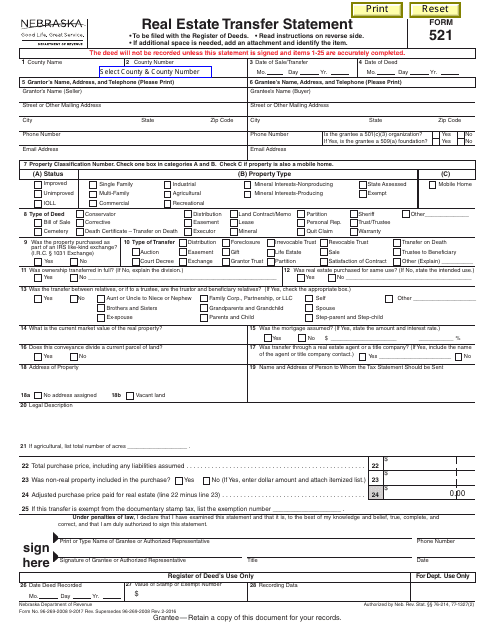

Nebraska Form 521

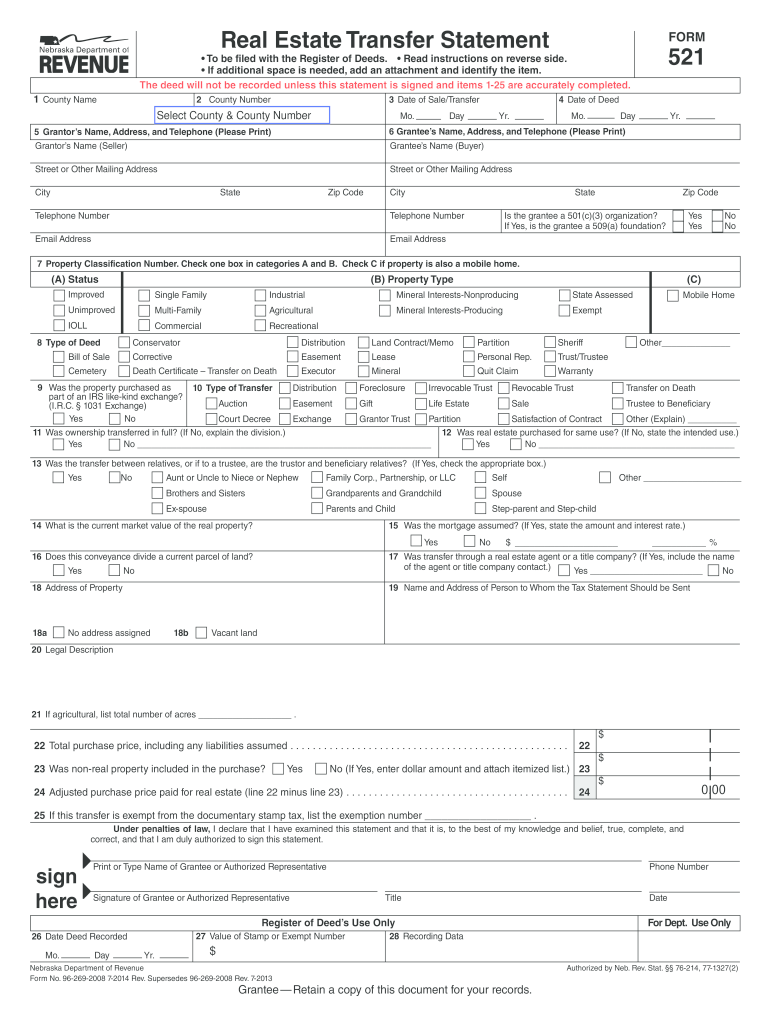

Nebraska Form 521 - Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant Form 521mh must be filed with the county treasurer in the county where the application for title Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. Web this certificate of exemption is to be filed with the real estate transfer statement, form 521, when exemption #5b is claimed in item 25 on the form 521. When and where to file. A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Web the real estate transfer statement (form 521) is used for the purpose of recording transfers of interest in real property. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Web estate transfer statement, form 521, is signed. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.

Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.a land contract or memorandum of contract requires a completed form 521, which is not subject to the documentary stamp tax until the deed is presented for recording. When and where to file. Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521. Web statement, form 521mh, when seeking a certificate of title for manufactured housing. Web the real estate transfer statement (form 521) is used for the purpose of recording transfers of interest in real property. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Numeric listing of all current nebraska tax forms. Web estate transfer statement, form 521, is signed.

Web estate transfer statement, form 521, is signed. When and where to file. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed form 521, which are not subject to the documentary stamp tax until the deed is. Web must file form 521. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521. Web death certificate pursuant to a transfer on death deed cover sheet: Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Web estate transfer statement, form 521, is signed. Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds.

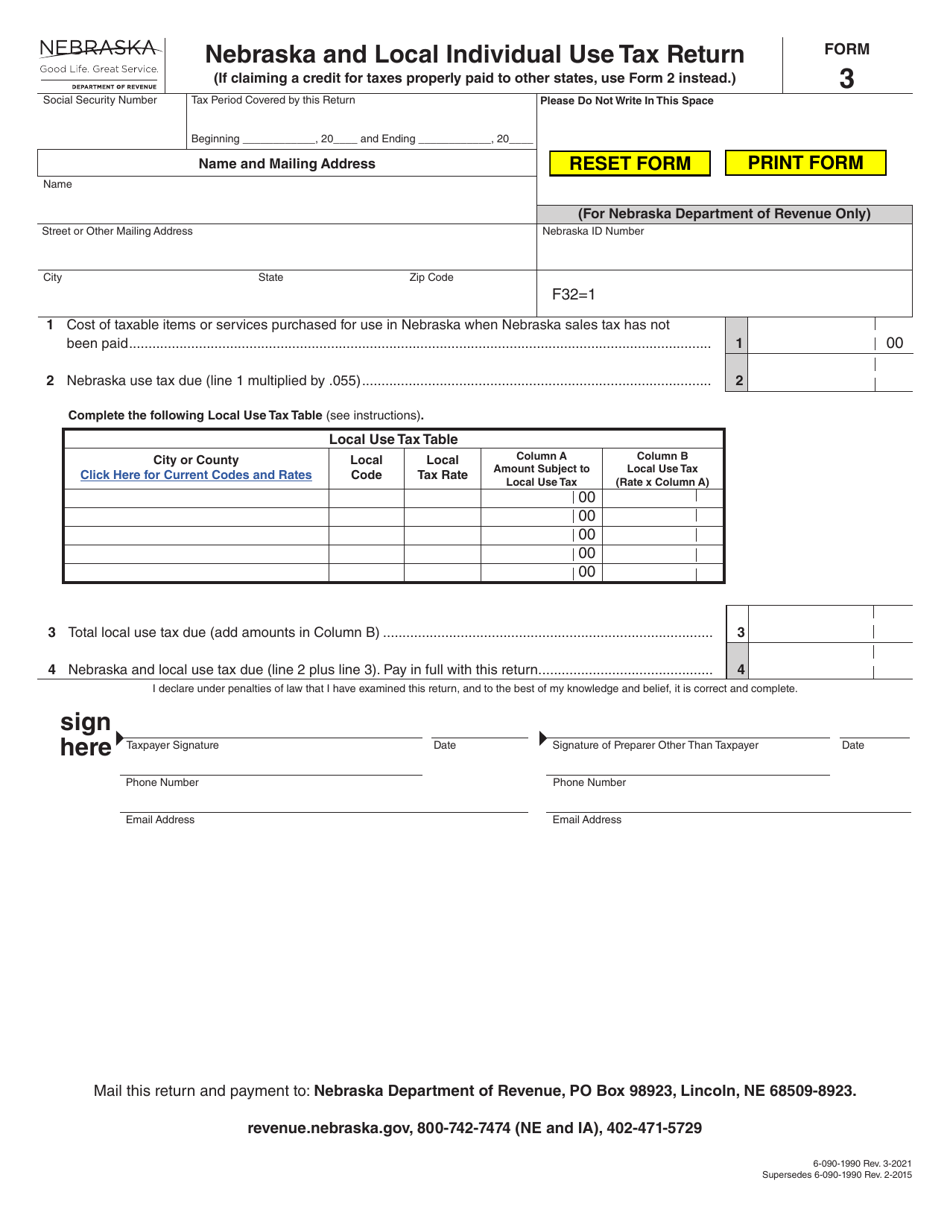

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

Web estate transfer statement, form 521, is signed. Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds. A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Form.

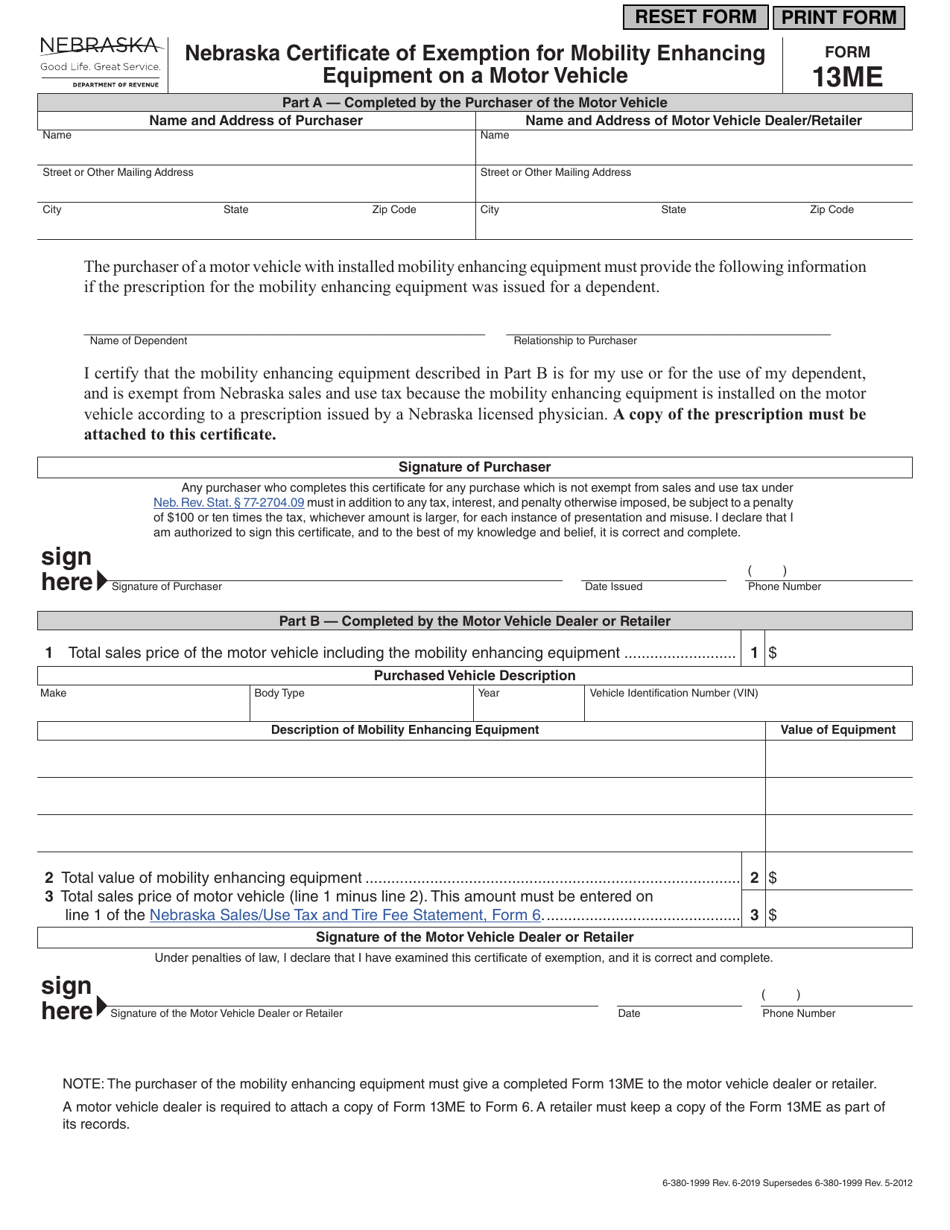

Form 13ME Download Fillable PDF or Fill Online Nebraska Certificate of

A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Web statement, form 521mh, when seeking a certificate of title for manufactured housing. Web this certificate of exemption is to be filed with the real estate transfer statement, form 521, when exemption #5b.

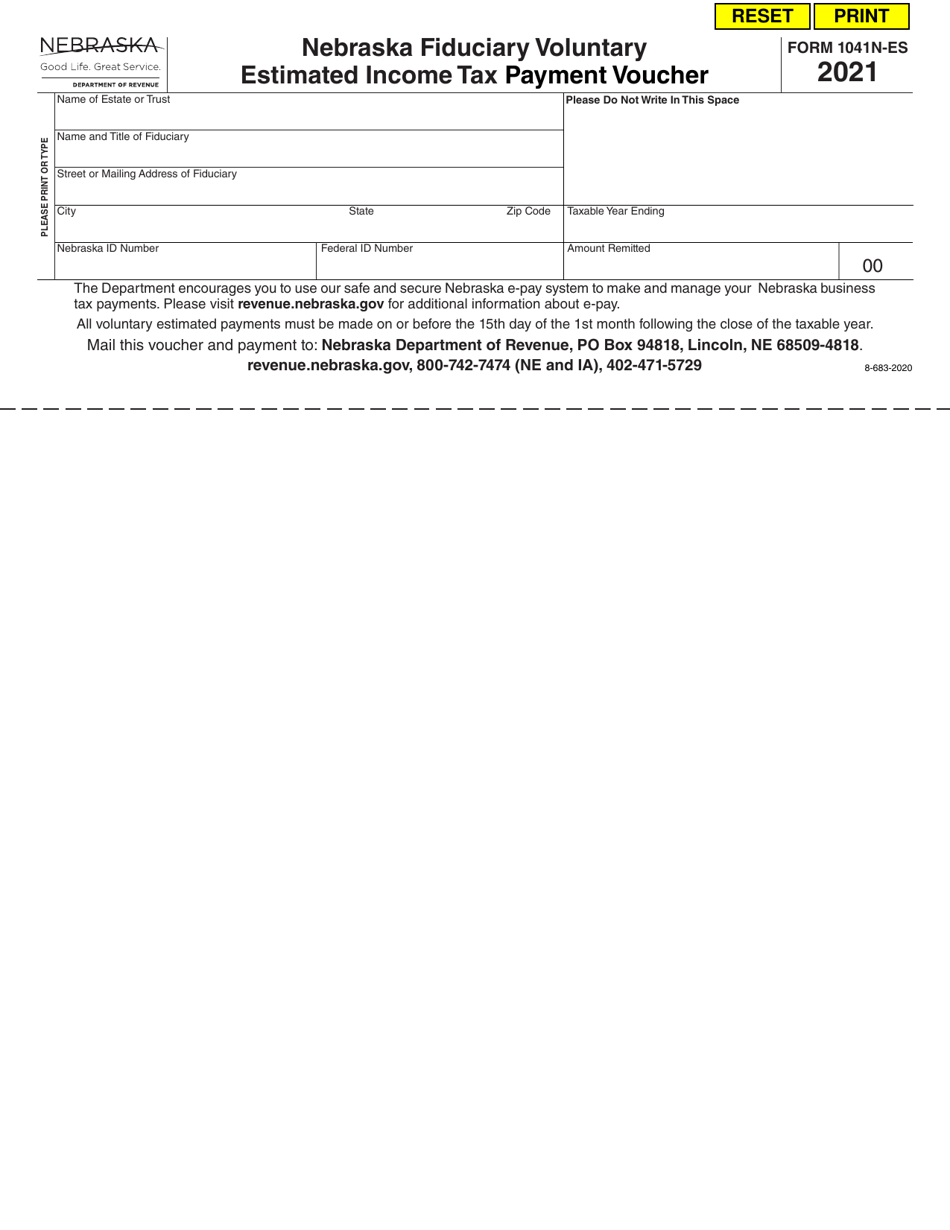

Form 1041NES Download Fillable PDF or Fill Online Nebraska Fiduciary

Numeric listing of all current nebraska tax forms. Web must file form 521. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Web the real estate transfer statement (form 521) is used for the purpose of recording transfers of interest in real property. Web estate transfer statement, form 521, is signed.

