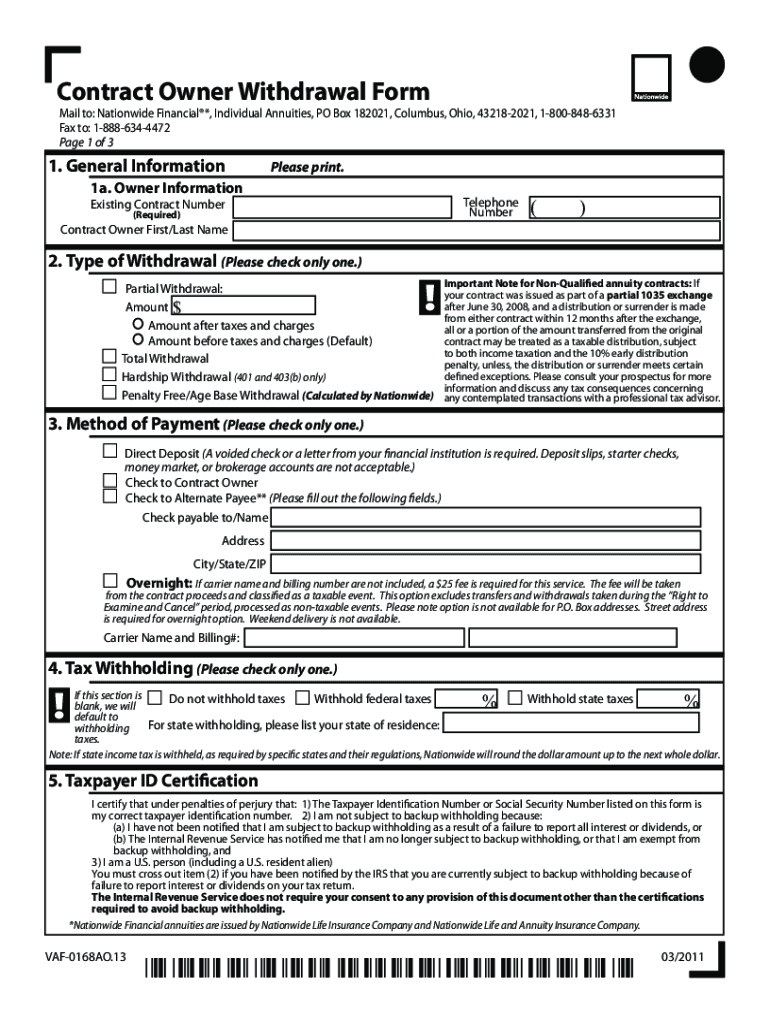

Nationwide Annuity Contract Owner Withdrawal Form

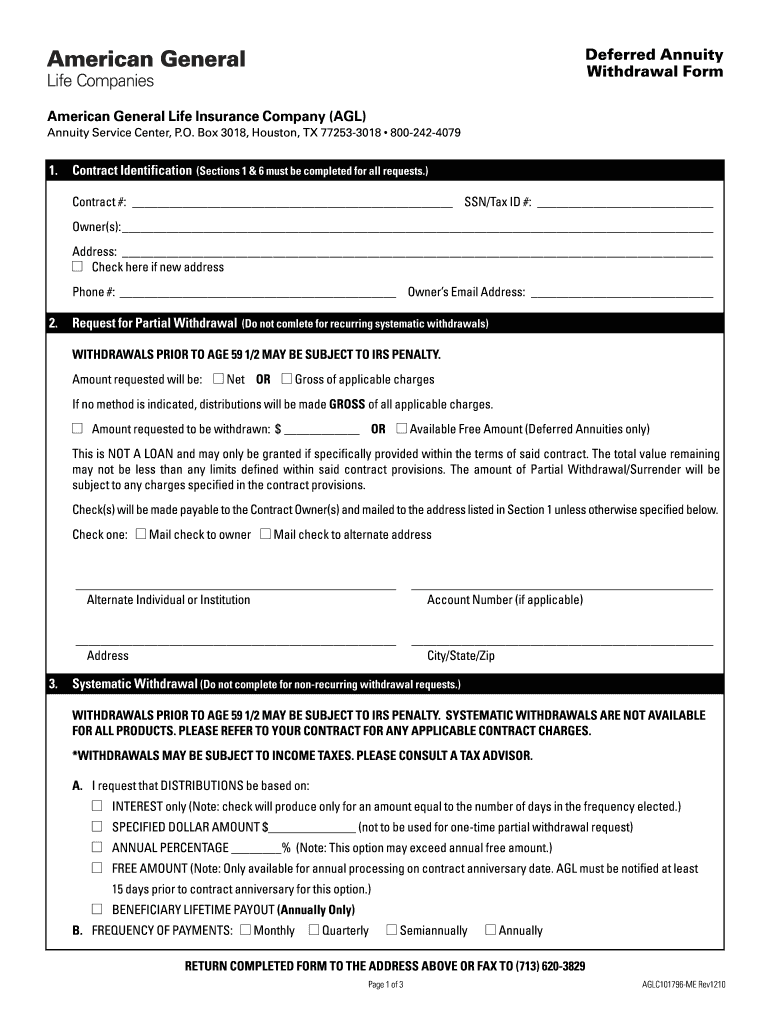

Nationwide Annuity Contract Owner Withdrawal Form - Obtained the later of the first option anniversary or the withdrawal availability date. Submit this form electronically at nationwide.com for quicker handlingcontact us: Nationwide strives to provide excellent customer service. Save your changes and share nationwide contract owner. After june 30, 2008, and a distribution or surrender is made amount $ amount after taxes and charges amount before taxes and. Save time and file a claim online. Ad explore annuity solutions from nationwide. Web 60 votes how to fill out and sign nationwide annuity contract owner withdrawal form online? Upload the annuitydocs nationwide com. Edit & sign nationwide annuity forms from anywhere.

Ad explore annuity solutions from nationwide. Ad explore annuity solutions from nationwide. Nationwide strives to provide excellent customer service. Web 60 votes how to fill out and sign nationwide annuity contract owner withdrawal form online? Save time and file a claim online. Web penalty free/age base withdrawal (calculated by nationwide) contract owner first/last name existing contract number (required) *nationwide financial annuities are. Create professional documents with signnow. Obtained the later of the first option anniversary or the withdrawal availability date. Contract owner withdrawal form (pdf) 07/01/2022: Enter contract owner information first name:

