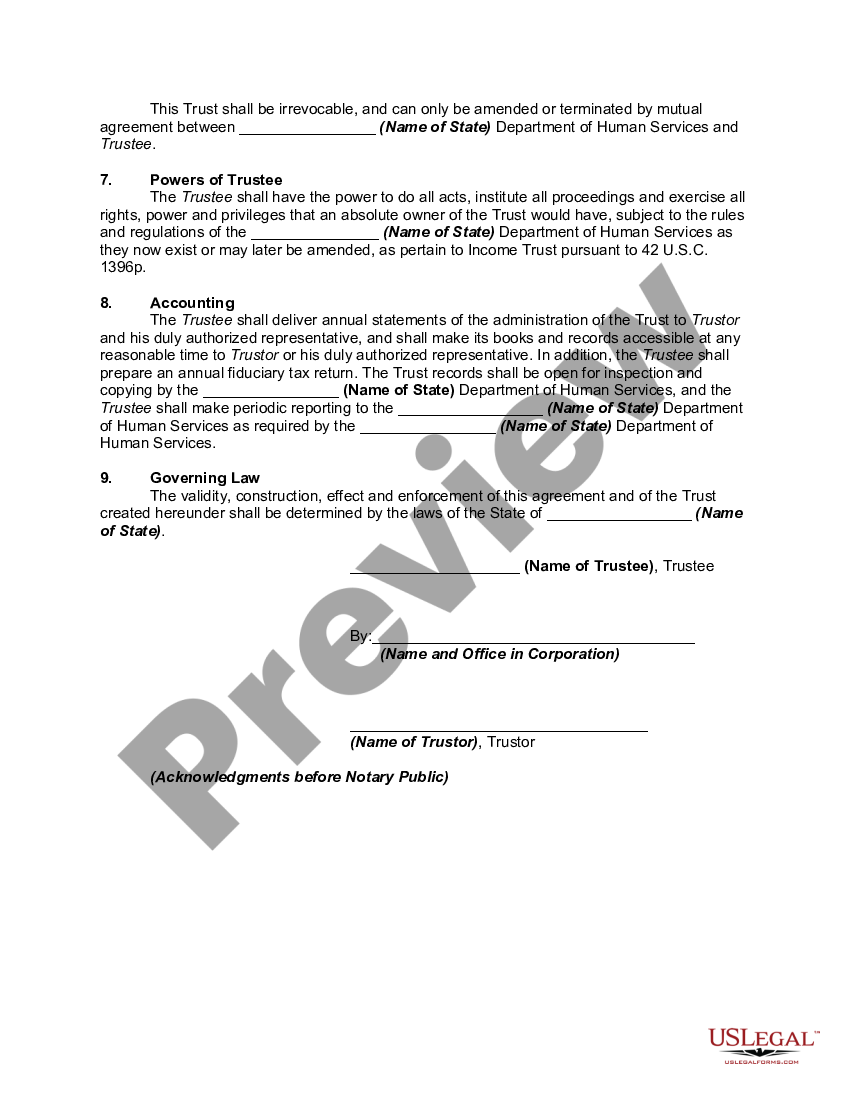

(1) by a florida court of competent jurisdiction for the purpose of. Web during the grantor’s lifetime, this trust shall only be subject to modification or termination in the following manner; Web the qualified medicaid income trust is a legal instrument which meets criteria in 42 united states code 1396 (p) and which allows individuals with income over the institutional. Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. Easily fill out pdf blank, edit, and sign them. It used to be that if this income limit. Download, print, and fill in the blanks. Rich text instant download buy now free preview description a trustor is the. Or irrevocable qualified income trust (qit). Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add.

Qualified Trust Cap Trust)

(1) by a florida court of competent jurisdiction for the purpose of. Web a qualified income trust is one of the best tools available that allow florida residents to qualify for medicaid. Web qualified income trusts (qit’s) are legal documents that must be prepared by an attorney. Ad create your last will and testament today. Type text, complete fillable fields,.

7 Things to Know Before Creating a Qualified Trust

Web miller trusts are also commonly known as a (d) (4) (b) trust; Ad trust form & more fillable forms, download and print now! How is income calculated for. Web qualified income trusts (qits) are a way for someone who earns above the medicaid income limit to get under that limit and become eligible for medicaid benefits. Rich text instant.

What is a Qualified Trust? Richert Quarles

Web if a medicaid applicant’s income exceeds the lawful amount for medicaid eligibility ($2,742.00 effective jan. Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. A person applying for medicaid benefits who has a gross monthly income exceeding the. Florida is.

Qualified Trust Agreement Form Florida Form Resume Examples

Web miller trusts are also commonly known as a (d) (4) (b) trust; As of january 2021, the federal ssi benefit rate is. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. A person applying for medicaid benefits who has a gross monthly income exceeding the. Web qualified income trusts (qit’s) are legal documents that.

Qualified Trust Agreement form Florida Elegant View In HTML

Download, print, and fill in the blanks. Web up to $40 cash back edit your florida qualified income trust form online. Miller trusts are solely designed to own. Or irrevocable qualified income trust (qit). Web qualified income trusts (qit’s) are legal documents that must be prepared by an attorney.

Qualified Trust Form Fill Out and Sign Printable PDF Template

Select popular legal forms & packages of any category. A person applying for medicaid benefits who has a gross monthly income exceeding the. Easily fill out pdf blank, edit, and sign them. Web florida medicaid tpl recovery program. Florida is one of the states in our country that set income and asset.

Florida Irrevocable Trust Execution Formalities Form Resume

Or irrevocable qualified income trust (qit). Miller trusts are solely designed to own. Ad trust form & more fillable forms, download and print now! Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. Save or instantly send your ready documents.

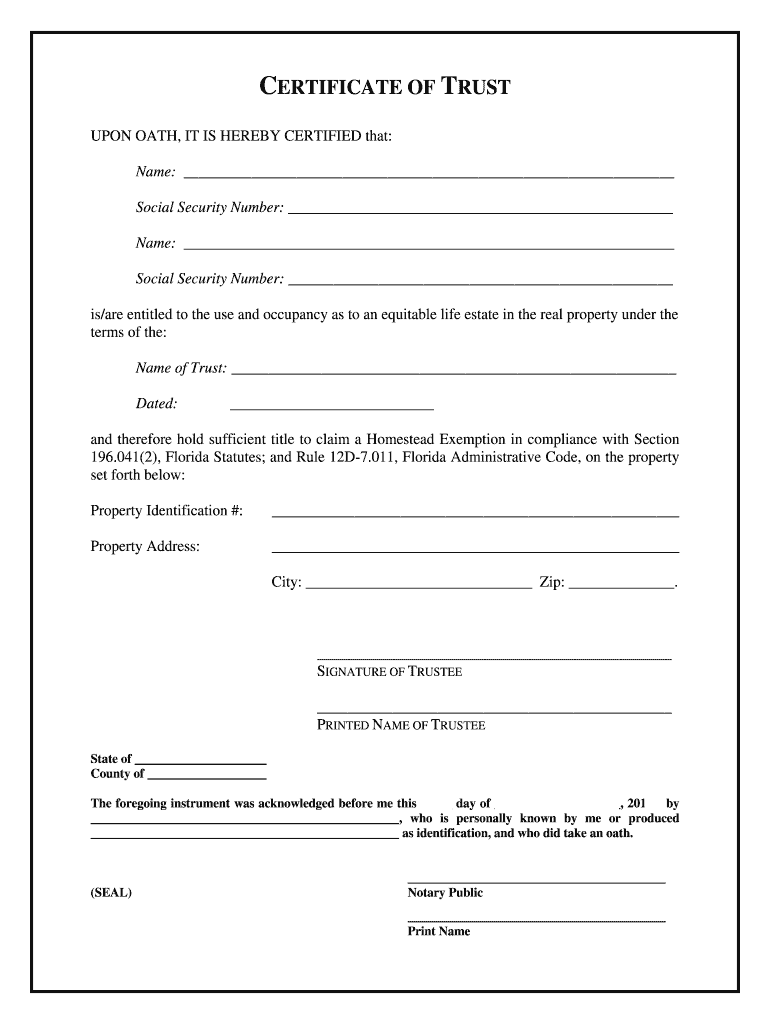

Certificate of Trust Form Fill Out and Sign Printable PDF Template

Web once the qit is drafted by a competent elder law attorney and is established by the medicaid applicant, the applicant’s spouse, or the applicant’s legal representative. A qualified income trust (or qit) is a mechanism to qualify for benefits when one's income exceeds the income limit (currently per month in fl). Save or instantly send your ready documents. Web.

Qualified Trust Declaration Form printable pdf download

It used to be that if this income limit. A qualified income trust (or qit) is a mechanism to qualify for benefits when one's income exceeds the income limit (currently per month in fl). Web the qualified medicaid income trust is a legal instrument which meets criteria in 42 united states code 1396 (p) and which allows individuals with income.

Qualified Miller Trust US Legal Forms

(1) by a florida court of competent jurisdiction for the purpose of. A person applying for medicaid benefits who has a gross monthly income exceeding the. Web once the qit is drafted by a competent elder law attorney and is established by the medicaid applicant, the applicant’s spouse, or the applicant’s legal representative. It used to be that if this.

Or Irrevocable Qualified Income Trust (Qit).

1, 2023), a qualified income trust may be created with the. Web miller trusts are also commonly known as a (d) (4) (b) trust; Ad create your last will and testament today. Web if a medicaid applicant’s income exceeds the lawful amount for medicaid eligibility ($2,742.00 effective jan.

Web The Qualified Medicaid Income Trust Is A Legal Instrument Which Meets Criteria In 42 United States Code 1396 (P) And Which Allows Individuals With Income Over The Institutional.

A person applying for medicaid benefits who has a gross monthly income exceeding the. Save or instantly send your ready documents. Miller trusts are solely designed to own. As of january 2021, the federal ssi benefit rate is.

Web Qualified Income Trusts (Qit’s) Are Legal Documents That Must Be Prepared By An Attorney.

Web during the grantor’s lifetime, this trust shall only be subject to modification or termination in the following manner; Web a qualified income trust is one of the best tools available that allow florida residents to qualify for medicaid. Web up to $40 cash back edit your florida qualified income trust form online. Florida is one of the states in our country that set income and asset.

Web Qualified Income Trusts (Qits) Are A Way For Someone Who Earns Above The Medicaid Income Limit To Get Under That Limit And Become Eligible For Medicaid Benefits.

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. (1) by a florida court of competent jurisdiction for the purpose of. Select popular legal forms & packages of any category. Easily fill out pdf blank, edit, and sign them.