Payroll Agreement Form

Payroll Agreement Form - Each employee who desires to receive electronic transfer of funds due as wages or salary will provide employer with a direct deposit authorization agreement. You can print other federal tax. Hr is responsible for reaching a new agreement with the employee or deducting the entire remaining amount from the final paycheck. Its wide collection of forms can save your. Save or instantly send your ready documents. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web complete payroll service agreement online with us legal forms. 2) from equal deductions from the next pay periods immediatel. Web we last updated the payroll deduction agreement in february 2023, so this is the latest version of form 2159, fully updated for tax year 2022. I (we) hereby authorize and release my employer, to make payment of any amounts owing to me (either of us).

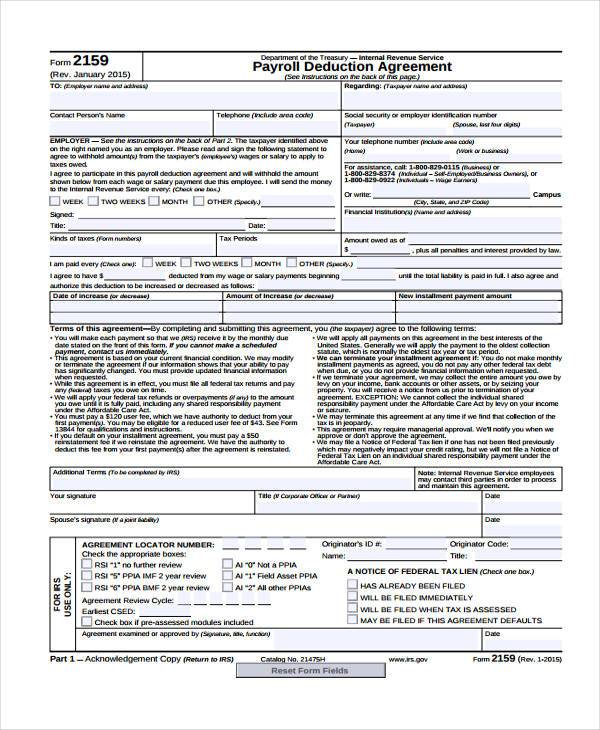

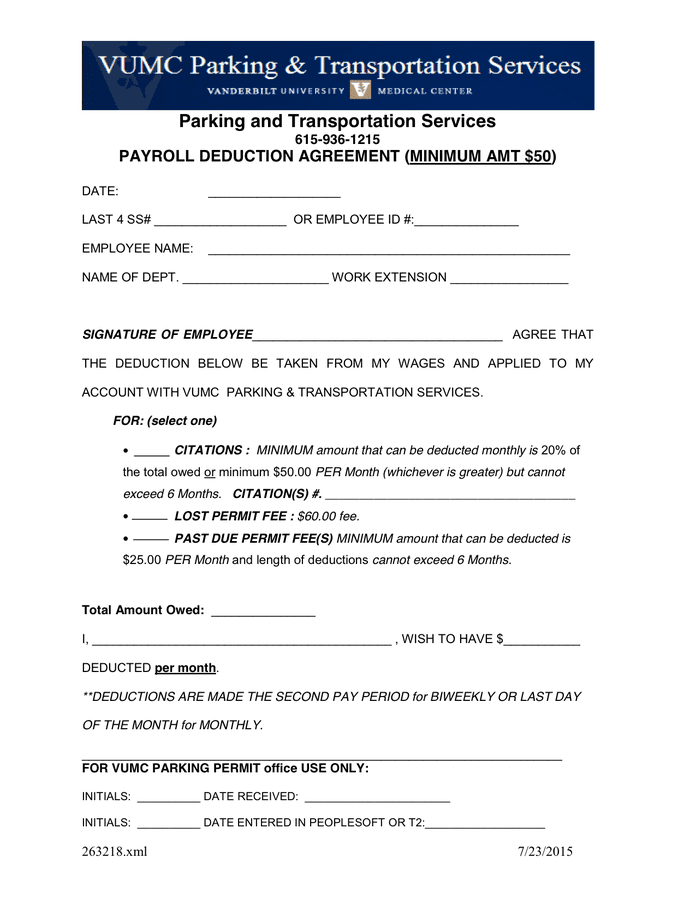

Web by signing this form, i authorize employer flexible to make deductions from my paycheck to repay this advance through either: I (we) hereby authorize and release my employer, to make payment of any amounts owing to me (either of us). Web this payroll support program agreement, including the application and all supporting documents submitted by the recipient and the payroll support certification attached hereto (collectively, agreement), memorializes the binding terms and conditions applicable to the recipient. Web how to make payments please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee. You can print other federal tax. Web we last updated the payroll deduction agreement in february 2023, so this is the latest version of form 2159, fully updated for tax year 2022. Web looking for payroll service agreement template to fill? Payroll deduction agreements are agreements where employers deduct payments from taxpayer’s wages, and mail them to the internal revenue service. Web in order to pay the employer’s employees, the processor will prepare vouchers which will include, at a minimum, the following information: Web this section provides procedures for processing payroll deduction agreements and direct debit installment agreements.

Request for wage determination and response to request. If they approve, hr must create an agreement form on pay advance and repayment terms. 20080701 kckps cbiz flex direct deposit. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web 1 | p a g e payroll service agreement this payroll service agreement (this “agreement”) is entered into by and between _______________________ , (the “employer”) and the payroll department, inc., (“tpd”) as of the date of the last signature on this agreement below. 2) from equal deductions from the next pay periods immediatel. (“domino’s”) and such of its subsidiaries and affiliates as the board of directors of domino’s (the “board”) may from time to time. Cocodoc is the best place for you to go, offering you a free and easy to edit version of payroll service agreement template as you need. Its wide collection of forms can save your. Web start by opening the payroll report generator software on your computer.

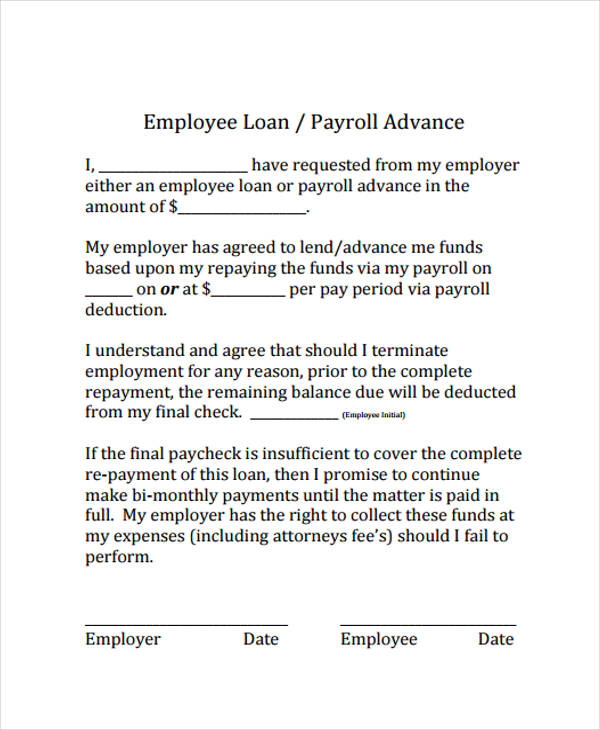

Get Our Sample of Employee Payroll Advance Template Payroll

1) one payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made or: An employer may enter into an agreement with a psp under which the employer authorizes the psp to perform one or more of the following acts on the employer’s behalf: Cocodoc is the best.

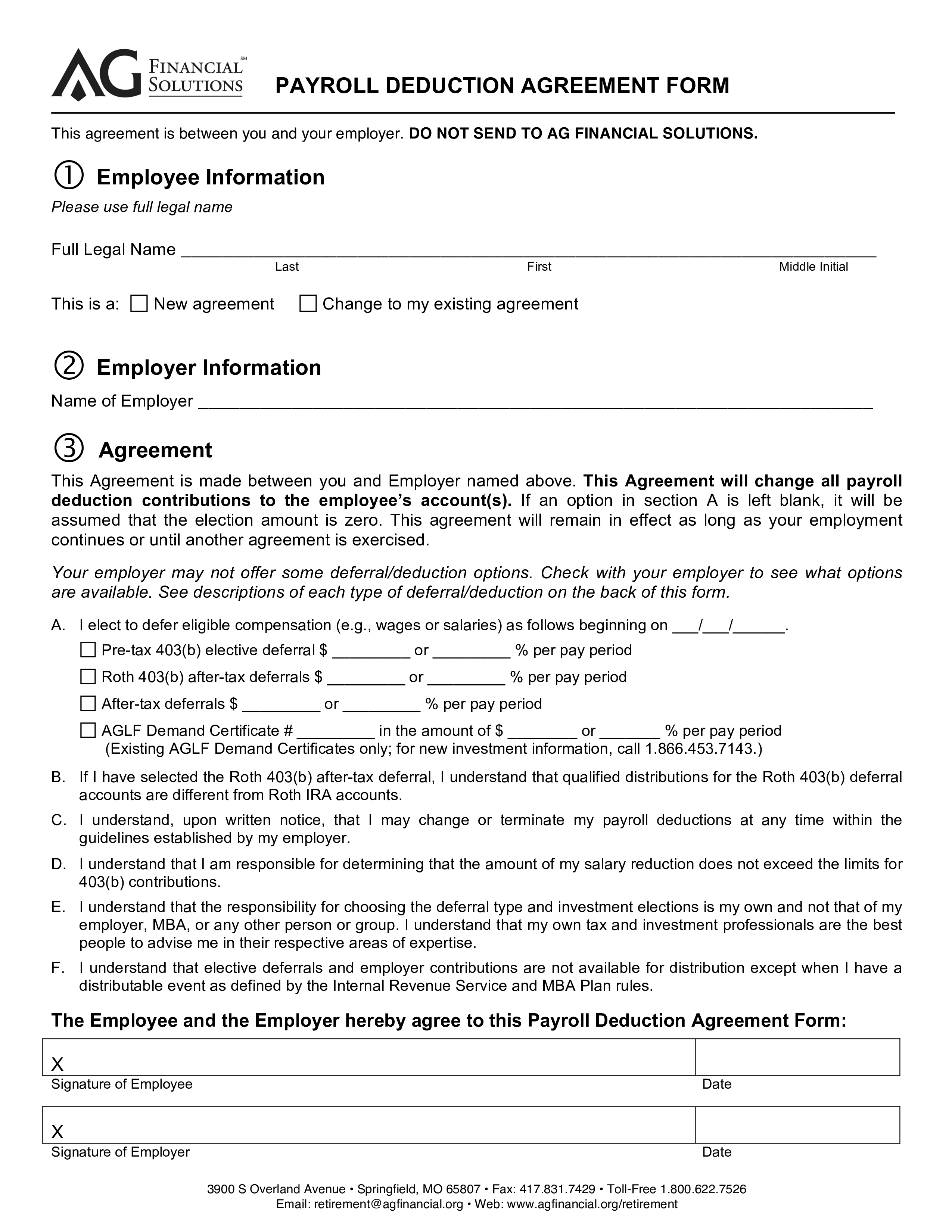

Payroll Service Agreement Payroll Damages

Web we last updated the payroll deduction agreement in february 2023, so this is the latest version of form 2159, fully updated for tax year 2022. Each employee who desires to receive electronic transfer of funds due as wages or salary will provide employer with a direct deposit authorization agreement. Web payroll until available funds are sufficient to process the.

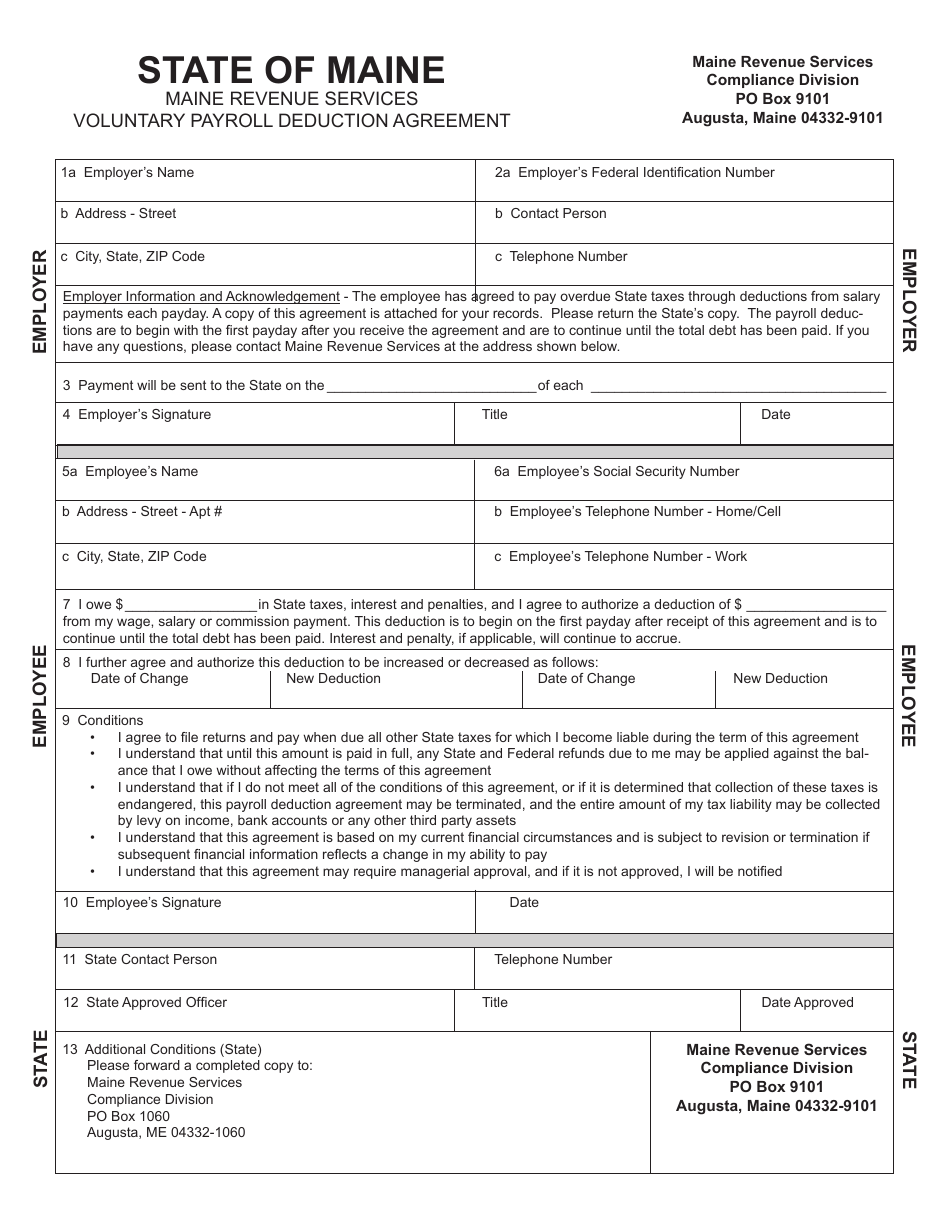

Maine Voluntary Payroll Deduction Agreement Form Download Fillable PDF

Request for wage determination and response to request. Employee’s name and address, amount of payment, date of payment, and identification of account into which the funds are deposited (the “vouchers”). Web this section provides procedures for processing payroll deduction agreements and direct debit installment agreements. Cocodoc is the best place for you to go, offering you a free and easy.

FREE 65+ Loan Agreement Form Example in PDF MS Word

2) from equal deductions from the next pay periods immediatel. Web how to make payments please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee. Web a payroll agreement is the contractual arrangement by which a business grants a payroll services firm the authority to process employee payroll, disburse paychecks and.

Payroll Deduction Agreement Free Download

Web looking for payroll service agreement template to fill? Hr is responsible for reaching a new agreement with the employee or deducting the entire remaining amount from the final paycheck. You can get the loan only by submitting this paper to your management. The direct deposit authorization agreement will authorize employer to use we Include any additional earnings or deductions.

FREE 9+ Sample Payroll Advance Forms in PDF MS Word

Web payroll until available funds are sufficient to process the payroll. Employee stock payroll deduction plan (the “plan”) is intended to provide a method by which eligible employees of domino’s pizza, inc. Web looking for payroll service agreement template to fill? Web this section provides procedures for processing payroll deduction agreements and direct debit installment agreements. Web by signing this.

Payroll Deduction Agreement Form Templates at

Make your check payable to the “united states treasury.” to insure proper credit, please write your employee’s name and social security number on each payment. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Federal id# t y p e a q u o t e.

Payroll Deduction Authorization form Template Awesome 11 Payroll

Save or instantly send your ready documents. Web payroll until available funds are sufficient to process the payroll. Each employee who desires to receive electronic transfer of funds due as wages or salary will provide employer with a direct deposit authorization agreement. I (we) hereby authorize and release my employer, to make payment of any amounts owing to me (either.

Payroll Form Templates charlotte clergy coalition

An employer may enter into an agreement with a psp under which the employer authorizes the psp to perform one or more of the following acts on the employer’s behalf: Web in order to pay the employer’s employees, the processor will prepare vouchers which will include, at a minimum, the following information: Web a payroll service provider (psp) is a.

Payroll deduction agreement in Word and Pdf formats

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If they approve, hr must create an agreement form on pay advance and repayment terms. 1) one payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this.

Employee’s Name And Address, Amount Of Payment, Date Of Payment, And Identification Of Account Into Which The Funds Are Deposited (The “Vouchers”).

Web start by opening the payroll report generator software on your computer. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Save or instantly send your ready documents. Web 1 | p a g e payroll service agreement this payroll service agreement (this “agreement”) is entered into by and between _______________________ , (the “employer”) and the payroll department, inc., (“tpd”) as of the date of the last signature on this agreement below.

Each Employee Who Desires To Receive Electronic Transfer Of Funds Due As Wages Or Salary Will Provide Employer With A Direct Deposit Authorization Agreement.

Easily fill out pdf blank, edit, and sign them. 1) one payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made or: There, you will write your personal details, the sum you are asking for, and the adequate payment method. Web how to make payments please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee.

20080701 Kckps Cbiz Flex Direct Deposit.

If they approve, hr must create an agreement form on pay advance and repayment terms. I (we) hereby authorize and release my employer, to make payment of any amounts owing to me (either of us). (“domino’s”) and such of its subsidiaries and affiliates as the board of directors of domino’s (the “board”) may from time to time. Include any additional earnings or deductions for each.

Cocodoc Is The Best Place For You To Go, Offering You A Free And Easy To Edit Version Of Payroll Service Agreement Template As You Need.

An employer may enter into an agreement with a psp under which the employer authorizes the psp to perform one or more of the following acts on the employer’s behalf: 2) from equal deductions from the next pay periods immediatel. Web this payroll support program agreement, including the application and all supporting documents submitted by the recipient and the payroll support certification attached hereto (collectively, agreement), memorializes the binding terms and conditions applicable to the recipient. Make your check payable to the “united states treasury.” to insure proper credit, please write your employee’s name and social security number on each payment.