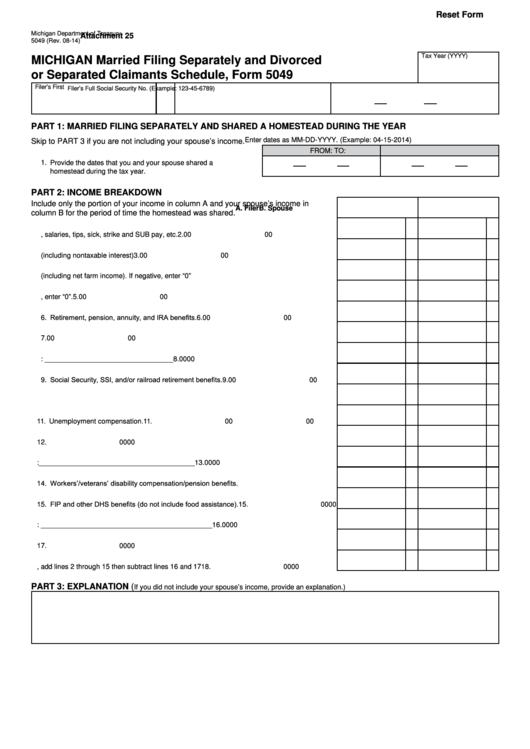

Michigan Form 5049

Michigan Form 5049 - Web they say the school refused to give the state attorney general’s office more than 6,000 documents for an investigation into how nassar was allowed to get away. Web and divorced or separated claimants schedule (form 5049) this form is intended to assist you to correctly calculate total household resources for the homestead property. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. Use get form or simply click on the template preview to open it in the editor. Web michigan (form 5049), which can be found on treasury’s web site. Web instructions included on form: In taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found. From the left menu, select state; Last name filer’s full social security no. Start completing the fillable fields.

Web instructions included on form: Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. Start completing the fillable fields. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Web if married filing separately, you must include form 5049. 2023 5049 5049 married filing separately, divorced, separated worksheet form link: Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. Web this form can be found at www.michigan.gov/taxes. Web or separated claimants schedule, form 5049 filer’s first name m.i. Last name filer’s full social security no.

Web michigan (form 5049), which can be found on treasury’s web site. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. Last name filer’s full social security no. On the your 2019 michigan taxes are ready for. Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. Start completing the fillable fields. 2023 5049 5049 married filing separately, divorced, separated worksheet form link: Web michigan tax forms 5049 last updated: Last name filer’s full social security no. Web form 5049 michigan explanation rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 67 votes how to fill out and sign michigan form 5049 online?

