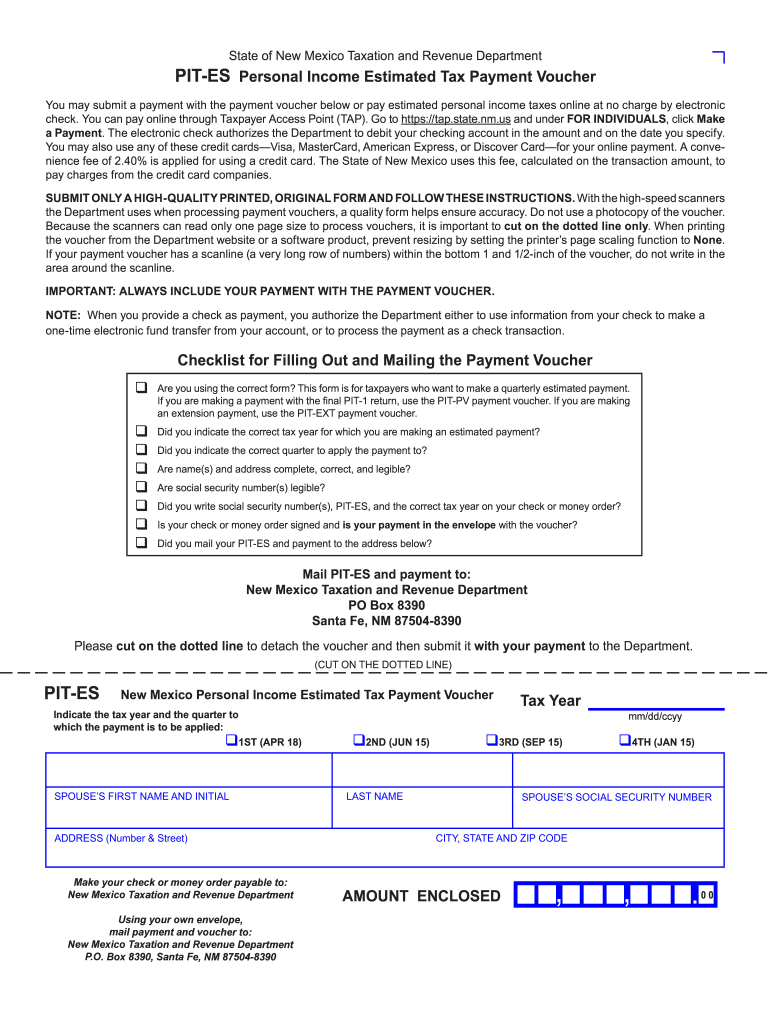

New Mexico State Tax Form

New Mexico State Tax Form - Web welcome to taxpayer access point. Electronic services are safe, secure, fast, and free. Sba.gov's business licenses and permits. Web the taxation and revenue department encourages all taxpayers to file electronically. It is not intended to. All others must file by april 18, 2023. Web if you move outside the state of new mexico, you should complete a new erb new mexico state taxwithholding form and check this box. You can file your return, pay your tax. Web new mexico taxpayer access point allows taxpayers to file their taxes, make payments, check refund statuses, manage their tax accounts, register new businesses, and more. Be sure to verify that the form you are downloading is for the correct.

Personal and business income taxes, gross receipts tax, weight distance tax. The state of new mexico taxation and revenue department recently upgraded taxpayer access point (tap). Web you can complete and sign the 2022 tax return forms online here on efile, before you download, print and mail them to the state tax agency. It is not intended to. Sba.gov's business licenses and permits. All others must file by april 18, 2023. Web new mexico taxpayer access point allows taxpayers to file their taxes, make payments, check refund statuses, manage their tax accounts, register new businesses, and more. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Web do i need a form? Web 55 rows new mexico has a state income tax that ranges between 1.7% and 4.9% , which is administered by the new mexico taxation and revenue department.

Sba.gov's business licenses and permits. However, the federal government is only exempt from specific types of transactions in new mexico. If you are a new mexico resident, you must file if you meet any of the following conditions: Web new mexico taxpayer access point allows taxpayers to file their taxes, make payments, check refund statuses, manage their tax accounts, register new businesses, and more. All others must file by april 18, 2022. All others must file by april 18, 2023. Web 55 rows new mexico has a state income tax that ranges between 1.7% and 4.9% , which is administered by the new mexico taxation and revenue department. It is not intended to. Complete, edit or print tax forms instantly. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023.

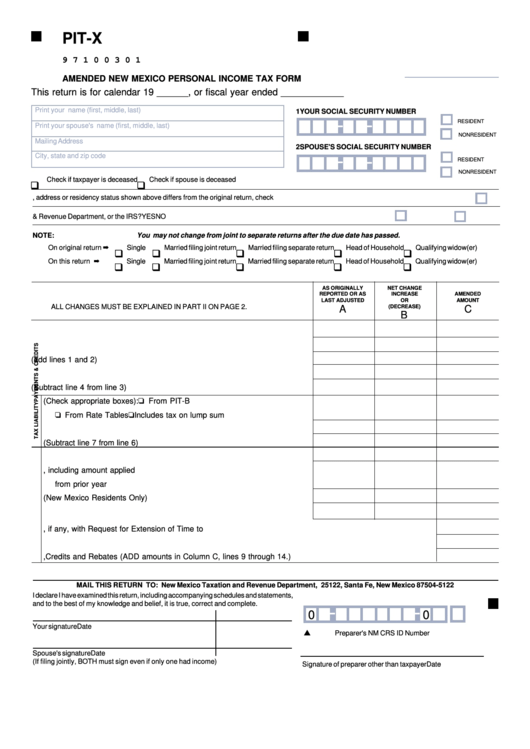

New mexico tax form 2018 pit x Fill out & sign online DocHub

Web the taxation and revenue department encourages all taxpayers to file electronically. Be sure to verify that the form you are downloading is for the correct. All others must file by april 18, 2022. Web 2/9/2023 read more. Complete, edit or print tax forms instantly.

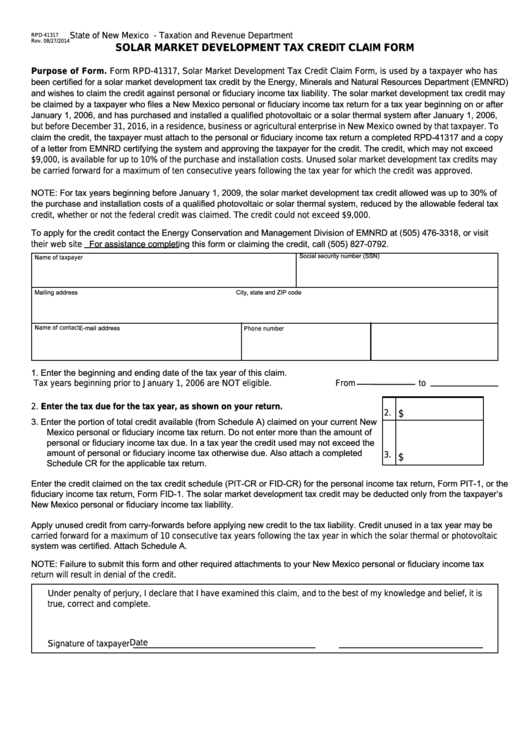

Fillable Form Rpd41317 New Mexico Solar Market Development Tax

Web you can complete and sign the 2022 tax return forms online here on efile, before you download, print and mail them to the state tax agency. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 02, 2022. • check your withholding status: Be sure to verify.

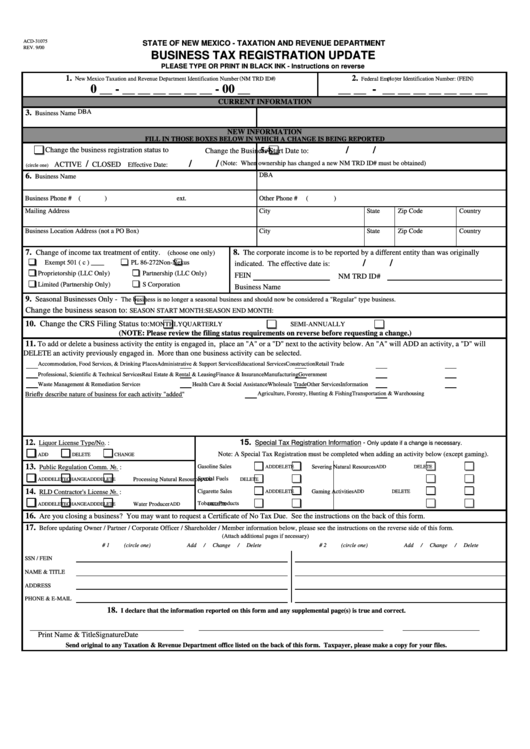

New Mexico Taxation And Revenue Department Business Tax Registration

Web • if you want new mexico stateincome tax withheld, check box number one (1). Be sure to verify that the form you are downloading is for the correct. Web if you move outside the state of new mexico, you should complete a new erb new mexico state taxwithholding form and check this box. However, the federal government is only.

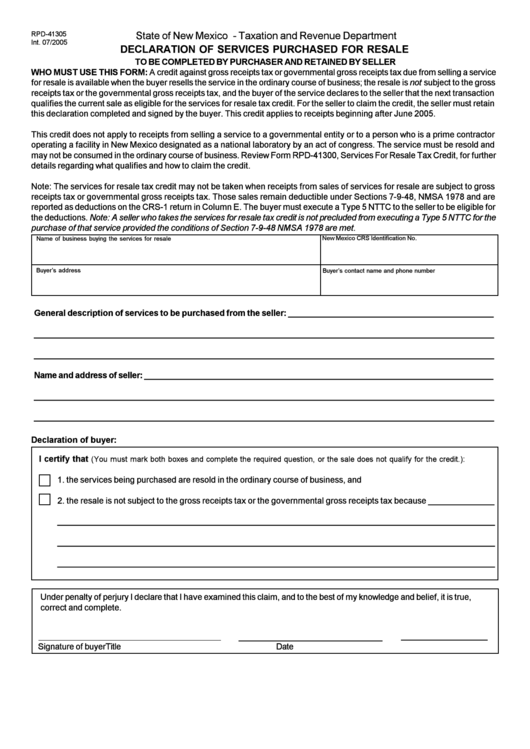

Form Rpd41305 Declaration Of Services Purchased For Resale State

Complete, edit or print tax forms instantly. Web you can complete and sign the 2022 tax return forms online here on efile, before you download, print and mail them to the state tax agency. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 02, 2022. Web •.

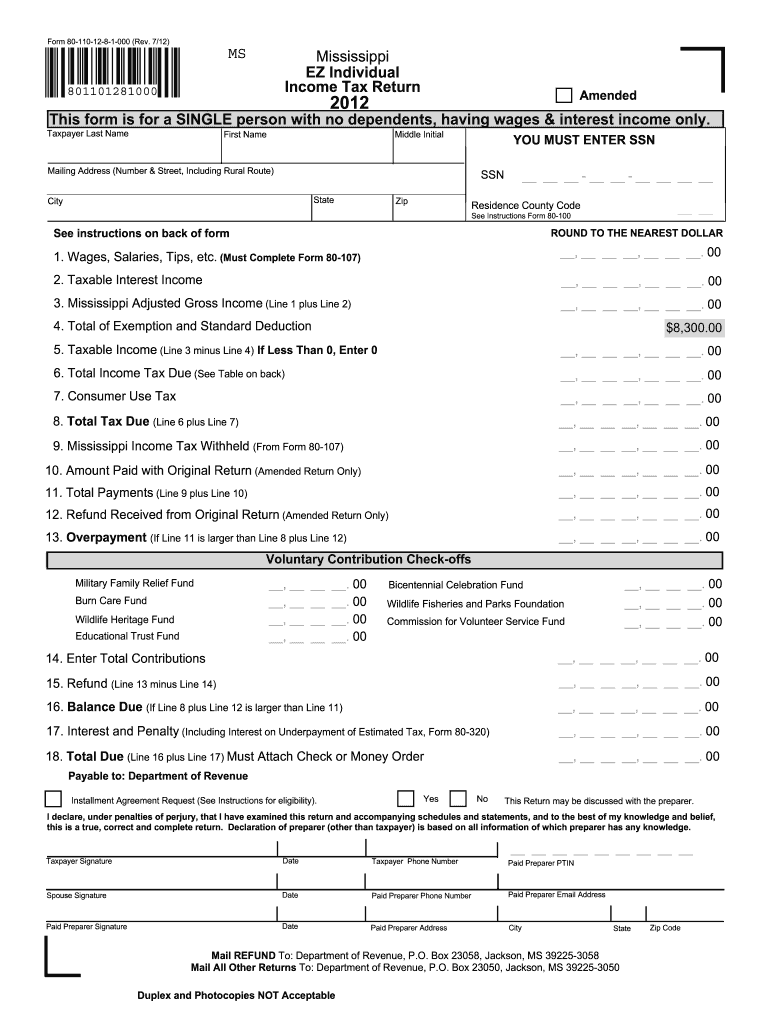

Ms State Tax Form 2022 W4 Form

Web new mexico taxpayer access point (tap). All others must file by april 18, 2023. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Personal and business income taxes, gross receipts tax, weight distance tax. If you are a new mexico resident, you must file.

Fillable Form PitX Amended New Mexico Personal Tax Form

Web new mexico taxpayer access point (tap). All others must file by april 18, 2023. Web welcome to taxpayer access point. The state of new mexico taxation and revenue department recently upgraded taxpayer access point (tap). Web you can complete and sign the 2022 tax return forms online here on efile, before you download, print and mail them to the.

New Mexico Personal Tax Spreadsheet Feel Free to Download!

If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. All others must file by april 18, 2023. If you are a new mexico resident, you must file if you meet any of the following conditions: • check your withholding status: Web if you move outside.

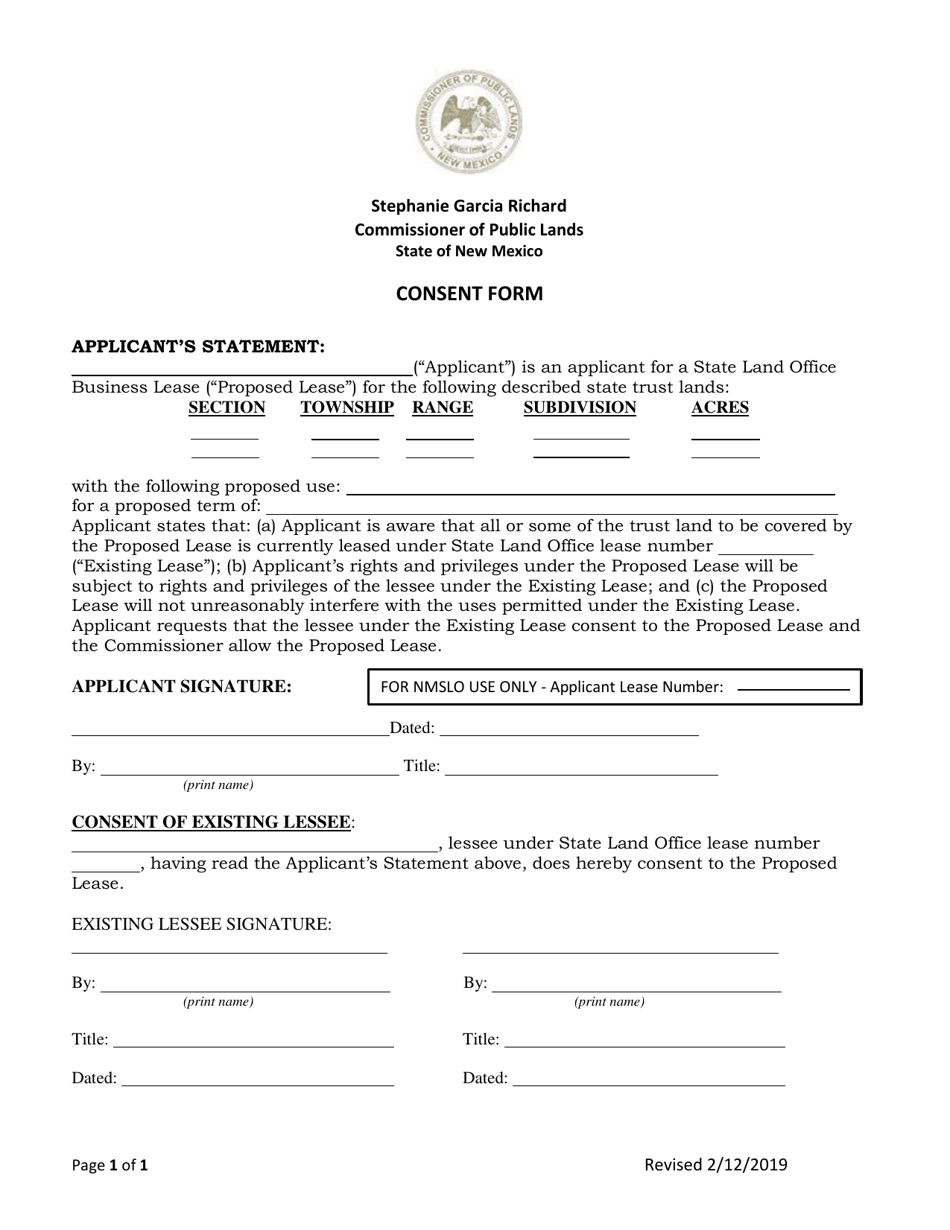

New Mexico Consent Form Download Fillable PDF Templateroller

Web 2/9/2023 read more. All others must file by april 18, 2023. Be sure to verify that the form you are downloading is for the correct. It is not intended to. • check your withholding status:

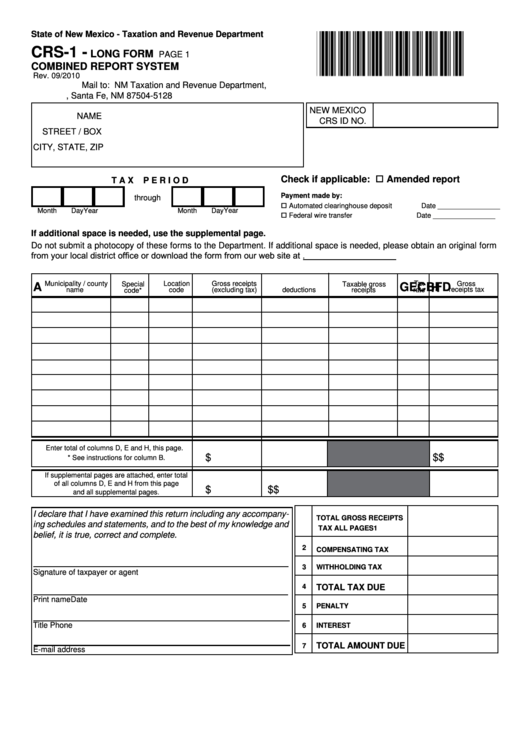

Fillable Form Crs1 (Long Form) Combined Report System printable pdf

Complete, edit or print tax forms instantly. Be sure to verify that the form you are downloading is for the correct. Electronic services are safe, secure, fast, and free. Web new mexico taxpayer access point allows taxpayers to file their taxes, make payments, check refund statuses, manage their tax accounts, register new businesses, and more. You can file your return,.

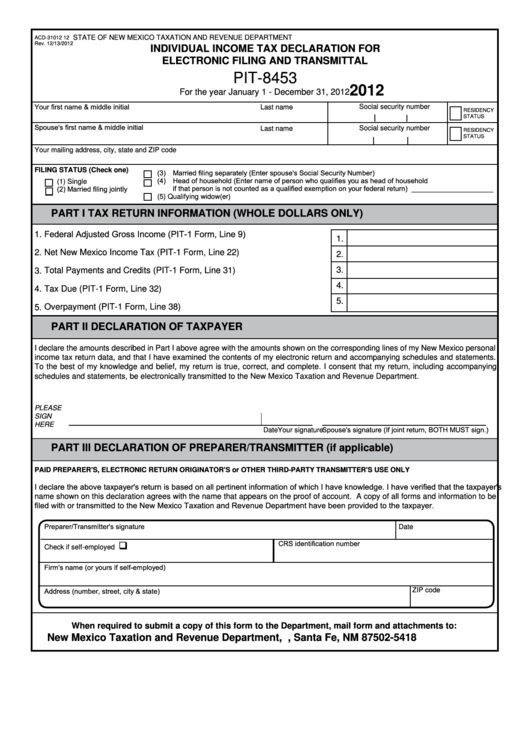

Form Pit8453 Individual Tax Declaration For Electronic Filing

Web you can complete and sign the 2022 tax return forms online here on efile, before you download, print and mail them to the state tax agency. All others must file by april 18, 2022. The state of new mexico taxation and revenue department recently upgraded taxpayer access point (tap). Web • if you want new mexico stateincome tax withheld,.

However, The Federal Government Is Only Exempt From Specific Types Of Transactions In New Mexico.

Complete, edit or print tax forms instantly. Personal and business income taxes, gross receipts tax, weight distance tax. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 02, 2022. It is not intended to.

Web Welcome To Taxpayer Access Point.

Web new mexico taxpayer access point allows taxpayers to file their taxes, make payments, check refund statuses, manage their tax accounts, register new businesses, and more. • check your withholding status: Web you can complete and sign the 2022 tax return forms online here on efile, before you download, print and mail them to the state tax agency. Electronic services are safe, secure, fast, and free.

Web If You Move Outside The State Of New Mexico, You Should Complete A New Erb New Mexico State Taxwithholding Form And Check This Box.

All others must file by april 18, 2023. Web 55 rows new mexico has a state income tax that ranges between 1.7% and 4.9% , which is administered by the new mexico taxation and revenue department. File your taxes and manage your account online. Married, married, but at a higher single rate, or.

Web The Taxation And Revenue Department Encourages All Taxpayers To File Electronically.

Web 2/9/2023 read more. You can file your return, pay your tax. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. The state of new mexico taxation and revenue department recently upgraded taxpayer access point (tap).