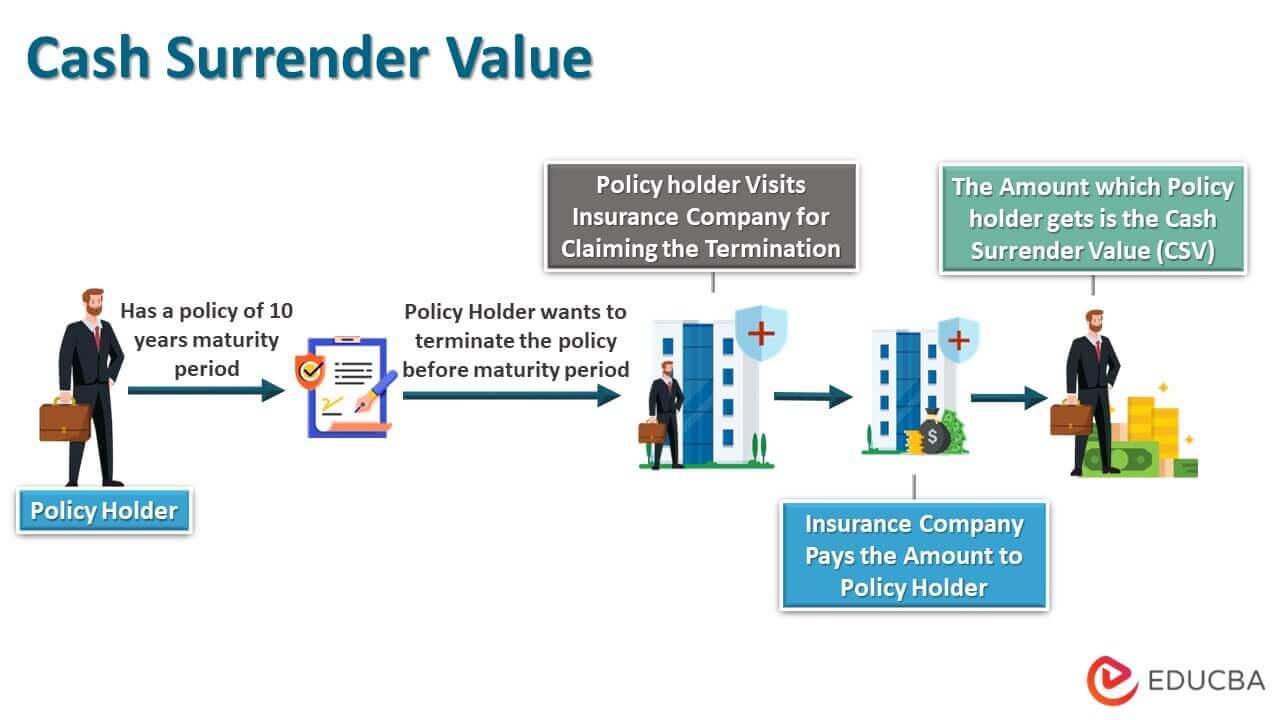

Web use this form to set up or make changes to recurring electronic funds transfers from your checking or savings account in order to make premium payments on your nationwide ®. Naturally, your death benefit and the cash. Web [1] earnings are taxed as ordinary income when withdrawn. Upload the annuitydocs nationwide com. Get your fillable patterns and complete it online using that instructions provides. Get your online template and fill it in using progressive features. Complete this form electronically at. Need to file an insurance or death benefit claim? (new form required annually) maximum withdrawal amount available without cdsc, mva and/or recoupment of unvested bonus, if applicable. Submit this form electronically at nationwide.com for quicker handlingcontact us:

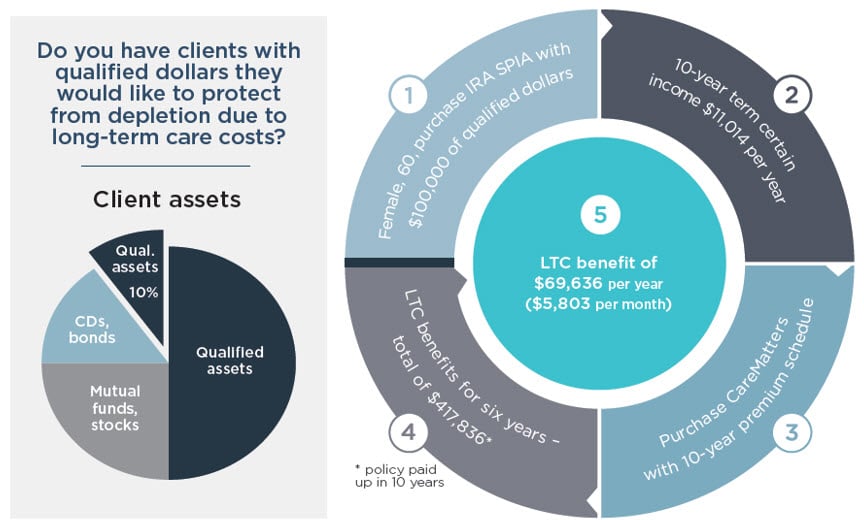

3 Creative ways that annuities can fund LTC Insurance

Nationwide strives to provide excellent customer service. Complete this form electronically at. Ad explore annuity solutions from nationwide. Create professional documents with signnow. Ad explore annuity solutions from nationwide.

annuity.withdrawal_graphic (1) IUPAT

Web for contracts with the lifetime income track rider or retirement income rider you must have: Naturally, your death benefit and the cash. After june 30, 2008, and a distribution or surrender is made amount $ amount after taxes and charges amount before taxes and. Contract owner withdrawal form (pdf) 07/01/2022: Web use this form to set up or make.

Nationwide Annuity New Heights 10 Annuity

Obtained the later of the first option anniversary or the withdrawal availability date. Web use this form to set up or make changes to recurring electronic funds transfers from your checking or savings account in order to make premium payments on your nationwide ®. Enter contract owner information first name: Web 60 votes how to fill out and sign nationwide.

American General Annuity Withdrawal Form 20202022 Fill and Sign

Upload the annuitydocs nationwide com. Save time and file a claim online. Edit & sign nationwide annuity forms from anywhere. Web nationally annuity withdrawal form. Naturally, your death benefit and the cash.

Nationwide Annuity Withdrawal Form Fill Out and Sign Printable PDF

Web nationwide forms download and print the nationwide form you need. Web nationally annuity withdrawal form. Web withdrawal form nationwide life insurance company upload online: Important company for connected states armed. Web contract owner withdrawal form (pdf) 07/01/2022:

Cash Surrender Value How Does Cash Surrender Value Work?

Complete this form electronically at. Nationwide strives to provide excellent customer service. Ad explore annuity solutions from nationwide. Edit & sign nationwide annuity forms from anywhere. Web 60 votes how to fill out and sign nationwide annuity contract owner withdrawal form online?

Nationwide announces launch of new Nationwide Defined Protection

Get your online template and fill it in using progressive features. Web penalty free/age base withdrawal (calculated by nationwide) contract owner first/last name existing contract number (required) *nationwide financial annuities are. Submit this form electronically at nationwide.com for quicker handlingcontact us: Web contract owner withdrawal form (pdf) 07/01/2022: Need to file an insurance or death benefit claim?

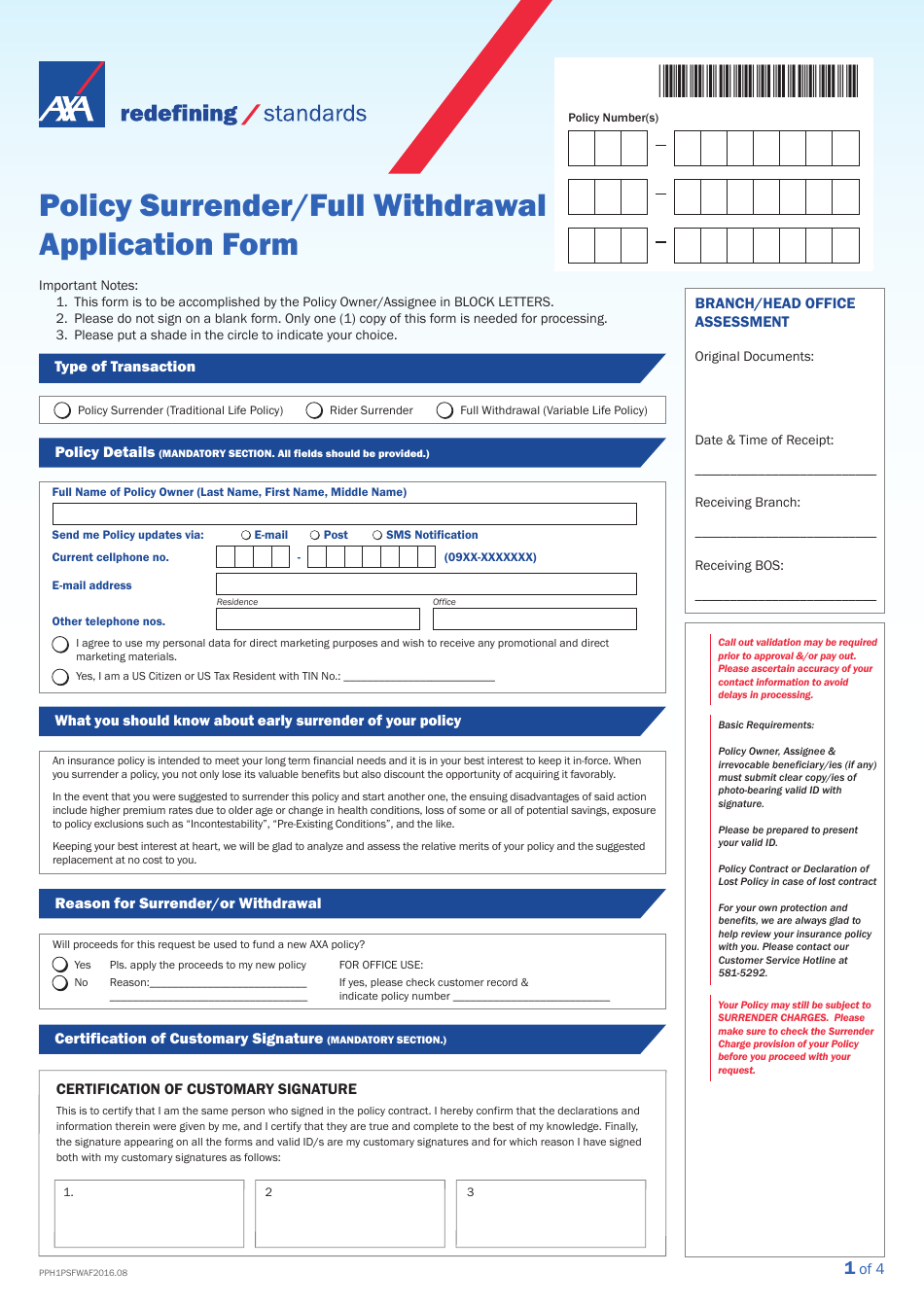

Philippines Policy Surrender/Full Withdrawal Application Form Axa

Important company for connected states armed. Save your changes and share nationwide contract owner. Save time and file a claim online. Web contract owner withdrawal form (pdf) 07/01/2022: (new form required annually) maximum withdrawal amount available without cdsc, mva and/or recoupment of unvested bonus, if applicable.

