Mn Form M1

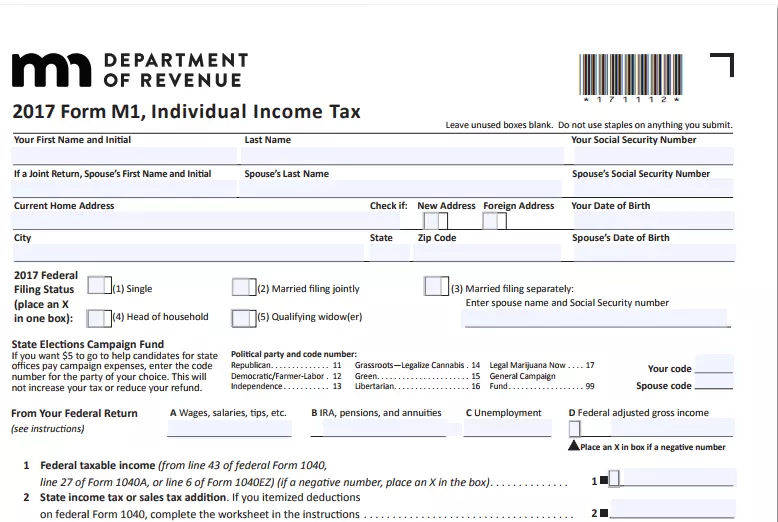

Mn Form M1 - Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. We'll make sure you qualify, calculate your minnesota property tax refund,. Web form m1 is the most common individual income tax return filed for minnesota residents. • as a nonresident, you are required to. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. See the form m1 instructions for details. You must file yearly by april 15. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Click filing on the left. 10 tax from the table in.

Web use form m1 , individual income tax , to estimate your minnesota tax. The purpose of form m1 is to determine. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. We'll make sure you qualify, calculate your minnesota property tax refund,. For more information about the minnesota income tax,. Web form m1 is the most common individual income tax return filed for minnesota residents. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web form m1 is the most common individual income tax return filed for minnesota residents. See the form m1 instructions for details. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax.

Click continue to locate the amount on the screen titled minnesota tax summary. You must file yearly by april 17. Click filing on the left. Your first name and initial last name. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. This form is for income earned in tax year 2022, with tax returns. If zero or less leave blank. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. We'll make sure you qualify, calculate your minnesota property tax refund,. This states that if you maintain your residence in the state of minnesota for the entire year and you meet the requirements of minimum earned income of $12,525 for tax.

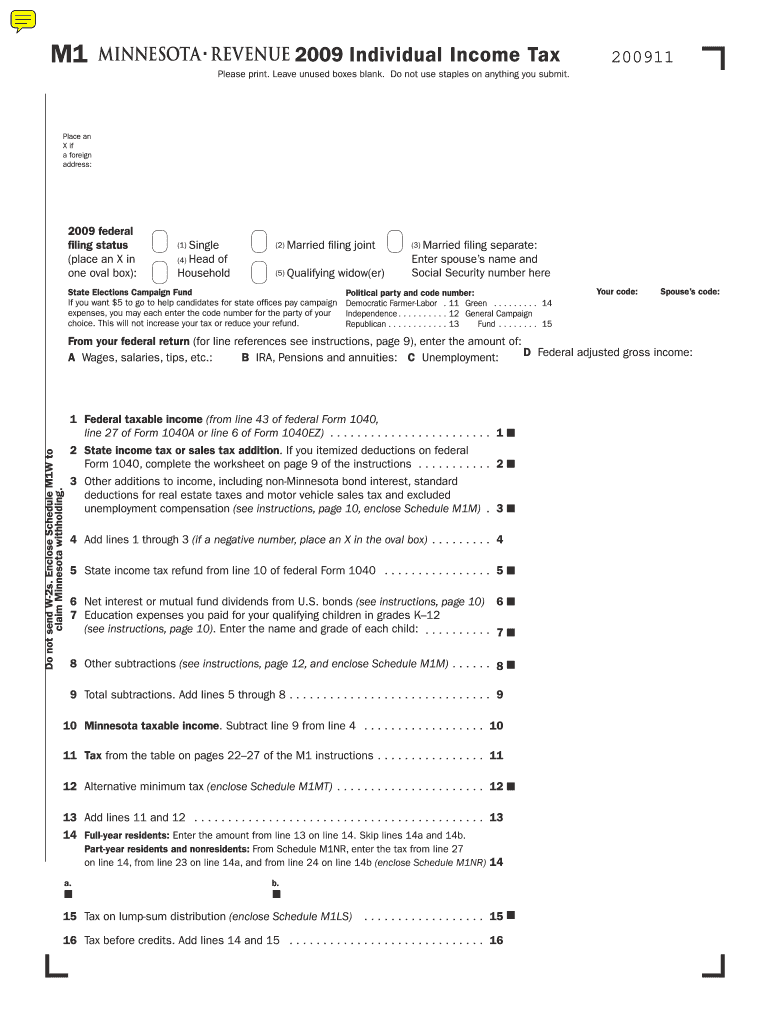

MN DoR M1 2009 Fill out Tax Template Online US Legal Forms

We'll make sure you qualify, calculate your minnesota property tax refund,. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. We last updated the individual income tax return in. Income you calculated in step 1 on form m1 , line 1. Web filing.

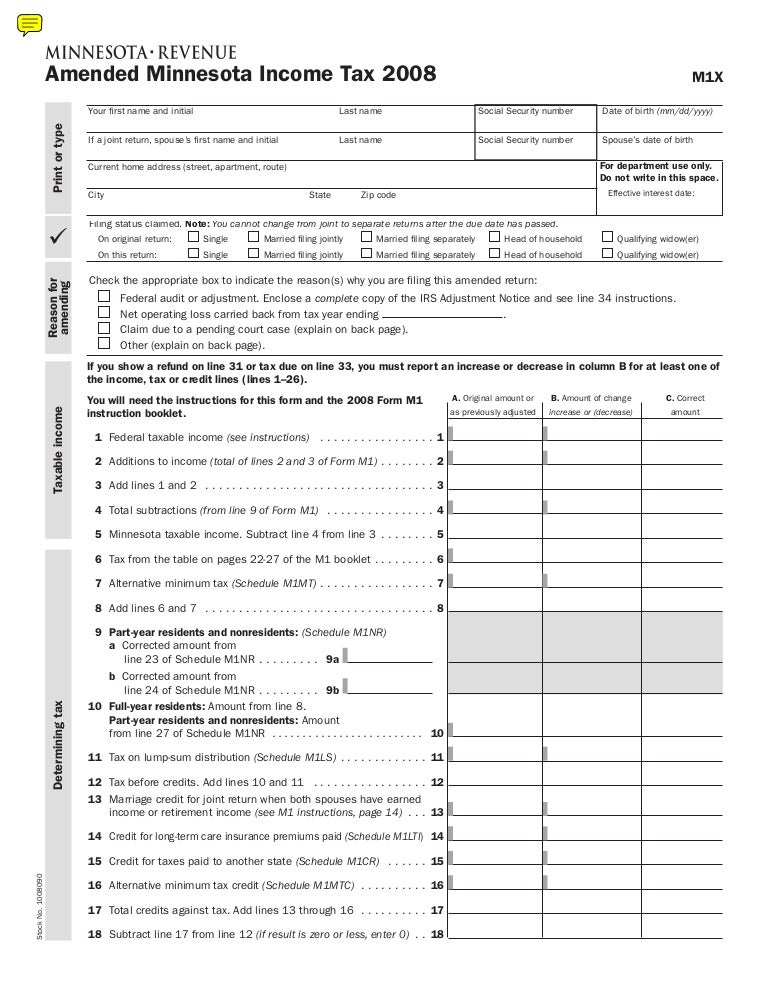

M1X taxes.state.mn.us

The purpose of form m1 is to determine. Click filing on the left. Web 2022 form m1, individual income tax *221111* 2022 form m1, individual income tax do not use staples on anything you submit. Web form m1 is the most common individual income tax return filed for minnesota residents. Web form m1 is the most common individual income tax.

