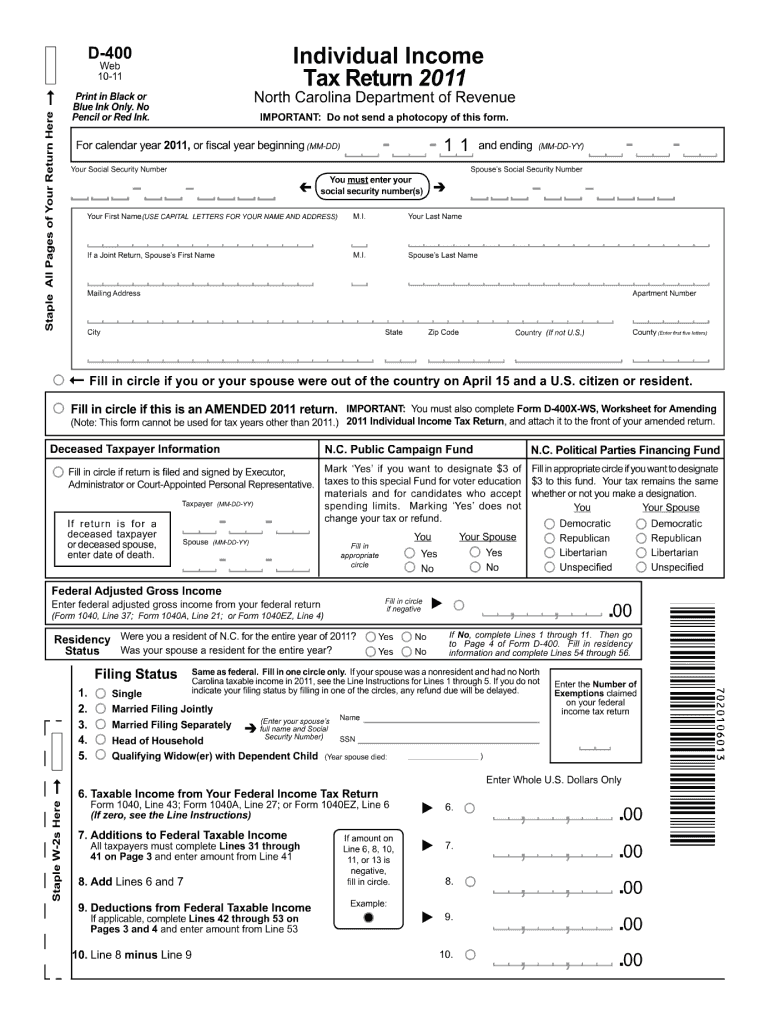

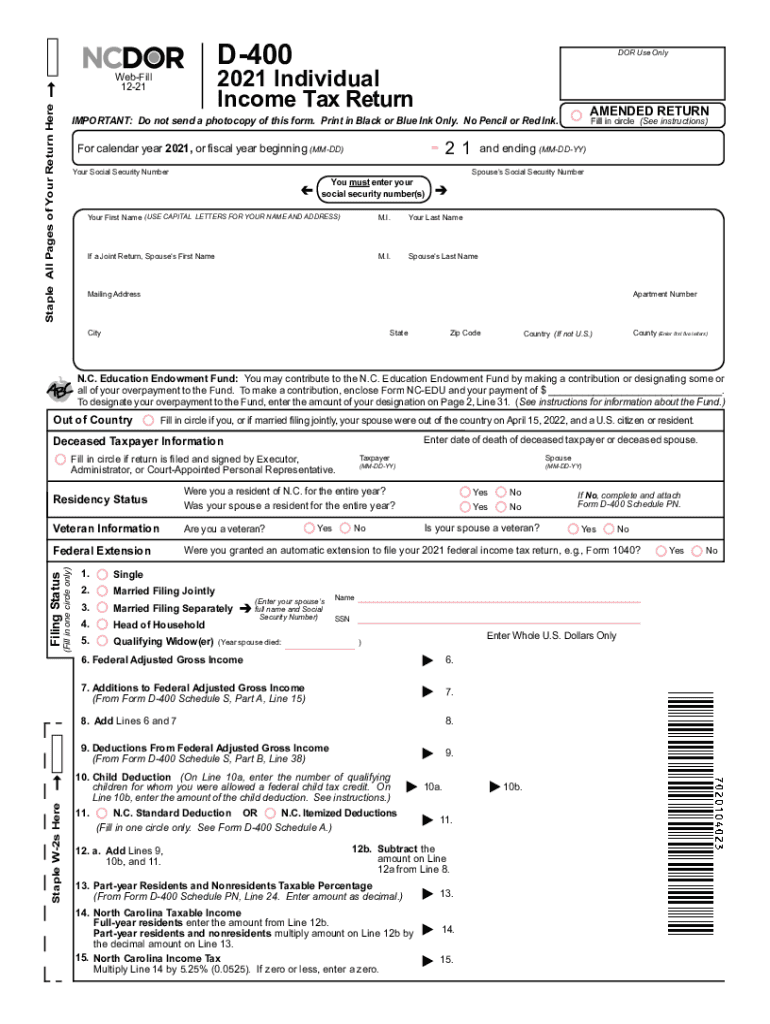

Nc D400 Form 2022

Nc D400 Form 2022 - To determine the amount of n.c. Individual income tax instructions schedule a: Electronic filing options and requirements; Web click here for help if the form does not appear after you click create form. Sales and use electronic data interchange (edi) step by step instructions for efile; Electronic filing options and requirements; Single married filing joint married filing separately head of household widow. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Web click here for help if the form does not appear after you click create form. Sales and use electronic data interchange (edi) step by step instructions for efile; Qualified mortgage interest and real estate property taxes. To determine the amount of n.c. Save or instantly send your ready documents. Sales and use electronic data interchange (edi) step by step instructions for efile; This form allows you to report your income, deductions, credits, and tax liability. Electronic filing options and requirements; Single married filing joint married filing separately head of household widow. You can also find instructions, schedules, and other forms on the ncdor website.

You can also find instructions, schedules, and other forms on the ncdor website. Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. To determine the amount of n.c. Individual income tax instructions schedule a: Web click here for help if the form does not appear after you click create form. Sales and use electronic data interchange (edi) step by step instructions for efile; Save or instantly send your ready documents. Sales and use electronic data interchange (edi) step by step instructions for efile; This form is for income earned in tax year 2022, with tax returns due in april 2023. Single married filing joint married filing separately head of household widow.

2014 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank

Easily fill out pdf blank, edit, and sign them. You can also find instructions, schedules, and other forms on the ncdor website. Individual income tax instructions schedule a: We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. To determine the amount of n.c.

D400 Form Fill Out and Sign Printable PDF Template signNow

Electronic filing options and requirements; This form allows you to report your income, deductions, credits, and tax liability. You can also find instructions, schedules, and other forms on the ncdor website. Web click here for help if the form does not appear after you click create form. Save or instantly send your ready documents.

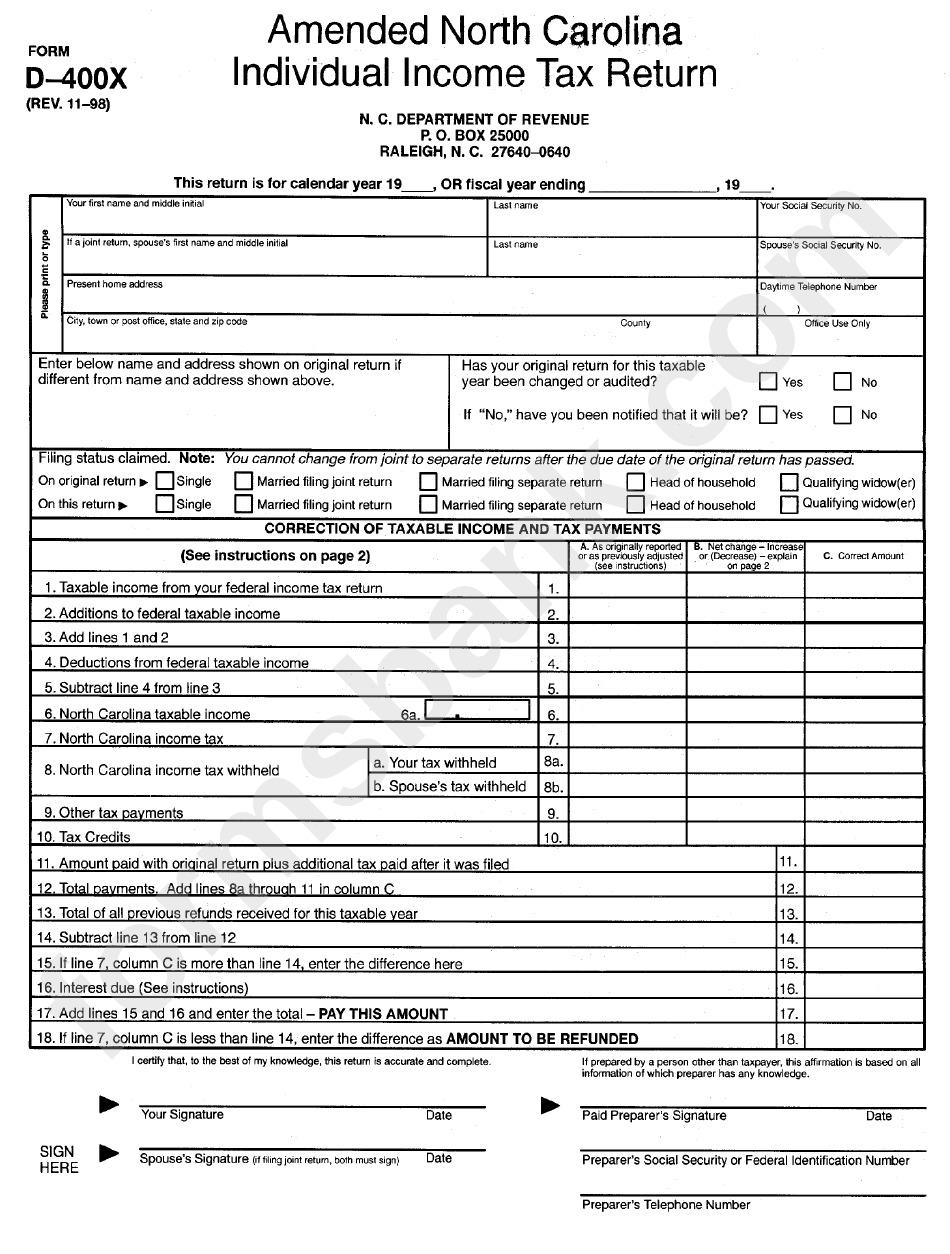

Fillable Form D400x Amended North Carolina Individual Tax

Individual income tax instructions schedule a: You can also find instructions, schedules, and other forms on the ncdor website. Easily fill out pdf blank, edit, and sign them. Sales and use electronic data interchange (edi) step by step instructions for efile; Electronic filing options and requirements;

Nc d400 instructions 2016

Sales and use electronic data interchange (edi) step by step instructions for efile; Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. You can also find instructions, schedules, and other forms on the ncdor website. Single married filing joint married filing separately head of.

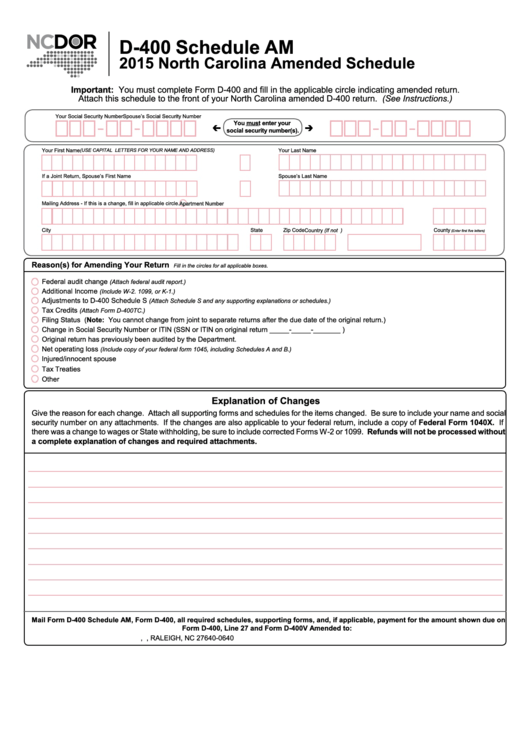

Form D400 Schedule Am North Carolina Amended Schedule 2015

Individual income tax instructions schedule a: This form allows you to report your income, deductions, credits, and tax liability. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sales and use electronic data interchange (edi) step by step instructions for efile;

Nc d400 instructions 2016

We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Sales and use electronic data interchange (edi) step by step instructions for efile; This form allows you to report your income, deductions, credits, and tax liability. This form is for income earned in tax.

Nc d400 instructions 2016

Save or instantly send your ready documents. Web click here for help if the form does not appear after you click create form. Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Sales and use electronic data interchange (edi) step by step instructions for.

