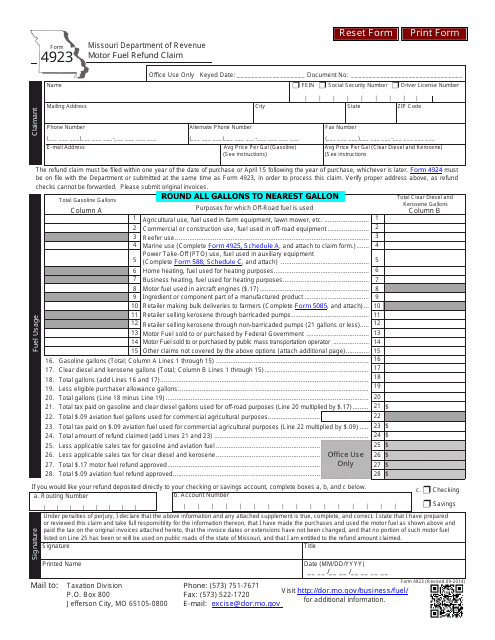

Missouri Gas Tax Refund Form 4925

Missouri Gas Tax Refund Form 4925 - Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. Web tax rate $0.17 schedule a — marine fuel purchases by county use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. “does missouri have a highway gasoline tax refund for the. Then you will need to go to the missouri. View sales history, tax history, home value estimates,. 2.5 cents in 2022 5 cents in 2023 7.5 cents in. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. 30, 2022, on purchases made after oct. 1, 2021, the date missouri most recently increased its gas. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to collect.

Web download my return template use this link to download a preformatted excel spreadsheet, enter your return information and come back later to upload and file your return. Web tax rate $0.17 schedule a — marine fuel purchases by county use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. Web 2 beds, 1 bath, 935 sq. Web once completed you can sign your fillable form or send for signing. House located at 1725 n missouri ave, oklahoma city, ok 73111 sold for $8,000 on jul 26, 1994. All forms are printable and downloadable. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. 2.5 cents in 2022 5 cents in 2023 7.5 cents in. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. If you would like your.

All forms are printable and downloadable. “does missouri have a highway gasoline tax refund for the. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. 30, 2022, on purchases made after oct. Claims must be postmarked between july 1 and. Then you will need to go to the missouri. Web tax rate $0.17 schedule a — marine fuel purchases by county use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. View sales history, tax history, home value estimates,. Web once completed you can sign your fillable form or send for signing.

