Ohio Sales Tax Exemption Form

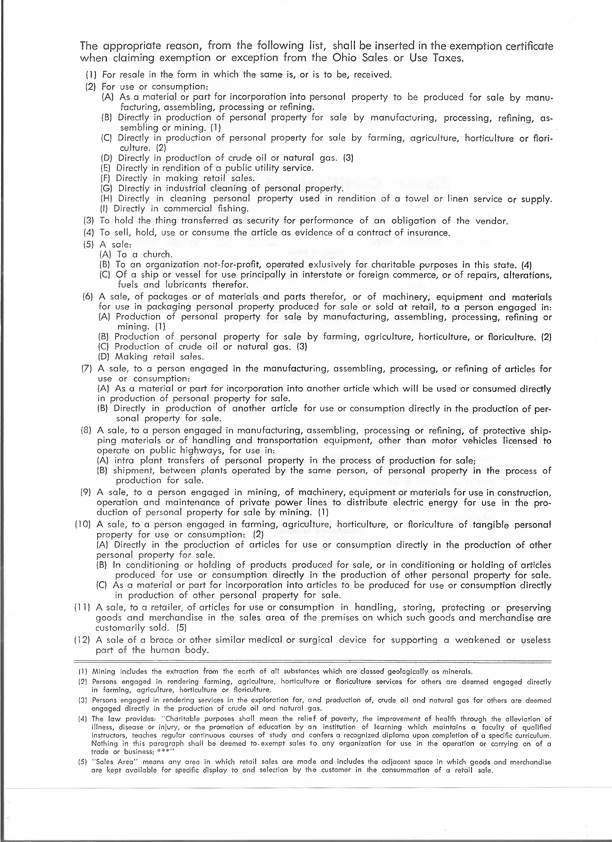

Ohio Sales Tax Exemption Form - If any of these links are broken, or you can't find the form you need, please let us know. Registration — ohio law requires any person or business making taxable retail sales to first obtain a. You can find resale certificates for other states here. Motor vehicle exemption certificate forms 3. Web tax forms tax forms access the forms you need to file taxes or do business in ohio. Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. Launch tax forms resource details related agencies &. Key sales & use tax resources.

You can find resale certificates for other states here. Counties and regional transit authorities may levy additional sales and use taxes. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. For more information about the sales and use tax, look at the options below. Motor vehicle exemption certificate forms 3. Web sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: Web the state sales and use tax rate is 5.75 percent. Most forms are available for download and some can be filled or filed online. Web (1) all sales are presumed to be taxable until the contrary is established. If any of these links are broken, or you can't find the form you need, please let us know.

Most forms are available for download and some can be filled or filed online. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. The exemption certificate may be provided electronically or in hard copy. Counties and regional transit authorities may levy additional sales and use taxes. Key sales & use tax resources. Web (1) all sales are presumed to be taxable until the contrary is established. This certificate is used to make a continuing claim of exemption or exception on purchases from the same vendor or seller. Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: You can find resale certificates for other states here.

Tax Exempt Form Ohio Fill Online, Printable, Fillable, Blank pdfFiller

This exemption certificate is used to claim exemption or exception on a single purchase. Web (1) all sales are presumed to be taxable until the contrary is established. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. If any of these links are.

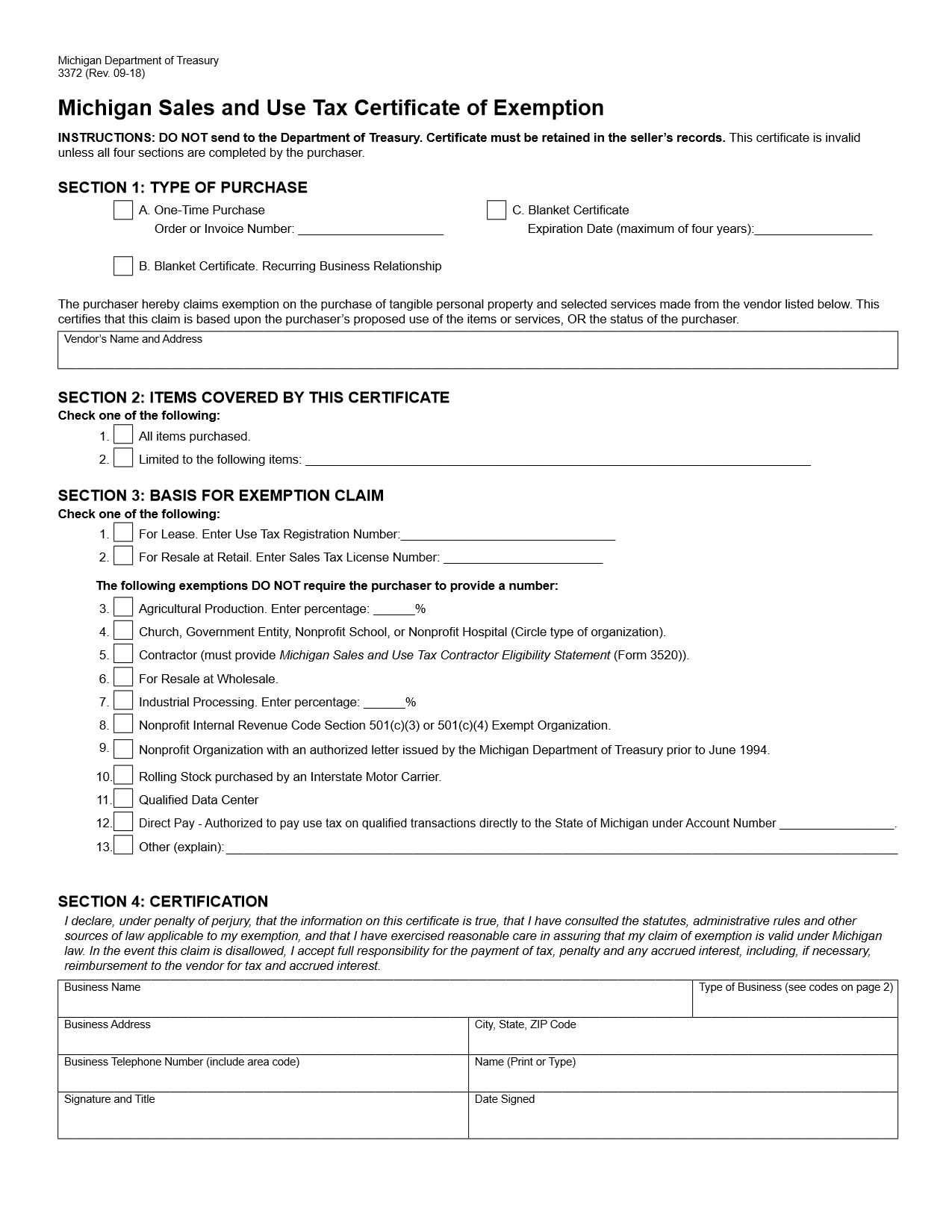

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

This exemption certificate is used to claim exemption or exception on a single purchase. If any of these links are broken, or you can't find the form you need, please let us know. For more information about the sales and use tax, look at the options below. This certificate is used to make a continuing claim of exemption or exception.

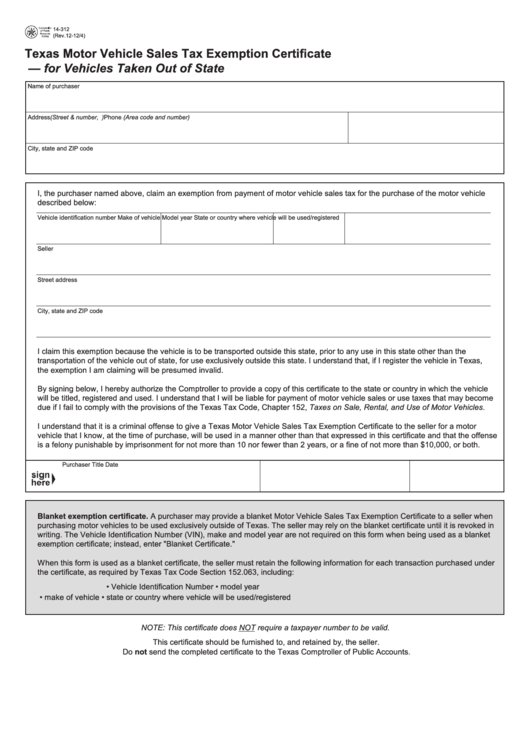

Fillable Motor Vehicle Sales Tax Exemption Certificate printable pdf

Registration — ohio law requires any person or business making taxable retail sales to first obtain a. Most forms are available for download and some can be filled or filed online. The exemption certificate may be provided electronically or in hard copy. Counties and regional transit authorities may levy additional sales and use taxes. Motor vehicle exemption certificate forms 3.

Ohio Tax Exempt

This exemption certificate is used to claim exemption or exception on a single purchase. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web (1) all sales are presumed to be taxable until the contrary is established. The exemption certificate may be provided electronically or in hard copy. Web we have three ohio.

Ohio Department Of Taxation Tax Exempt Form TAXF

Web sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: Web the state sales and use tax rate is 5.75 percent. The exemption certificate may be provided electronically or in hard copy. If any of these links are broken,.

Printable Florida Sales Tax Exemption Certificates

Motor vehicle exemption certificate forms 3. Registration — ohio law requires any person or business making taxable retail sales to first obtain a. Key sales & use tax resources. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi.

Employee's Withholding Exemption Certificate Ohio Free Download

Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below. Motor vehicle exemption certificate forms 3. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. 3/15 tax.ohio.gov.

Migdalia Guyton

If any of these links are broken, or you can't find the form you need, please let us know. Most forms are available for download and some can be filled or filed online. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services.

ohiosalestaxexemptionsigned South Slavic Club of Dayton

Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file. The exemption certificate may be provided electronically or in hard copy. Key sales & use tax resources. For more information about the sales and use tax, look at the options below. You can find resale certificates for other states here.

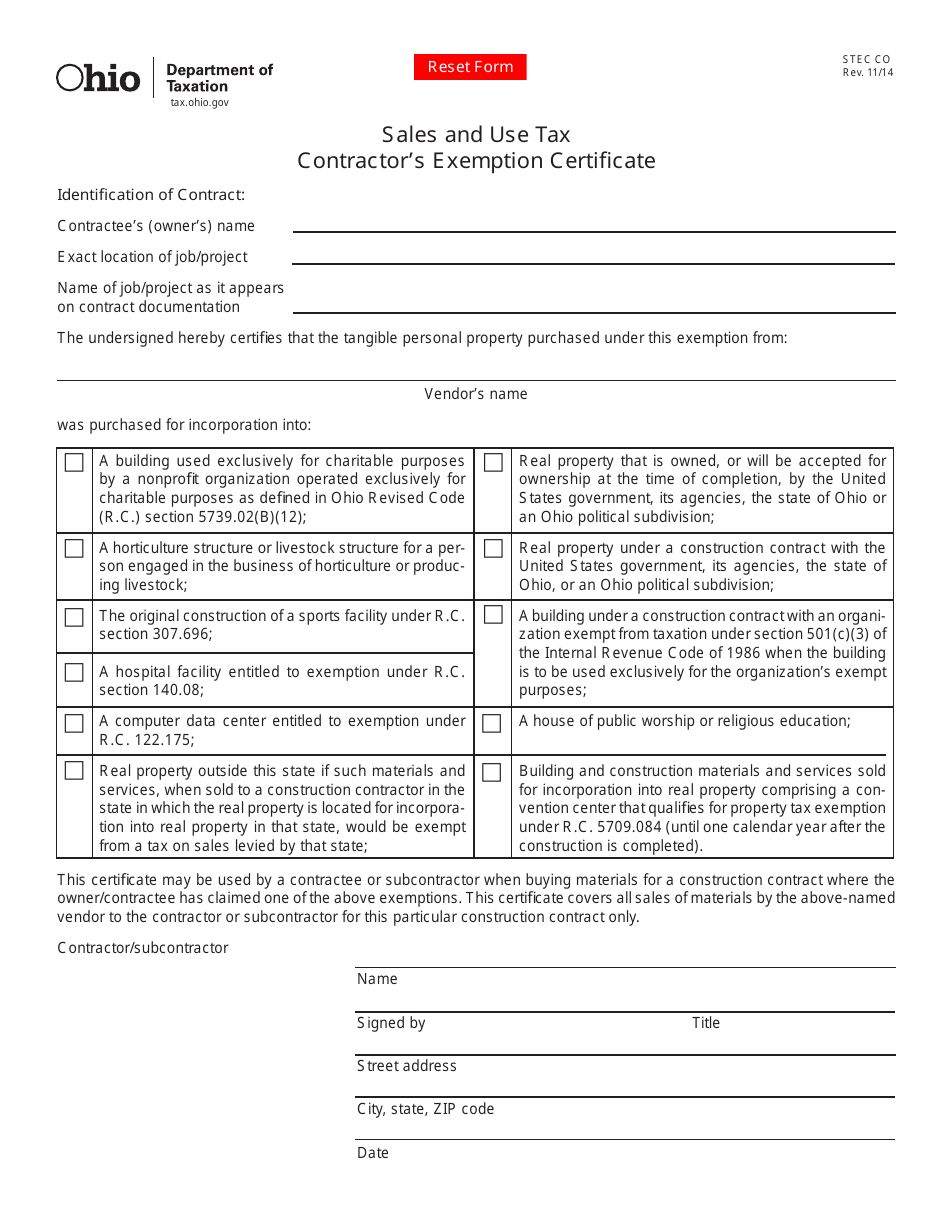

Form STEC CO Download Fillable PDF or Fill Online Contractor's

Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file. Web (1) all sales are presumed to be taxable until the contrary is established. This exemption certificate is used to claim exemption or exception on a single purchase. Web tax forms tax forms access the forms you need to file.

Registration — Ohio Law Requires Any Person Or Business Making Taxable Retail Sales To First Obtain A.

This exemption certificate is used to claim exemption or exception on a single purchase. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate to the vendor or seller. The exemption certificate may be provided electronically or in hard copy. Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file.

This Certificate Is Used To Make A Continuing Claim Of Exemption Or Exception On Purchases From The Same Vendor Or Seller.

Motor vehicle exemption certificate forms 3. Most forms are available for download and some can be filled or filed online. Web the state sales and use tax rate is 5.75 percent. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from:

Key Sales & Use Tax Resources.

Web tax forms tax forms access the forms you need to file taxes or do business in ohio. You can find resale certificates for other states here. Launch tax forms resource details related agencies &. If any of these links are broken, or you can't find the form you need, please let us know.

Web Sales And Use Tax Blanket Exemption Certificate The Purchaser Hereby Claims Exception Or Exemption On All Purchases Of Tangible Personal Property And Selected Services Made Under This Certifi Cate From:

Counties and regional transit authorities may levy additional sales and use taxes. Web (1) all sales are presumed to be taxable until the contrary is established. For more information about the sales and use tax, look at the options below. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes.