Mn 1099 Form Printable

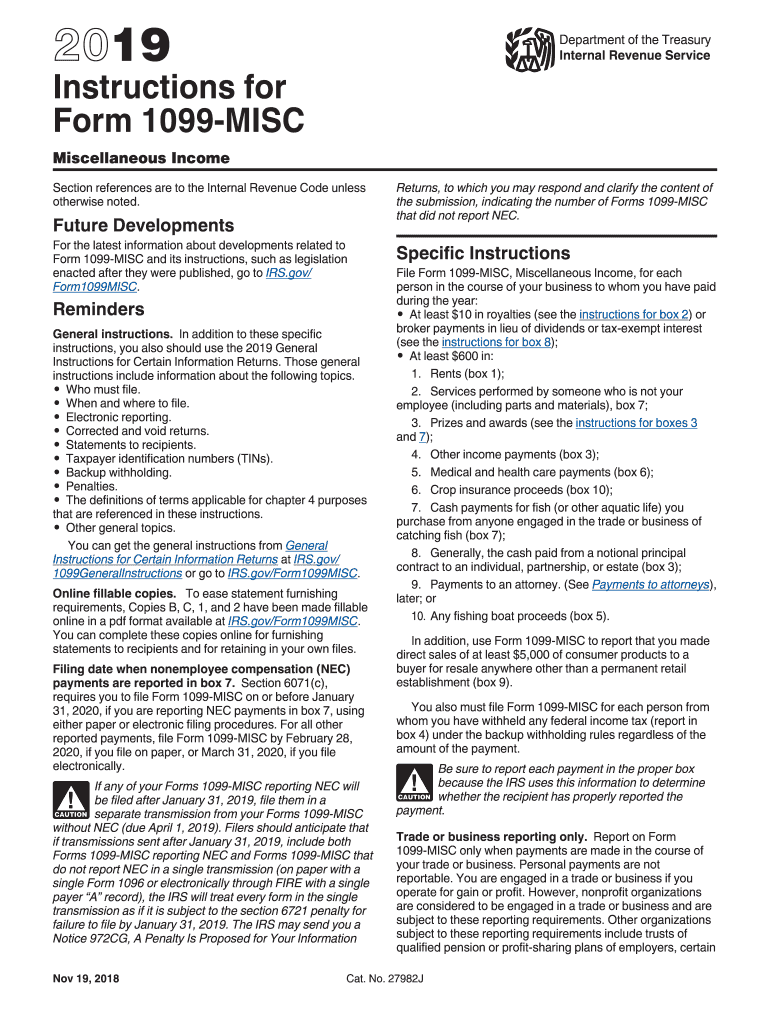

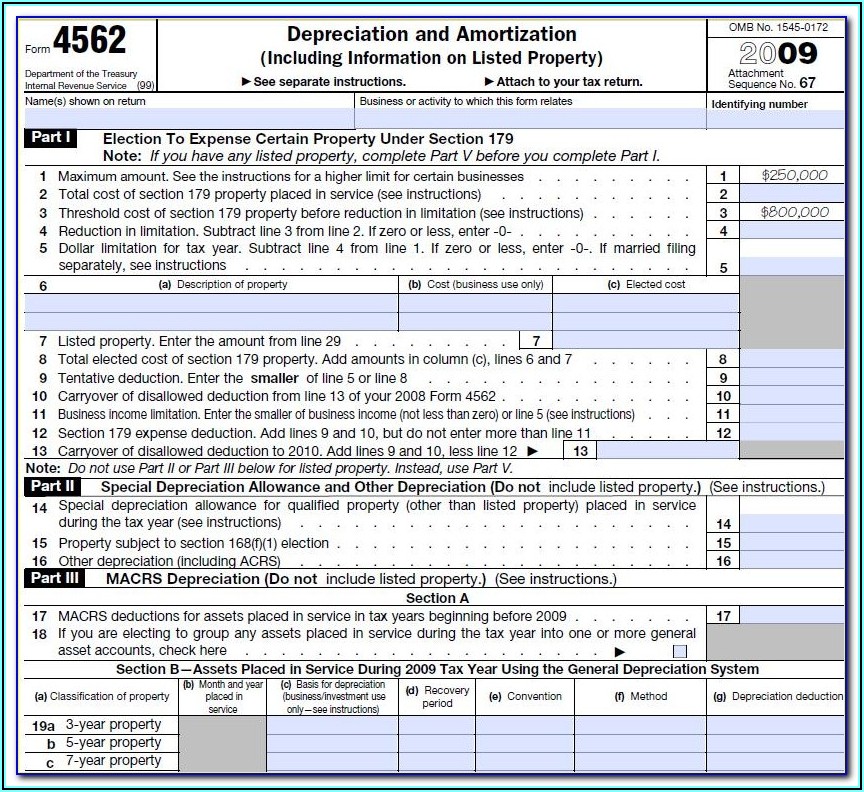

Mn 1099 Form Printable - For filing and furnishing instructions, including due dates, and requesting filing. Web withholding tax file formats. Do not miss the deadline Suppliers may call or email the 1099 helpline at mmb with questions. Web minnesota management and budget (mmb) mailed all 1099 forms to suppliers the week of january 27, 2020. You can get minnesota tax forms either by mail or in person. Name is required on this line; Web 1098, 1099, 3921, or 5498 that you print from the irs website. Imports from quickbooks & creates pdf. Web january 21, 2021.

Web withholding tax file formats. Fill, edit, sign, download & print. For filing and furnishing instructions, including due dates, and requesting filing. Suppliers may call or email the 1099 helpline at mmb with questions. Web 1098, 1099, 3921, or 5498 that you print from the irs website. Web january 21, 2021. Do not leave this line blank. Web instructions for recipient recipient’s taxpayer identification number (tin). Go to www.irs.gov/freefile to see. Web get the mn w2 form printable you require.

Web what types of 1099 forms does minnesota require? Minnesota requires the filing of the following 1099 forms only if there is a state tax withholding. Use this tool to search for a specific tax form using the tax form number or name. Imports from quickbooks & creates pdf. Name is required on this line; Do not leave this line blank. The minnesota department of revenue must send you this information by january 31 of the. You can get minnesota tax forms either by mail or in person. Web withholding tax file formats. Complete, edit or print tax forms instantly.

1099 Form Printable Template Form Resume Examples djVaJ4dl2J

Do not miss the deadline For your protection, this form may show only the last four digits of your social security number. Ad get the latest 1099 misc online. Ad access irs tax forms. Do not leave this line blank.

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

Name is required on this line; Fill, edit, sign, download & print. For your protection, this form may show only the last four digits of your social security number. Suppliers may call or email the 1099 helpline at mmb with questions. Web withholding tax file formats.

Free 1099 Form 2013 Printable Free Printable A To Z

For your protection, this form may show only the last four digits of your social security number. You can also look for forms by category below the search box. Suppliers may call or email the 1099 helpline at mmb with questions. Do not leave this line blank. Complete, edit or print tax forms instantly.

1099 Misc Form 2019 Irs Fill Out and Sign Printable PDF Template

Ad access irs tax forms. You can also look for forms by category below the search box. Fill in the blank fields; Name (as shown on your income tax return). Web instructions for recipient recipient’s taxpayer identification number (tin).

1099 Int Tax Form Printable Universal Network

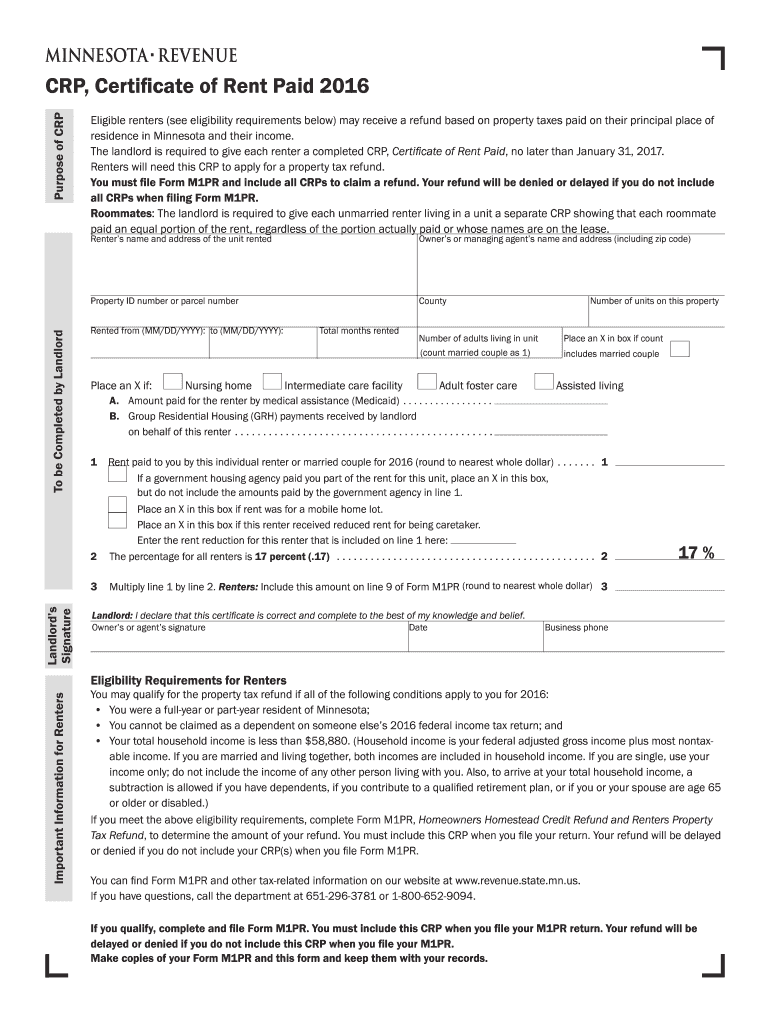

Web this fact sheet explains your requirements and options for submitting form 1099 information to the minnesota department of revenue. Use this tool to search for a specific tax form using the tax form number or name. Filing requirements [+] form 1099 e. Web what types of 1099 forms does minnesota require? Do not leave this line blank.