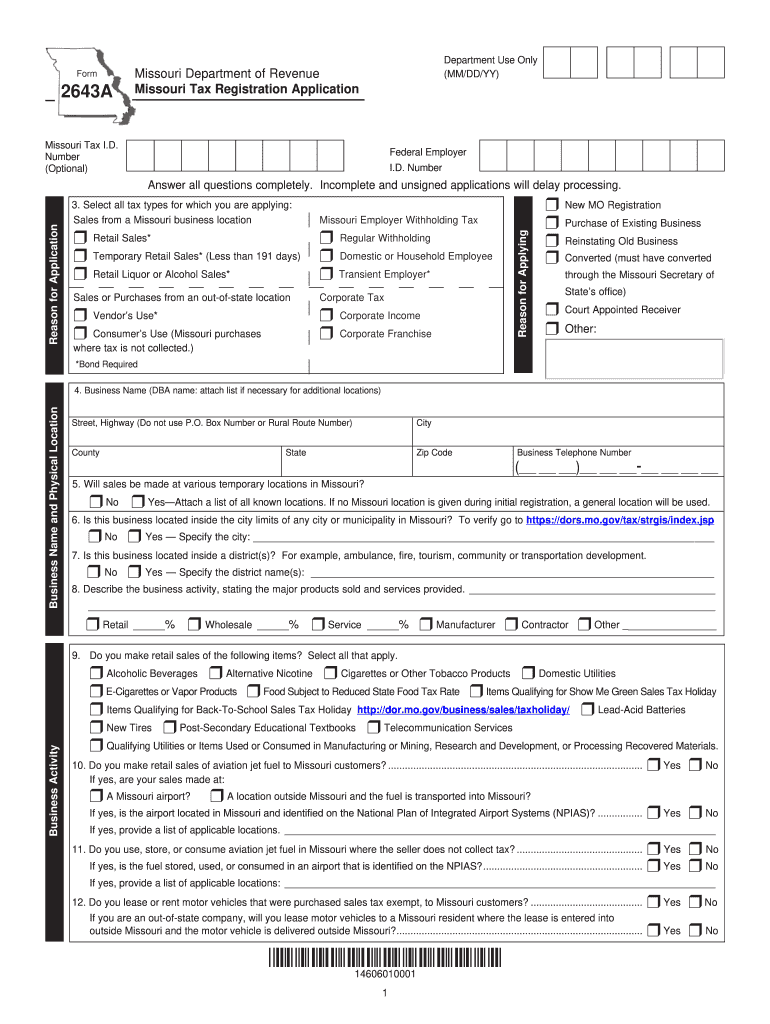

Missouri Tax Forms 2020

Web once completed you can sign your fillable form or send for signing. View sales history, tax history, home value estimates,. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. House located at 1725 n missouri ave, oklahoma city, ok.

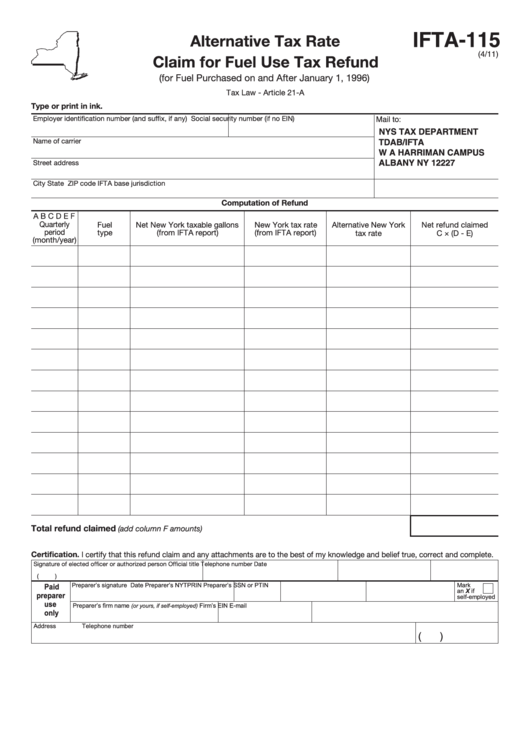

Missouri Ifta Tax Forms topfripdesigns

Web local missouri gas tax refund: Web tax rate $0.17 schedule a — marine fuel purchases by county use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to collect..

