Oklahoma Form 566

Oklahoma Form 566 - Please read the information on pages 2 and 3 carefully. Web in may, gov. An expert does your return, start to finish. Provide this form and supporting documents with your oklahoma tax return. Name as shown on return. Check the box on line 1b to indicate whether the credit is based on an investment in depreciable. The current tax year is 2022, and most states will release updated tax forms between. Web question about oklahoma form 566 (2020) i came across this form 566 and there is a requirement that states the employee may not have been working in oklahoma before. Web taxformfinder provides printable pdf copies of 55 current oklahoma income tax forms. Notice to county assessor of cancellation of oklahoma.

What does this new statute do? Web employee benefits division newsroom search results enrollment calculator benefits department provider directory flexible spending health savings account. Stitt signed house bill 2759 into law. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Web oklahoma tax is computed based on line 13 of form 511. Check the box on line 1b to indicate whether the credit is based on an investment in depreciable. To determine the oklahoma net. Name as shown on return. Full service for personal taxes full service for business taxes. Web this new credit has been added starting in tax year 2020.

Web taxformfinder provides printable pdf copies of 55 current oklahoma income tax forms. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Stitt signed house bill 2759 into law. 2357.405 definitions “qualified software or cybersecurity employee” means any person employed. The current tax year is 2022, and most states will release updated tax forms between. Notice to county assessor of cancellation of oklahoma. What does this new statute do? Web this new credit has been added starting in tax year 2020. An expert does your return, start to finish. Must provide oklahoma form 566.

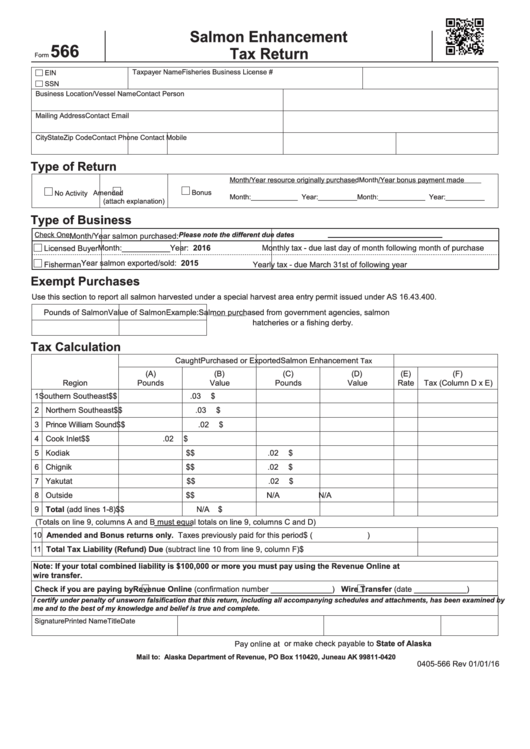

Form 566 Salmon Enhancement Tax Return Alaska Department Of Revenue

Must provide oklahoma form 566. 2357.405 definitions “qualified software or cybersecurity employee” means any person employed. Web oklahoma tax is computed based on line 13 of form 511. Full service for personal taxes full service for business taxes. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on.

