New Jersey Tax Waiver Form

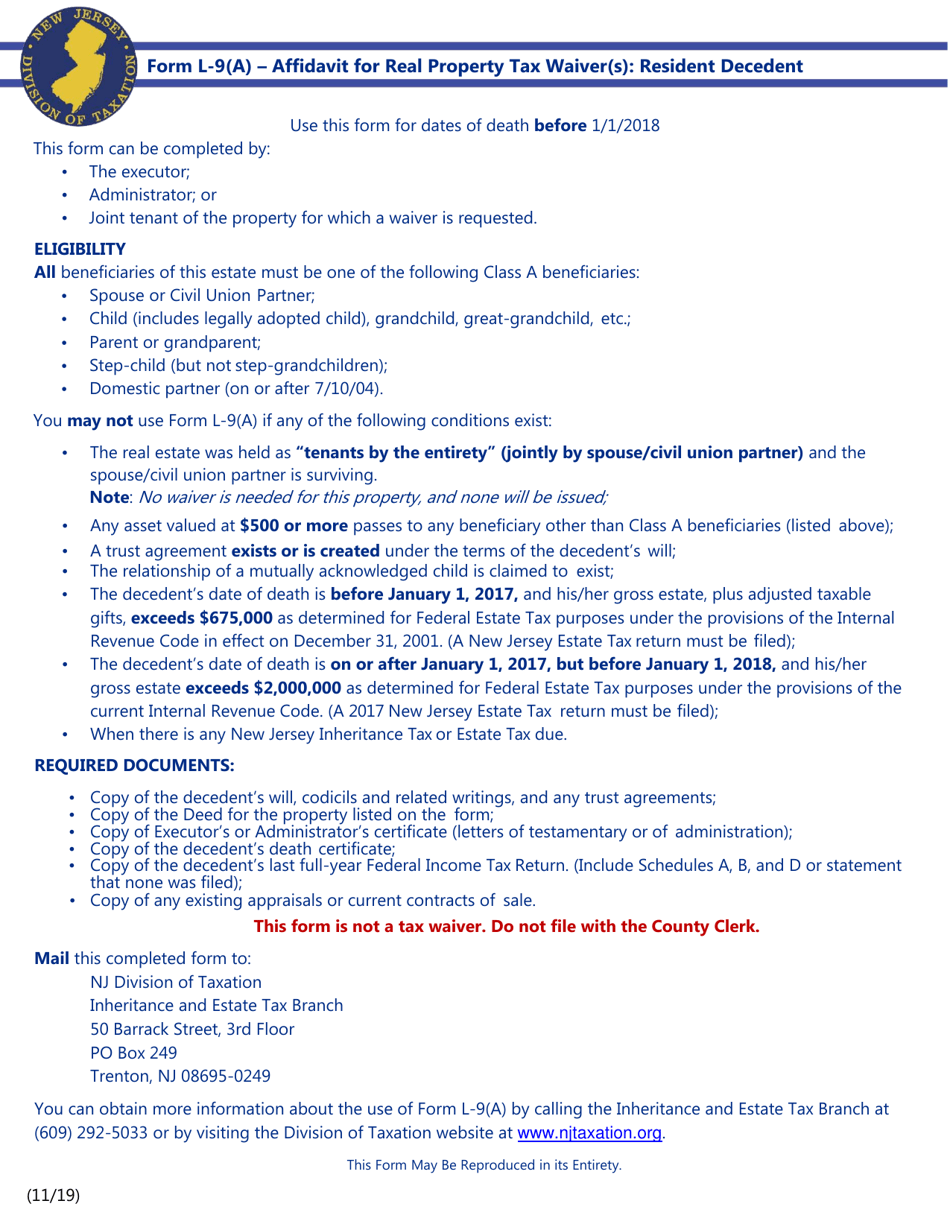

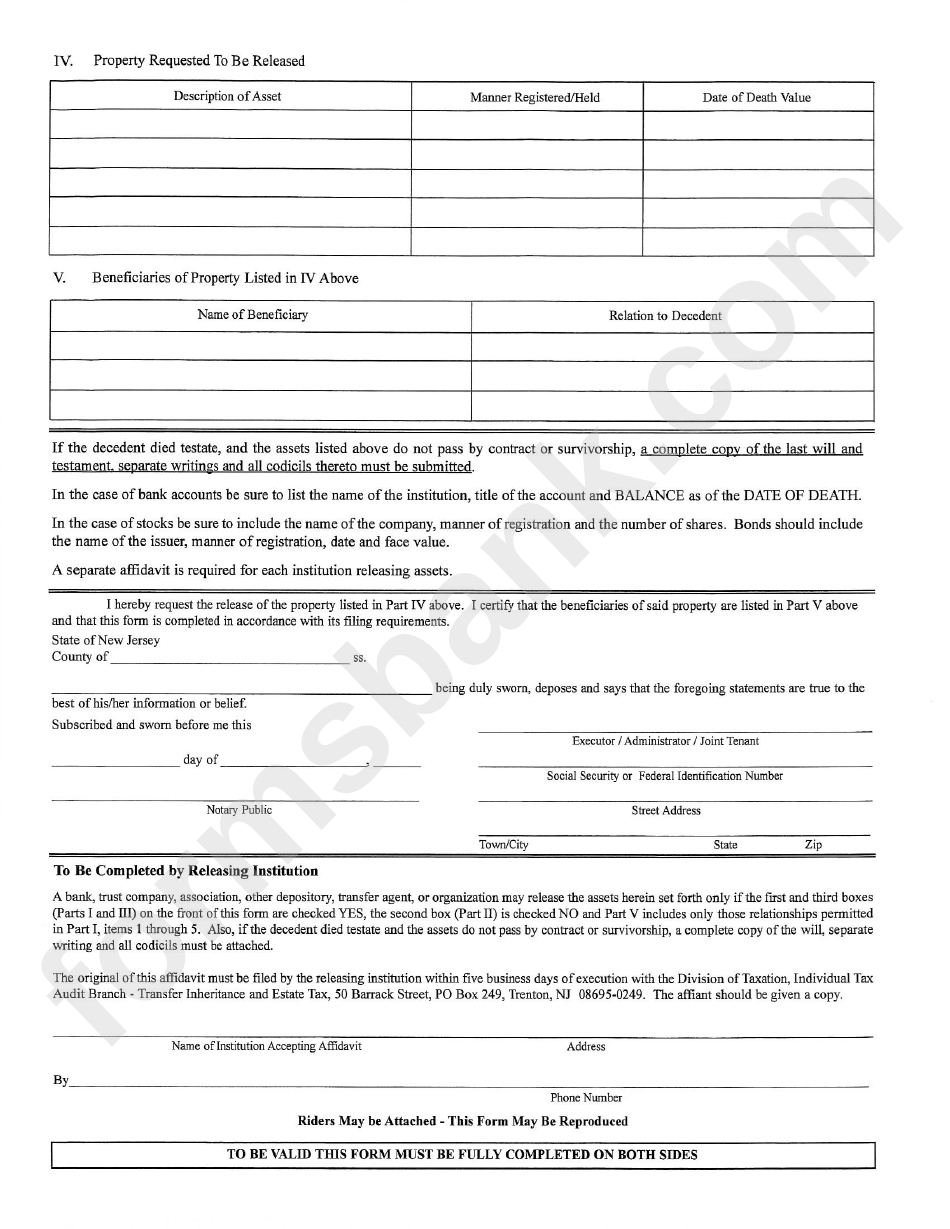

New Jersey Tax Waiver Form - Web one way to obtain the tax waiver is to file a completed inheritance tax return. Web employer payroll tax. Web this form can be completed by: Or class a “payable on death (pod)”. Fill out the affidavit requesting preliminary waivers: The surviving class a joint tenant (often a spouse or civil union partner); Web while you will need a tax clearance waiver from the new jersey division of taxation, the lack of such a waiver does not preclude you from selling the home, said. State of new jersey the department of the treasury division of. Submit the waiver in person or via. O real estate transfers always require.

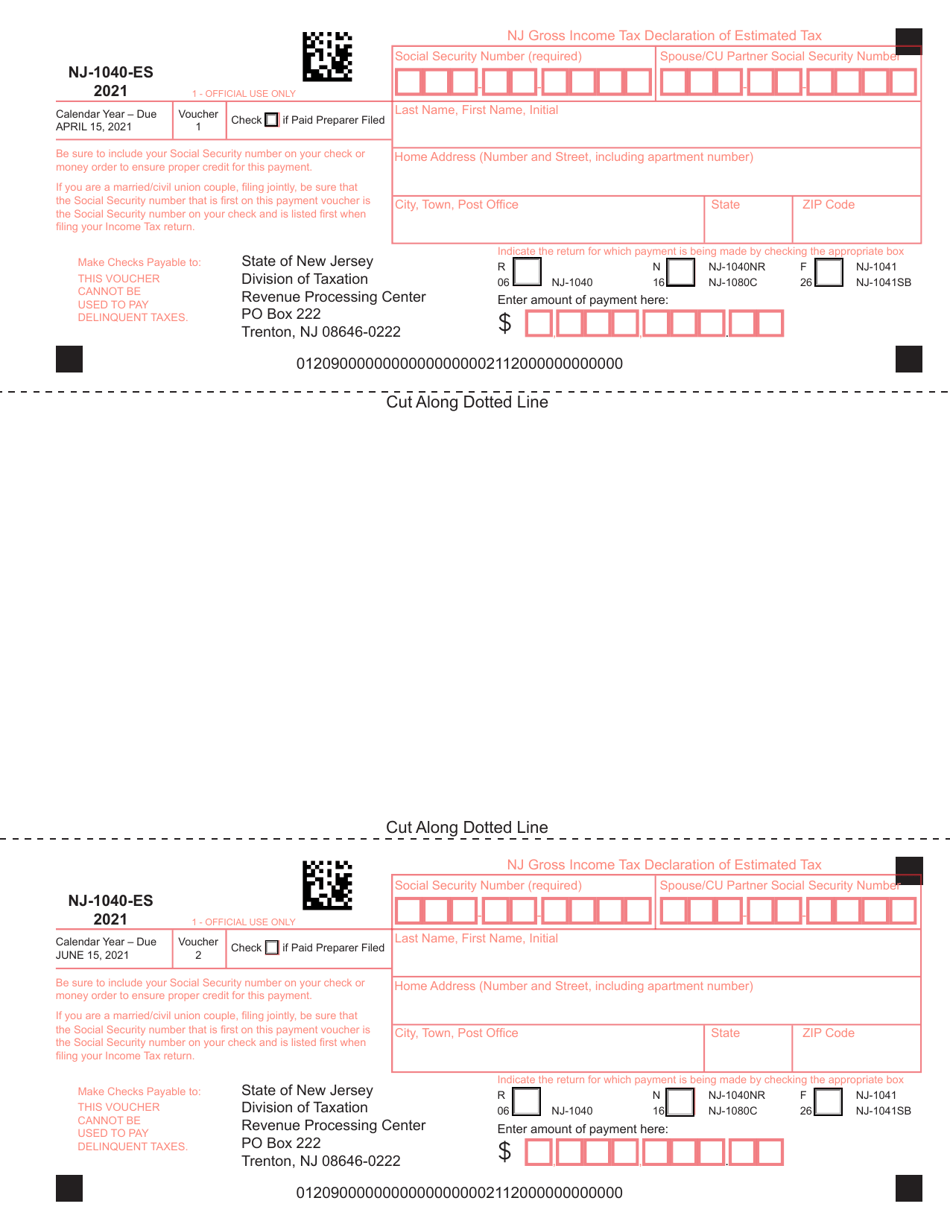

Web one way to obtain the tax waiver is to file a completed inheritance tax return. Web while you will need a tax clearance waiver from the new jersey division of taxation, the lack of such a waiver does not preclude you from selling the home, said. Submit the waiver in person or via. Create legally binding electronic signatures on any device. Fill out the affidavit requesting preliminary waivers: Or class a “payable on death (pod)”. Payment on account (estimated payment) voucher:. O to get this form, you must file a return with the division. The surviving class a joint tenant (often a spouse or civil union partner); Web employer payroll tax.

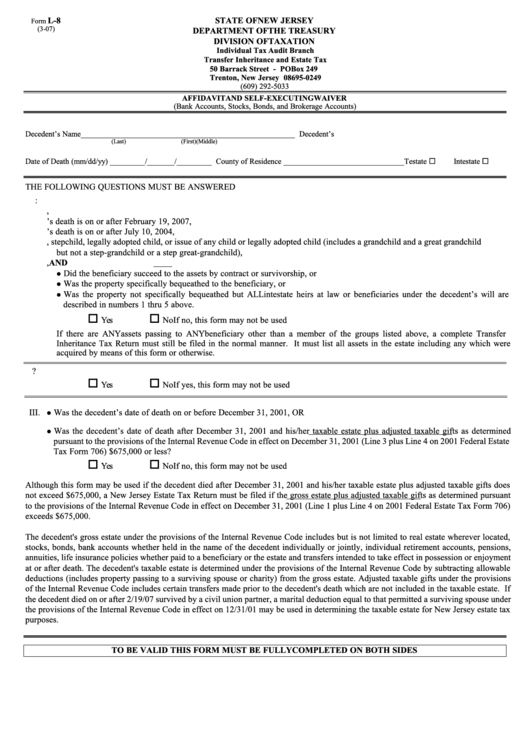

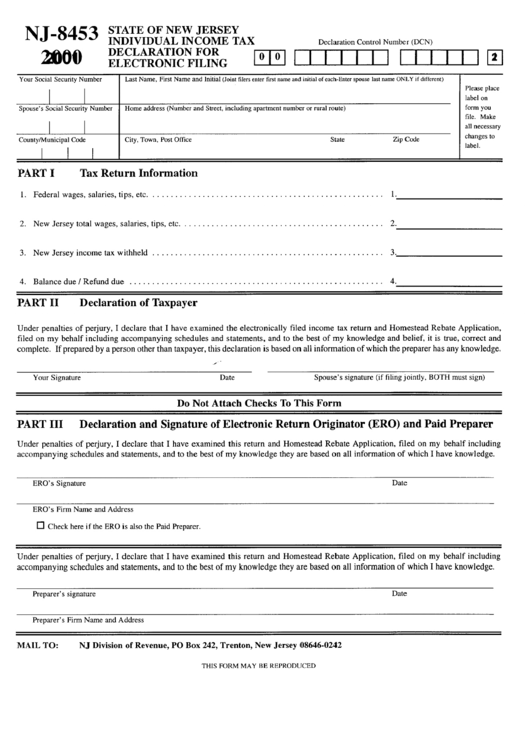

Web develops tax forms, instructional materials, notices and publications; Ad signnow allows users to edit, sign, fill and share all type of documents online. Edit your nj tax waiver online type text, add images, blackout confidential details, add comments, highlights and more. State of new jersey the department of the treasury division of. Or class a “payable on death (pod)”. O real estate transfers always require. Web a filing method that uses the federal form 706 as it existed in 2001 to report the assets and liabilities of the decedent, and to arrive at a net taxable estate in order to compute the. Submit the waiver in person or via. Web complete the fee waiver form and submit the required documents to the court to see if you meet the guidelines. Create legally binding electronic signatures on any device.