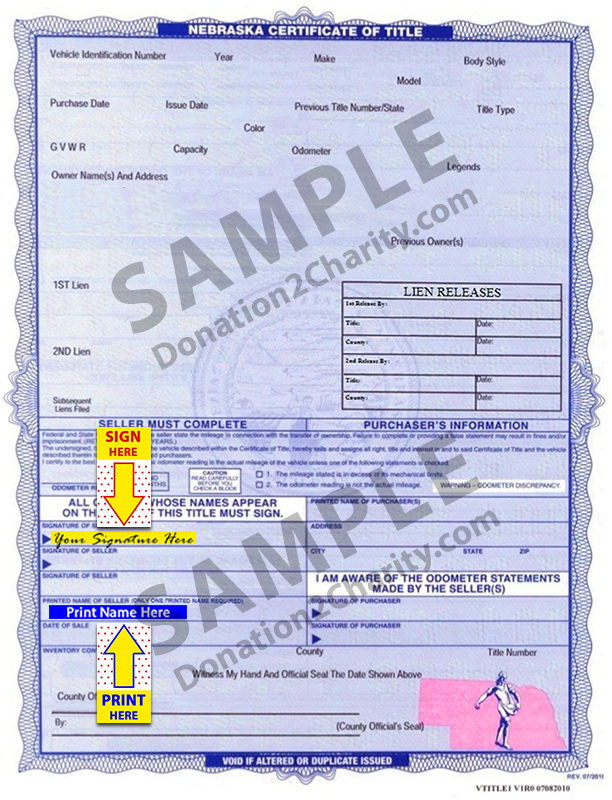

Nebraska Donation2Charity

Web death certificate pursuant to a transfer on death deed cover sheet: Web this certificate of exemption is to be filed with the real estate transfer statement, form 521, when exemption #5b is claimed in item 25 on the form 521. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Any grantee,.