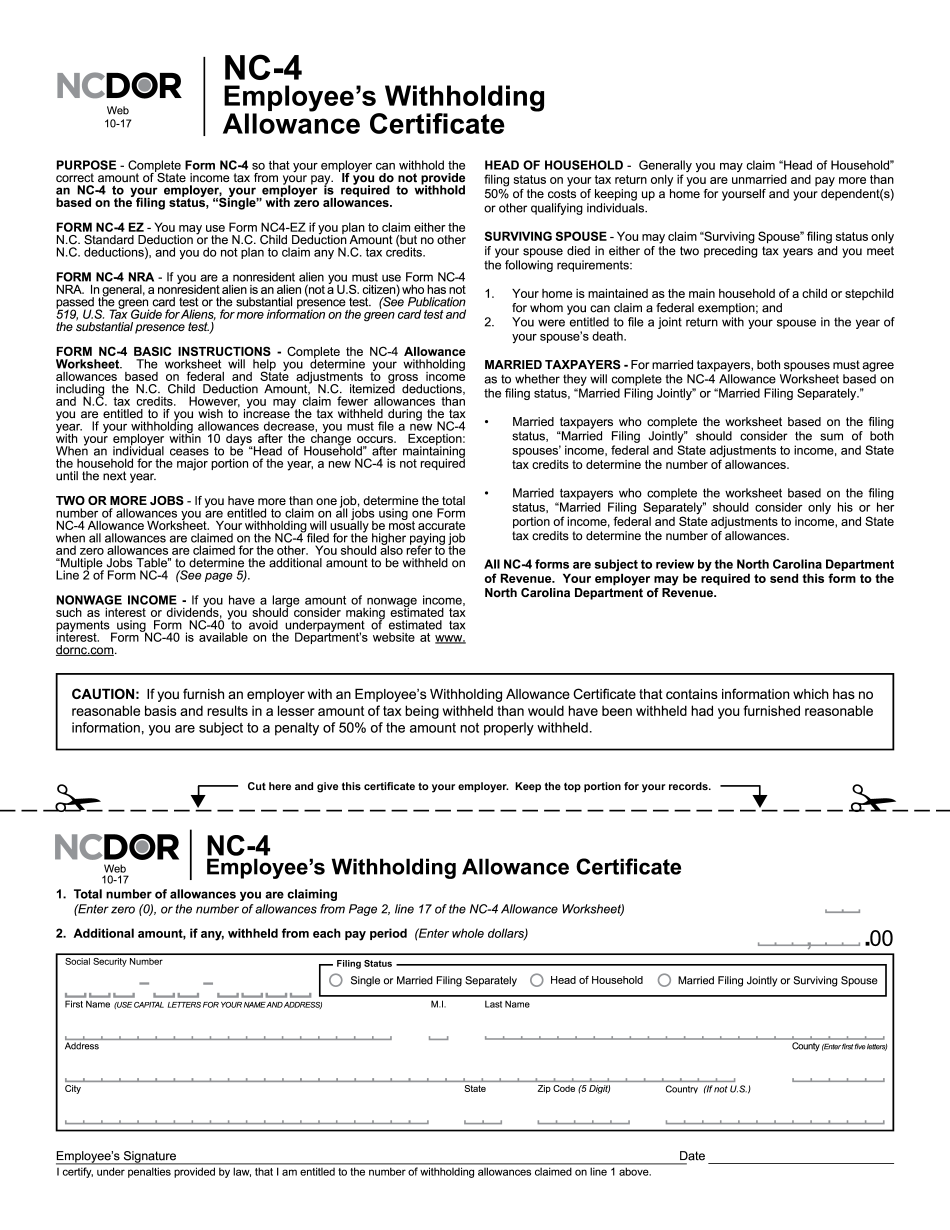

NC4 2022 Printable Form North Carolina Employee's Withholding

Single married filing joint married filing separately head of household widow. Save or instantly send your ready documents. Individual income tax instructions schedule a: Qualified mortgage interest and real estate property taxes. Web click here for help if the form does not appear after you click create form.

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Sales and use electronic data interchange (edi) step by step instructions for efile; You can also find instructions, schedules, and other forms on the ncdor website. Electronic filing options and requirements; Individual income tax instructions schedule a: Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december.

Explore Our Example of Commission Payment Voucher Template Payment

This form is for income earned in tax year 2022, with tax returns due in april 2023. Sales and use electronic data interchange (edi) step by step instructions for efile; Electronic filing options and requirements; Single married filing joint married filing separately head of household widow. You can also find instructions, schedules, and other forms on the ncdor website.

Sales And Use Electronic Data Interchange (Edi) Step By Step Instructions For Efile;

Electronic filing options and requirements; Single married filing joint married filing separately head of household widow. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Sales and use electronic data interchange (edi) step by step instructions for efile;

Qualified Mortgage Interest And Real Estate Property Taxes.

Save or instantly send your ready documents. Individual income tax instructions schedule a: This form is for income earned in tax year 2022, with tax returns due in april 2023. Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022.

Web Click Here For Help If The Form Does Not Appear After You Click Create Form.

You can also find instructions, schedules, and other forms on the ncdor website. This form allows you to report your income, deductions, credits, and tax liability. Easily fill out pdf blank, edit, and sign them. Electronic filing options and requirements;