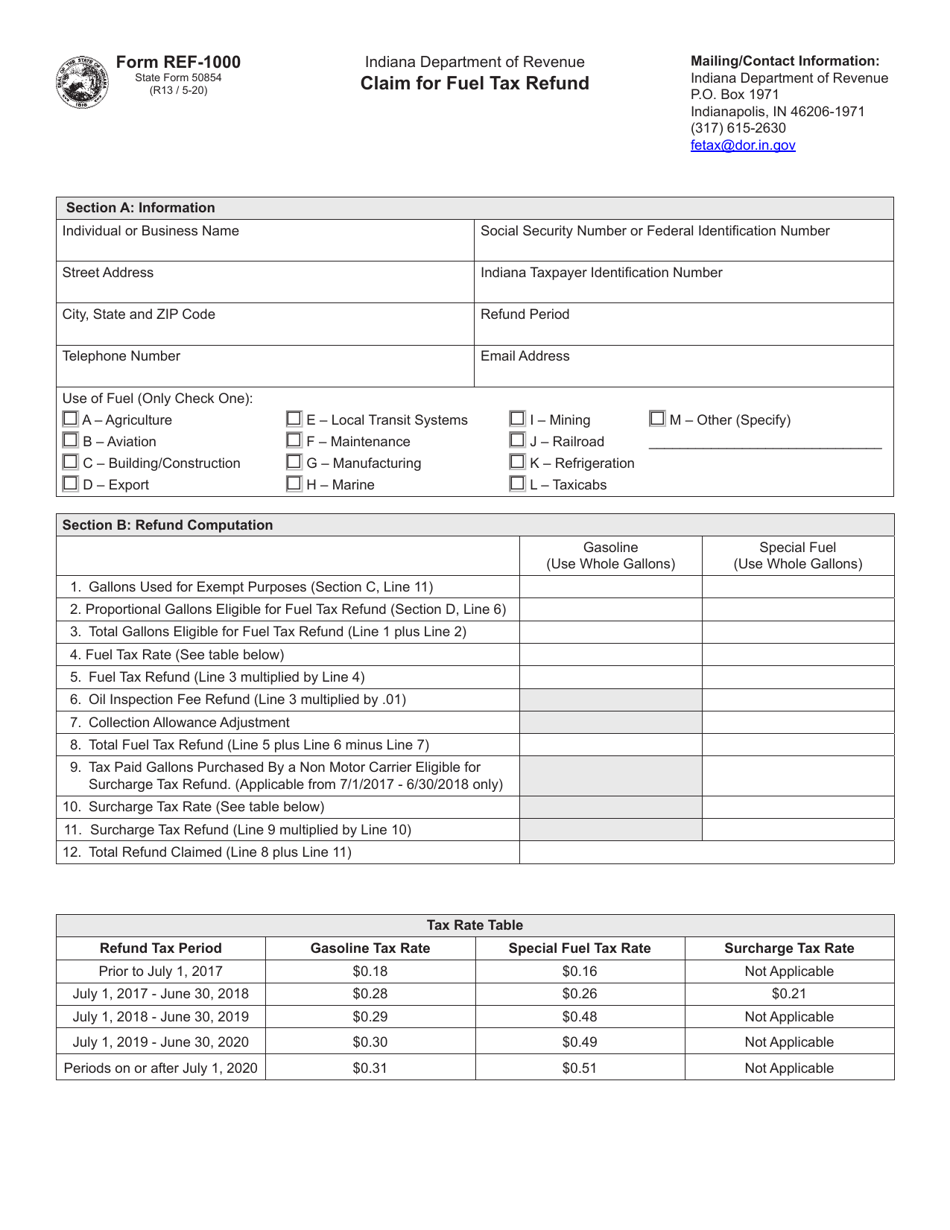

Form REF1000 (State Form 50854) Download Fillable PDF or Fill Online

Web 2 beds, 1 bath, 935 sq. Web you still have time to file a claim for a gas tax refund.the missouri department of revenue said as of july 15, they’ve received 3,175 gas tax refund claims. Web the bill also allows missourians to request a refund once a year for refunds on the gas tax in the following amounts..

missouri gas tax refund Christel Engel

30, 2022, on purchases made after oct. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between oct. Web you may not apply for a refund claim until july 1, 2022, however.

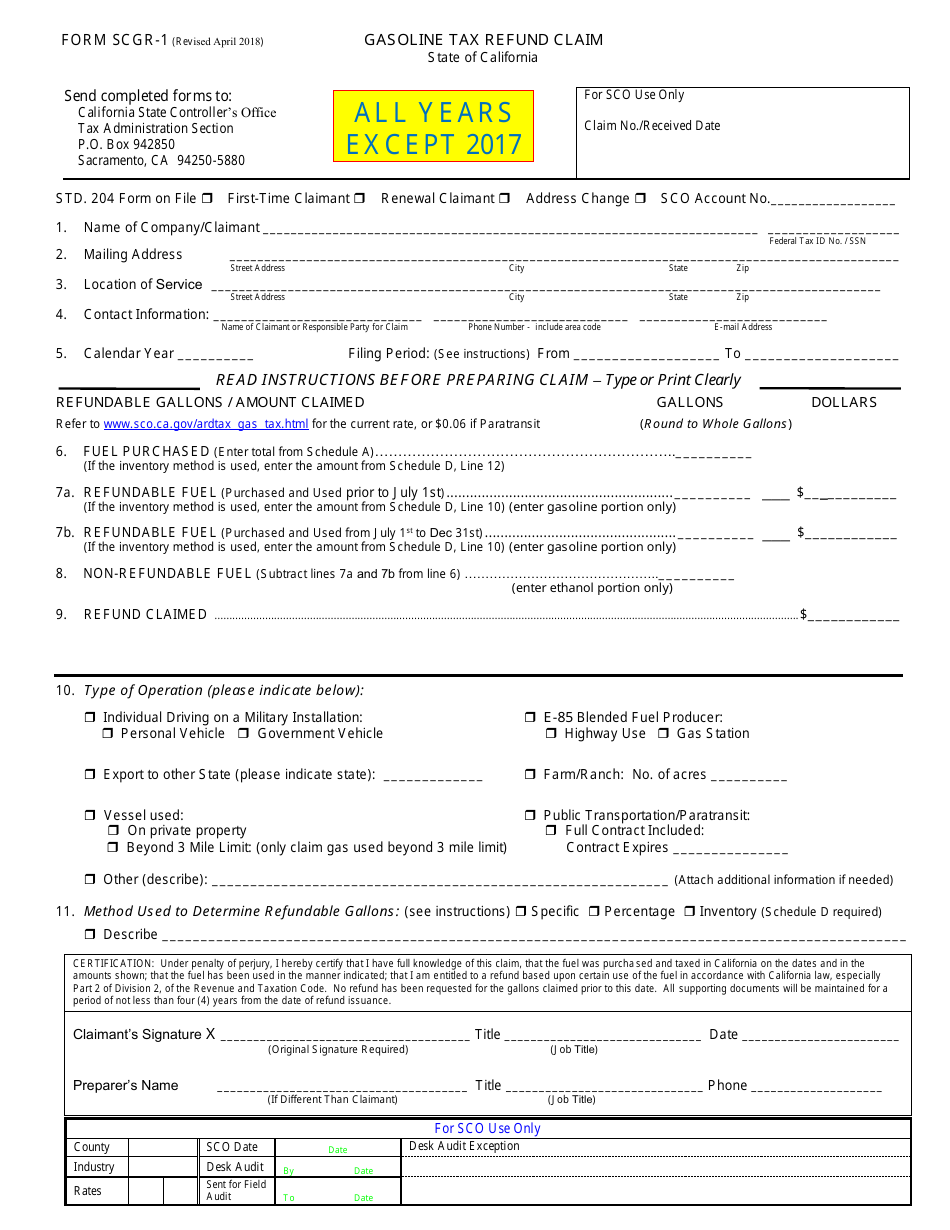

Form SCGR1 Download Fillable PDF or Fill Online Gasoline Tax Refund

Web the bill also allows missourians to request a refund once a year for refunds on the gas tax in the following amounts. Web refund claims can be submitted from july 1, 2022, to sept. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web download my return template.

missouri gas tax refund spreadsheet Lala Lombardo

Web first, you will need to have all the receipts from any gas purchase made between october 1, 2021 and june 30, 2022. All forms are printable and downloadable. Then you will need to go to the missouri. Web 2 beds, 1 bath, 935 sq. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2.

Missouri gas tax app can help Missourians get refund on gas tax

Claims must be postmarked between july 1 and. Web once completed you can sign your fillable form or send for signing. 30, 2022, on purchases made after oct. Web tax rate $0.17 schedule a — marine fuel purchases by county use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to. 2.5 cents.

Ifta Reporting Form Missouri Universal Network

View sales history, tax history, home value estimates,. Web refund claims can be submitted from july 1, 2022, to sept. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to.

Here's how to get a refund for Missouri's gas tax increase Howell

Web you still have time to file a claim for a gas tax refund.the missouri department of revenue said as of july 15, they’ve received 3,175 gas tax refund claims. All forms are printable and downloadable. House located at 1725 n missouri ave, oklahoma city, ok 73111 sold for $8,000 on jul 26, 1994. Web refund claims can be submitted.

Intensive Weblog Diaporama

House located at 1725 n missouri ave, oklahoma city, ok 73111 sold for $8,000 on jul 26, 1994. 30, 2022, on purchases made after oct. Web first, you will need to have all the receipts from any gas purchase made between october 1, 2021 and june 30, 2022. Web refund claims can be submitted from july 1, 2022, to sept..

“Does Missouri Have A Highway Gasoline Tax Refund For The.

Web local missouri gas tax refund: Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. Web refund claims can be submitted from july 1, 2022, to sept. Web tax rate $0.17 schedule a — marine fuel purchases by county use this schedule to report the number of gallons of gasoline purchased before october 1, 2021, rounded to.

Web First, You Will Need To Have All The Receipts From Any Gas Purchase Made Between October 1, 2021 And June 30, 2022.

Then you will need to go to the missouri. Web you still have time to file a claim for a gas tax refund.the missouri department of revenue said as of july 15, they’ve received 3,175 gas tax refund claims. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to collect. House located at 1725 n missouri ave, oklahoma city, ok 73111 sold for $8,000 on jul 26, 1994.

Web You May Not Apply For A Refund Claim Until July 1, 2022, However You Will Need To Begin Saving Records Of Each Purchase Occurring On Or After Oct.

1, 2021, the date missouri most recently increased its gas. All forms are printable and downloadable. Web the bill also allows missourians to request a refund once a year for refunds on the gas tax in the following amounts. Claims must be postmarked between july 1 and.

View Sales History, Tax History, Home Value Estimates,.

Web once completed you can sign your fillable form or send for signing. 2.5 cents in 2022 5 cents in 2023 7.5 cents in. Web 2 beds, 1 bath, 935 sq. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025.