Mo Form 5870

Mo Form 5870 - This form was not provided to developers for tax year 2022. Web mo form 5870, foster care affidavit, has been added to setup > pricing. Married filing combined, qualifying widow (er), single, and head of household maximum. Be sure to include form 5870 when. Web revised statutes of missouri, missouri law. Engaged parties names, places of residence and numbers etc. Web use this field to enter the amounts calculated on form 5870, foster care affidavit. The maximum deduction is $5,000 ($2,500 if married filing separate). Web this schedule(s) provides detail in support of the amount(s) shown as disbursements on form 4757, distributor’s monthly tax report. S corporation and partnership packages:

Expedited enforcement of child custody determination. Web revised statutes of missouri, missouri law. Web these forms are designed for people who agree on the terms of their child custody case. S corporation and partnership packages: Web use this field to enter the amounts calculated on form 5870, foster care affidavit. Web this schedule(s) provides detail in support of the amount(s) shown as disbursements on form 4757, distributor’s monthly tax report. Request for missouri absentee ballot. Be sure to include form 5870 when. A petition under sections 452.850 to 452.915 shall be verified. — where a special term shall be ordered, under section 545.850, the judge.

Certified copies of all orders sought to be. Web these forms are designed for people who agree on the terms of their child custody case. Expedited enforcement of child custody determination. The maximum deduction is $5,000 ($2,500 if married filing separate). Married filing combined, qualifying widow (er), single, and head of household maximum. Web forms for use in the following categories have past approved by to supreme court plus ca be found at www.courts.mo.gov by locating court forms available the quick linked. You must save each form before you begin entering information. Each disbursement of product should be. Prosecuting attorney to be notified, when. — where a special term shall be ordered, under section 545.850, the judge.

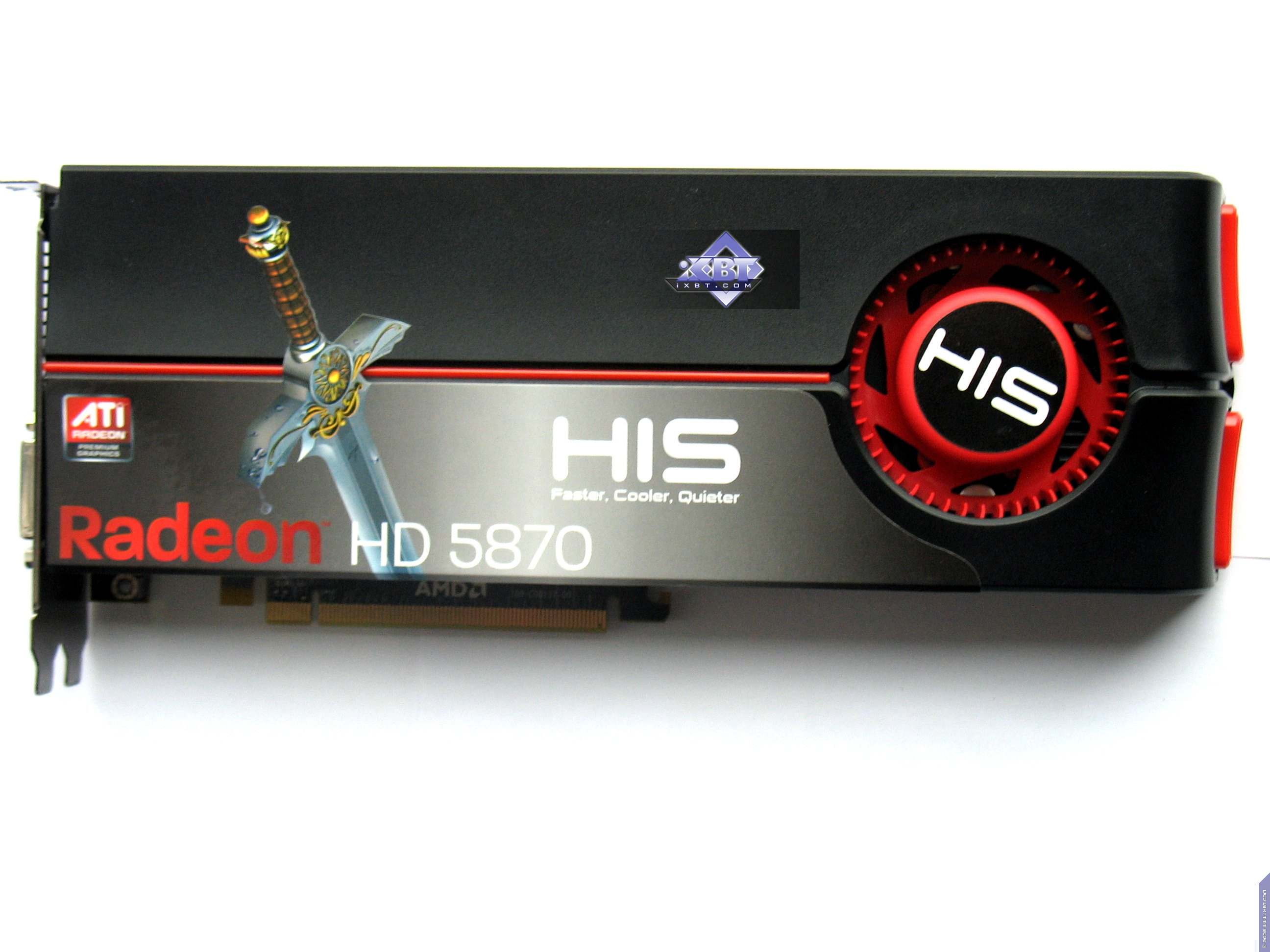

Under the 5870's skin & Specifications VisionTek Radeon HD 5870

Web use this field to enter the amounts calculated on form 5870, foster care affidavit. Web these forms are designed for people who agree on the terms of their child custody case. Web this practice alert is to notify staff that beginning with tax year 2022, missouri revised statute 143.1170 allows individuals to claim a deduction for expenses directly related.

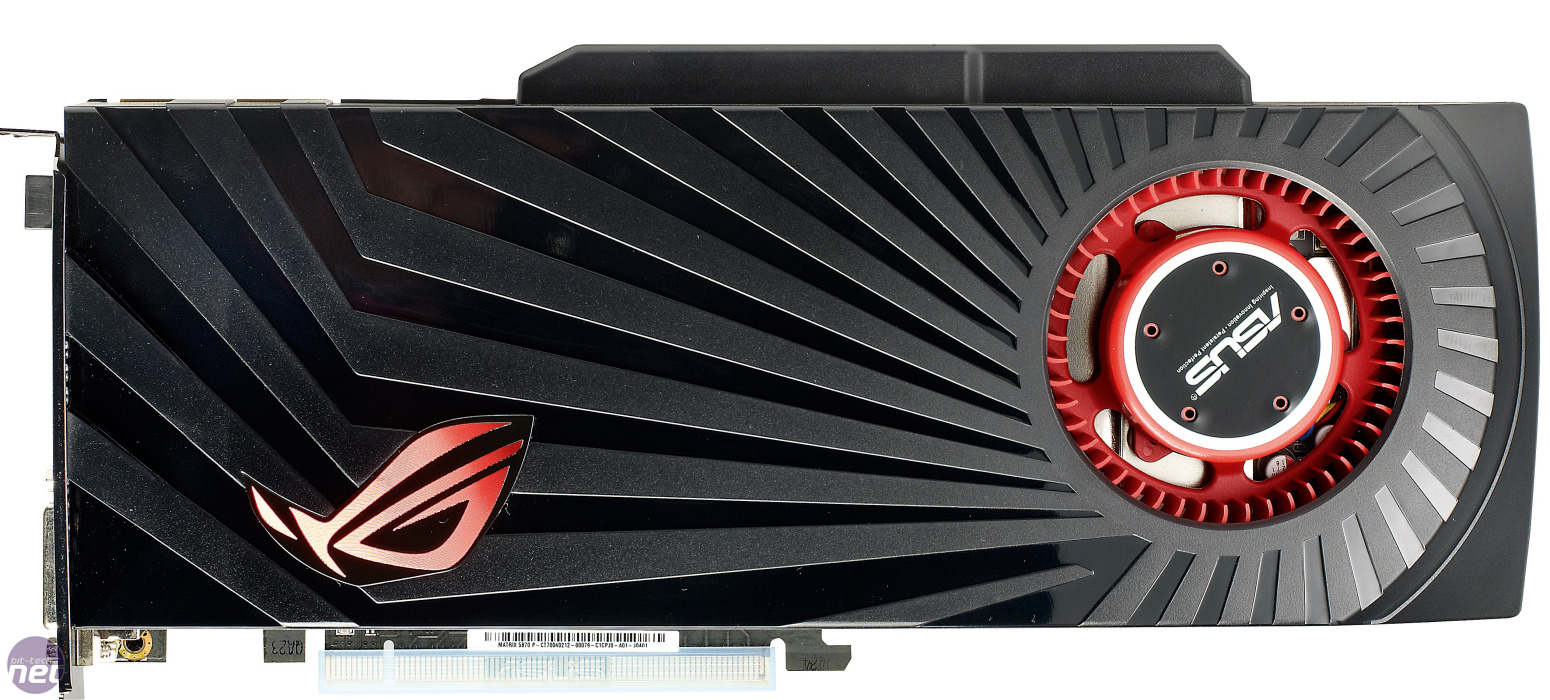

Asus Radeon HD 5870 Voltage Tweak Review

Each disbursement of product should be. — where a special term shall be ordered, under section 545.850, the judge. This form was not provided to developers for tax year 2022. Prosecuting attorney to be notified, when. Web form 5830 agreement for delayed delivery of certificate of ownership this is a written agreement executed between the purchaser and licensed dealer acknowledging.

