Ny State Solar Tax Credit Form

Ny State Solar Tax Credit Form - Web new york state tax credit. The most commonly used forms and instructions are listed. Web arizona offers eligible solar owners a state income tax credit worth 25% of the total system cost up to a maximum of $1,000. Web the equipment must be installed and used at your principal residence in new york state. Have questions about your solar tax credits? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Name(s) as shown on return your social security number does the geothermal energy system use a ground source. Some municipalities and school districts have opted out. Web in addition to our incentive programs and financing options, you may qualify for federal and/or new york state tax credits for installing solar at home. Web incentive programs, tax credits, and solar rebates in new york*.

The most commonly used forms and instructions are listed. To claim this credit, fill out this form and include the final result of it on irs form 1040. Web check out the top utility net metering programs in new york: Qualified homeowners with home solar could be eligible. Web who is eligible? Have questions about your solar tax credits? Name(s) as shown on return your social security number does the geothermal energy system use a ground source. Arizona form 310 and instructions for completing can. There may also be significant federal, state, and local tax credits for installing solar at your home. The new york solar tax.

Web form rp 487 from new york state department of taxation and finance; Arizona form 310 and instructions for completing can. Web ready to go solar? The system must also be. Have questions about your solar tax credits? Web empire zone (ez) credits. Web new york state tax credit. The new york solar tax. We offer additional incentives to some homeowners through. Web in addition to our incentive programs and financing options, you may qualify for federal and/or new york state tax credits for installing solar at home.

NY STATE SOLAR 37 Photos & 28 Reviews Solar Installation 385 W

Web form rp 487 from new york state department of taxation and finance; The new york solar tax. Web empire zone (ez) credits. Web arizona offers eligible solar owners a state income tax credit worth 25% of the total system cost up to a maximum of $1,000. The most commonly used forms and instructions are listed.

How Does the Federal Solar Tax Credit Work?

Have questions about your solar tax credits? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Name(s) as shown on return your social security number does the geothermal energy system use a ground source. Web the equipment must be installed and used at your principal residence in new york state. Web arizona offers eligible.

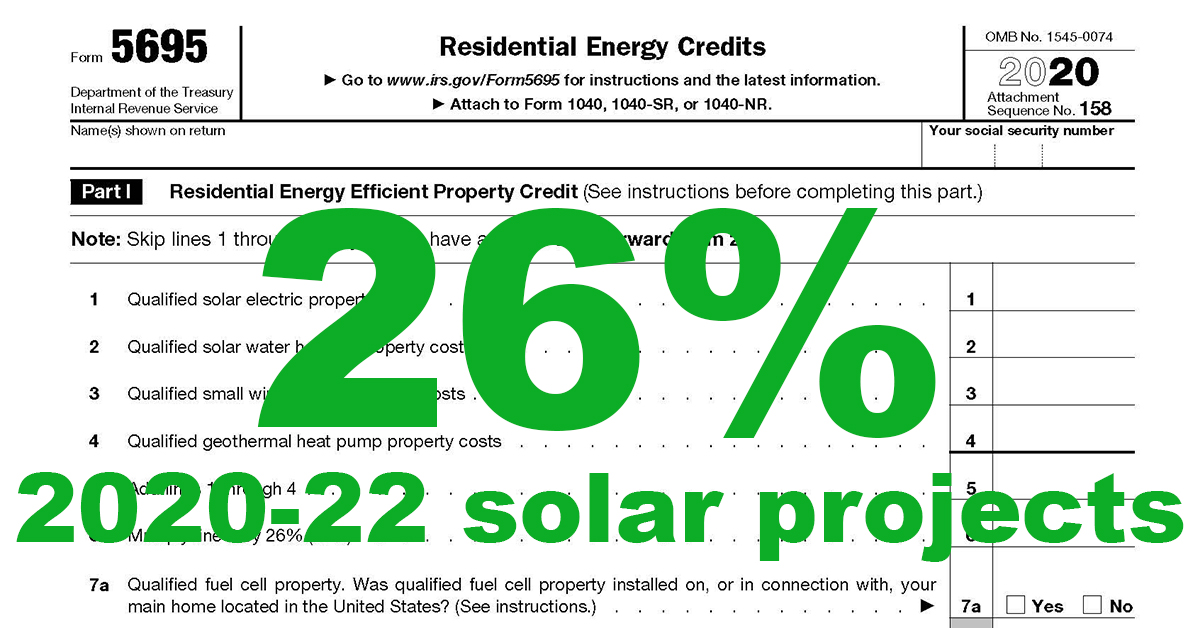

Irs Solar Tax Credit 2022 Form

Web discuss tax credits and financing options for your project with your solar contractor, and consult with your tax advisor. Web the solar energy system must use solar radiation to produce energy for heating, cooling, hot water, or electricity for residential use. Web form rp 487 from new york state department of taxation and finance; New york state solar equipment.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

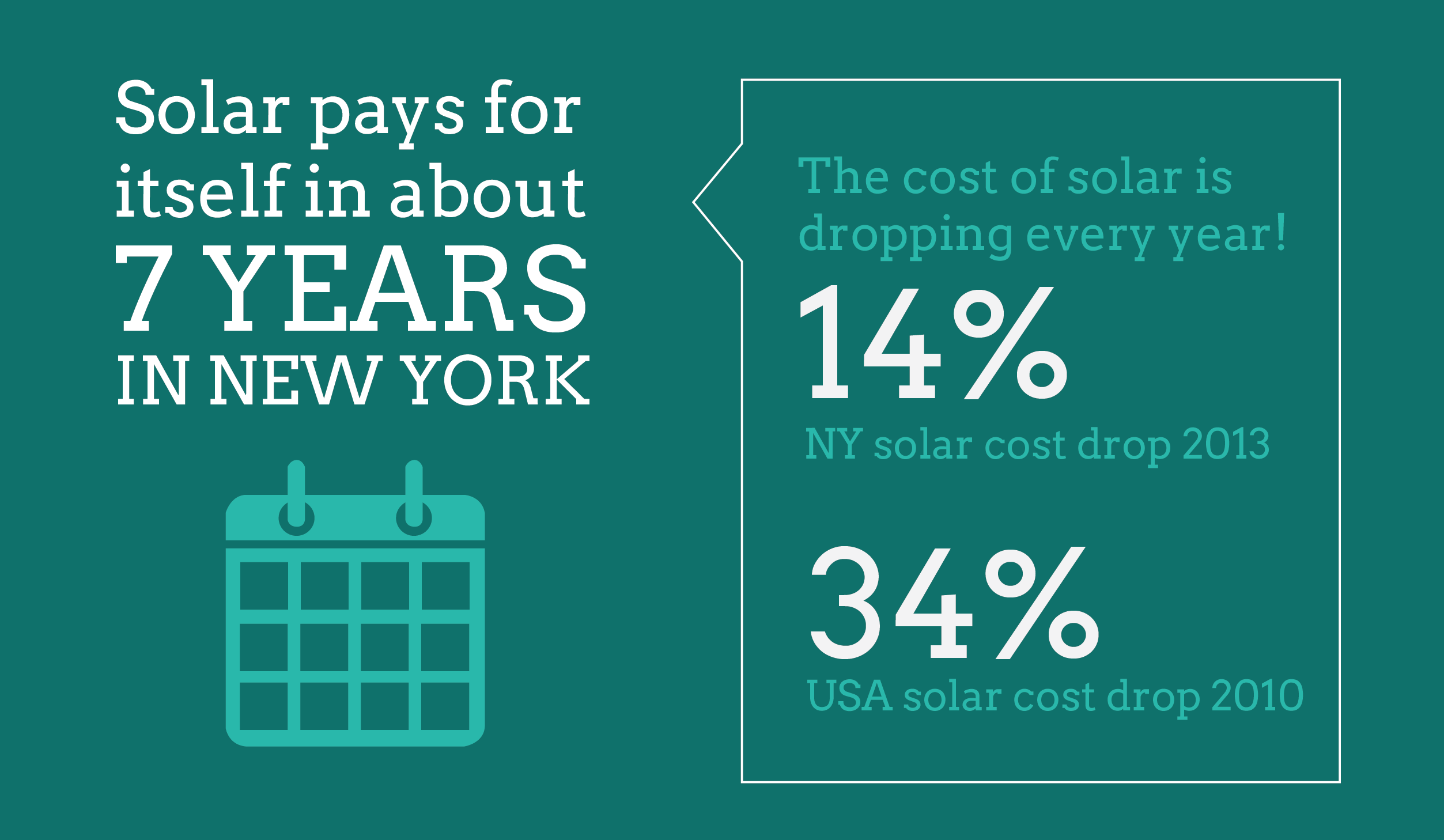

There may also be significant federal, state, and local tax credits for installing solar at your home. Some municipalities and school districts have opted out. The most commonly used forms and instructions are listed. Qualified homeowners with home solar could be eligible. Web new york is one of the few states that offer a statewide tax credit in addition to.

Puget Sound Solar LLC

Some municipalities and school districts have opted out. Web new york state tax credit. The new york solar tax. Web the solar energy system must use solar radiation to produce energy for heating, cooling, hot water, or electricity for residential use. There may also be significant federal, state, and local tax credits for installing solar at your home.

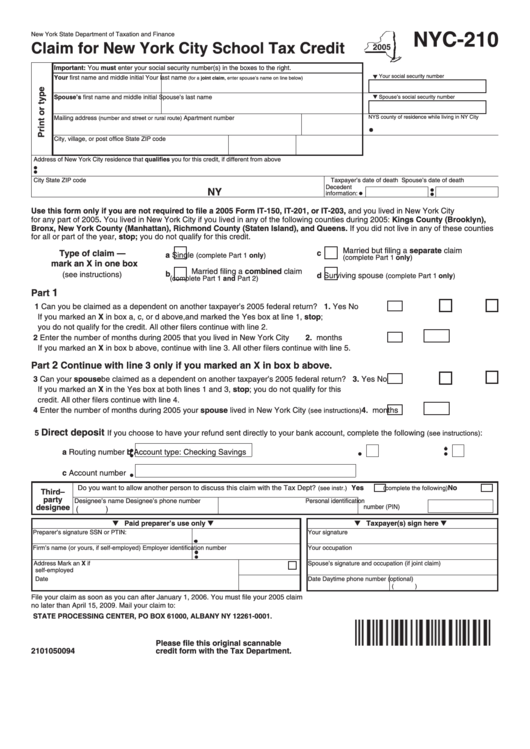

Fillable Form Nyc210 Claim For New York City School Tax Credit Form

Web new york state tax credit. Web incentive programs, tax credits, and solar rebates in new york*. Web form rp 487 from new york state department of taxation and finance; New york state solar equipment tax credit. Name(s) as shown on return your social security number does the geothermal energy system use a ground source.

Filing For The Solar Tax Credit Wells Solar

Web empire zone (ez) credits. Web check out the top utility net metering programs in new york: Web ready to go solar? Web in addition to our incentive programs and financing options, you may qualify for federal and/or new york state tax credits for installing solar at home. You are entitled to claim this credit if you:

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web ready to go solar? Web how much you can save depends on the electric rates in your area. Web new york state tax credit. Web form rp 487 from new york state department of taxation and finance; Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

New York Solar Tax Credit Explained EnergySage

Web discuss tax credits and financing options for your project with your solar contractor, and consult with your tax advisor. Web the solar energy system must use solar radiation to produce energy for heating, cooling, hot water, or electricity for residential use. The new york solar tax. Web in addition to our incentive programs and financing options, you may qualify.

Web The Solar Energy System Must Use Solar Radiation To Produce Energy For Heating, Cooling, Hot Water, Or Electricity For Residential Use.

Web arizona offers eligible solar owners a state income tax credit worth 25% of the total system cost up to a maximum of $1,000. Web new york state tax credit. We offer additional incentives to some homeowners through. Web ready to go solar?

To Claim This Credit, Fill Out This Form And Include The Final Result Of It On Irs Form 1040.

Web in addition to our incentive programs and financing options, you may qualify for federal and/or new york state tax credits for installing solar at home. The most commonly used forms and instructions are listed. Some municipalities and school districts have opted out. Web the equipment must be installed and used at your principal residence in new york state.

The System Must Also Be.

New york state solar equipment tax credit. Web how much you can save depends on the electric rates in your area. Web form rp 487 from new york state department of taxation and finance; Web advertisement explore options new york solar incentives available in 2023 investment tax credit also known as the solar tax credit, homeowners can get a tax.

Purchased Solar Energy System Equipment, Entered Into A Written Agreement For The Lease Of Solar Energy.

Web discuss tax credits and financing options for your project with your solar contractor, and consult with your tax advisor. Ez employment incentive credit for the financial services industry. Web new york is one of the few states that offer a statewide tax credit in addition to the federal one, and it comes in the form of the ny solar energy equipment credit. Arizona form 310 and instructions for completing can.