Medicare Overpayment Form Part B

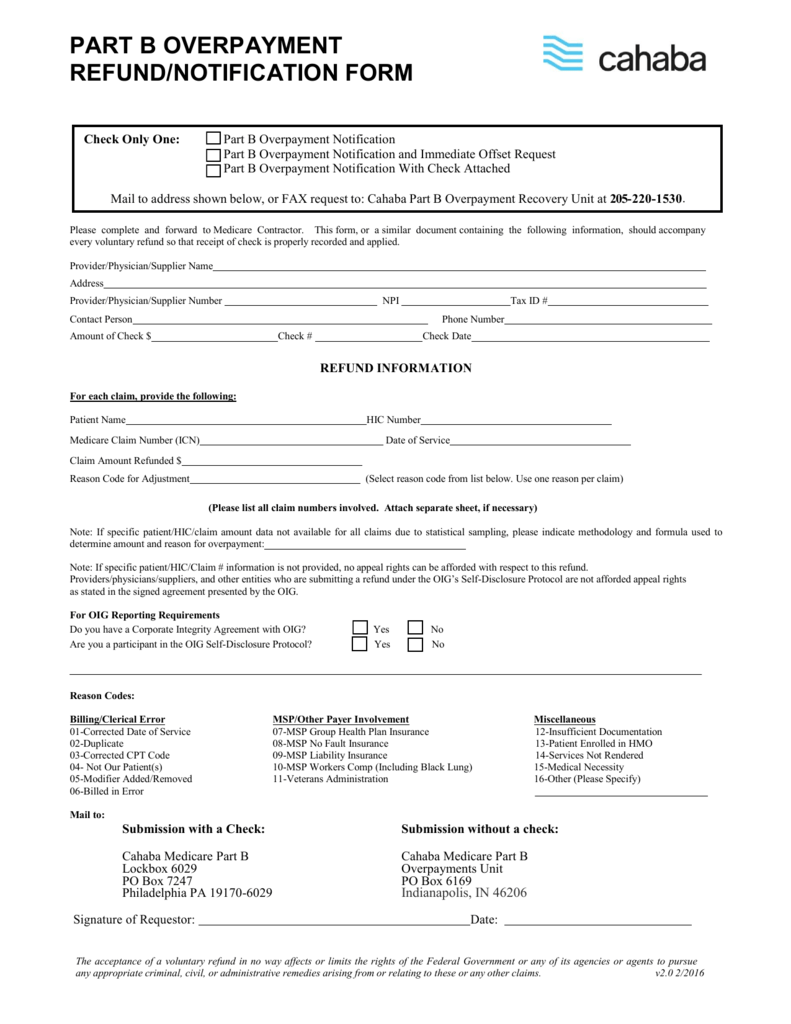

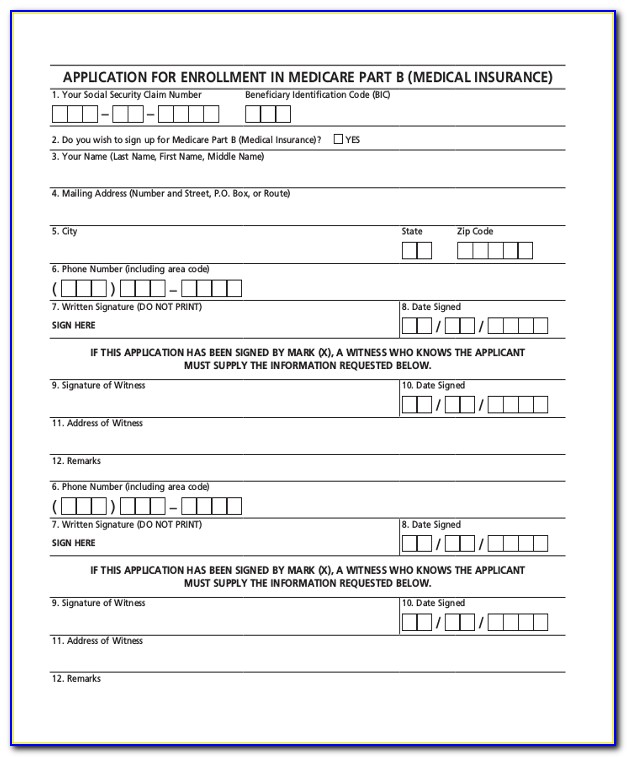

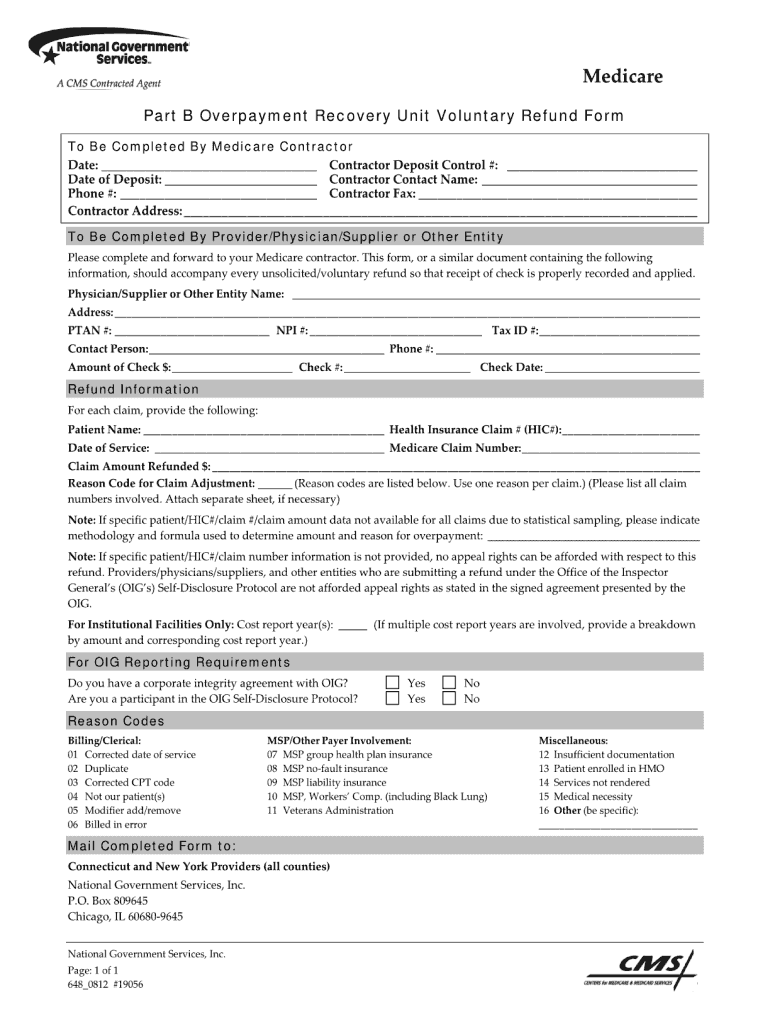

Medicare Overpayment Form Part B - Identified overpayments are debts owed to the federal government. Web an overpayment is a payment made by cms to a provider that exceeds the amount due and payable according to existing laws and regulations. When you identify a medicare overpayment, use the overpayment refund form to submit the voluntary refund. Submit the part a voluntary refund form without a check and when the claim (s) are adjusted, ngs will create an account receivable and generate a demand letter to you. A voluntary refund should be made to medicare any time an overpayment has been identified by a provider. Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the united states government, via novitas solutions, as one of its medicare contractors. Jurisdiction 6 medicare part b msp overpayment request form. View details to avoid processing delays. This will ensure we properly record and apply your check. Instead of completing the overpayment recovery request form , you can now submit the request through mycgs.

Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the united states government, via novitas solutions, as one of its medicare contractors. When you identify a medicare overpayment, use the overpayment refund form to submit the voluntary refund. Submit the part a voluntary refund form without a check and when the claim (s) are adjusted, ngs will create an account receivable and generate a demand letter to you. Beneficiary’s medicare beneficiary id number (s) claim number (s) reason for overpayment. A voluntary refund should be made to medicare any time an overpayment has been identified by a provider. Doing this will generate a demand letter identifying the amount to be refunded. Web an overpayment is a payment made by cms to a provider that exceeds the amount due and payable according to existing laws and regulations. Submit a check with the part a voluntary refund form. Instead of completing the overpayment recovery request form , you can now submit the request through mycgs. Web the tips below will allow you to fill in medicare part b overpayment refund form.

When the claim (s) is adjusted, medicare will apply the monies to the overpayment. Fill in the required boxes which are colored in yellow. Allow national government services to set up an immediate recoupment for this overpayment request. Use this form to sumbit an overpayment or refund to quickly and easily: Submit a check with the part a voluntary refund form. Web overpayments are medicare funds that you or a beneficiary has received in excess of the amount allowed payable under the medicare statute and regulations. Laws and regulations require us to recover overpayments. Beneficiary’s medicare beneficiary id number (s) claim number (s) reason for overpayment. Web the tips below will allow you to fill in medicare part b overpayment refund form. Type directly into the required fields on the overpayment refund form, then print.

part b overpayment refund/notification form

View details to avoid processing delays. Web the tips below will allow you to fill in medicare part b overpayment refund form. Submit the part a voluntary refund form without a check and when the claim (s) are adjusted, ngs will create an account receivable and generate a demand letter to you. Web part b providers may submit an overpayment.

Medicare Form 1490s Dme Form Resume Examples XE8jblR8Oo

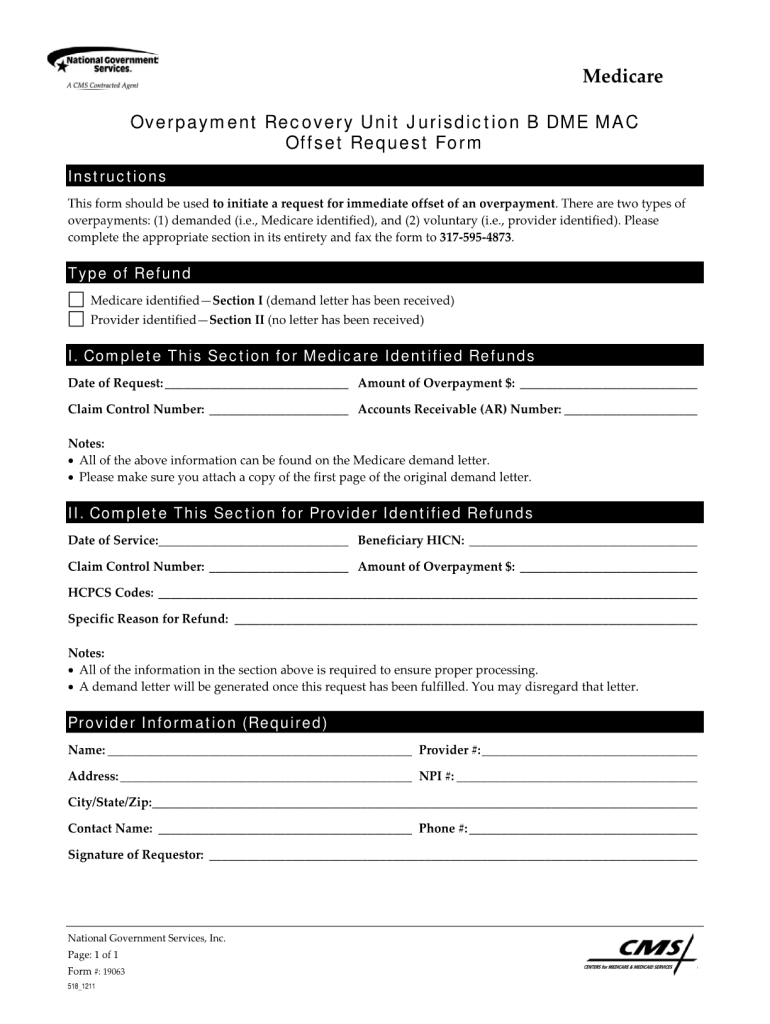

Web if this form is not available to you, you should still return the money. Allow national government services to set up an immediate recoupment for this overpayment request. Doing this will generate a demand letter identifying the amount to be refunded. Web part b providers may submit an overpayment recovery request to notify us of an overpayment. This fact.

Medicare Part D Prior Auth Form For Medications Form Resume

When the claim (s) is adjusted, medicare will apply the monies to the overpayment. View details to avoid processing delays. Doing this will generate a demand letter identifying the amount to be refunded. Identified overpayments are debts owed to the federal government. Overpayments are medicare funds that a provider, physician, supplier or beneficiary has received in excess of amounts due.

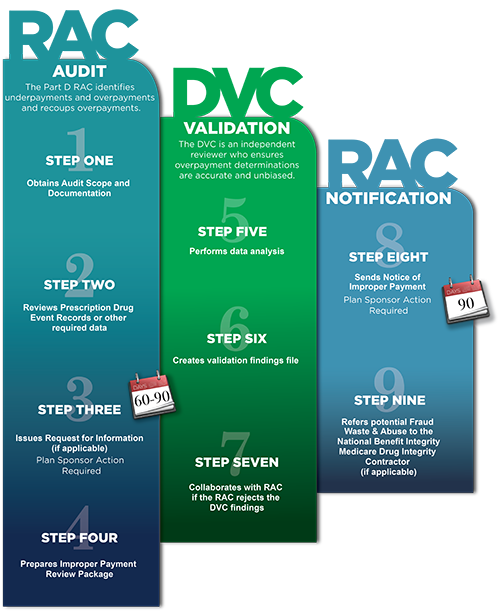

Part D RAC Audit Process CMS

Web if this form is not available to you, you should still return the money. Illegible forms may cause a delay in processing. When the claim (s) is adjusted, medicare will apply the monies to the overpayment. Laws and regulations require us to recover overpayments. This fact sheet describes the overpayment collection process.

Wellcare Medicare Part D Coverage Determination Request Form Form

Overpayments are medicare funds that a provider, physician, supplier or beneficiary has received in excess of amounts due and payable by medicare. Laws and regulations require us to recover overpayments. When the claim (s) is adjusted, medicare will apply the monies to the overpayment. This will ensure we properly record and apply your check. Doing this will generate a demand.

Form Medicare Unit Jurisdiction Dme Form Fill Online, Printable

When you identify a medicare overpayment, use the overpayment refund form to submit the voluntary refund. This will ensure we properly record and apply your check. Web an overpayment is a payment made by cms to a provider that exceeds the amount due and payable according to existing laws and regulations. Fill in the required boxes which are colored in.

Medicare Refund Form Fill Online, Printable, Fillable, Blank pdfFiller

Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the united states government, via novitas solutions, as one of its medicare contractors. Beneficiary’s medicare beneficiary id number (s) claim number (s) reason for overpayment. Identified overpayments are debts owed to the federal government. Illegible forms may cause a delay in.

SSA POMS GN 05002.300 Examples of Completed SSA1099s 02/02/2017

Web the tips below will allow you to fill in medicare part b overpayment refund form. Jurisdiction 6 medicare part b msp overpayment request form. Submit a check with the part a voluntary refund form. Web if this form is not available to you, you should still return the money. Instead of completing the overpayment recovery request form , you.

Ssa Poms Nl 00701.117 Form Cms L457 Acknowledgement Of Within Medicare

Illegible forms may cause a delay in processing. Submit the part a voluntary refund form without a check and when the claim (s) are adjusted, ngs will create an account receivable and generate a demand letter to you. View details to avoid processing delays. When the claim (s) is adjusted, medicare will apply the monies to the overpayment. Doing this.

