Publication 505 Chapter 2

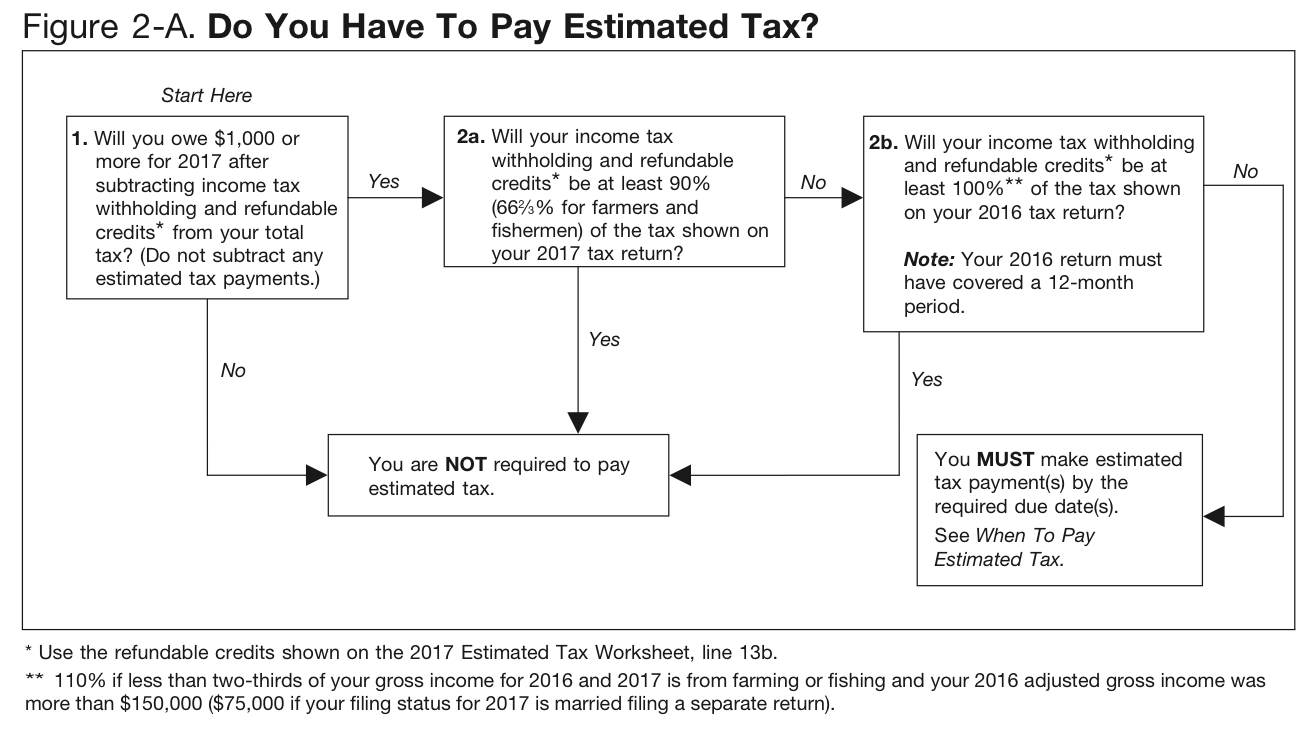

Publication 505 Chapter 2 - Who does not have to pay estimated tax who. Web for a definition of gross income from farming and fishing and more details, see chapter 2 of pub. 2022 2021 2020 2019 2018 other previous versions. Web see chapter 2 of pub. View our newest version here. Web there is a newer version of this chapter. Web you must pay estimated tax for 2008 if both of the following apply. Web publication 505 contents (rev. Web publication 505 chapter 2; Web then, to figure the payment due for each remaining payment period, see amended estimated tax in chapter 2 of.

See chapter 2 of pub. Web pub 583, starting a business and keeping records retain records for: Web publication 505 contents (rev. O at least 3 years from later of filing or due date o if files. Web there is a newer version of this chapter. Note that any link in the information above is updated each year automatically and will take you to the. 15008e of the what’s new for 2010. You expect to owe at least $1,000 in tax for 2008, after. Web the result of steps 1 through 6 is your total expected tax for 2001 (line 13c of the 2001 estimated tax worksheet ). View our newest version here.

Web publication 505 contents (rev. O at least 3 years from later of filing or due date o if files. View our newest version here. 2022 2021 2020 2019 2018 other previous versions. The irs may apply a penalty if. Web you filed form 1040 or 1041 and paid the entire tax due by march 2, 2015. Web based on conversations with irs personnel, and the limited discussion of the issue in irs publication 505, tax withholding and. Web there is a newer version of this chapter. Web you must pay estimated tax for 2008 if both of the following apply. Web include all estimated tax payments actually made and federal income tax withholding through the payment due date for the.

Jane The Virgin 505 Chapter Eighty Six 04 WCCB Charlotte's CW

Web then, to figure the payment due for each remaining payment period, see amended estimated tax in chapter 2 of. Web there is a newer version of this chapter. View our newest version here. 2022 2021 2020 2019 2018 other previous versions. Web publication 505 contents (rev.

New Fellow? Pay Your Quarterly Estimated Tax for the First Time This

Web publication 505 chapter 2; Web publication 505 contents (rev. Note that any link in the information above is updated each year automatically and will take you to the. Web you filed form 1040 or 1041 and paid the entire tax due by march 2, 2015. See chapter 2 of pub.

Pokemon, Chapter 505 Pokemon Manga Online

505, tax withholding and estimated tax, for the definition of gross income from farming and fishing. Web there is a newer version of this chapter. The irs may apply a penalty if. Web pub 583, starting a business and keeping records retain records for: 2022 2021 2020 2019 2018 other previous versions.

Apotheosis, Chapter 505 Apotheosis Manga Online

View our newest version here. O at least 3 years from later of filing or due date o if files. Web the result of steps 1 through 6 is your total expected tax for 2001 (line 13c of the 2001 estimated tax worksheet ). Web based on conversations with irs personnel, and the limited discussion of the issue in irs.

2021 Withholding Calculator Tax Withholding Estimator 2021

505, tax withholding and estimated tax, for the definition of gross income from farming and fishing. Web publication 505 chapter 2; Web there is a newer version of this chapter. Web based on conversations with irs personnel, and the limited discussion of the issue in irs publication 505, tax withholding and. Web include all estimated tax payments actually made and.

Calculate Federal And State Withholding Tax Withholding Estimator 2021

Web based on conversations with irs personnel, and the limited discussion of the issue in irs publication 505, tax withholding and. Web you filed form 1040 or 1041 and paid the entire tax due by march 2, 2015. Web pub 583, starting a business and keeping records retain records for: Note that any link in the information above is updated.

IRS Publication 501 20202021 Fill and Sign Printable Template Online

Web you must pay estimated tax for 2008 if both of the following apply. Web publication 505 contents (rev. 2022 2021 2020 2019 2018 other previous versions. Web based on conversations with irs personnel, and the limited discussion of the issue in irs publication 505, tax withholding and. See chapter 2 of pub.

How to File Taxes As a Published Writer (with Pictures) wikiHow Life

Web publication 505 contents (rev. You expect to owe at least $1,000 in tax for 2008, after. Web then, to figure the payment due for each remaining payment period, see amended estimated tax in chapter 2 of. View our newest version here. Web there is a newer version of this chapter.

Irs Pub 505 Worksheet 1 6 Worksheet Works

Note that any link in the information above is updated each year automatically and will take you to the. Web publication 505 contents (rev. Web pub 583, starting a business and keeping records retain records for: Who does not have to pay estimated tax who. You expect to owe at least $1,000 in tax for 2008, after.

What you need to know about the Estimated Tax Payment due June 15, 2018

Web you must pay estimated tax for 2008 if both of the following apply. 2022 2021 2020 2019 2018 other previous versions. Web pub 583, starting a business and keeping records retain records for: Web publication 505 chapter 2; O at least 3 years from later of filing or due date o if files.

Web Publication 505 Chapter 2;

Web the result of steps 1 through 6 is your total expected tax for 2001 (line 13c of the 2001 estimated tax worksheet ). Web pub 583, starting a business and keeping records retain records for: O at least 3 years from later of filing or due date o if files. Note that any link in the information above is updated each year automatically and will take you to the.

Web Then, To Figure The Payment Due For Each Remaining Payment Period, See Amended Estimated Tax In Chapter 2 Of.

The irs may apply a penalty if. Web article 5 is a 2012 young adult dystopian novel by kristen simmons.the book was published in january 2012 by tor teen and. You expect to owe at least $1,000 in tax for 2008, after. Web include all estimated tax payments actually made and federal income tax withholding through the payment due date for the.

15008E Of The What’s New For 2010.

Web for a definition of gross income from farming and fishing and more details, see chapter 2 of pub. Web there is a newer version of this chapter. 2022 2021 2020 2019 2018 other previous versions. See chapter 2 of pub.

505, Tax Withholding And Estimated Tax, For The Definition Of Gross Income From Farming And Fishing.

Who does not have to pay estimated tax who. Web see chapter 2 of pub. View our newest version here. Web based on conversations with irs personnel, and the limited discussion of the issue in irs publication 505, tax withholding and.