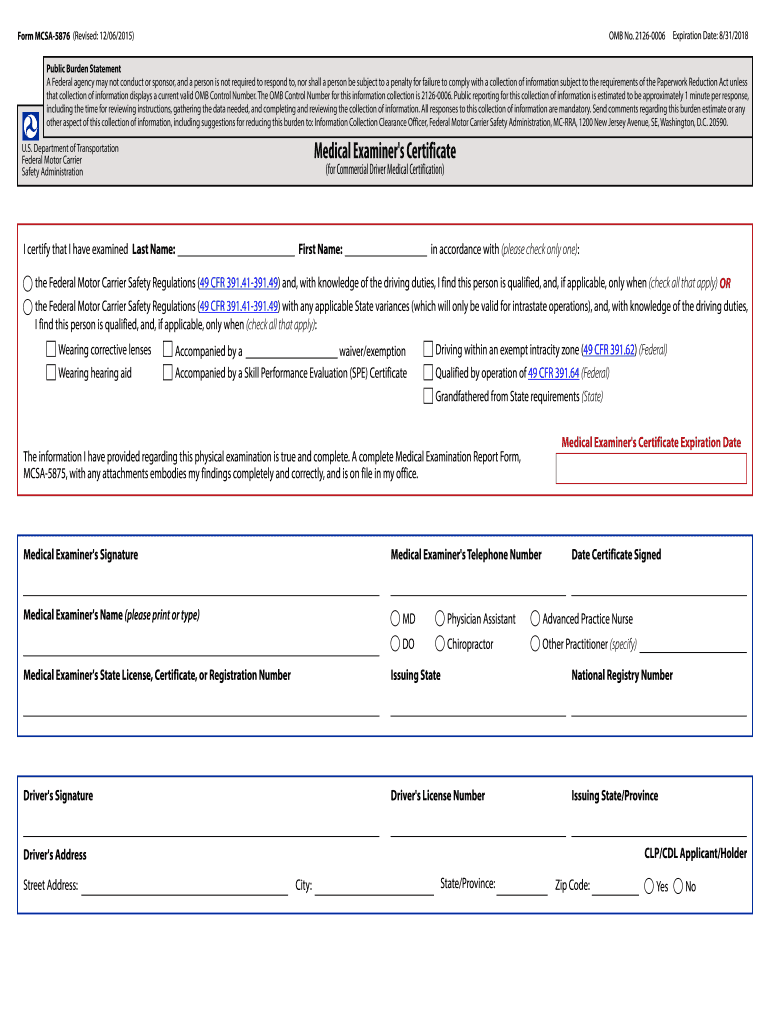

2015 Form MCSA5876 Fill Online, Printable, Fillable, Blank PDFfiller

Web an affidavit (form 5870) must be supplied to verify the taxpayer is a foster parent. Web revised statutes of missouri, missouri law. Certified copies of all orders sought to be. Web this practice alert is to notify staff that beginning with tax year 2022, missouri revised statute 143.1170 allows individuals to claim a deduction for expenses directly related to..

Box, Bundle, Impressions ASUS Matrix 5870 Review Page 2

Married filing combined, qualifying widow (er), single, and head of household maximum. — where a special term shall be ordered, under section 545.850, the judge. How to use the forms: S corporation and partnership packages: Expedited enforcement of child custody determination.

Asus Matrix Radeon HD 5870 Graphics Card Review

Web these forms are designed for people who agree on the terms of their child custody case. Web forms for use in the following categories have past approved by to supreme court plus ca be found at www.courts.mo.gov by locating court forms available the quick linked. You must save each form before you begin entering information. Expedited enforcement of child.

Under the 5870's skin & Specifications VisionTek Radeon HD 5870

Certified copies of all orders sought to be. Web foster parents can now deduct expenses related to caring for a foster child. Be sure to include form 5870 when. Web revised statutes of missouri, missouri law. The maximum deduction is $5,000 ($2,500 if married filing separate).

iXBT Labs More RADEON HD 5870 Graphics Cards Page 1 Introduction

Engaged parties names, places of residence and numbers etc. How to use the forms: Web this practice alert is to notify staff that beginning with tax year 2022, missouri revised statute 143.1170 allows individuals to claim a deduction for expenses directly related to. Certified copies of all orders sought to be. S corporation and partnership packages:

KSD_5870 Berita dan Ulasan Dunia Kereta dan

Web foster parents can now deduct expenses related to caring for a foster child. Web revised statutes of missouri, missouri law. Married filing combined, qualifying widow (er), single, and head of household maximum. Expedited enforcement of child custody determination. Web this practice alert is to notify staff that beginning with tax year 2022, missouri revised statute 143.1170 allows individuals to.

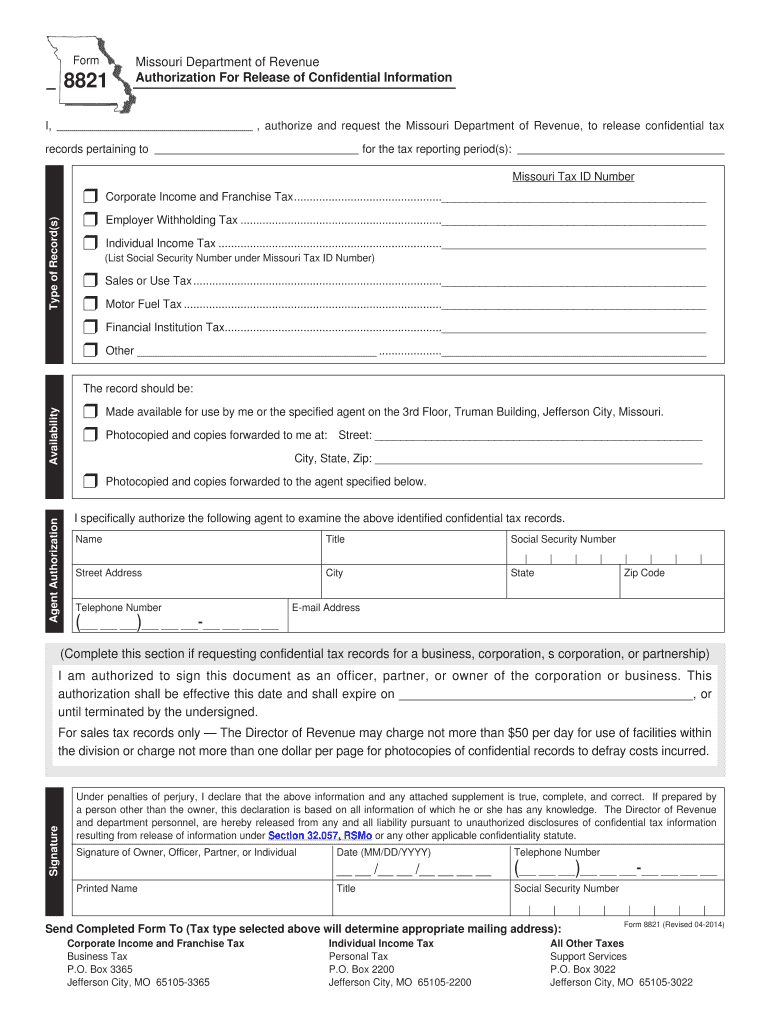

Missouri Form 8821 Authorization for Release of Confidential

You must save each form before you begin entering information. Web use this field to enter the amounts calculated on form 5870, foster care affidavit. — where a special term shall be ordered, under section 545.850, the judge. Request for missouri absentee ballot. Engaged parties names, places of residence and numbers etc.

Mo Form 53 C Fill and Sign Printable Template Online US Legal Forms

A petition under sections 452.850 to 452.915 shall be verified. Web form 5870, foster care affidavit, will now be attached automatically when there is a value on line 24 of form mo 1040, individual income tax return. Web foster parents can now deduct expenses related to caring for a foster child. Web mo form 5870, foster care affidavit, has been.

Web An Affidavit (Form 5870) Must Be Supplied To Verify The Taxpayer Is A Foster Parent.

Web foster parents can now deduct expenses related to caring for a foster child. Web this schedule(s) provides detail in support of the amount(s) shown as disbursements on form 4757, distributor’s monthly tax report. S corporation and partnership packages: You must save each form before you begin entering information.

Web Form 5870, Foster Care Affidavit, Will Now Be Attached Automatically When There Is A Value On Line 24 Of Form Mo 1040, Individual Income Tax Return.

Expedited enforcement of child custody determination. How to use the forms: Engaged parties names, places of residence and numbers etc. This form was not provided to developers for tax year 2022.

Web Form 5830 Agreement For Delayed Delivery Of Certificate Of Ownership This Is A Written Agreement Executed Between The Purchaser And Licensed Dealer Acknowledging The Sale.

Web this practice alert is to notify staff that beginning with tax year 2022, missouri revised statute 143.1170 allows individuals to claim a deduction for expenses directly related to. Request for missouri absentee ballot. Certified copies of all orders sought to be. Web forms for use in the following categories have past approved by to supreme court plus ca be found at www.courts.mo.gov by locating court forms available the quick linked.

The Maximum Deduction Is $5,000 ($2,500 If Married Filing Separate).

Married filing combined, qualifying widow (er), single, and head of household maximum. A petition under sections 452.850 to 452.915 shall be verified. Web mo form 5870, foster care affidavit, has been added to setup > pricing. — where a special term shall be ordered, under section 545.850, the judge.