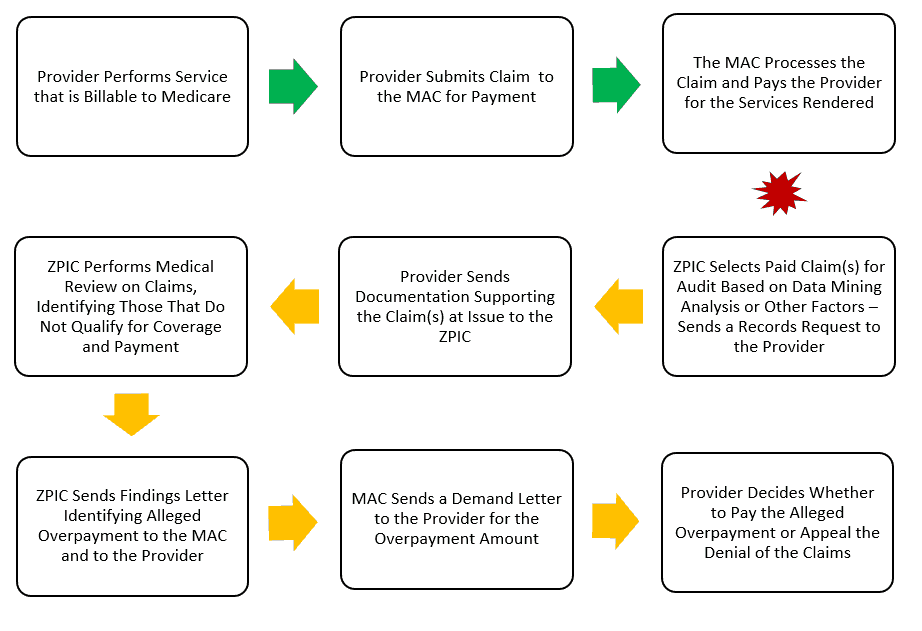

Zone Program Integrity Contractor (ZPIC) Investigations and Audits

This fact sheet describes the overpayment collection process. This will ensure we properly record and apply your check. Web an overpayment is a payment made by cms to a provider that exceeds the amount due and payable according to existing laws and regulations. Type directly into the required fields on the overpayment refund form, then print. Web part b providers.

Instead Of Completing The Overpayment Recovery Request Form , You Can Now Submit The Request Through Mycgs.

Web part b providers may submit an overpayment recovery request to notify us of an overpayment. Jurisdiction 6 medicare part b msp overpayment request form. Fill in the required boxes which are colored in yellow. Type directly into the required fields on the overpayment refund form, then print.

Allow National Government Services To Set Up An Immediate Recoupment For This Overpayment Request.

Web overpayments are medicare funds that you or a beneficiary has received in excess of the amount allowed payable under the medicare statute and regulations. This fact sheet describes the overpayment collection process. Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the united states government, via novitas solutions, as one of its medicare contractors. Web an overpayment is a payment made by cms to a provider that exceeds the amount due and payable according to existing laws and regulations.

Beneficiary’s Medicare Beneficiary Id Number (S) Claim Number (S) Reason For Overpayment.

Laws and regulations require us to recover overpayments. When the claim (s) is adjusted, medicare will apply the monies to the overpayment. Submit a check with the part a voluntary refund form. A voluntary refund should be made to medicare any time an overpayment has been identified by a provider.

Web The Tips Below Will Allow You To Fill In Medicare Part B Overpayment Refund Form.

When you identify a medicare overpayment, use the overpayment refund form to submit the voluntary refund. Overpayments are medicare funds that a provider, physician, supplier or beneficiary has received in excess of amounts due and payable by medicare. Submit the part a voluntary refund form without a check and when the claim (s) are adjusted, ngs will create an account receivable and generate a demand letter to you. Illegible forms may cause a delay in processing.