Ok Form 200 Instructions

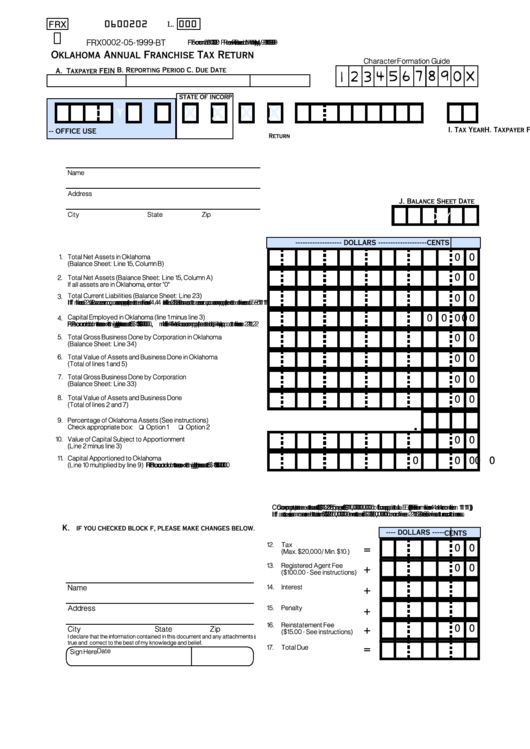

Ok Form 200 Instructions - Edit your oklahoma annual franchise tax return online type text, add images, blackout confidential details, add comments, highlights and more. • complete sections one and. I elect to file one return for both. Time for filing and payment information 5. Save or instantly send your ready documents. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Who must pay the franchise tax? Differences between the old and new taxes 3. Web franchise tax return (form 200). Web fill online, printable, fillable, blank form 200:

Indicate this amount on line 13 of the form 200. Oklahoma annual franchise tax return (state of oklahoma) form. Easily fill out pdf blank, edit, and sign them. I elect to file one return for both. • complete sections one and. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended. Who must pay the franchise tax? Web fill online, printable, fillable, blank form 200: Oklahoma > other > section 2 franchise tax return general information > line 5. Save or instantly send your ready documents.

• complete sections one and. Use fill to complete blank online state of. Web franchise tax return (form 200). Save or instantly send your ready documents. Web fill online, printable, fillable, blank form 200: (line 16 of form 200.) if you. Who must pay the franchise tax? Differences between the old and new taxes 3. I elect to file one return for both. Indicate this amount on line 13 of the form 200.

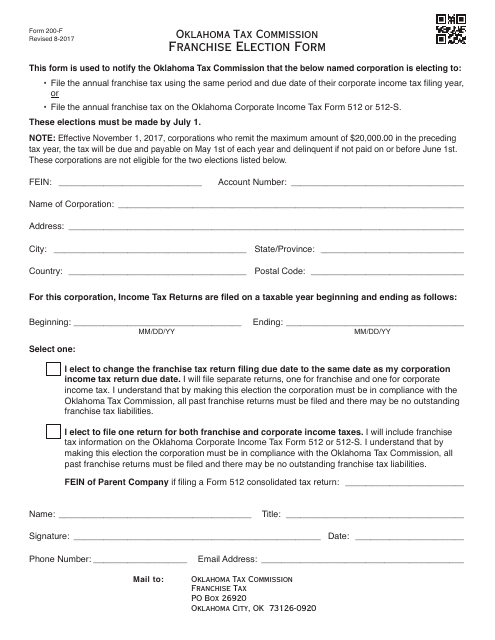

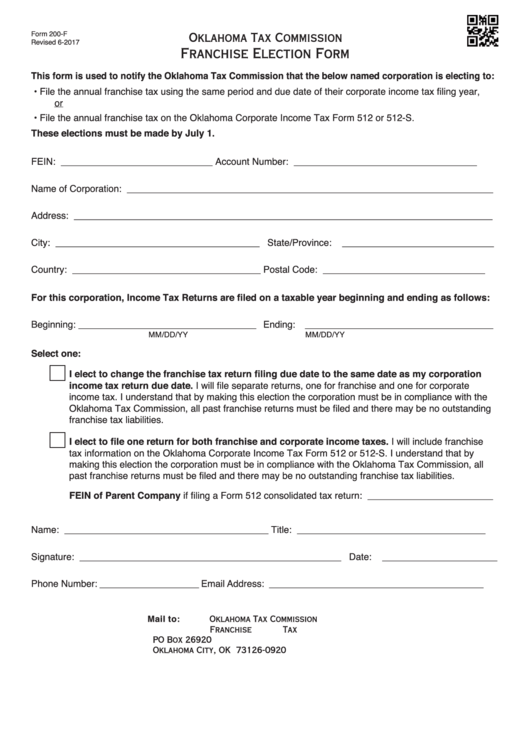

OTC Form 200F Download Fillable PDF or Fill Online Franchise Election

Web to print the form: Time for filing and payment information 5. Save or instantly send your ready documents. Web franchise tax return (form 200). Differences between the old and new taxes 3.

Fillable Form 200F Franchise Election Oklahoma Tax Commission

Liability for filing return 4. Indicate this amount on line 13 of the form 200. Web franchise tax return (form 200). Differences between the old and new taxes 3. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended.

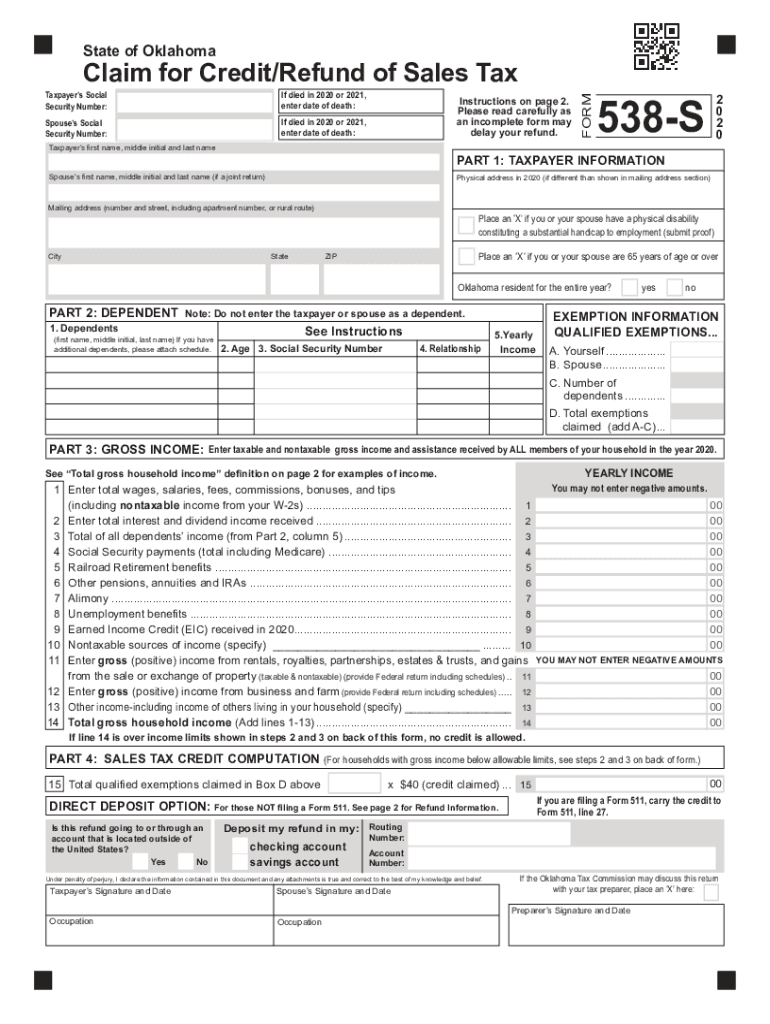

Work oklahoma tax credit online form Fill out & sign online DocHub

Liability for filing return 4. Save or instantly send your ready documents. Who must pay the franchise tax? The remittance of estimated franchise tax must be made on. Sign it in a few clicks draw.

Form CE 200 Sample Electronic forms, Form, 1.state

Sign it in a few clicks draw. Indicate this amount on line 13 of the form 200. Save or instantly send your ready documents. Who must pay the franchise tax? Oklahoma annual franchise tax return (state of oklahoma) form.

TH200 Instructions for Program Operators Free Download

If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Use get form or simply click on the template preview to open it in the. (line 16 of form 200.) if you.

OK Form 729 20152021 Fill and Sign Printable Template Online US

Web fill online, printable, fillable, blank form 200: Sign it in a few clicks draw. Indicate this amount on line 13 of the form 200. Edit your oklahoma annual franchise tax return online type text, add images, blackout confidential details, add comments, highlights and more. Web to print the form:

Does Allbeauty Com Sell Genuine Products?

Easily fill out pdf blank, edit, and sign them. Liability for filing return 4. Differences between the old and new taxes 3. (line 16 of form 200.) if you. Web to print the form:

Form 200 Oklahoma Annual Franchise Tax Return 1999 printable pdf

If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Edit your oklahoma annual franchise tax return online type text, add images, blackout confidential details, add comments, highlights and more. Differences between the old and new taxes 3. The remittance of estimated franchise tax must be made on. Easily fill out pdf blank, edit,.

OK DOC Form 030118B 20132022 Fill and Sign Printable Template Online

(line 16 of form 200.) if you. Edit your oklahoma annual franchise tax return online type text, add images, blackout confidential details, add comments, highlights and more. Oklahoma annual franchise tax return (state of oklahoma) form. I elect to file one return for both. Save or instantly send your ready documents.

Oklahoma > Other > Section 2 Franchise Tax Return General Information > Line 5.

• complete sections one and. I elect to file one return for both. (line 16 of form 200.) if you. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement.

Liability For Filing Return 4.

Time for filing and payment information 5. Use fill to complete blank online state of. Indicate this amount on line 13 of the form 200. Save or instantly send your ready documents.

Corporations That Remitted The Maximum Amount Of Franchise Tax For The Preceding Tax Year Or Have Had Their Corporate Charter Suspended.

Web fill online, printable, fillable, blank form 200: Web to print the form: Who must pay the franchise tax? Edit your oklahoma annual franchise tax return online type text, add images, blackout confidential details, add comments, highlights and more.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Use get form or simply click on the template preview to open it in the. Sign it in a few clicks draw. Web franchise tax return (form 200). Oklahoma annual franchise tax return (state of oklahoma) form.