Minnesota Tax Form M1 Instructions

Minnesota Tax Form M1 Instructions - Web 9995 2021 form m1nr, page 2 *211371* 21 penalty on early withdrawal of savings (from line 18 of federal schedule 1). Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. If you care for a child or dependent of your household, you may need to file form m1cd along with your other tax. This form is for income earned in tax year 2022, with tax returns due in. It will help candidates for state. Sign it in a few clicks draw your. 22 net operating loss carryover adjustment from. Web you must file a minnesota form m1, individual income tax return, if you are a: Web 5 rows more about the minnesota form m1 instructions. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022.

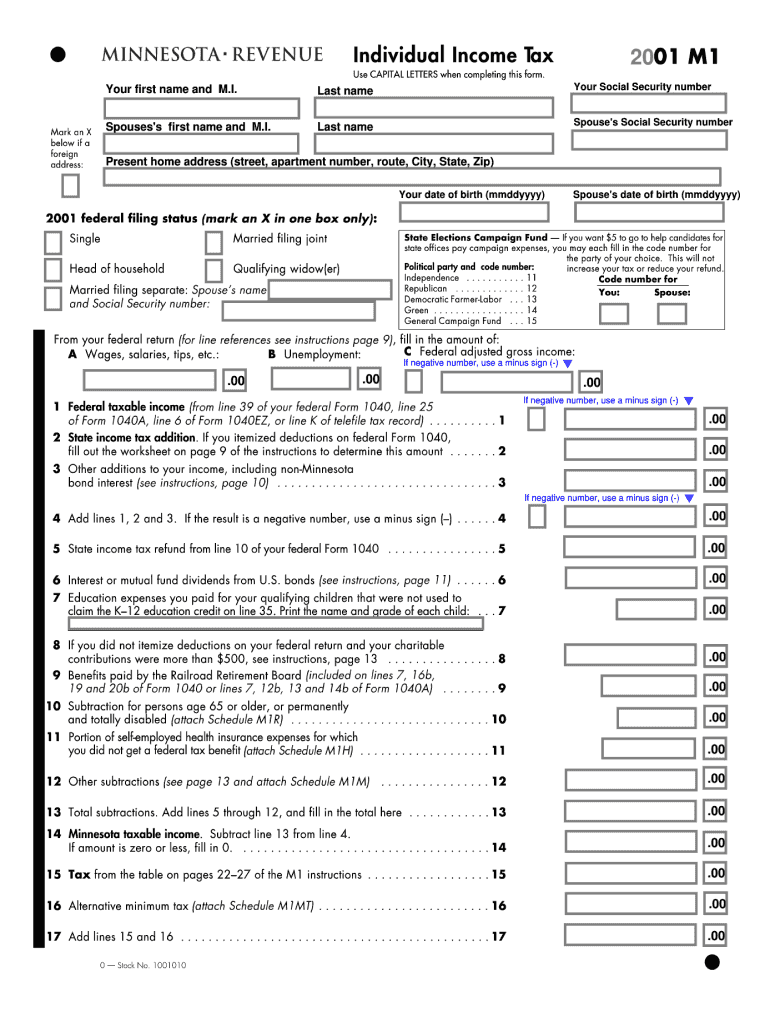

Web 2019 form m1, individual income tax leave unused boxes blank. This form is for income earned in tax year 2022, with tax returns due in. Minnesota individual income tax, mail station 0010, 600 n. 22 net operating loss carryover adjustment from. You can also look for forms by category below the search box. It will help candidates for state. Web you must file yearly by april 15. Minnesota form m1est is a fillable payment record you can use to. Ad download or email mn form m1 & more fillable forms, register and subscribe now! Web city 2022 federal filing status (place an x in one box):

Do not use staples on anything you submit. *191111* 2019 federal filing status (place an x in one box): Web the computation worksheet and instructions for form m1est can be found inside the pdf file. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. If you care for a child or dependent of your household, you may need to file form m1cd along with your other tax. This form is for income earned in tax year 2022, with tax returns due in. 22 net operating loss carryover adjustment from. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022.

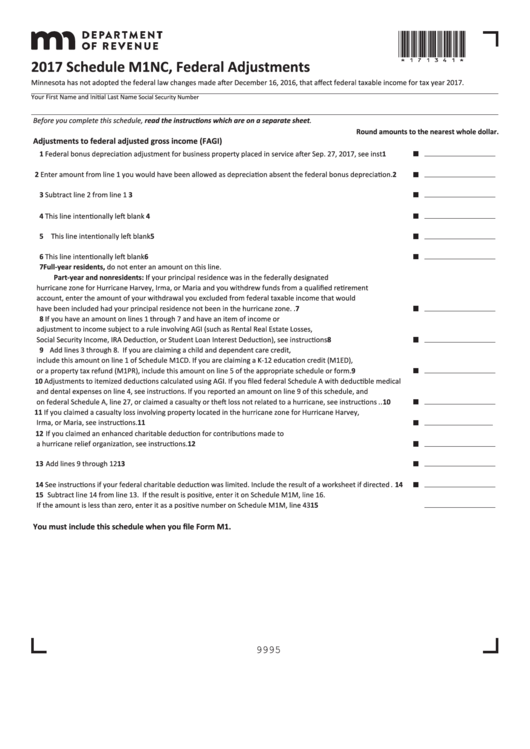

Fillable Schedule M1nc Federal Adjustments 2017 printable pdf download

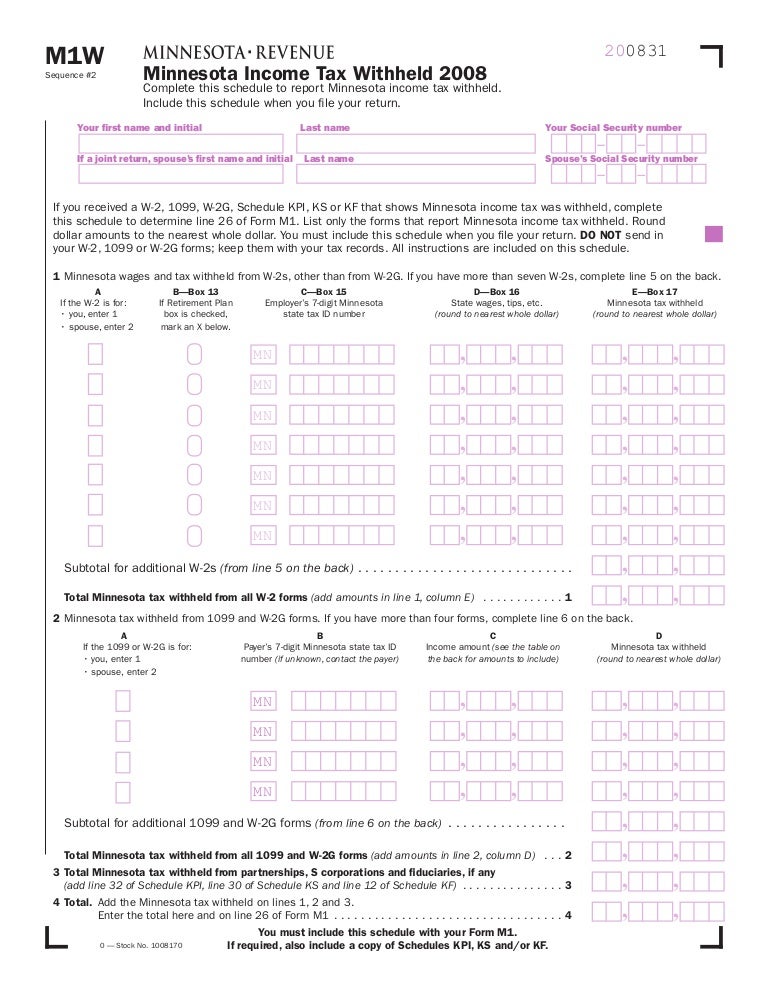

Web 2020 minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld >. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Sign it in a few clicks draw your. *191111*.

Form M1 Individual Tax YouTube

You can also look for forms by category below the search box. Spouse’s social security number spouse’s date of birth check if address is: Minnesota individual income tax, mail station 0010, 600 n. Web you must file a minnesota form m1, individual income tax return, if you are a: Ad download or email mn form m1 & more fillable forms,.

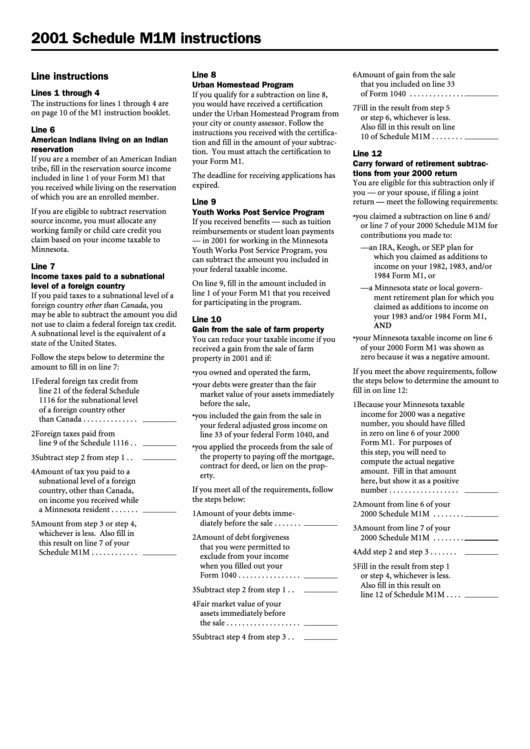

Schedule M1m Instructions 2001 printable pdf download

Web expenses deducted on your federal return attributable to income not taxed by minnesota (other than interest or mutual fund dividends from u.s. Download or email mn form m1 & more fillable forms, try for free now! It will help candidates for state. Complete, edit or print tax forms instantly. Web 2020 form m1, individual income tax state elections campaign.

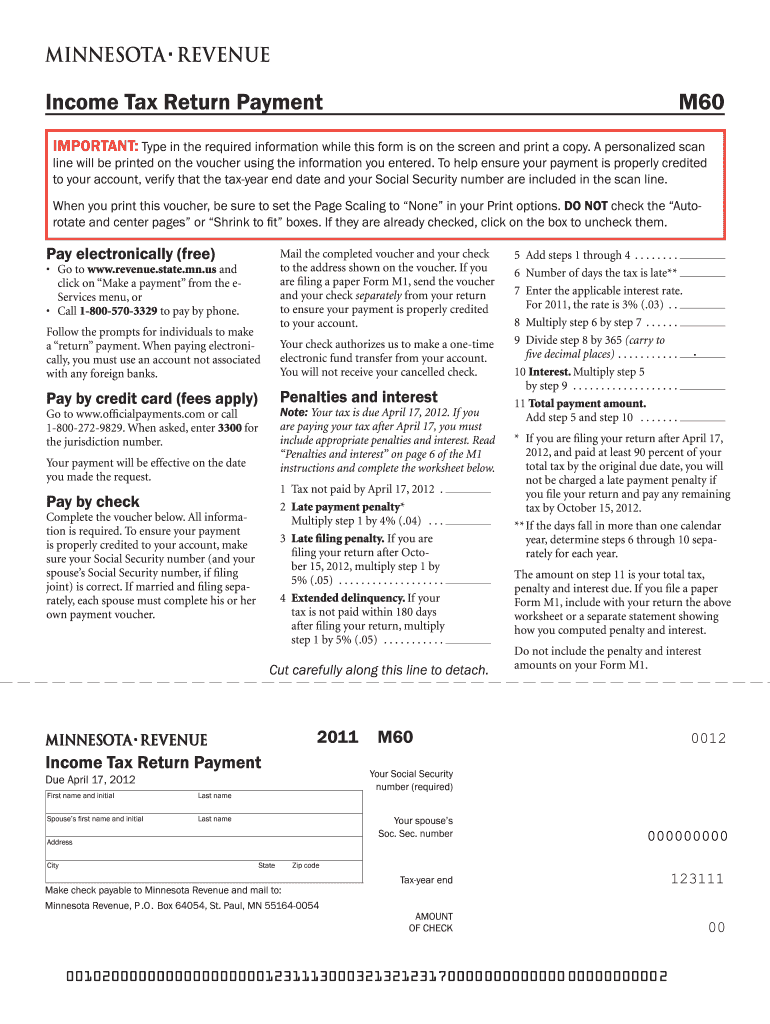

Mn tax payment voucher m60 Fill out & sign online DocHub

22 net operating loss carryover adjustment from. New foreign single married filing jointly. Minnesota individual income tax, mail station 0010, 600 n. Download or email mn form m1 & more fillable forms, try for free now! Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue.

2020 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Do not use staples on anything you submit. Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue. It will help candidates for state. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web 5 rows more about the minnesota form m1 instructions.

2013 Minnesota Tax Instructions

You can also look for forms by category below the search box. Download or email mn form m1 & more fillable forms, try for free now! Web 2019 form m1, individual income tax leave unused boxes blank. Do not use staples on anything you submit. Before starting your minnesota income tax return ( form m1 , individual income tax ),.

Minnesota tax forms Fill out & sign online DocHub

We last updated minnesota form m1. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Edit your mn tax forms 2016 printable online type text, add images, blackout confidential details, add comments, highlights and more. Minnesota individual income tax applies to residents and nonresidents.

M1 Tax Documents Fill Out and Sign Printable PDF Template signNow

Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. If you care for a child or dependent of your household, you may need to file form m1cd along with your other tax. 22 net operating loss carryover adjustment from. Download or email mn.

Minnesota Tax Table M1 Instructions 2020

Web you must file a minnesota form m1, individual income tax return, if you are a: Web the computation worksheet and instructions for form m1est can be found inside the pdf file. Web 9995 2021 form m1nr, page 2 *211371* 21 penalty on early withdrawal of savings (from line 18 of federal schedule 1). Spouse’s social security number spouse’s date.

M1W taxes.state.mn.us

It will help candidates for state. Edit your mn tax forms 2016 printable online type text, add images, blackout confidential details, add comments, highlights and more. Web 9995 2021 form m1nr, page 2 *211371* 21 penalty on early withdrawal of savings (from line 18 of federal schedule 1). Web expenses deducted on your federal return attributable to income not taxed.

Edit Your Mn Tax Forms 2016 Printable Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

We last updated minnesota form m1. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. 22 net operating loss carryover adjustment from.

Web 2020 Minnesota Individual Income Tax Forms And Instructions > Form M1 Minnesota Individual Income Tax Return > Schedule M1W Minnesota Income Tax Withheld >.

You can also look for forms by category below the search box. Sign it in a few clicks draw your. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Complete, edit or print tax forms instantly.

Web City 2022 Federal Filing Status (Place An X In One Box):

New foreign single married filing jointly. Web expenses deducted on your federal return attributable to income not taxed by minnesota (other than interest or mutual fund dividends from u.s. Web you must file a minnesota form m1, individual income tax return, if you are a: Web 9995 2021 form m1nr, page 2 *211371* 21 penalty on early withdrawal of savings (from line 18 of federal schedule 1).

Minnesota Individual Income Tax, Mail Station 0010, 600 N.

Minnesota form m1est is a fillable payment record you can use to. *191111* 2019 federal filing status (place an x in one box): It will help candidates for state. Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue.