Nys 100 Form Online

Nys 100 Form Online - Double check all the fillable fields to ensure complete. Choose the document template you want from our library of legal forms. You may apply online at. Web execute nys 100 online application within a couple of minutes by following the instructions below: Once completed you can sign your fillable. Web enter your official contact and identification details. Web fill online, printable, fillable, blank nys100 (new york) form. At online banks was 4.89 percent as of july 1, up from 1.75 percent a year earlier, according to depositaccounts.com. This form is to be filed by a petitioner (taxpayer) who. Enter date of first operations in new york state:

Save or instantly send your ready documents. Web form listing by number; Use fill to complete blank online new york state pdf forms for free. Web open the nys 100 fillable form and follow the instructions easily sign the new york state employer registration number lookup with your finger send filled & signed nys100n or save rate the nys unemployment exemption 4.6 satisfied 97 votes handy tips for filling out nys 100 application online Web www.labor.ny.gov for more information and appropriate forms. Utilize a check mark to indicate the answer wherever required. Fillable form # completed by hand name of form purpose of form; Choose the document template you want from our library of legal forms. New york state and local quarterly sales and use tax return. For unemployment insurance, withholding, and wage reporting.

With an online services account, you can make a payment, respond to. Web form listing by number; Web you can register by: Easily fill out pdf blank, edit, and sign them. Web enter your official contact and identification details. Once completed you can sign your fillable. Web online services is the fastest, most convenient way to do business with the tax department. Save or instantly send your ready documents. For unemployment insurance, withholding, and wage reporting. Double check all the fillable fields to ensure complete.

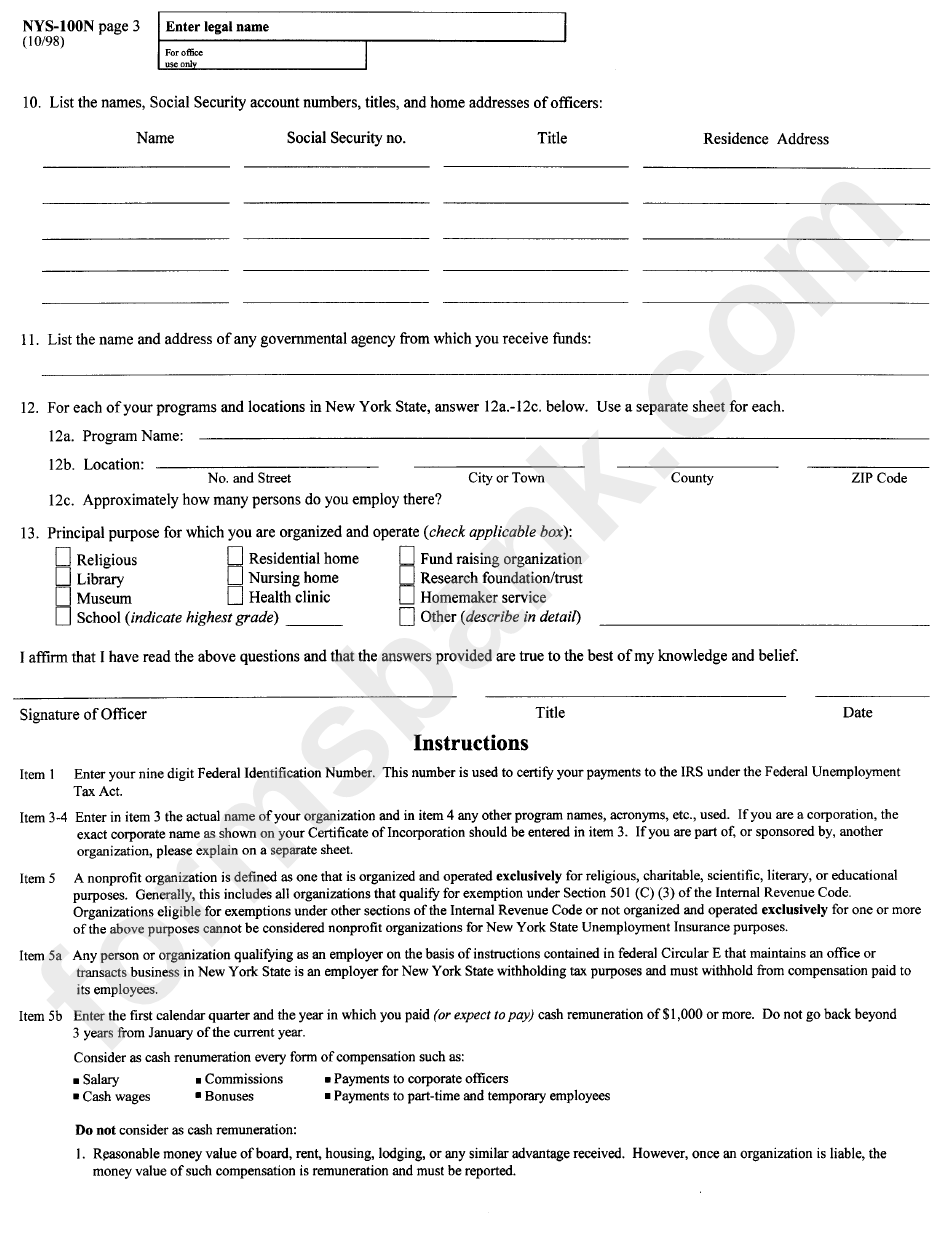

Form Nys100n Instructions printable pdf download

Web form listing by number; New york state and local quarterly sales and use tax return. Web enter your official contact and identification details. At online banks was 4.89 percent as of july 1, up from 1.75 percent a year earlier, according to depositaccounts.com. You may apply online at.

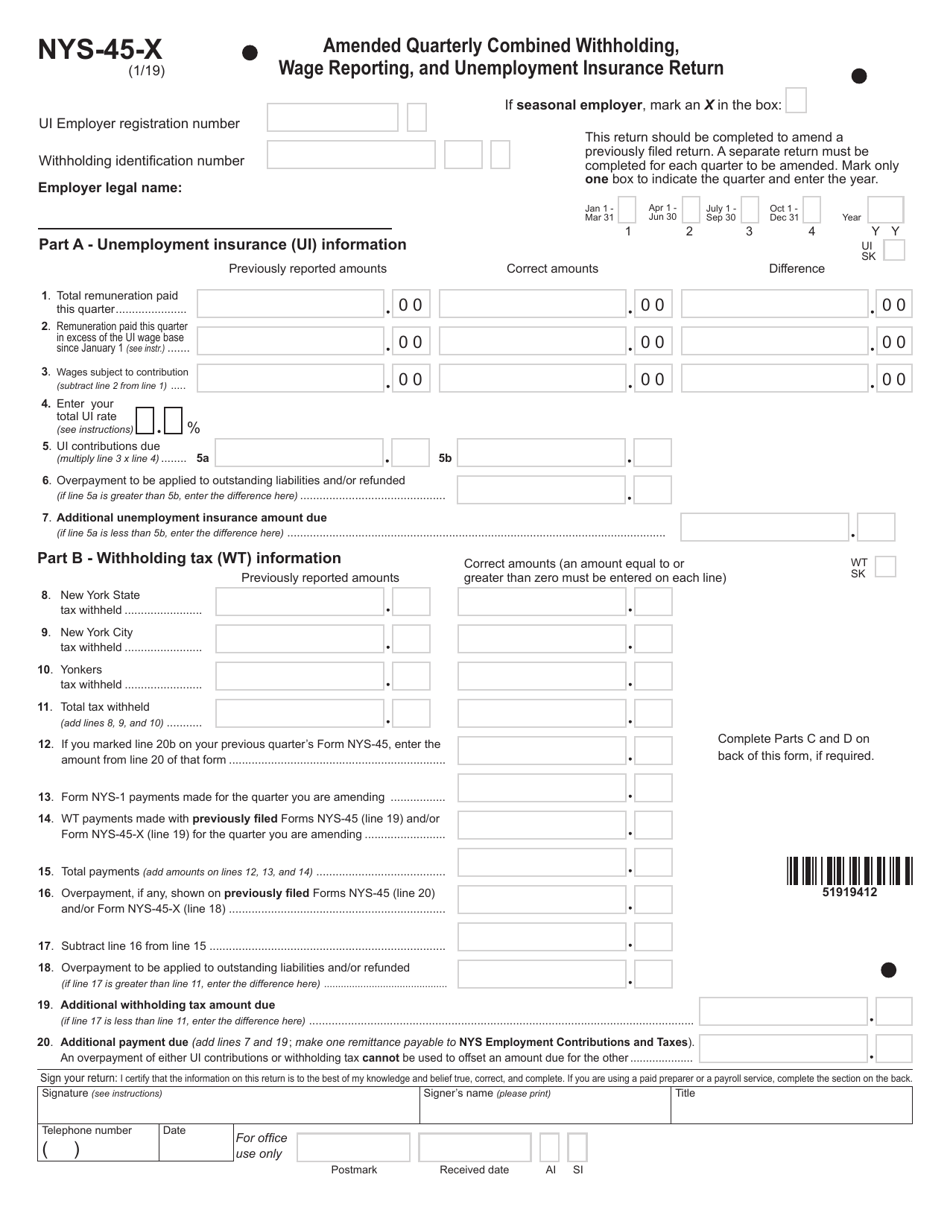

Form NYS45X Download Fillable PDF or Fill Online Amended Quarterly

It's used to calculate personal income tax. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. For unemployment insurance, withholding, and wage reporting. Web you can register by: Web online services is the fastest, most convenient way to do business with the tax department.

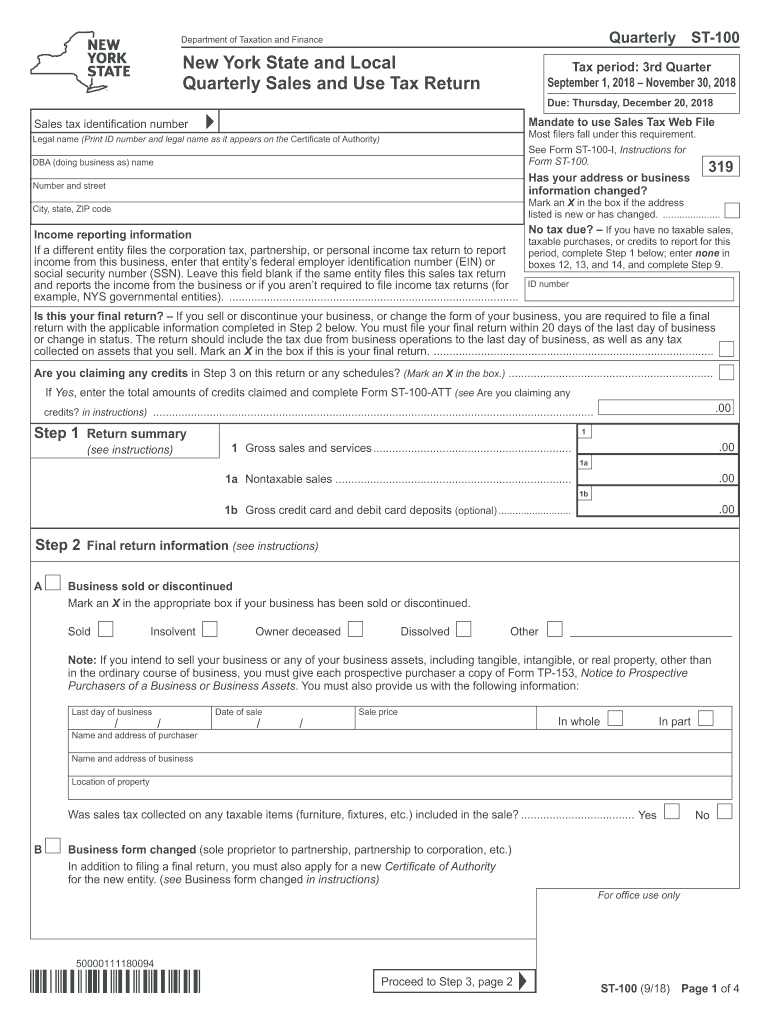

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

If you are not liable for unemployment insurance (ui) contributions but want to provide. Web online services is the fastest, most convenient way to do business with the tax department. Enter date of first operations in new york state: Web execute nys 100 online application within a couple of minutes by following the instructions below: New york state and local.

Nys 100 ≡ Fill Out Printable PDF Forms Online

Web you can register by: Use fill to complete blank online new york state pdf forms for free. New york state and local quarterly sales and use tax return. Applying online through new york business express (see employer registration for unemployment insurance, withholding, and wage reporting for. Web fill online, printable, fillable, blank nys100 (new york) form.

Form NYS100IT Download Printable PDF or Fill Online New York State

Web execute nys 100 online application within a couple of minutes by following the instructions below: Easily fill out pdf blank, edit, and sign them. Enter the date of the first payroll you withheld (or will withhold) new york state income tax from your. At online banks was 4.89 percent as of july 1, up from 1.75 percent a year.

20132023 Form NY NYS100 Fill Online, Printable, Fillable, Blank

Easily fill out pdf blank, edit, and sign them. Once completed you can sign your fillable. Choose the document template you want from our library of legal forms. Save or instantly send your ready documents. You may apply online at.

Nys 100 ≡ Fill Out Printable PDF Forms Online

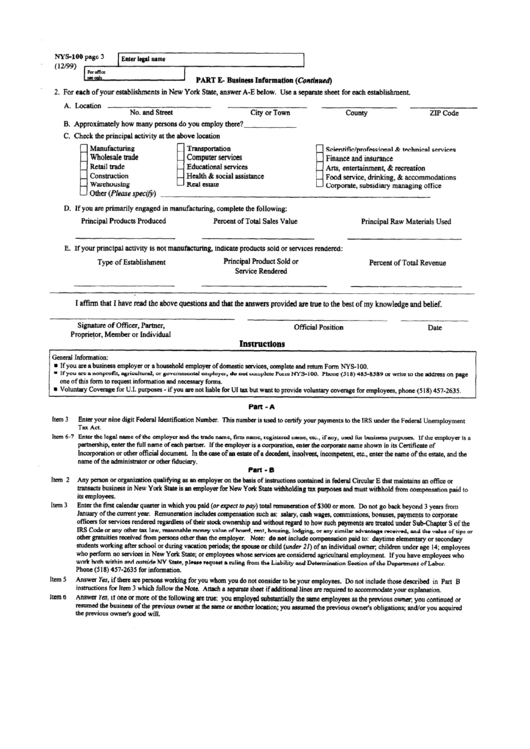

Applying online through new york business express (see employer registration for unemployment insurance, withholding, and wage reporting for. Register on line at www.labor.ny.gov, or mail it to the address on the top of the form or fax it to the fax number on page 1 of the form note: Save or instantly send your ready documents. You may apply online.

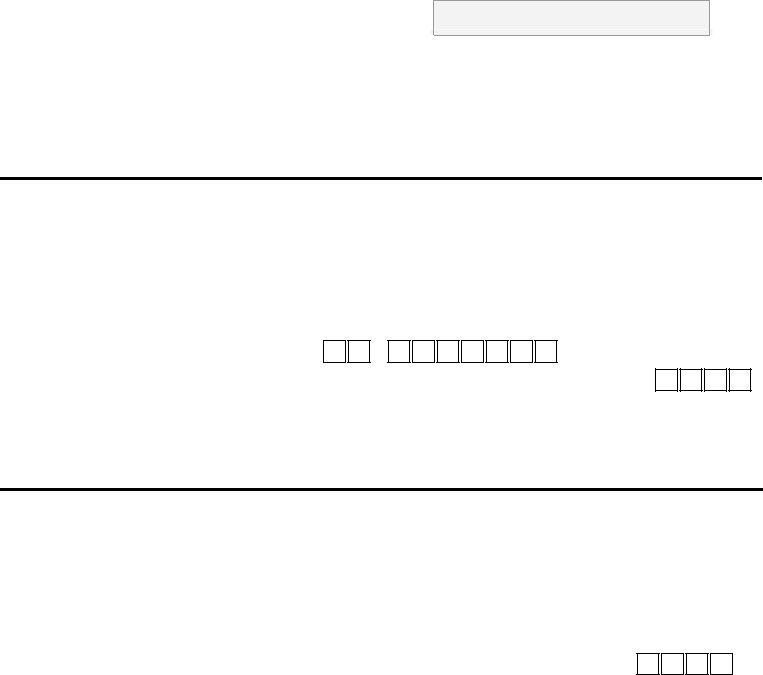

Form Nys100 Part EBusiness Information(Continued) printable pdf

You may apply online at. \u2022 business employer, or \u2022 household employer of. Easily fill out pdf blank, edit, and sign them. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Utilize a check mark to indicate the answer wherever required.

Nys 100 Fill in Form Fill Out and Sign Printable PDF Template signNow

It's used to calculate personal income tax. Enter the date of the first payroll you withheld (or will withhold) new york state income tax from your. Web fill online, printable, fillable, blank nys100 (new york) form. Web open the nys 100 fillable form and follow the instructions easily sign the new york state employer registration number lookup with your finger.

Fill Free fillable Nys100 (New York) PDF form

You may apply online at. This form is to be filed by a petitioner (taxpayer) who. If you are not liable for unemployment insurance (ui) contributions but want to provide. Web fill online, printable, fillable, blank nys100 (new york) form. Fillable form # completed by hand name of form purpose of form;

Applying Online Through New York Business Express (See Employer Registration For Unemployment Insurance, Withholding, And Wage Reporting For.

For unemployment insurance, withholding, and wage reporting. At online banks was 4.89 percent as of july 1, up from 1.75 percent a year earlier, according to depositaccounts.com. Web you can register by: Web use the nys 100 form to register for unemployment insurance, withholding and wage reporting if you are a:

Web Www.labor.ny.gov For More Information And Appropriate Forms.

Fillable form # completed by hand name of form purpose of form; New york state and local quarterly sales and use tax return. It's used to calculate personal income tax. Web enter your official contact and identification details.

Enter Date Of First Operations In New York State:

Easily fill out pdf blank, edit, and sign them. You may apply online at. Web form listing by number; Choose the document template you want from our library of legal forms.

Web Execute Nys 100 Online Application Within A Couple Of Minutes By Following The Instructions Below:

Double check all the fillable fields to ensure complete. Web open the nys 100 fillable form and follow the instructions easily sign the new york state employer registration number lookup with your finger send filled & signed nys100n or save rate the nys unemployment exemption 4.6 satisfied 97 votes handy tips for filling out nys 100 application online This form is to be filed by a petitioner (taxpayer) who. March 1, 2023, through may 31, 2023.