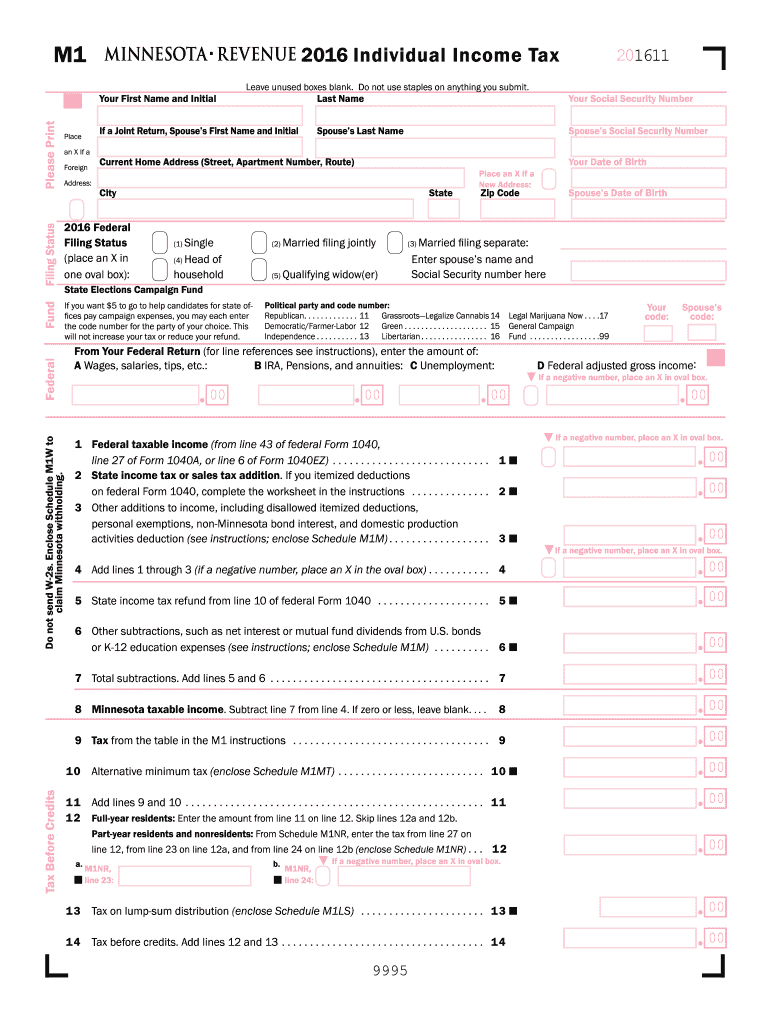

2016 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Do not use staples on anything you submit. If you make any statements on this form that. It will help candidates for state offices. You can also look for forms by category below the search box.

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

• as a nonresident, you are required to. Web upload the minnesota form m1 instructions 2022 edit & sign mn tax from anywhere save your changes and share minnesota m1 instructions rate the 2021 minnesota form 4.7. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Complete form m1 using the minnesota..

Fill Free fillable Minnesota Department of Revenue PDF forms

You can also look for forms by category below the search box. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. Web use form m1.

2016 M1 Instructions Fill Out and Sign Printable PDF Template signNow

Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. Before starting your minnesota income tax return ( form m1, individual income tax.

M1 Tax Table 2017 Instructions

Your first name and initial last name. We last updated the individual income tax return in. Do not use staples on anything you submit. Complete form m1 using the minnesota. Web form m1 is the most common individual income tax return filed for minnesota residents.

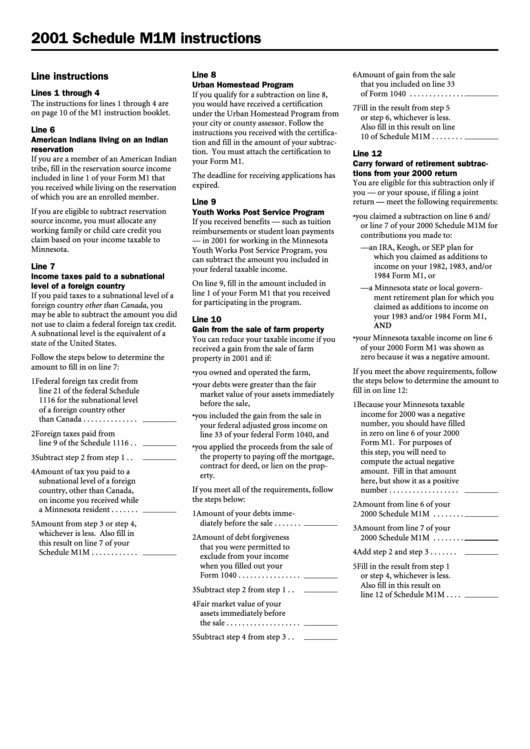

Schedule M1m Instructions 2001 printable pdf download

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. Complete form m1 using the minnesota. Web 2020 form m1, individual income tax state elections campaign fund to grant.

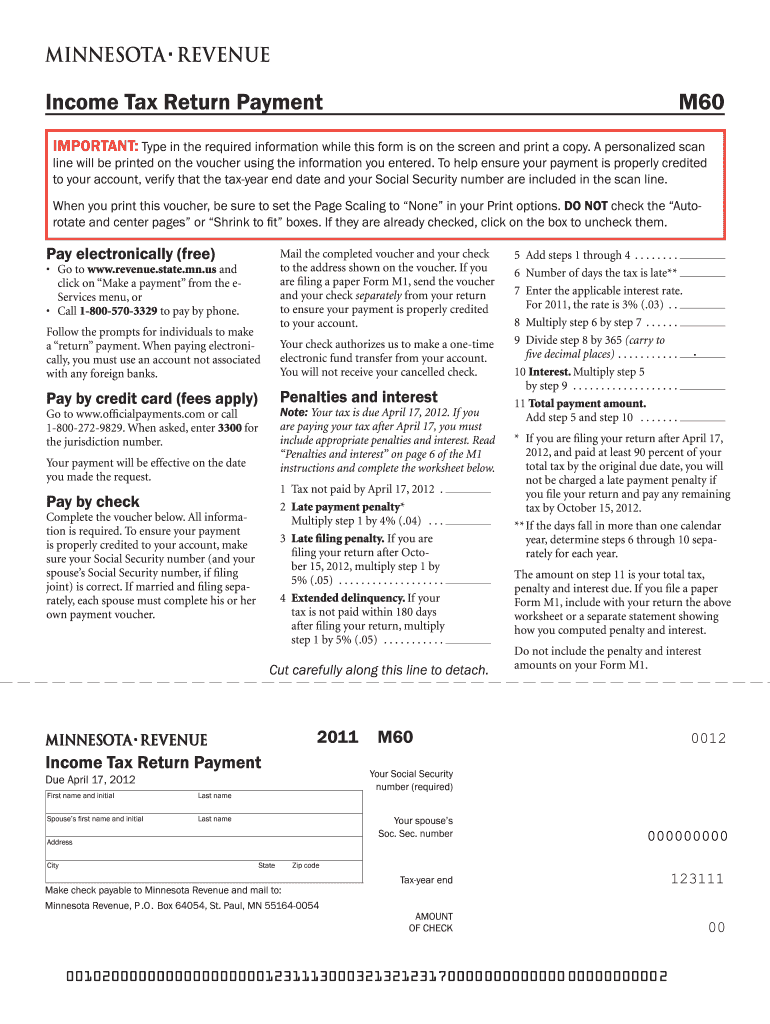

Mn tax payment voucher m60 Fill out & sign online DocHub

This form is for income earned in tax year 2022, with tax returns. You must file yearly by april 17. It will help candidates for state offices. Use this tool to search for a specific tax form using the tax form number or name. If you make any statements on this form that.

Minnesota Form M1

For more information about the minnesota income tax,. We'll make sure you qualify, calculate your minnesota property tax refund,. Use this tool to search for a specific tax form using the tax form number or name. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Web form m1 is the most common.

Web We Last Updated Minnesota Form M1 Instructions In February 2023 From The Minnesota Department Of Revenue.

Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Income you calculated in step 1 on form m1 , line 1. If zero or less leave blank. Complete form m1 using the minnesota.

Web Minnesota Individual Income Tax Forms And Instructions > Form M1 Minnesota Individual Income Tax Return > Schedule M1W Minnesota Income Tax.

It will help candidates for state offices. See the form m1 instructions for details. Web use form m1 , individual income tax , to estimate your minnesota tax. Web upload the minnesota form m1 instructions 2022 edit & sign mn tax from anywhere save your changes and share minnesota m1 instructions rate the 2021 minnesota form 4.7.

Web File Form M1, Individual Income Tax, With The Minnesota Department Of Revenue.

Use this tool to search for a specific tax form using the tax form number or name. You must file yearly by april 17. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. We'll make sure you qualify, calculate your minnesota property tax refund,.

This States That If You Maintain Your Residence In The State Of Minnesota For The Entire Year And You Meet The Requirements Of Minimum Earned Income Of $12,525 For Tax.

Web 2022 form m1, individual income tax *221111* 2022 form m1, individual income tax do not use staples on anything you submit. 10 tax from the table in. Click continue to locate the amount on the screen titled minnesota tax summary. Web what is minnesota form m1?