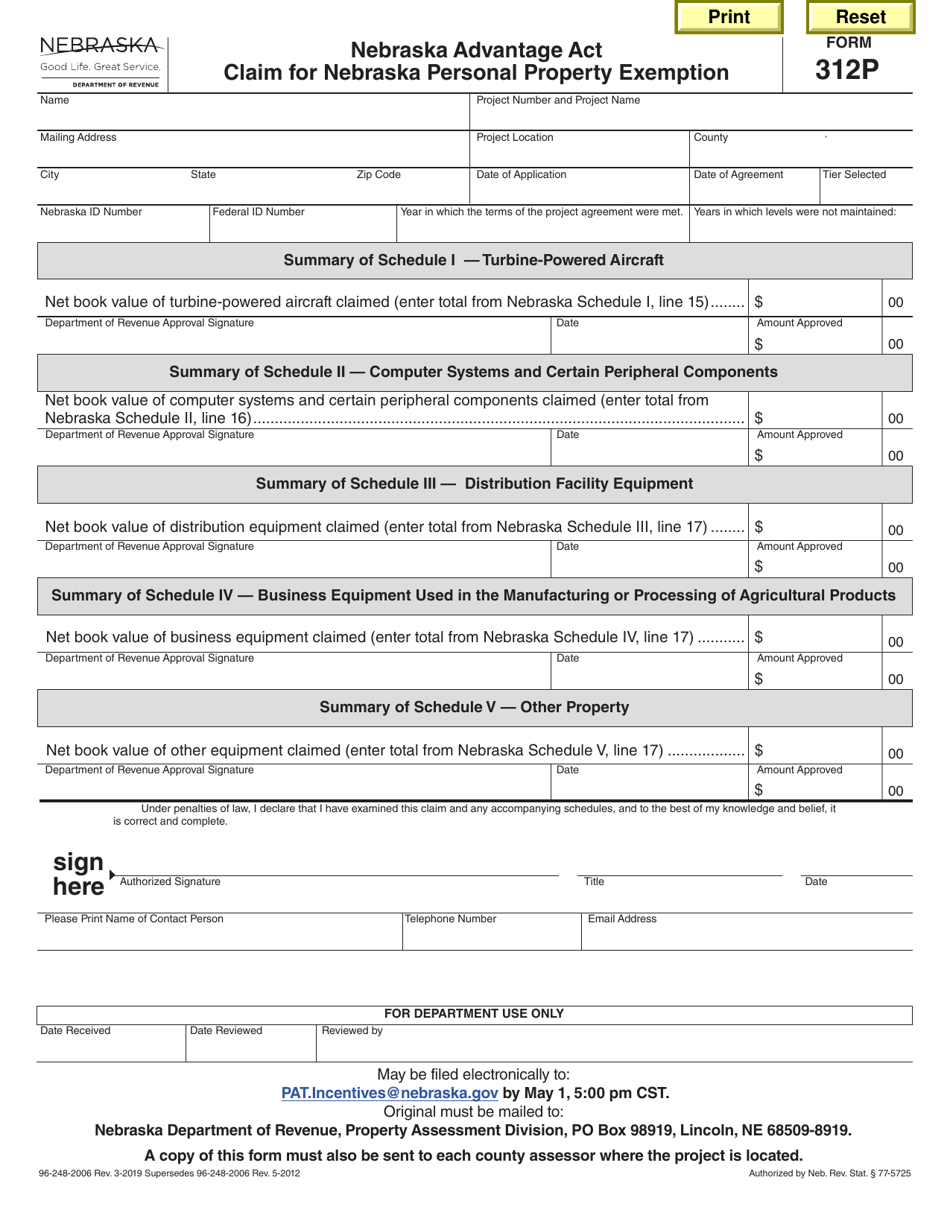

Form 312P Download Fillable PDF or Fill Online Nebraska Advantage Act

Web statement, form 521mh, when seeking a certificate of title for manufactured housing. Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. Form 521mh must be filed with the county treasurer in the county where the application for title Any grantee, or grantee’s authorized representative, who wishes.

Form 521 Download Fillable PDF or Fill Online Real Estate Transfer

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.a land contract or memorandum of contract requires a completed form 521, which is not subject to the documentary stamp tax until the deed is.

Interspousal Transfer Deed Form Massachusetts Form Resume Examples

Web must file form 521. Web the real estate transfer statement (form 521) is used for the purpose of recording transfers of interest in real property. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.a land contract or memorandum of contract requires a completed form 521, which is not subject.

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

When and where to file. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. Form 521mh must be filed with the county treasurer in the county where the application for title Land contracts,.

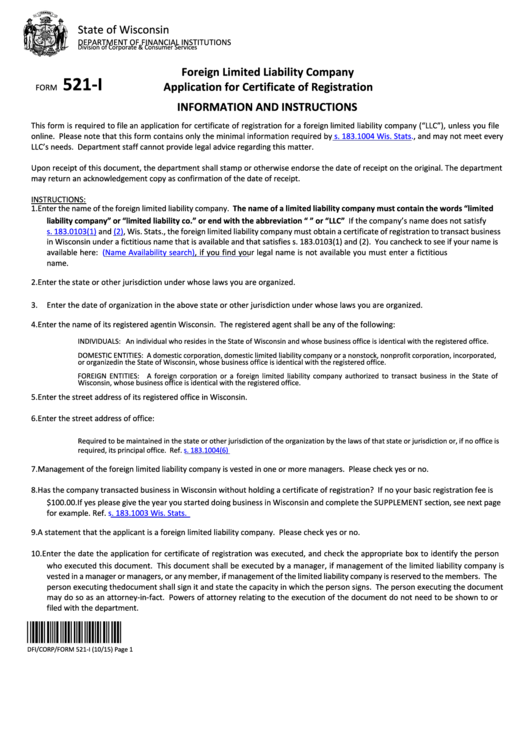

Form 521I Limited Liability Company Application For Certificate Of

Web death certificate pursuant to a transfer on death deed cover sheet: If the grantee or purchaser fails to furnish a completed form 521, nebraska law Web estate transfer statement, form 521, is signed. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521. Web the real estate transfer statement (form.

Nebraska Form 521 Fill Out and Sign Printable PDF Template signNow

Web death certificate pursuant to a transfer on death deed cover sheet: A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. When and where to file. Web this certificate of exemption is to be filed with the real estate transfer statement, form.

Web Estate Transfer Statement, Form 521, Is Signed.

Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Previous years' income tax forms. Numeric listing of all current nebraska tax forms.

Land Contracts, Memoranda Of Contract, And Death Certificates Being Recorded Pursuant To A Transfer On Death Deed

Web must file form 521. A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.a land contract or memorandum of contract requires a completed form 521, which is not subject to the documentary stamp tax until the deed is presented for recording. Web this certificate of exemption is to be filed with the real estate transfer statement, form 521, when exemption #5b is claimed in item 25 on the form 521.

Web Estate Transfer Statement, Form 521, Is Signed.

Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant Form 521mh must be filed with the county treasurer in the county where the application for title Web death certificate pursuant to a transfer on death deed cover sheet: Web statement, form 521mh, when seeking a certificate of title for manufactured housing.

Every Deed Or Any Other Instrument Affecting Title To Real Property Is Required To Be Recorded With The County Register Of Deeds.

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed form 521, which are not subject to the documentary stamp tax until the deed is. When and where to file. Web the real estate transfer statement (form 521) is used for the purpose of recording transfers of interest in real property. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.