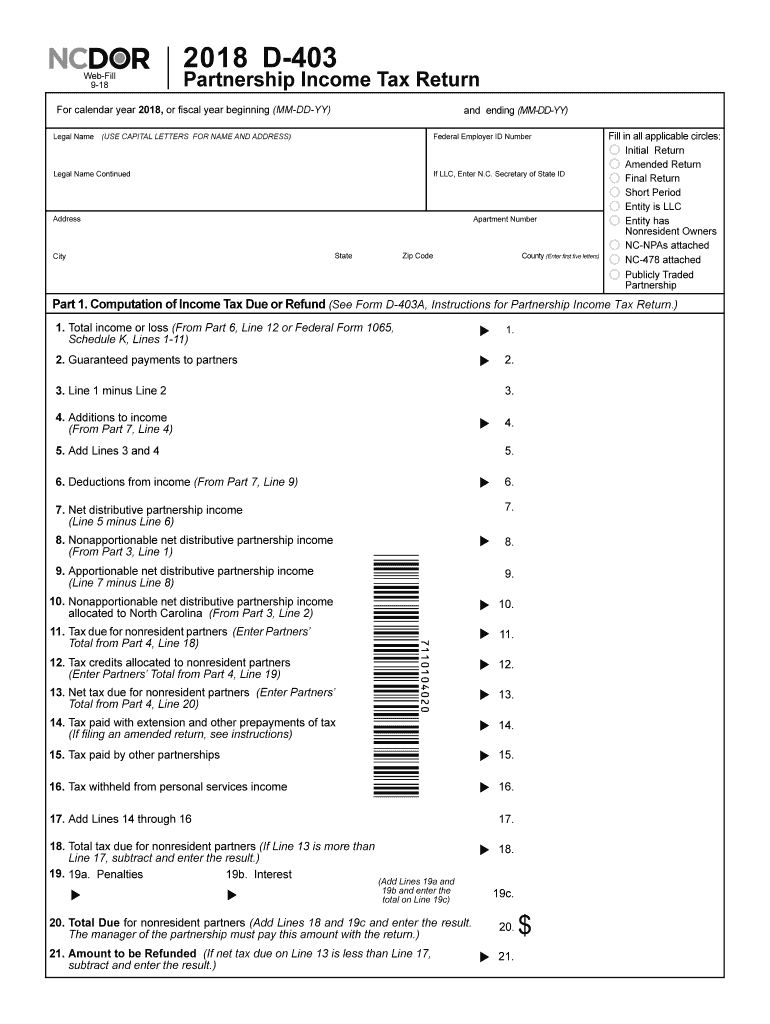

Nc Form D-403

Nc Form D-403 - Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. For partners who are c or s. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. The waiver applies to the failure. Third party file and pay option: Third party file and pay option: Third party file and pay. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web safety measures are in place to protect your tax information. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web safety measures are in place to protect your tax information. For partners who are c or s. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Third party file and pay. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Third party file and pay option: Third party file and pay option: The waiver applies to the failure.

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Web safety measures are in place to protect your tax information. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. For partners who are c or s. Third party file and pay option: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Third party file and pay option: The waiver applies to the failure. Third party file and pay.

Form D403TC Download Fillable PDF or Fill Online Partnership Tax

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Third party file and pay option: Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. The waiver applies to the.

20182022 Form NC NC3 Fill Online, Printable, Fillable, Blank pdfFiller

Web safety measures are in place to protect your tax information. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including,.

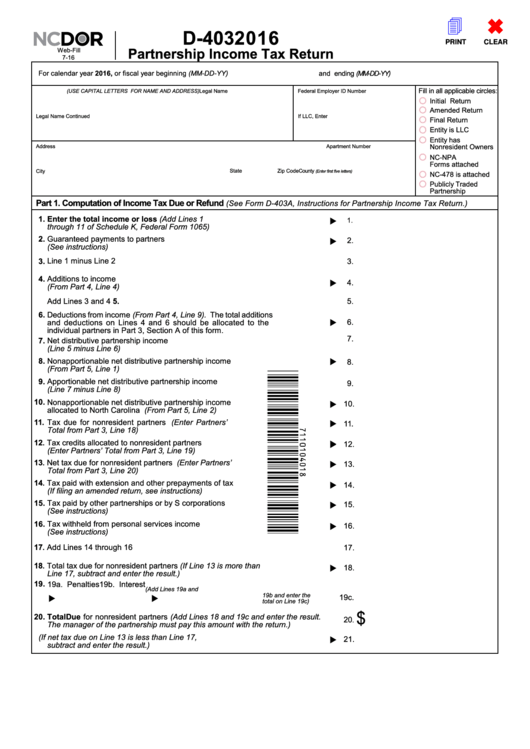

Fillable Form D403 Partnership Tax Return 2016 printable

Third party file and pay option: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not.

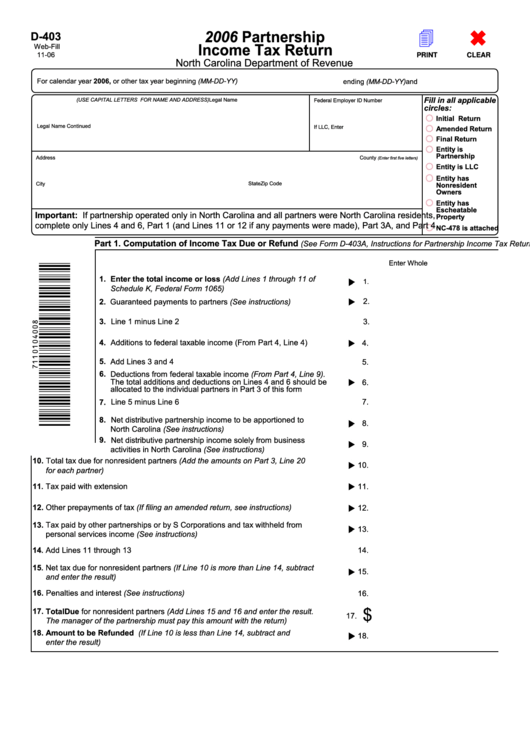

Fillable Form D403 Partnership Tax Return 2006, Form Nc K1

Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Third party file and pay. Third party file and pay option: For partners who are c or s. Web safety measures are in place to protect your tax information.

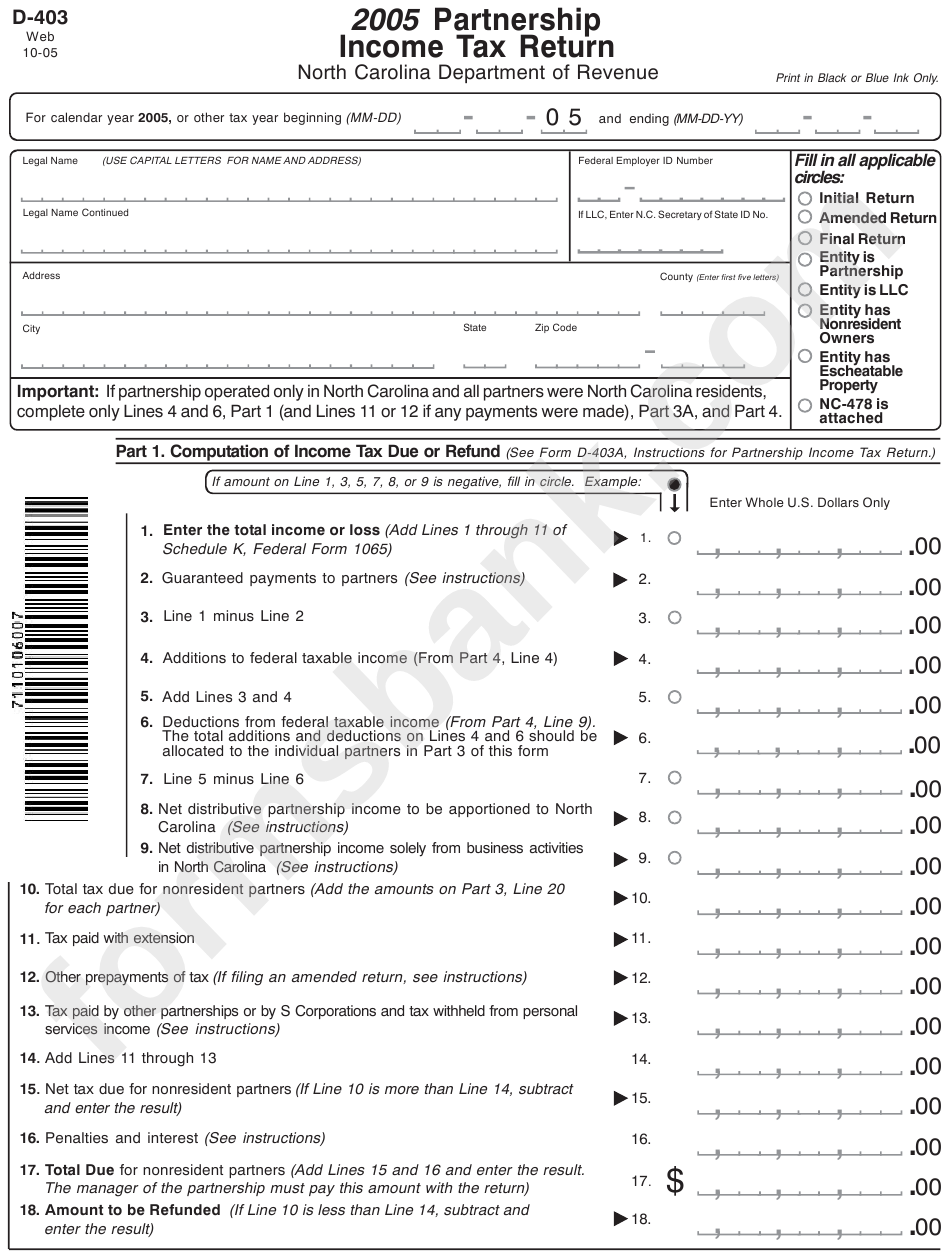

Form D403 Partnership Tax Return 2005, Form Nc K1

Third party file and pay option: Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web the term “doing business in north.

2018 Form NC DoR D403 Fill Online, Printable, Fillable, Blank pdfFiller

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. The waiver applies to the failure. Third party file and pay. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue..

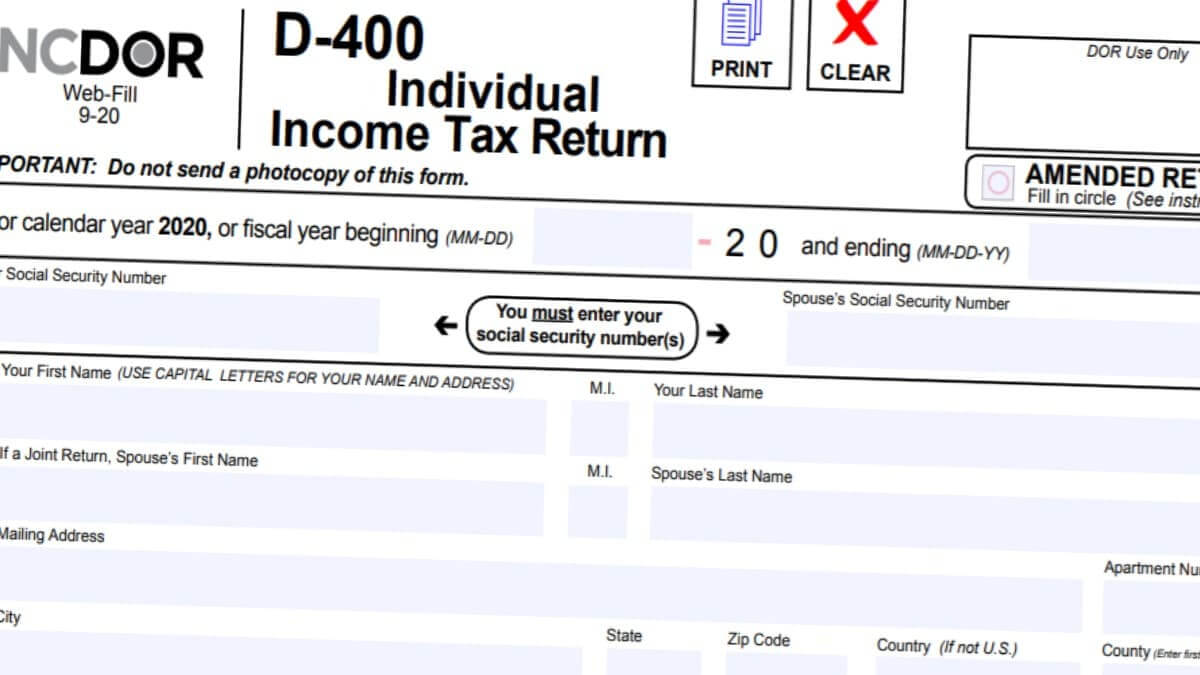

D400 Form 2022 2023 IRS Forms Zrivo

For partners who are c or s. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Third party file and pay. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the.

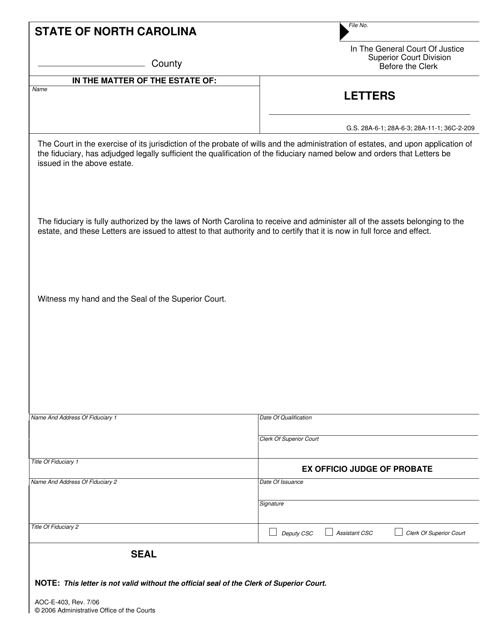

Form AOCE403 Download Fillable PDF or Fill Online Letters North

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. For partners who are c.

20192021 Form NC DoR D403 K1 Fill Online, Printable, Fillable, Blank

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Third party file and pay. Third party file and pay option: For partners who are c or s. Third party file and pay option:

NC D403 NCNPA 2013 Fill out Tax Template Online US Legal Forms

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Web safety measures are in place to protect your tax information. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part.

Third Party File And Pay Option:

Web safety measures are in place to protect your tax information. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Third party file and pay.

For Partners Who Are C Or S.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Third party file and pay option: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. The waiver applies to the failure.