Ohio Form 4738

Ohio Form 4738 - Matt dodovich, an attorney supervisor in the. Web ohio pass through entity tax type codes tax period 04738 = pte 4738 return use last day of taxable year 04739 = pte 4738 estimate example: Web ohio has created a new tax form, ohio form it 4738, on which ptes can make the election if they do so on or before the filing deadline. Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b. Web ohio pte 2022 return information last modified: If the amount on a line is. Leave the state use field. Web the ohio historic rehabilitation tax credit is a credit equal to 25% of qualified expenditures to rehabilitate a historic building according to certain preservation criteria. Ohio does list lacert as an approved vendor to.

Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form. Matt dodovich, an attorney supervisor in the. The tos no longer requires pte and fiduciary filers to. Section 4738.021 | collection of. Web section section 4738.01 | motor vehicle salvage definitions. Web ohio pte 2022 return information last modified: Section 4738.02 | motor vehicle salvage dealer's license required. Web the ohio department of taxation jan. Web payment due dates are october 15, 2022, and january 15, 2023. Web ohio pass through entity tax type codes tax period 04738 = pte 4738 return use last day of taxable year 04739 = pte 4738 estimate example:

When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12) to notify the department. Web ohio has created a new tax form, ohio form it 4738, on which ptes can make the election if they do so on or before the filing deadline. Web ohio department of natural resources Web here’s how you know. Leave the state use field. Web section section 4738.01 | motor vehicle salvage definitions. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web ohio pte 2022 return information last modified: Here’s how you know language translation. Section 4738.021 | collection of.

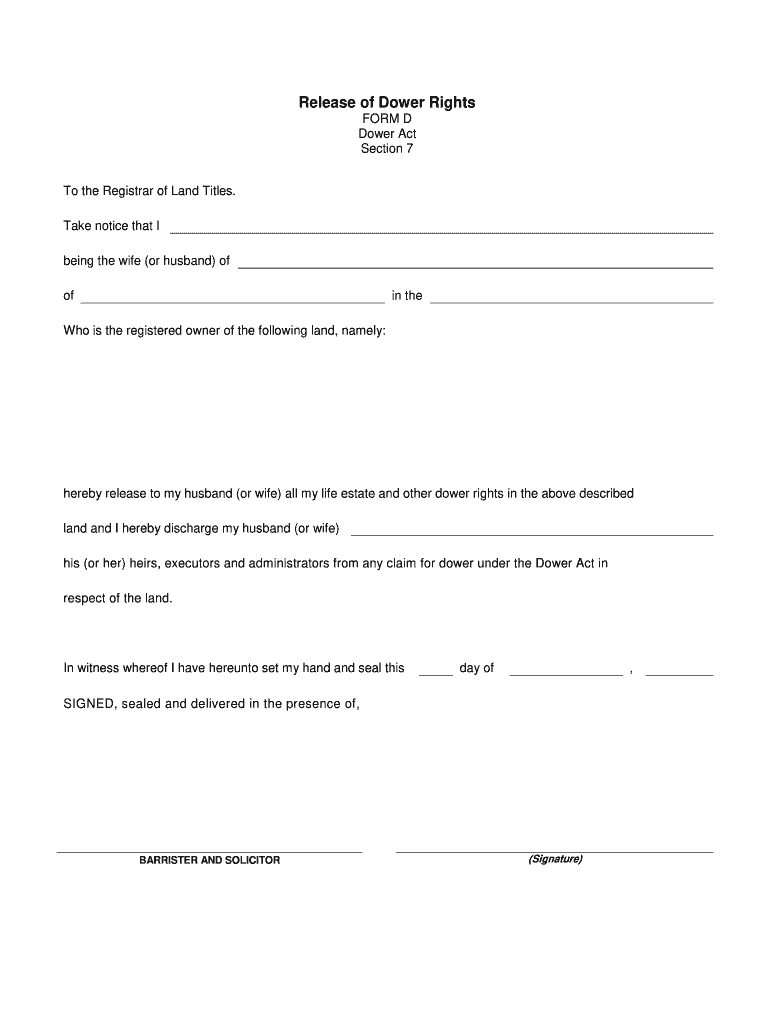

Ohio Dower Release 20202021 Fill and Sign Printable Template Online

Web here’s how you know. Leave the state use field. For taxable year 2022, the due date for filing is april 18,. If the amount on a line is. Web ohio pte 2022 return information last modified:

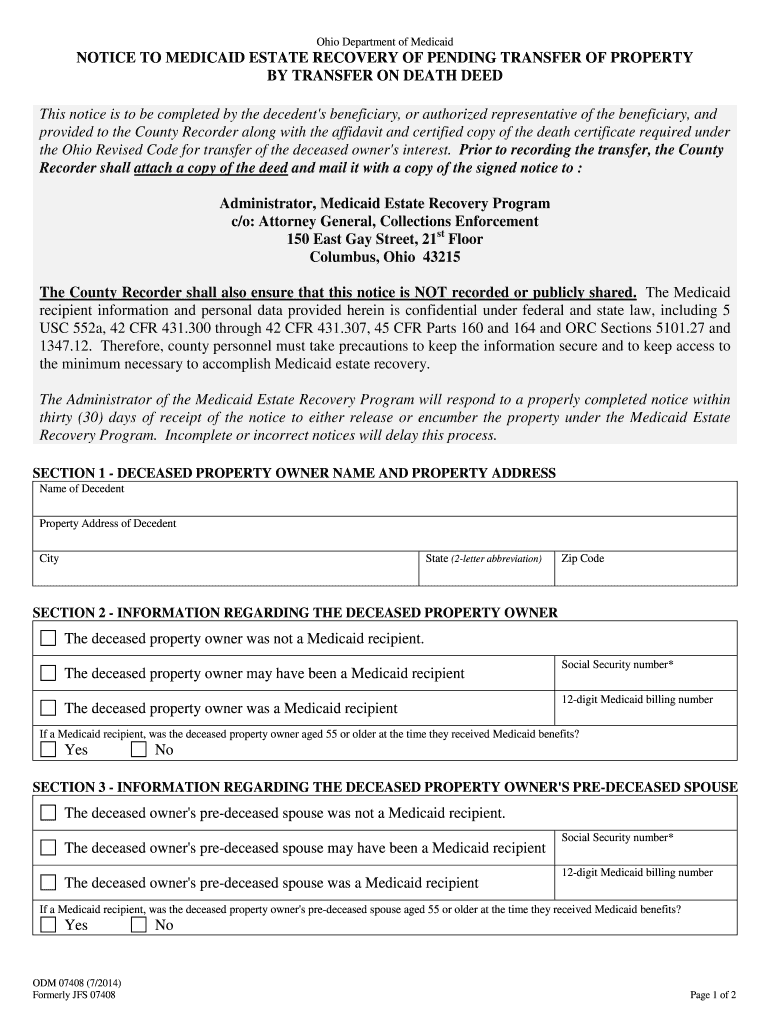

Ohio Form Medicaid Fill Out and Sign Printable PDF Template signNow

Leave the state use field. Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form. Web ohio has created a new tax form, ohio form it 4738, on which ptes can make the election if they do so on or before the filing deadline. When you.

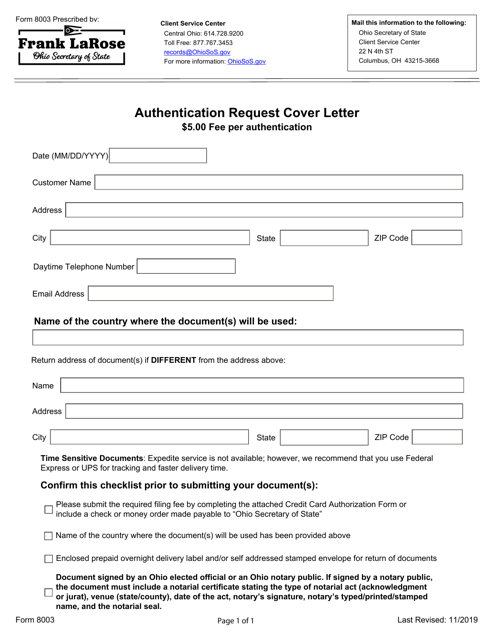

Form 8003 Download Fillable PDF or Fill Online Authentication Request

Leave the state use field. Web the ohio historic rehabilitation tax credit is a credit equal to 25% of qualified expenditures to rehabilitate a historic building according to certain preservation criteria. 02/28/2023 all transferred payments carry to it 4738, line 12 with a supporting statement. If the amount on a line is. The tos no longer requires pte and fiduciary.

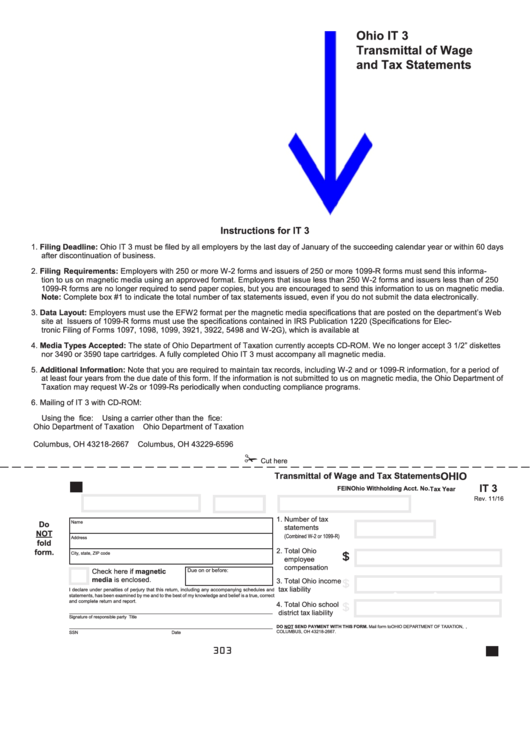

Ohio Form It 3 Transmittal Of Wage And Tax Statements printable pdf

This is effective for years. When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12) to notify the department. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b..

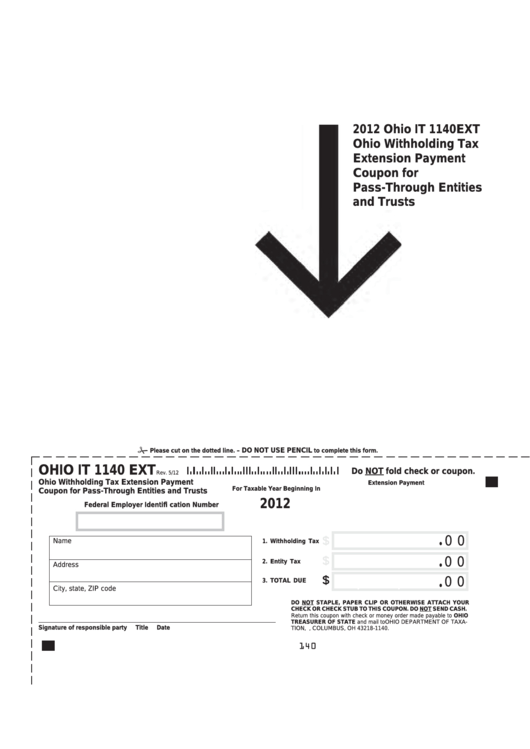

Fillable Ohio Form It 1140 Ext Ohio Withholding Tax Extension Payment

Leave the state use field. The tos no longer requires pte and fiduciary filers to. Web here’s how you know. Web the ohio department of taxation jan. Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form.

Ohio Title Search Fill and Sign Printable Template Online US Legal

Web ohio department of natural resources Web election is made known to the department by filing the it 4738. Section 4738.02 | motor vehicle salvage dealer's license required. Web ohio pte 2022 return information last modified: When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12) to notify the.

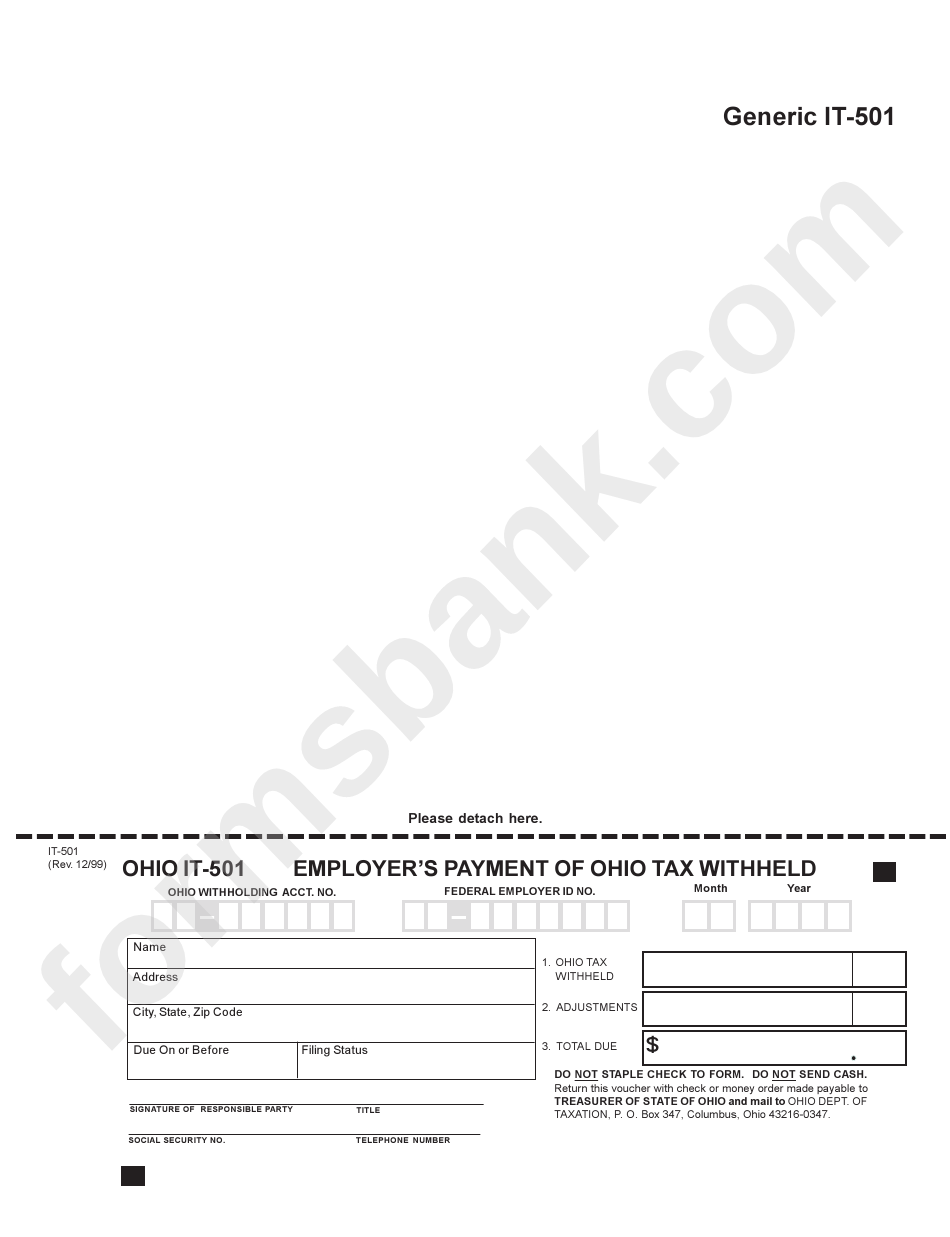

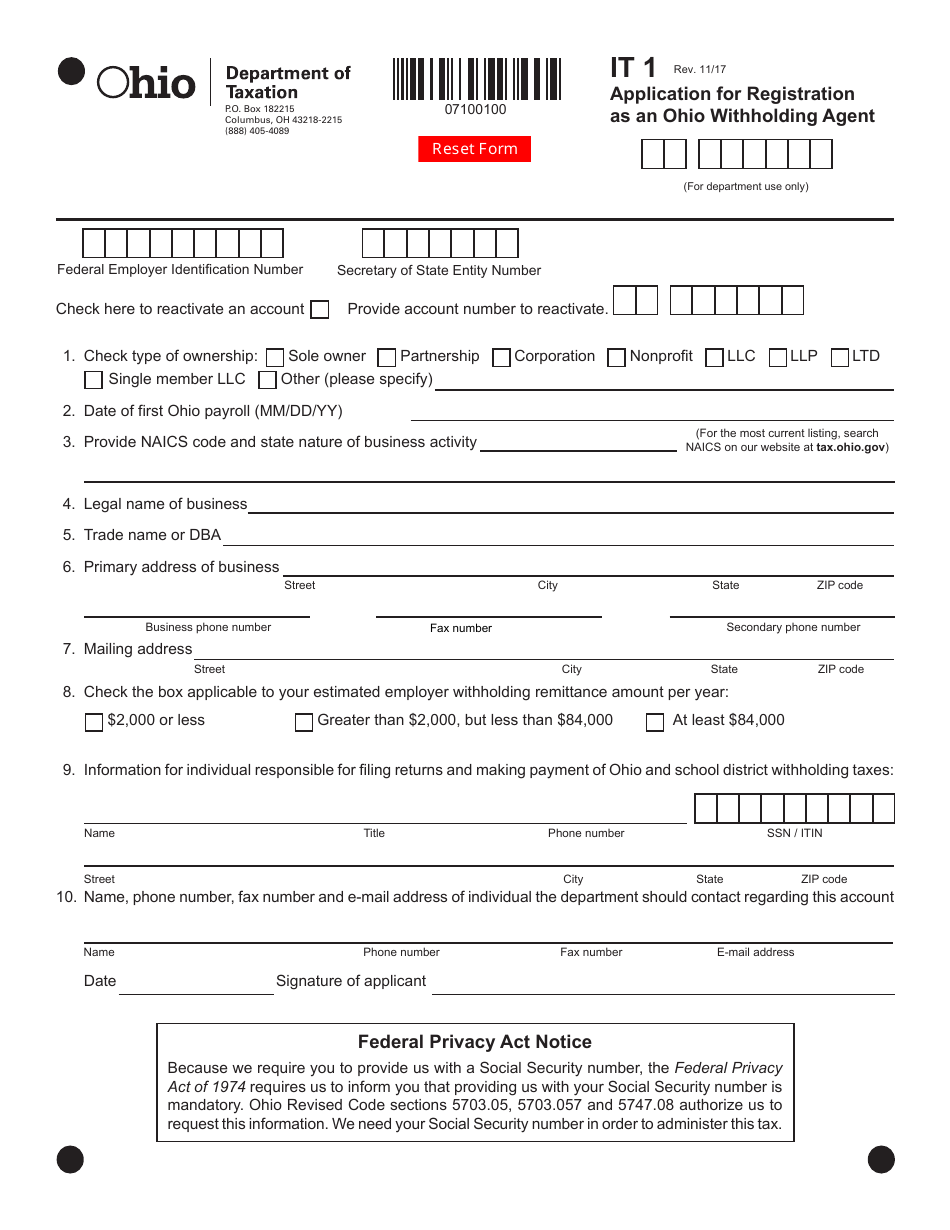

Ohio Form It501 Employers Payment Of Ohio Tax Withheld printable pdf

Web ohio pass through entity tax type codes tax period 04738 = pte 4738 return use last day of taxable year 04739 = pte 4738 estimate example: If the amount on a line is. Web section section 4738.01 | motor vehicle salvage definitions. Web election is made known to the department by filing the it 4738. Web ohio pte 2022.

I9 Form 2021 Printable Customize and Print

Web ohio pte 2022 return information last modified: Web the ohio historic rehabilitation tax credit is a credit equal to 25% of qualified expenditures to rehabilitate a historic building according to certain preservation criteria. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio.

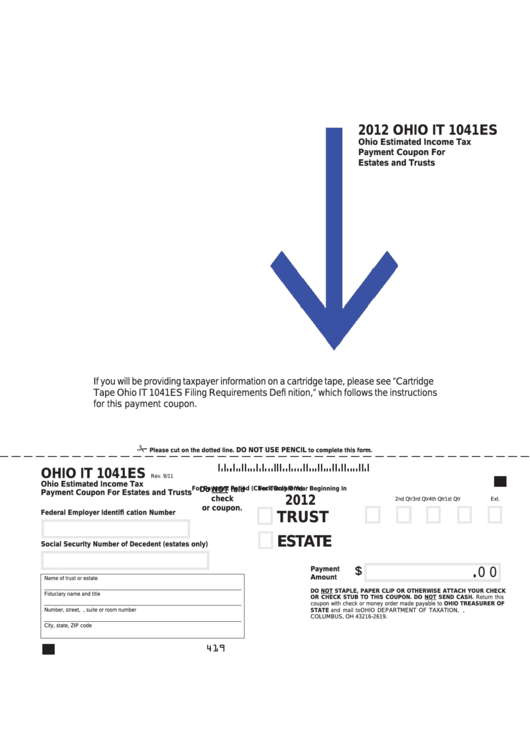

Fillable Ohio Form It 1041es Ohio Estimated Tax Payment Coupon

Ohio does list lacert as an approved vendor to. Section 4738.02 | motor vehicle salvage dealer's license required. Web election is made known to the department by filing the it 4738. Tax rate is 5% for the taxable year beginning january 1, 2022, and for taxable years beginning january 1,. Web the ohio historic rehabilitation tax credit is a credit.

Web Ohio Department Of Natural Resources

Web ohio form 4738 is a new ohio entity tax return and it would be great to be able to e file this return thru the software. If the amount on a line is. Web the ohio department of taxation jan. For taxable year 2022, the due date for filing is april 18,.

Web Ohio Pte 2022 Return Information Last Modified:

Ohio does list lacert as an approved vendor to. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Tax rate is 5% for the taxable year beginning january 1, 2022, and for taxable years beginning january 1,. Web ohio has created a new tax form, ohio form it 4738, on which ptes can make the election if they do so on or before the filing deadline.

Web The Ohio Society Of Cpas Is Offering A Cpe Webinar On Thursday, March 9 At Noon To Cover The New It 4738 Form.

Web section section 4738.01 | motor vehicle salvage definitions. This is effective for years. Web payment due dates are october 15, 2022, and january 15, 2023. Matt dodovich, an attorney supervisor in the.

Here’s How You Know Language Translation.

The tos no longer requires pte and fiduciary filers to. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b. When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12) to notify the department. Web the ohio historic rehabilitation tax credit is a credit equal to 25% of qualified expenditures to rehabilitate a historic building according to certain preservation criteria.