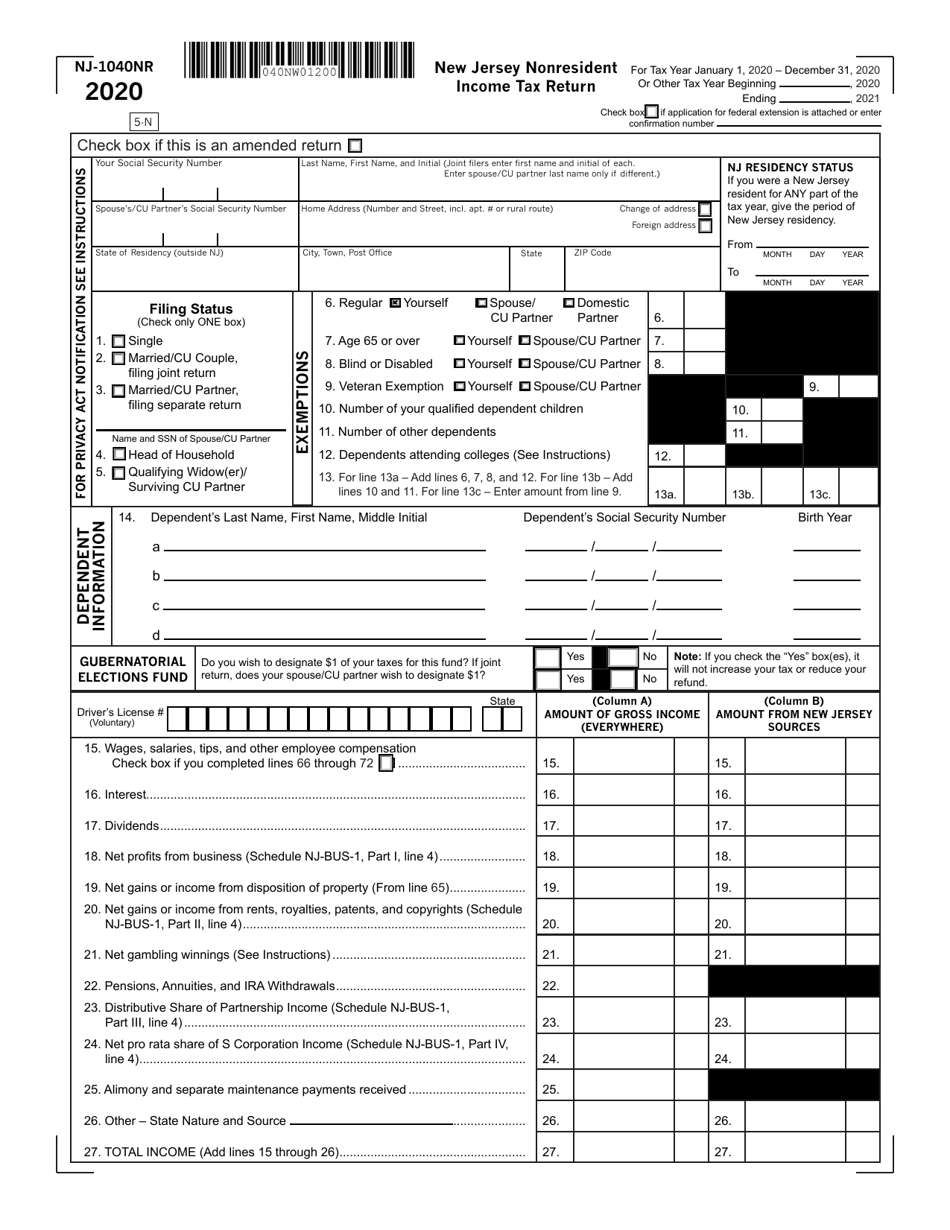

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

Web develops tax forms, instructional materials, notices and publications; A complete inheritance or estate tax return cannot be completed yet; Web employer payroll tax. Fill out the affidavit requesting preliminary waivers: State of new jersey the department of the treasury division of.

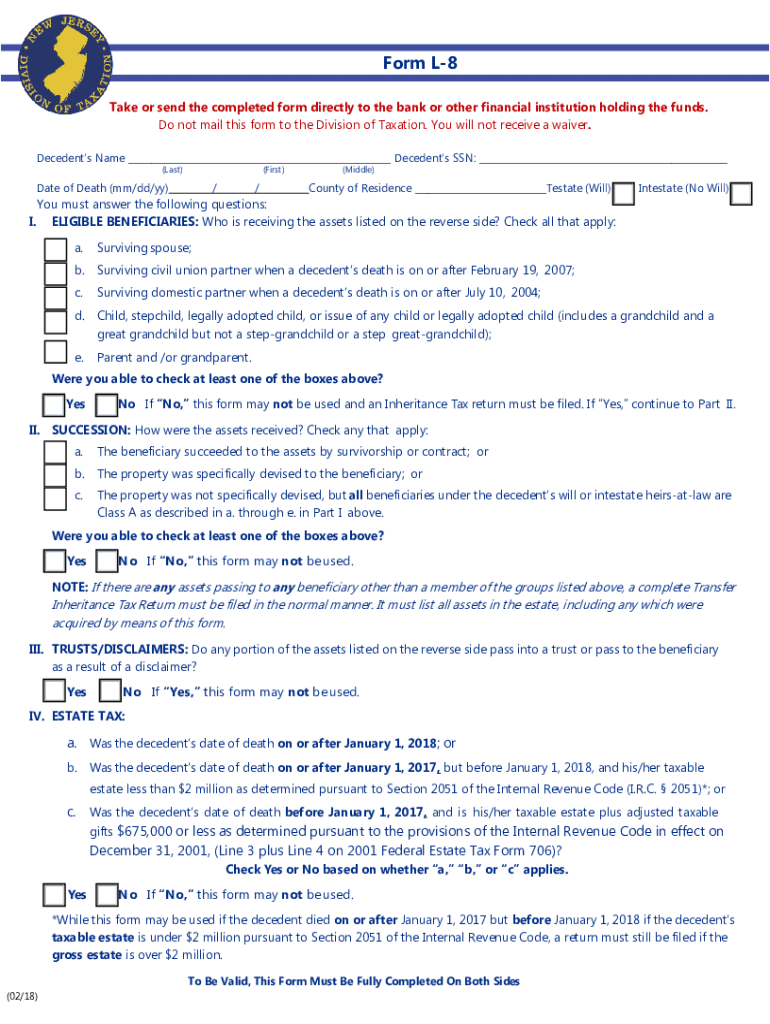

Nj Inheritance Tax Waiver cloudshareinfo

Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate. Web employer payroll tax. You can apply for a fee waiver in any nj state court: Web original inheritance tax waivers must be filed with the county clerk's office.

NJ DoT L8 20182021 Fill out Tax Template Online US Legal Forms

Payment on account (estimated payment) voucher:. Provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and. Ad signnow allows users to edit, sign, fill and share all type of documents online. Web a filing method that uses the federal form 706 as it existed in 2001 to report the assets and liabilities of the decedent, and to arrive.

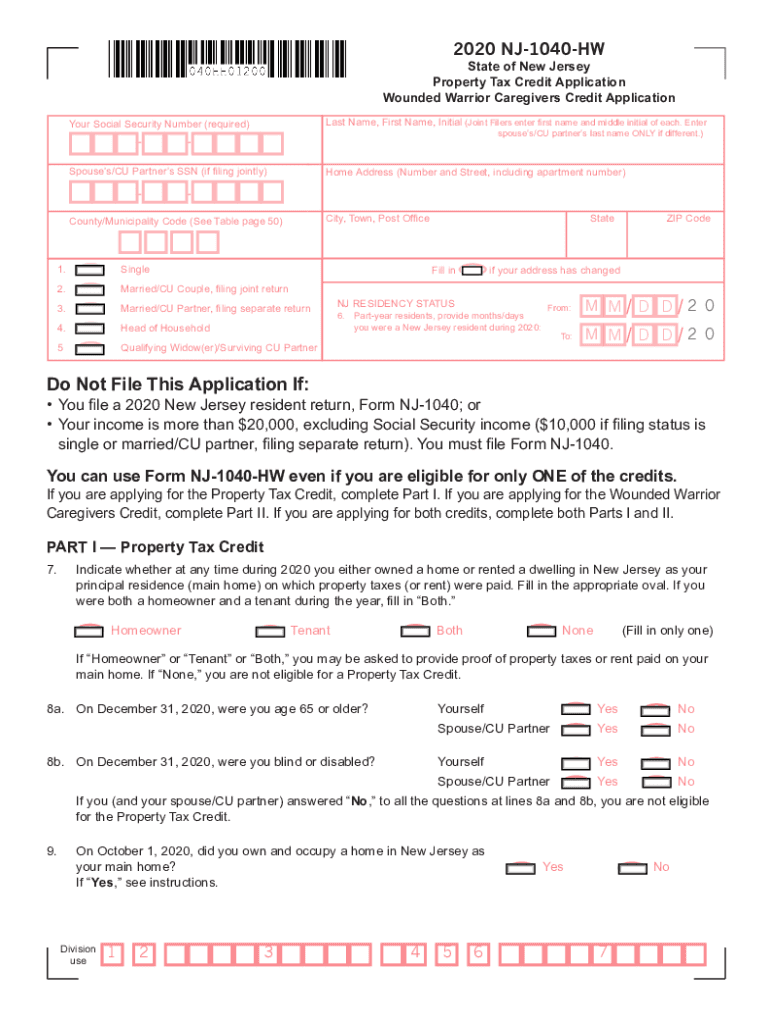

1040 Hw Credit Fill Out and Sign Printable PDF Template signNow

You can apply for a fee waiver in any nj state court: O real estate transfers always require. Or all beneficiaries are class a, but estate does not qualify to. Web complete the fee waiver form and submit the required documents to the court to see if you meet the guidelines. O to get this form, you must file a.

Fillable Form L8 Affidavit And SelfExecuting Waiver State Of New

Or all beneficiaries are class a, but estate does not qualify to. Web for release of nj bank accounts, stock, brokerage accounts and investment bonds. Provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and. Or class a “payable on death (pod)”. Web tax waivers are required for transfers to domestic partners.

Form NJ1040ES Download Fillable PDF or Fill Online Estimated Tax

Web while you will need a tax clearance waiver from the new jersey division of taxation, the lack of such a waiver does not preclude you from selling the home, said. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax.

Form Nj8453 Individual Tax Declaration For Electronic Filing

Web for release of nj bank accounts, stock, brokerage accounts and investment bonds. Web a filing method that uses the federal form 706 as it existed in 2001 to report the assets and liabilities of the decedent, and to arrive at a net taxable estate in order to compute the. Payment on account (estimated payment) voucher:. State of new jersey.

Inheritance Tax Waiver Form Puerto Rico Form Resume Examples

Create legally binding electronic signatures on any device. Fill out the affidavit requesting preliminary waivers: Sign it in a few clicks draw your signature, type it,. Web while you will need a tax clearance waiver from the new jersey division of taxation, the lack of such a waiver does not preclude you from selling the home, said. Web develops tax.

Form L9(A) Download Fillable PDF or Fill Online Affidavit for Real

Or all beneficiaries are class a, but estate does not qualify to. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate. O to get this form, you must file a return with the division. Web one way to.

Form L8 Affidavit And SelfExecuting Waiver New Jersey Department

Payment on account (estimated payment) voucher:. Or class a “payable on death (pod)”. You can apply for a fee waiver in any nj state court: Web tax waivers are required for transfers to domestic partners. Web develops tax forms, instructional materials, notices and publications;

Edit Your Nj Tax Waiver Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web this form can be completed by: A complete inheritance or estate tax return cannot be completed yet; Web employer payroll tax. You can apply for a fee waiver in any nj state court:

Fill Out The Affidavit Requesting Preliminary Waivers:

Sign it in a few clicks draw your signature, type it,. Ad signnow allows users to edit, sign, fill and share all type of documents online. Or all beneficiaries are class a, but estate does not qualify to. O to get this form, you must file a return with the division.

Web Tax Waivers Are Required For Transfers To Domestic Partners.

Web complete the fee waiver form and submit the required documents to the court to see if you meet the guidelines. State of new jersey the department of the treasury division of. Payment on account (estimated payment) voucher:. Web one way to obtain the tax waiver is to file a completed inheritance tax return.

Web The Tax Waiver Form Issued By The Division Releases Both The Inheritance Tax And The Estate Tax Lien, And Permits The Transfer Of Property For Both Inheritance Tax And Estate.

Web develops tax forms, instructional materials, notices and publications; The surviving class a joint tenant (often a spouse or civil union partner); Or class a “payable on death (pod)”. Web a filing method that uses the federal form 706 as it existed in 2001 to report the assets and liabilities of the decedent, and to arrive at a net taxable estate in order to compute the.