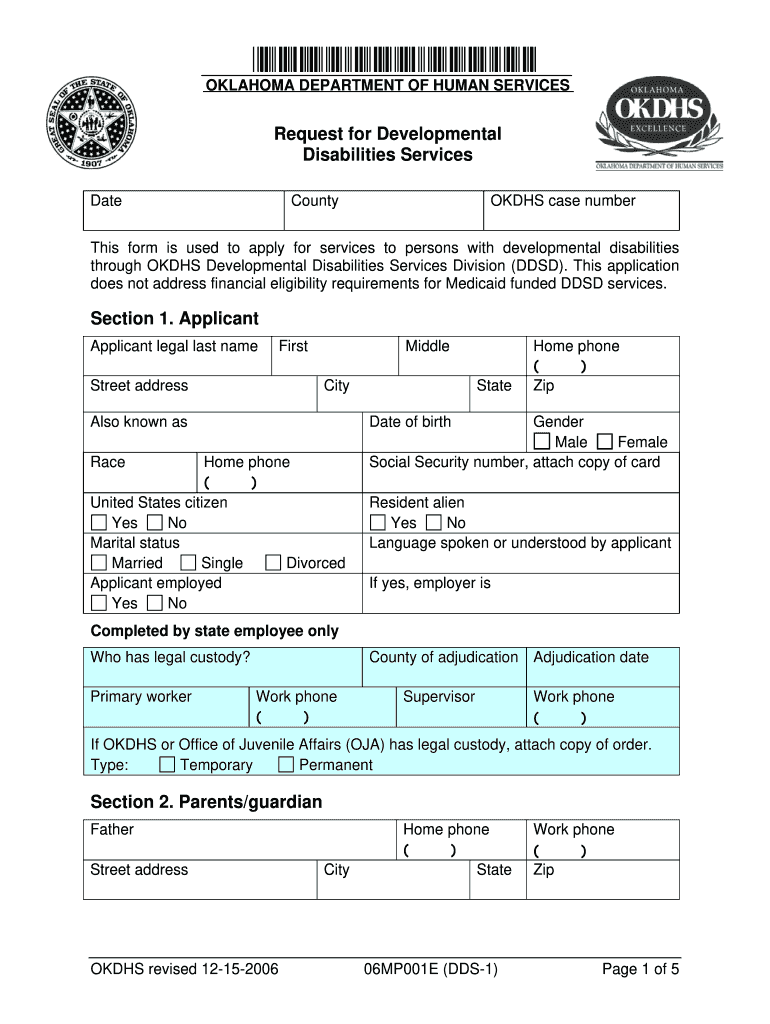

Oklahoma Form 06mp001e Dated 9 22 15 Fill Out and Sign Printable PDF

Web question about oklahoma form 566 (2020) i came across this form 566 and there is a requirement that states the employee may not have been working in oklahoma before. Provide this form and supporting documents with your oklahoma tax return. Web taxformfinder provides printable pdf copies of 55 current oklahoma income tax forms. Notice to county assessor of cancellation.

2019 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Web taxformfinder provides printable pdf copies of 55 current oklahoma income tax forms. The current tax year is 2022, and most states will release updated tax forms between. Notice to county assessor of cancellation of oklahoma. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma.

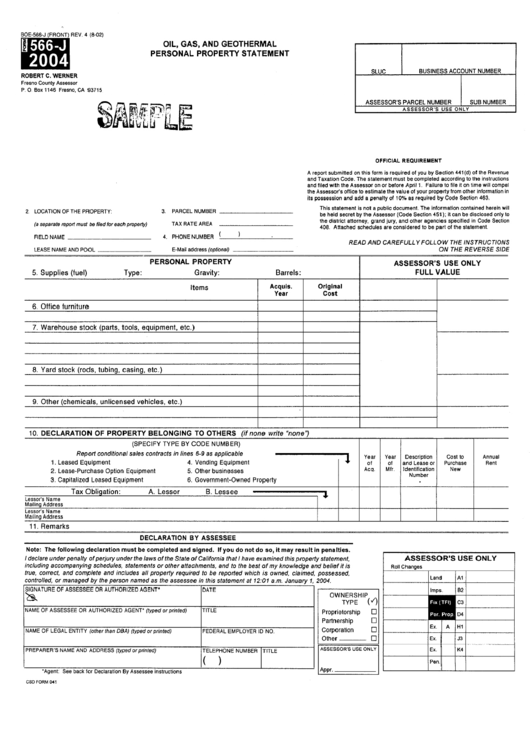

Form 566J Oil, Gas, And Geotermal Personal Property Statement 2004

Please read the information on pages 2 and 3 carefully. Name as shown on return. 2357.405 definitions “qualified software or cybersecurity employee” means any person employed. Provide this form and supporting documents with your oklahoma tax return. Web in may, gov.

936 Form Oklahoma Fill Online, Printable, Fillable, Blank pdfFiller

An expert does your return, start to finish. Web 1 oklahoma business incentives and tax guide published june 2022 welcome to the 2022 oklahoma business incentives and tax information guide. Web other credits form state of oklahoma name as shown on return: Hb 2759 created an oklahoma credit against income taxes for certain qualified and. Notice to county assessor of.

재료반환표 자재/생산 표준서식

Hb 2759 created an oklahoma credit against income taxes for certain qualified and. Name as shown on return. Full service for personal taxes full service for business taxes. To determine the oklahoma net. 2357.405 definitions “qualified software or cybersecurity employee” means any person employed.

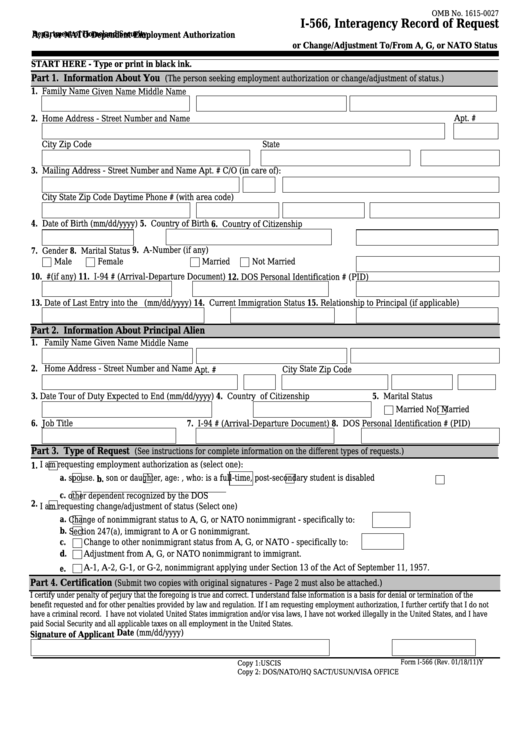

Fillable Form I566 Interagency Record Of Request printable pdf download

To determine the oklahoma net. Must provide oklahoma form 566. Provide this form and supporting documents with your oklahoma tax return. Web other credits form state of oklahoma name as shown on return: Web this new credit has been added starting in tax year 2020.

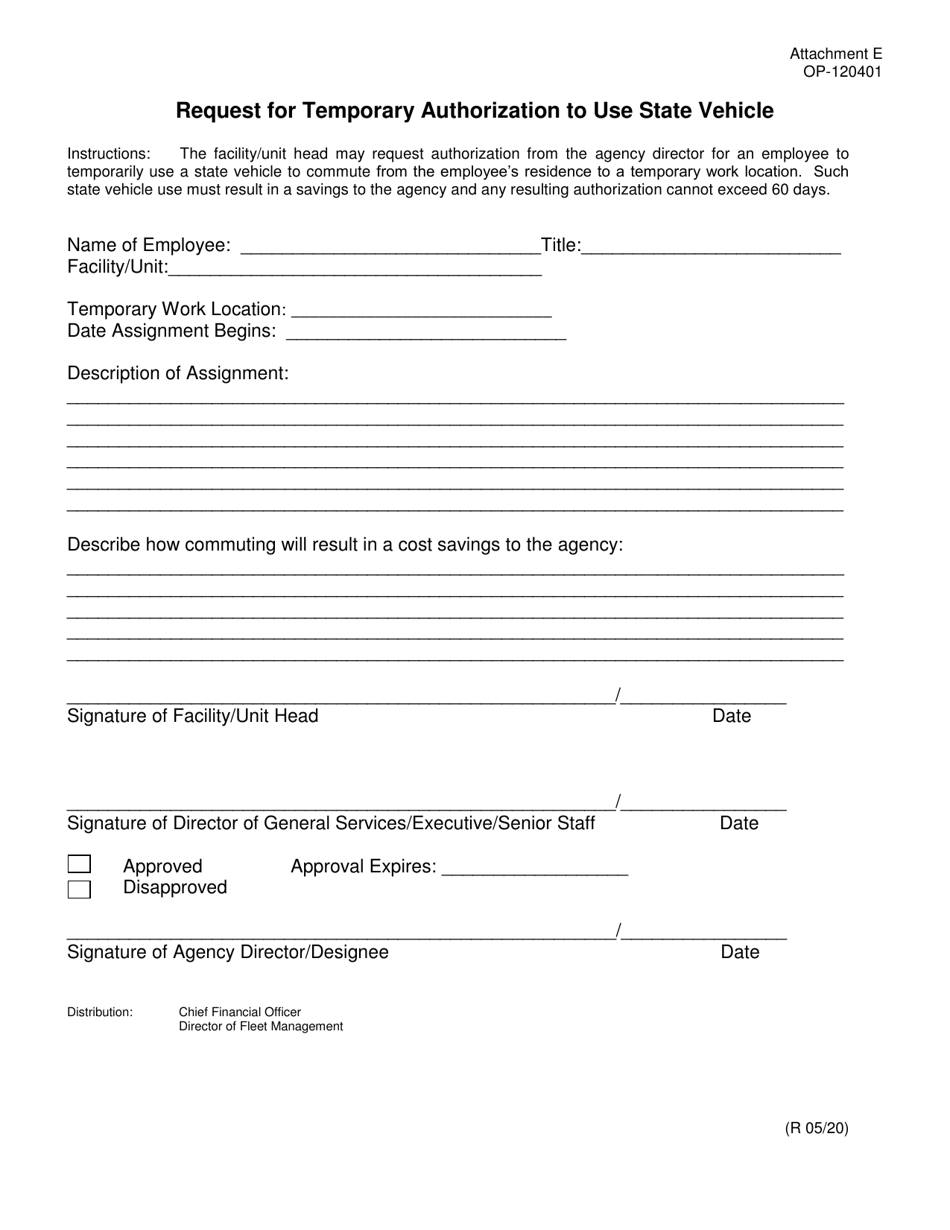

Form OP120401 Attachment E Download Printable PDF or Fill Online

Must provide oklahoma form 566. To determine the oklahoma net. Full service for personal taxes full service for business taxes. An expert does your return, start to finish. 2357.405 definitions “qualified software or cybersecurity employee” means any person employed.

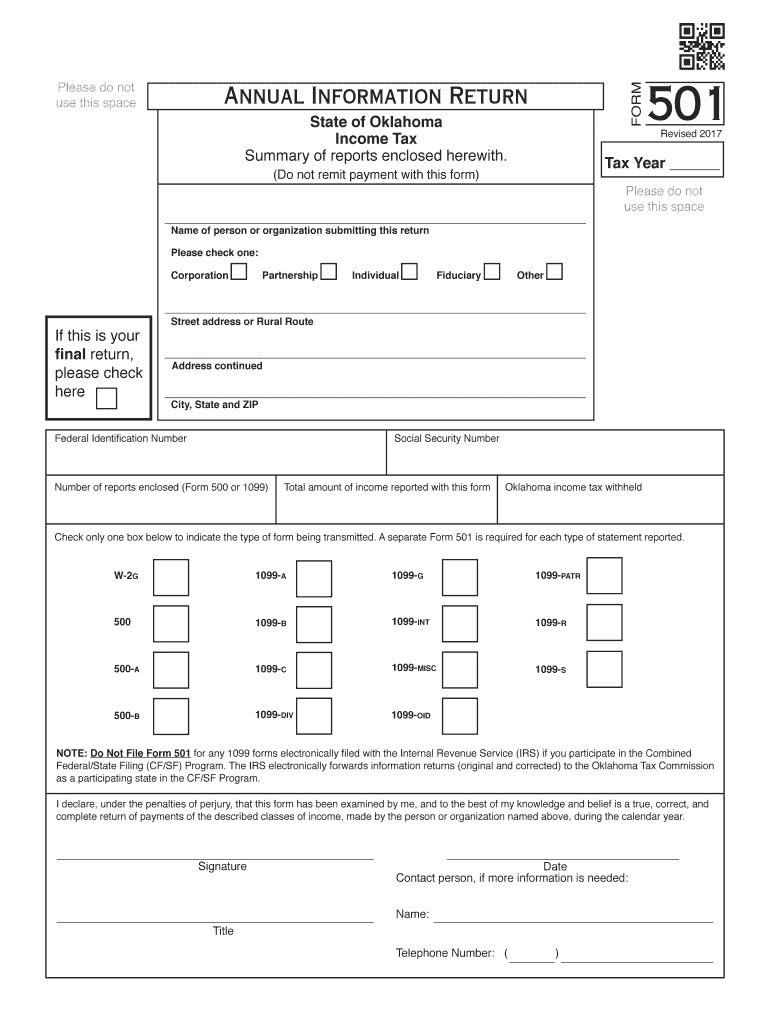

Form 501 Fill Out and Sign Printable PDF Template signNow

Notice to county assessor of cancellation of oklahoma. Web 1 oklahoma business incentives and tax guide published june 2022 welcome to the 2022 oklahoma business incentives and tax information guide. Web in may, gov. To determine the oklahoma net. An expert does your return, start to finish.

Fill Free fillable I566 (USCIS) PDF form

2357.405 definitions “qualified software or cybersecurity employee” means any person employed. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Web question about oklahoma form 566 (2020) i came across this form 566 and there is a requirement that states the employee.

Stitt Signed House Bill 2759 Into Law.

The current tax year is 2022, and most states will release updated tax forms between. Web in may, gov. Must provide oklahoma form 566. Hb 2759 created an oklahoma credit against income taxes for certain qualified and.

Provide This Form And Supporting Documents With Your Oklahoma Tax Return.

Web other credits form state of oklahoma name as shown on return: Web taxformfinder provides printable pdf copies of 55 current oklahoma income tax forms. 2357.405 definitions “qualified software or cybersecurity employee” means any person employed. What does this new statute do?

To Determine The Oklahoma Net.

Web question about oklahoma form 566 (2020) i came across this form 566 and there is a requirement that states the employee may not have been working in oklahoma before. Full service for personal taxes full service for business taxes. Web employee benefits division newsroom search results enrollment calculator benefits department provider directory flexible spending health savings account. Web oklahoma tax is computed based on line 13 of form 511.

Notice To County Assessor Of Cancellation Of Oklahoma.

Please read the information on pages 2 and 3 carefully. Name as shown on return. Web this new credit has been added starting in tax year 2020. Check the box on line 1b to indicate whether the credit is based on an investment in depreciable.