Mutual Of Omaha Annuity Withdrawal Form Form Resume Examples

Obtained the later of the first option anniversary or the withdrawal availability date. Enter contract owner information first name: Web 60 votes how to fill out and sign nationwide annuity contract owner withdrawal form online? Edit & sign nationwide annuity forms from anywhere. Naturally, your death benefit and the cash.

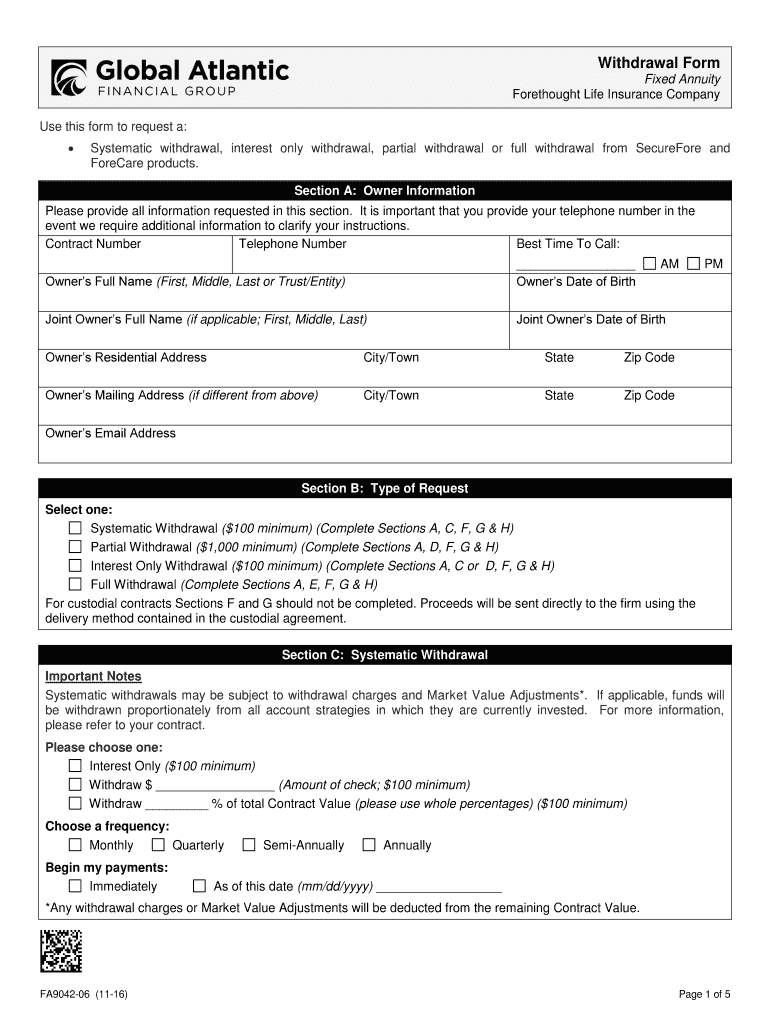

Global Atlantic Annuity Forms Fill Out and Sign Printable PDF

Ad explore annuity solutions from nationwide. Save time and file a claim online. Edit & sign nationwide annuity forms from anywhere. Web penalty free/age base withdrawal (calculated by nationwide) contract owner first/last name existing contract number (required) *nationwide financial annuities are. Get your online template and fill it in using progressive features.

Web Withdrawal Form Nationwide Life Insurance Company Upload Online:

Save time and file a claim online. Obtained the later of the first option anniversary or the withdrawal availability date. Edit & sign nationwide annuity forms from anywhere. Web for contracts with the lifetime income track rider or retirement income rider you must have:

Complete This Form Electronically At.

Submit this form electronically at nationwide.com for quicker handlingcontact us: Save your changes and share nationwide contract owner. Enter contract owner information first name: Web [1] earnings are taxed as ordinary income when withdrawn.

Ad Explore Annuity Solutions From Nationwide.

(new form required annually) maximum withdrawal amount available without cdsc, mva and/or recoupment of unvested bonus, if applicable. After june 30, 2008, and a distribution or surrender is made amount $ amount after taxes and charges amount before taxes and. Web find and download a variety of annuity forms that can be used to service your clients. Naturally, your death benefit and the cash.

Upload The Annuitydocs Nationwide Com.

Need to file an insurance or death benefit claim? Web contract owner withdrawal form (pdf) 07/01/2022: Create professional documents with signnow. There may be a 10% federal tax penalty on withdrawals before age 59½.