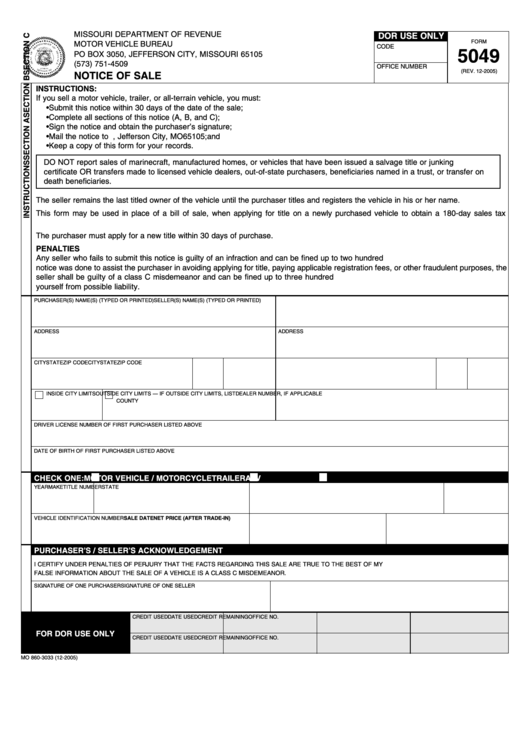

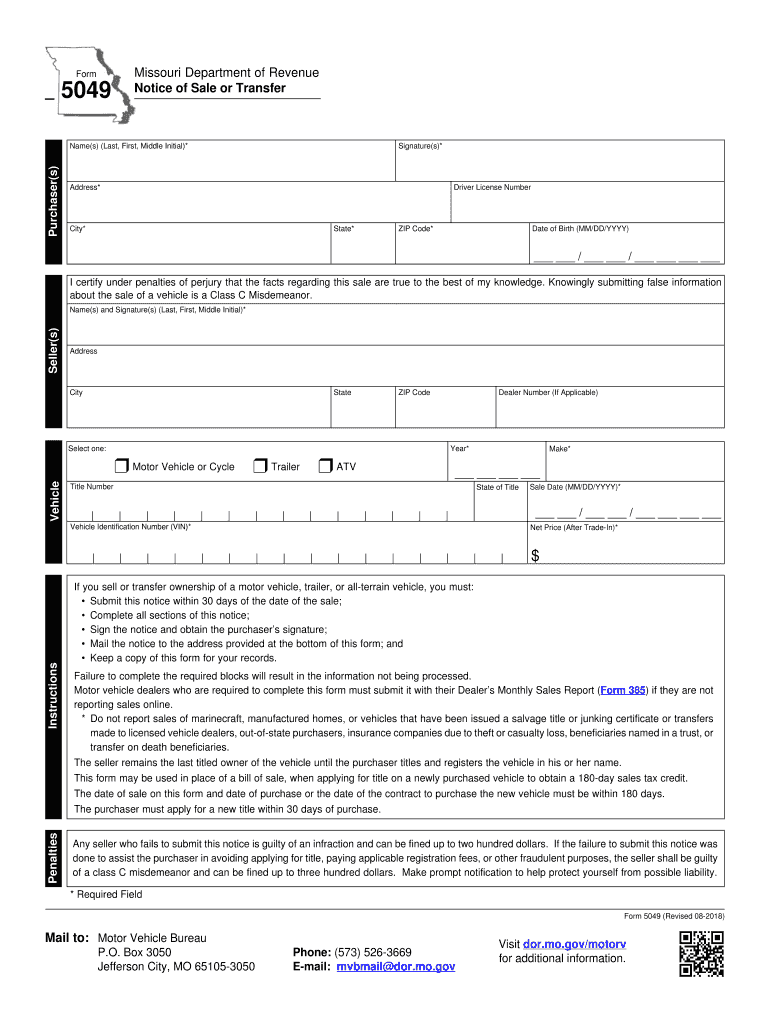

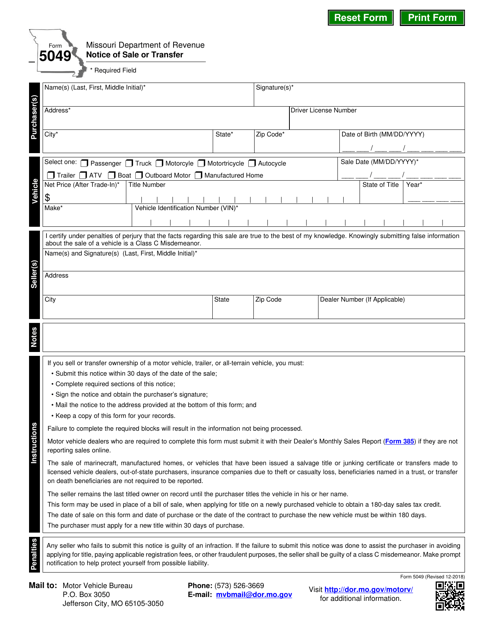

Fillable Notice Of Sale 5049 printable pdf download

Social security, ssi, and/or and sub pay, etc. Wages, salaries, tips, sick, strike 21. On the your 2019 michigan taxes are ready for. Web if married filing separately, you must include form 5049. Web michigan (form 5049), which can be found on treasury’s web site.

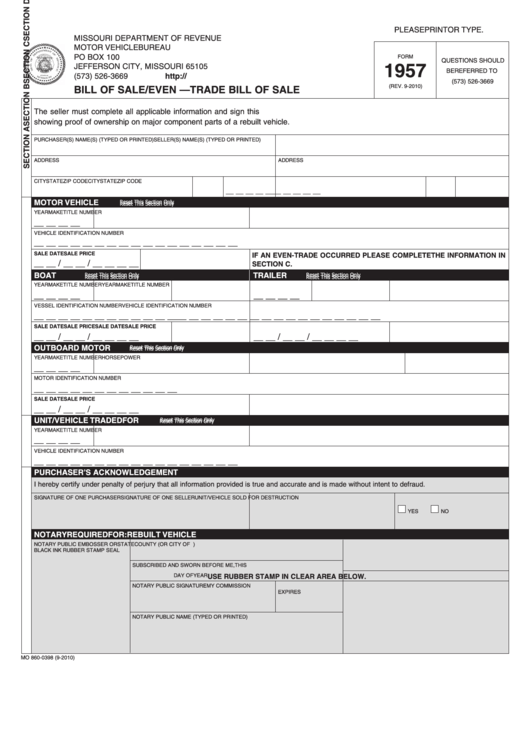

Misouri Department Of Revenue Form 5049 Fill Out and Sign Printable

Use this option to browse a list of forms by. Web michigan (form 5049), which can be found on treasury’s web site. In taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. Web michigan married filing.

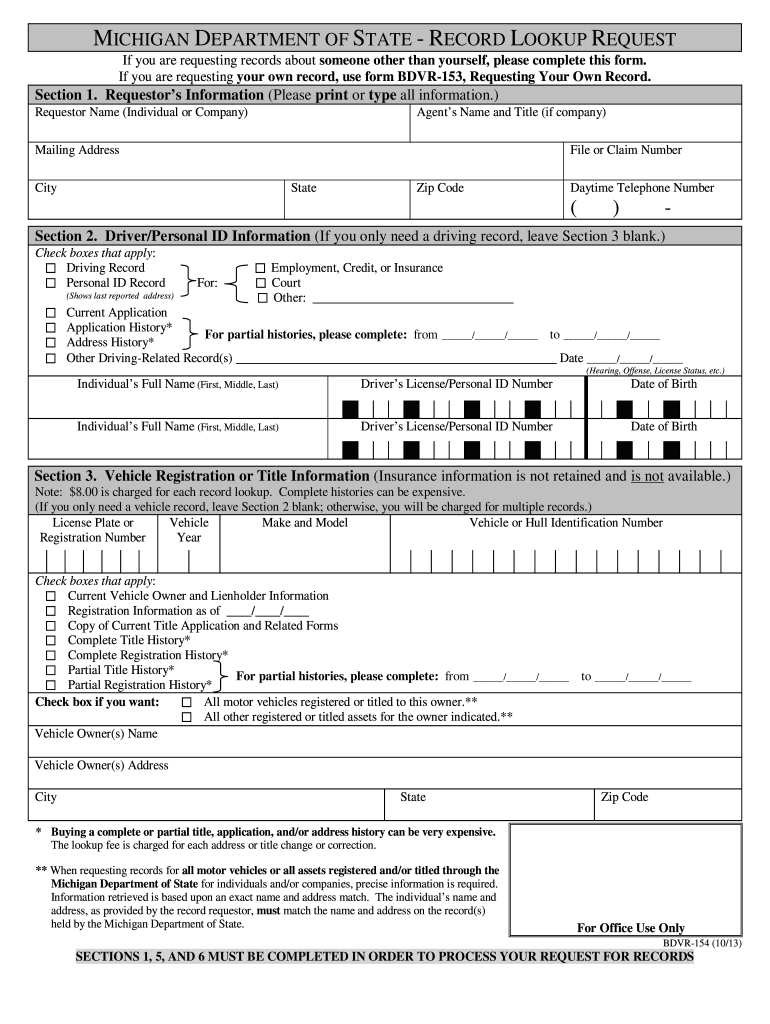

Michigan Form 154 Fill Out and Sign Printable PDF Template signNow

Web we last updated michigan form 5049 in february 2023 from the michigan department of treasury. Start completing the fillable fields. Web form 5049 michigan explanation rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 67 votes how to fill out and sign michigan form 5049 online? We last updated the.

Form 5049 Fill Out, Sign Online and Download Fillable PDF, Missouri

Start completing the fillable fields. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. 2023 5049 5049 married filing separately, divorced, separated worksheet form link: Web michigan tax forms 5049 last updated: We last updated the worksheet for married, filing separately and divorced 5049 in.

Fillable Form 1957 Bill Of Sale/even Trade Bill Of Sale, Form 5049

Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. This form is for income earned in tax year 2022, with tax returns.

5049 Mason Rd, Howell, MI 3 Bed, 3 Bath SingleFamily Home Trulia

We last updated the worksheet for married, filing separately and divorced 5049 in. Social security, ssi, and/or and sub pay, etc. This form is for income earned in tax year 2022, with tax returns due in april. Web or separated claimants schedule, form 5049 filer’s first name m.i. Taxformfinder provides printable pdf copies of 98.

How To Sell A Car In Missouri What The Department Of Revenue Needs

On the your 2019 michigan taxes are ready for. Web and divorced or separated claimants schedule (form 5049) this form is intended to assist you to correctly calculate total household resources for the homestead property. You do not need form 5049. Web they say the school refused to give the state attorney general’s office more than 6,000 documents for an.

Fillable Form 5049 Michigan Married Filing Separately And Divorced Or

Use get form or simply click on the template preview to open it in the editor. Web this form can be found at www.michigan.gov/taxes. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. This form is for income earned in tax year 2022, with tax returns due in april. Wages,.

전세금 인상통지서 샘플, 양식 다운로드

Web if married filing separately, you must include form 5049. Last name filer’s full social security no. Web we last updated michigan form 5049 in february 2023 from the michigan department of treasury. Web instructions included on form: Web they say the school refused to give the state attorney general’s office more than 6,000 documents for an investigation into how.

FIA Historic Database

Web instructions included on form: Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. Use get form or simply click on the template preview to open it in the editor. Web or separated claimants schedule, form 5049 filer’s first.

We Last Updated The Worksheet For Married, Filing Separately And Divorced 5049 In.

Web or separated claimants schedule, form 5049 filer’s first name m.i. Wages, salaries, tips, sick, strike 21. Last name attachment 25 issued under authority of public. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury.

Web If Married Filing Separately, You Must Include Form 5049.

Web or separated claimants schedule, form 5049 filer’s first name m.i. Use get form or simply click on the template preview to open it in the editor. Web they say the school refused to give the state attorney general’s office more than 6,000 documents for an investigation into how nassar was allowed to get away. Taxformfinder provides printable pdf copies of 98.

On The Your 2019 Michigan Taxes Are Ready For.

Search by form name or key word: Web michigan married filing separately and divorced or separated claimants schedule, form 5049 filer’s first name m.i. Web michigan (form 5049), which can be found on treasury’s web site. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony.

You Do Not Need Form 5049.

Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. In taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found. Web this form can be found at www.michigan.gov/taxes. 2023 5049 5049 married filing separately, divorced, separated worksheet form link: