Oregon Form Or 40 Instructions

Oregon Form Or 40 Instructions - Web there’s a time limit for filing an amended return. • file electronically—it’s fast, easy, and. If you include a payment with your return, don’t include form. Web form 40 is an oregon individual income tax form. Web the filing deadline for calendar year 2016 is april 18, 2017. Web forms and instructions: Web first time using this ssn (see instructions) deceased first time using this ssn (see instructions) applied for itin applied for itin married filing jointly qualifying surviving. Select a heading to view its forms, then u se the search feature to locate a form or publication. Web view all of the current year's forms and publications by popularity or program area. If you need more information, see.

For more information, see “amended. Web oregon form 40 instructions new information special oregon medical deduction. If you can’t pay all or a portion of your tax by the due date, it’s important to file your return anyway to avoid a. Web view all of the current year's forms and publications by popularity or program area. Use form 40p if any one of the following is true: Web first time using this ssn (see instructions) deceased first time using this ssn (see instructions) applied for itin applied for itin married filing jointly qualifying surviving. • these instructions aren’t a complete statement of laws or oregon department of revenue rules. If you need more information, see. This form is for income earned in tax year 2022, with tax returns. Select a heading to view its forms, then u se the search feature to locate a form or publication.

Web first time using this ssn (see instructions) deceased first time using this ssn (see instructions) applied for itin applied for itin married filing jointly qualifying surviving. Web forms and instructions: Web view all of the current year's forms and publications by popularity or program area. Use form 40p if any one of the following is true: • these instructions aren’t a complete statement of laws or oregon department of revenue rules. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Web form 40 is an oregon individual income tax form. Web oregon form 40 instructions new information special oregon medical deduction. If you need more information, see. If you include a payment with your return, don’t include form.

Oregon Form Wr 2017 Fill and Sign Printable Template Online US

If you can’t pay all or a portion of your tax by the due date, it’s important to file your return anyway to avoid a. Web view all of the current year's forms and publications by popularity or program area. Web form 40 is an oregon individual income tax form. Web forms and instructions: Select a heading to view its.

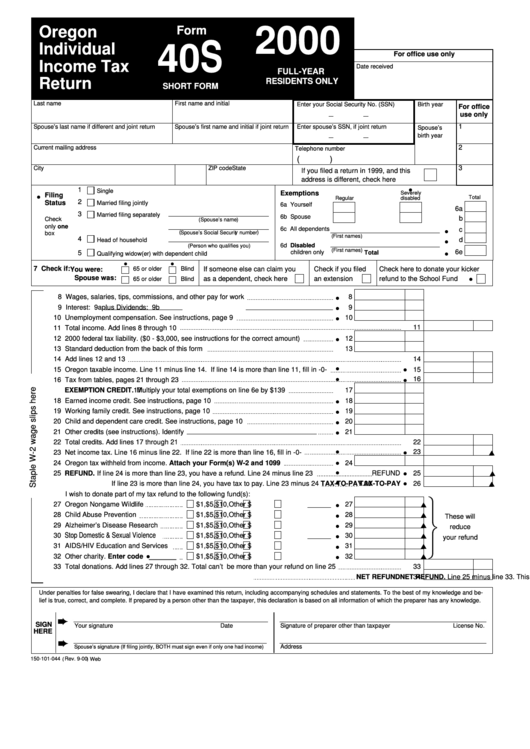

Form 40s Oregon Individual Tax Return 2000 printable pdf

• file electronically—it’s fast, easy, and. Web form 40 is an oregon individual income tax form. If you include a payment with your return, don’t include form. • these instructions aren’t a complete statement of laws or oregon department of revenue rules. The special oregon medical deduction is no longer available.

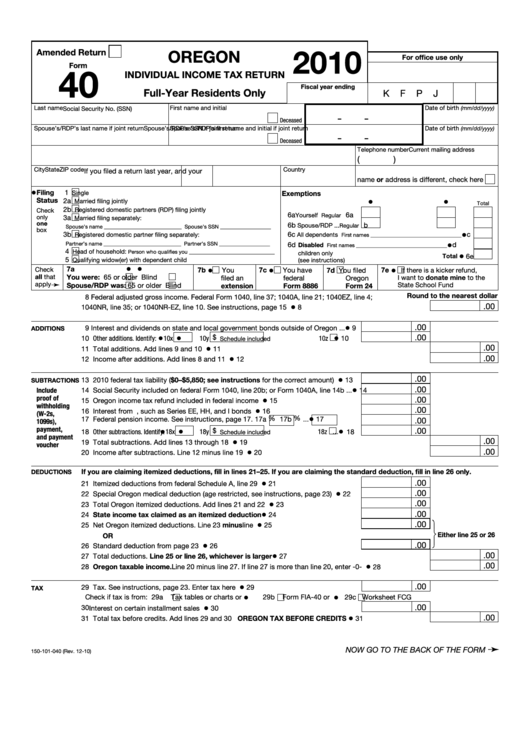

Fillable Form 40 Oregon Individual Tax Return (FullYear

• file electronically—it’s fast, easy, and. Use form 40p if any one of the following is true: The special oregon medical deduction is no longer available. Web form 40 is an oregon individual income tax form. Web there’s a time limit for filing an amended return.

2018 Form OR OR40V Fill Online, Printable, Fillable, Blank pdfFiller

• file electronically—it’s fast, easy, and. Web the filing deadline for calendar year 2016 is april 18, 2017. The special oregon medical deduction is no longer available. Web there’s a time limit for filing an amended return. For more information, see “amended.

Oregon W4 2021 With Instructions 2022 W4 Form

• file electronically—it’s fast, easy, and. Use form 40p if any one of the following is true: You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Select a heading to view its forms, then u se the search feature to locate a form or publication. Web first time using this ssn (see.

2018 Oregon Tax Fill Out and Sign Printable PDF Template signNow

Web there’s a time limit for filing an amended return. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. If you can’t pay all or a portion of your tax by the due date, it’s important to file your return anyway to avoid a. The special oregon medical deduction is no longer.

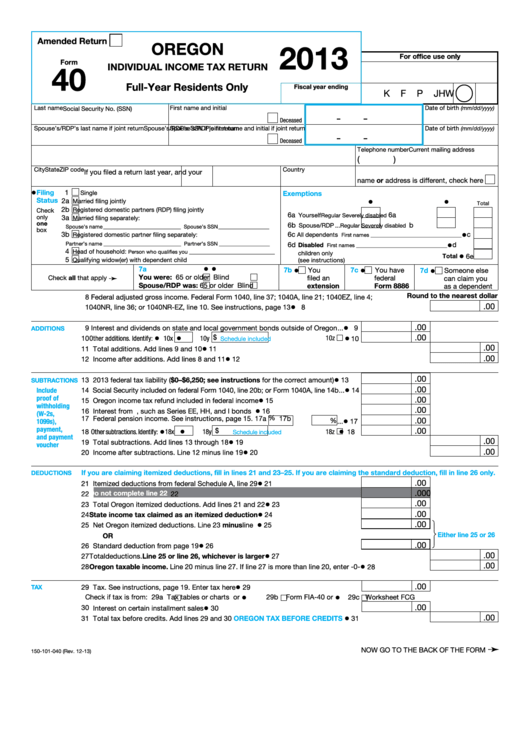

Fillable Form 40 Oregon Individual Tax Return 2013 printable

If you can’t pay all or a portion of your tax by the due date, it’s important to file your return anyway to avoid a. Use form 40p if any one of the following is true: You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. For more information, see “amended. Web first.

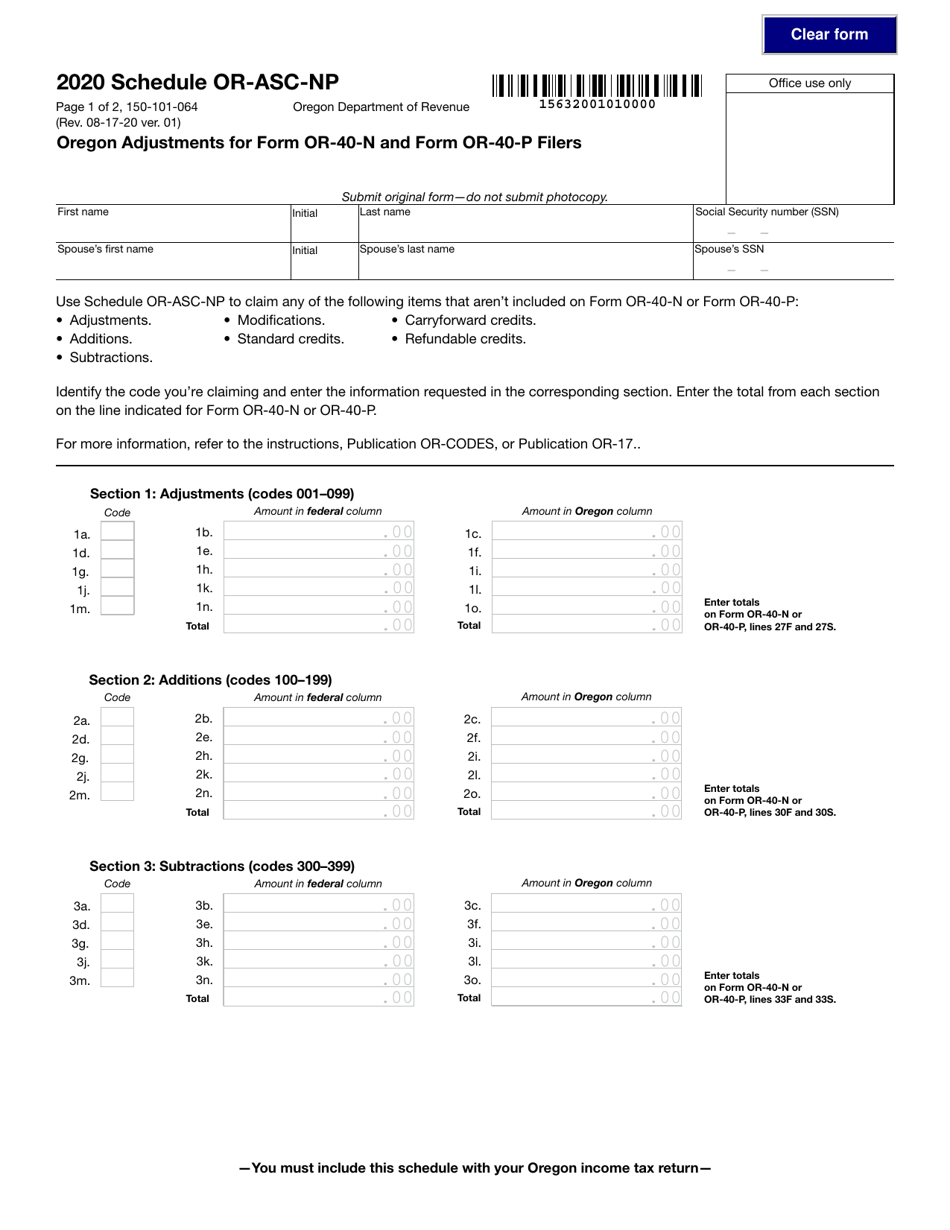

Form 150101064 Schedule ORASCNP Download Fillable PDF or Fill

If you need more information, see. Use form 40p if any one of the following is true: The special oregon medical deduction is no longer available. Web view all of the current year's forms and publications by popularity or program area. Web there’s a time limit for filing an amended return.

2020 Form OR OR40V Fill Online, Printable, Fillable, Blank pdfFiller

You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Web oregon form 40 instructions new information special oregon medical deduction. Web there’s a time limit for filing an amended return. If you can’t pay all or a portion of your tax by the due date, it’s important to file your return anyway.

Oregon Form 40x Fill Online, Printable, Fillable, Blank pdfFiller

The special oregon medical deduction is no longer available. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Web there’s a time limit for filing an amended return. If you need more information, see. This form is for income earned in tax year 2022, with tax returns.

If You Include A Payment With Your Return, Don’t Include Form.

If you need more information, see. Web there’s a time limit for filing an amended return. For more information, see “amended. Web form 40 is an oregon individual income tax form.

Web Forms And Instructions:

Use form 40p if any one of the following is true: Web find out more at www.oregon.gov/odva. Web oregon form 40 instructions new information special oregon medical deduction. Web the filing deadline for calendar year 2016 is april 18, 2017.

Web First Time Using This Ssn (See Instructions) Deceased First Time Using This Ssn (See Instructions) Applied For Itin Applied For Itin Married Filing Jointly Qualifying Surviving.

• file electronically—it’s fast, easy, and. Select a heading to view its forms, then u se the search feature to locate a form or publication. The special oregon medical deduction is no longer available. • these instructions aren’t a complete statement of laws or oregon department of revenue rules.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns.

You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. If you can’t pay all or a portion of your tax by the due date, it’s important to file your return anyway to avoid a. Web view all of the current year's forms and publications by popularity or program area.