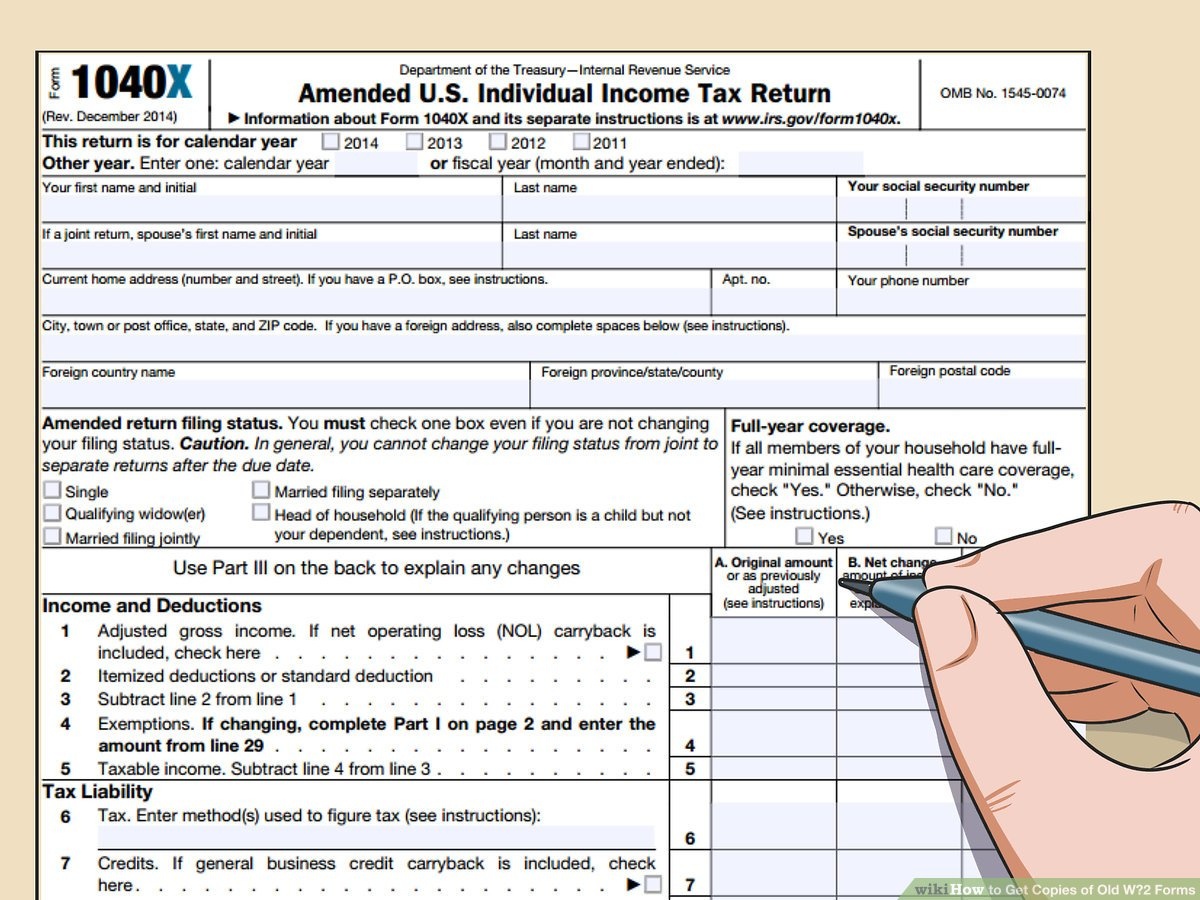

14 Form Mn Ten Great 14 Form Mn Ideas That You Can Share With Your

For your protection, this form may show only the last four digits of your social security number. Web get the mn w2 form printable you require. Go to www.irs.gov/freefile to see. Ad access irs tax forms. Web january 21, 2021.

Nc 1099 Form Printable Form Resume Examples

Fill in the blank fields; Concerned parties names, places of residence and. Web 1098, 1099, 3921, or 5498 that you print from the irs website. Complete, edit or print tax forms instantly. Web this fact sheet explains your requirements and options for submitting form 1099 information to the minnesota department of revenue.

What is a 1099Misc Form? Financial Strategy Center

Use this tool to search for a specific tax form using the tax form number or name. Complete, edit or print tax forms instantly. Go to www.irs.gov/freefile to see. You can also look for forms by category below the search box. The minnesota department of revenue must send you this information by january 31 of the.

How To File 1099 S Fill Online, Printable, Fillable, Blank pdfFiller

For your protection, this form may show only the last four digits of your social security number. Do not leave this line blank. Ad get the latest 1099 misc online. Filing requirements [+] form 1099 e. Minnesota requires the filing of the following 1099 forms only if there is a state tax withholding.

Efile 2022 Form 1099R Report the Distributions from Pensions

You can also look for forms by category below the search box. Do not miss the deadline Web january 21, 2021. Web this fact sheet explains your requirements and options for submitting form 1099 information to the minnesota department of revenue. Ad access irs tax forms.

Name (As Shown On Your Income Tax Return).

Web what types of 1099 forms does minnesota require? Ad get the latest 1099 misc online. Web 1098, 1099, 3921, or 5498 that you print from the irs website. Web this fact sheet explains your requirements and options for submitting form 1099 information to the minnesota department of revenue.

Do Not Leave This Line Blank.

Web january 21, 2021. Imports from quickbooks & creates pdf. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. Name is required on this line;

Web Withholding Tax File Formats.

Filing requirements [+] form 1099 e. You can also look for forms by category below the search box. Web get the mn w2 form printable you require. For filing and furnishing instructions, including due dates, and requesting filing.

Minnesota Requires The Filing Of The Following 1099 Forms Only If There Is A State Tax Withholding.

Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/freefile to see.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)